I joined an inflation panel organized by @BudgetHawks yesterday. I'll do a short🧵summarizing my six points but watch it all for a broader set of perspectives--with various disagreements but a consensus that we should not be overconfident on this topic. dropbox.com/s/5fl91e93gzr5…

https://twitter.com/greg_ip/status/1410605611914387456

1. Before getting to inflation, the even more important issue is what is happening in the real economy. Remarkably the US is expected to be above pre-pandemic forecasts for real GDP by the end of the year--the only G7 country where this is expected. (Note, is a forecast.)

2. The United States has also had much more inflation than other countries. This says inflation is not just about reopening, supply chain issues, global commodity prices, base effects, etc., because they also have those in Germany and France.

3. Not only have forecasters been very wrong about inflation this year they have been very overconfident. In May the Survey of Professional Forecasters expected 2.1% core CPI for the yr, we've already had that in just five months. The odds they put on 3%+ inflation were very low.

4. I will now make a confident prediction: inflation is going to slow dramatically. It has been running at an 8% annual rate so all the arguments you've heard for why the pace will slow are right. But they also don't speak to the question of whether it will slow to 2%, 3% or 4%.

(As an aside, the most likely scenario is that inflation is lower over the next six months than it will be in 2022. That is because some of the transitory increases, like car prices, will fall, temporarily lowering inflation. But will only be a transitory lowering.)

5. Best guess for core PCE in 2022 is closer to 3% than 2% (plus or minus a huge amount). Part of that is due to micro factors. Transitory increases will go away but some shoes have yet to drop: shelter, services, commodities, wages to prices, prices to wages, & sticky prices.

(As an aside, more energy has gone into identifying price spikes that will go away than the ones that haven't happened yet. Shelter has been growing slower than normal, it should at least normalize if not more and it is 40% of core CPI and 18% of core PCE.)

(Also, are businesses going to take inflation into effect when setting wages later this year? They haven't in decades but this year could be different. If businesses ignore inflation will be a big loss for real wages. If they do could be another source of persistent inflation.)

6. Most important reason to expect substantial persistence for inflation at least through 2022 and probably longer is that relative to pre-pandemic trends there are many reasons to expect demand to be up and supply to be down.

Demand will likely be up relative to pre-pandemic trends because of the excess savings people have, the continued fiscal stimulus (relative to pre-pandemic), and easy monetary conditions. Plus job growth and wages.

