Dear users of @zapper_fi,

I hope you are fully aware of the misleading and often unrealistic "ROI" in the "Opportunities" section for Liquidity Pools.

I hope you realise you can still underperform simple "hodling" even with "ROI" of 100%+.

If not, let me explain to you why. 🧵👇

I hope you are fully aware of the misleading and often unrealistic "ROI" in the "Opportunities" section for Liquidity Pools.

I hope you realise you can still underperform simple "hodling" even with "ROI" of 100%+.

If not, let me explain to you why. 🧵👇

TL;DR:

- "ROI" on @zapper_fi is based on the fees from the last 24hrs & ignores IL which makes it an unreliable approximation of future returns.

- Toolkit from @ApyVision is a must for LPs in IL-exposed pools.

- IL-protected pools from @Bancor are the best place for passive LPs.

- "ROI" on @zapper_fi is based on the fees from the last 24hrs & ignores IL which makes it an unreliable approximation of future returns.

- Toolkit from @ApyVision is a must for LPs in IL-exposed pools.

- IL-protected pools from @Bancor are the best place for passive LPs.

1) Before I start, I want to make it clear that this is not a rant on @zapper_fi. It's a great tool and I use it a lot. But I think the Team could do a much better job when it comes to informing users about certain risks which can result in financial loss.

2) @zapper_fi has been killing in terms of user adoption. It is a go-to DeFi interface and many novices start their DeFi adventure there. That's why the Team should maintain the highest level of responsibility and this thread is my open letter to them.

https://twitter.com/sebaudet26/status/1407459415234654209

3) To the point. I honestly believe that using the name "ROI" in the "Opportunities" section for Liquidity Pools is not only wrong but also unfair. ROI (return on investment) is a ratio between net profit (total income - costs) and invested capital.

en.wikipedia.org/wiki/Net_income

en.wikipedia.org/wiki/Net_income

4) Zapper suggests that $1000 invested in the $GTC-ETH Uniswap pool will bring me a profit of $4392 in a year. If something sounds too good, it usually is.

What are the assumptions here?

1⃣ Fees APR from the last 24 hrs will not change.

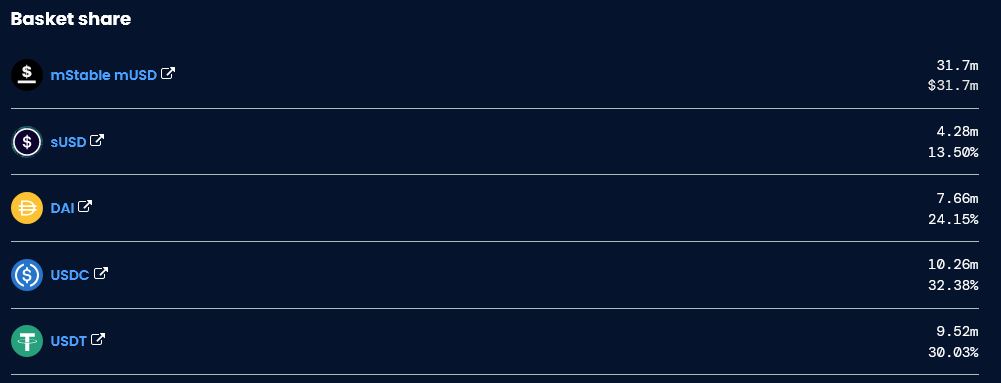

2⃣ There will be no impermanent loss (IL).

What are the assumptions here?

1⃣ Fees APR from the last 24 hrs will not change.

2⃣ There will be no impermanent loss (IL).

5) Displayed “ROI” is not really ROI. This is a highly volatile approximation of APR from the fees generated in the pool in the last 24 hours. It disregards the impact of IL which is a serious cost for liquidity providers (LPs).

Learn more about IL:

Learn more about IL:

https://twitter.com/korpi87/status/1372634328308518912

6) Let's break down both assumptions of Zapper's "ROI" to find out how realistic they are.

1⃣ Fees APR from the last 24 hrs will not change.

Fees APR is dependent on the volume to liquidity ratio (V/L) in the pool. The higher V/L, the higher Fees APR.

1⃣ Fees APR from the last 24 hrs will not change.

Fees APR is dependent on the volume to liquidity ratio (V/L) in the pool. The higher V/L, the higher Fees APR.

https://twitter.com/korpi87/status/1372634343793958920

7) A screenshot of the Zapper's top pools, where $GTC-ETH had 440% "ROI", was taken on 28.06 00:00 UTC. Displayed Fees APR (called "ROI") was based on the V/L on 27.06. Now compare it with the graph of V/L over time from @ApyVision. It was a one-off event. Not really sustainable.

8) "ROI" on Zapper changes all the time because V/L is volatile. Just compare two screenshots taken on a day with high (22.06) and low (27.06) market volatility. Obviously, using pool performance in the last 24 hrs as an approximation of future returns is far too simplistic.

9) @ApyVision offers a better approach. Quick summary of the pool displays average Fees APR from the last 7, 14, 30 days and since the inception of the pool. It allows you to compare the stability of returns over time. For more detailed insight, you should check the graph of V/L.

10) Let's go to the second assumption of Zapper's "ROI":

2⃣ There will be no impermanent loss (IL).

Well... It's possible but hardly probable. Removing IL from LP ROI is like ignoring all the future variable costs when running a business just because they are hard to predict.

2⃣ There will be no impermanent loss (IL).

Well... It's possible but hardly probable. Removing IL from LP ROI is like ignoring all the future variable costs when running a business just because they are hard to predict.

11) Ignoring IL has become a dirty standard in the crypto industry. But the ugly truth is that many LPs underperform a simple buy-and-hold strategy because of IL.

I made an analysis of how IL impacts ROI from long-term LPing. Check out my findings:

I made an analysis of how IL impacts ROI from long-term LPing. Check out my findings:

https://twitter.com/korpi87/status/1409449804703440897

12) Fees APRs that disregard IL, like Zapper's "ROI", are unrealistic and misleading indicators of future returns. It's time DeFi users start demanding better solutions. IL-adjusted data from @ApyVision sets the standards other platforms should look up to.

https://twitter.com/korpi87/status/1409449890036469761

13) APY Vision displays 3 types of APR: Fees APR (counterpart of Zapper's "ROI"), IL APR (impact of IL) and Net APR (Fees APR + IL APR). They are calculated for the specific periods of time (e.g. yesterday, last 7, 14, 30 days) and take into account fees and IL in these periods.

14) "Yesterday" on the $GTC-ETH graph is 27.06 UTC, therefore, Zapper's "ROI" and APY Vision's "Fees APY" should be the same. Indeed, they are fairly close, probably different by a few Ethereum blocks only. Nevertheless, "Net APY" is 100pp lower than "Fees APY" due to IL.

15) The impact of IL is often much more severe. Even high positive "ROI" on Zapper may still mean a net loss for LPs because of IL. Consider the graph for $FORTH-ETH. Although "ROI" on 27.06 is above 200%, IL dwarfs the fees on that day and Net APR is negative at -130%.

16) Sometimes IL on a given day may be negligible but it doesn't mean it should be ignored. The graph for $NAOS-ETH depicts it perfectly. Although IL on 27.06 is close to 0 and LPs are lured with 100%+ Net APR, longer-term LPing actually underperforms a buy-and-hold strategy.

17) Evidently, IL has a meaningful impact on the real ROI for LPs and assuming it won't materialize is just turning a blind eye to the serious problem. Current "ROI" on @zapper_fi is a hardly realistic figure which, imo, does more bad than good by misleading unconscious users.

18) If we want another cohort of adopters to enter DeFi space, we should make sure they don't get burned in their first DeFi interactions.

What can we do?

1⃣ Demand user-oriented practices from DeFi apps.

2⃣ Educate DeFi users about potential dangers.

What can we do?

1⃣ Demand user-oriented practices from DeFi apps.

2⃣ Educate DeFi users about potential dangers.

19) My input into 1⃣:

Dear @zapper_fi,

Please rename your "ROI" to "Fees APR", clearly inform your users how it's calculated and explain to them that IL is a serious risk. Ideally, show more reliable data which takes IL into account - @ApyVision proves it can be done.

Dear @zapper_fi,

Please rename your "ROI" to "Fees APR", clearly inform your users how it's calculated and explain to them that IL is a serious risk. Ideally, show more reliable data which takes IL into account - @ApyVision proves it can be done.

20) My input into 2⃣ (1):

Dear DeFi users,

Remember: IL is real and can't be simply ignored. If you want to be LP in IL-exposed pools, be aware of that risk and try to quantify a risk/reward ratio of LPing. A comprehensive set of tools from @ApyVision is what you need.

Dear DeFi users,

Remember: IL is real and can't be simply ignored. If you want to be LP in IL-exposed pools, be aware of that risk and try to quantify a risk/reward ratio of LPing. A comprehensive set of tools from @ApyVision is what you need.

21) My input into 2⃣ (2):

When you are an LP in IL-exposed pools, you can take a more active approach to LPing to mitigate IL.

I described a few mitigation strategies in my thread on IL:

When you are an LP in IL-exposed pools, you can take a more active approach to LPing to mitigate IL.

I described a few mitigation strategies in my thread on IL:

https://twitter.com/korpi87/status/1372634338181939206

22) My input into 2⃣ (3):

None of the above methods guarantee you will not suffer from IL and eventually incur a net loss from LPing. If you want a full protection from IL, become an LP on @Bancor.

None of the above methods guarantee you will not suffer from IL and eventually incur a net loss from LPing. If you want a full protection from IL, become an LP on @Bancor.

https://twitter.com/korpi87/status/1409449836336881670

23) LPs on Bancor accrue full IL protection after 100 days. Because the protocol takes IL risk, LPs have guaranteed profits vs "hodling". This is often not the case in other AMMs - just compare net returns from long-term LPing on Uniswap and Bancor:

https://twitter.com/korpi87/status/1409449880985255938

24) Imo, @Bancor is a superior place for passive LPs, however, many LPs have been lured into pools with unrealistic high "ROIs" having a skewed view of future returns. When better standards are adopted, competition between DEXs becomes fair and DeFi users will benefit the most.

If you've managed to get that far, I hope you understand I'm not just ranting on Zapper but want all DeFi users to benefit from improved standards of information and increased risk awareness. Do you want the same? Please retweet this thread. Thanks!

https://twitter.com/korpi87/status/1410555632638386180

• • •

Missing some Tweet in this thread? You can try to

force a refresh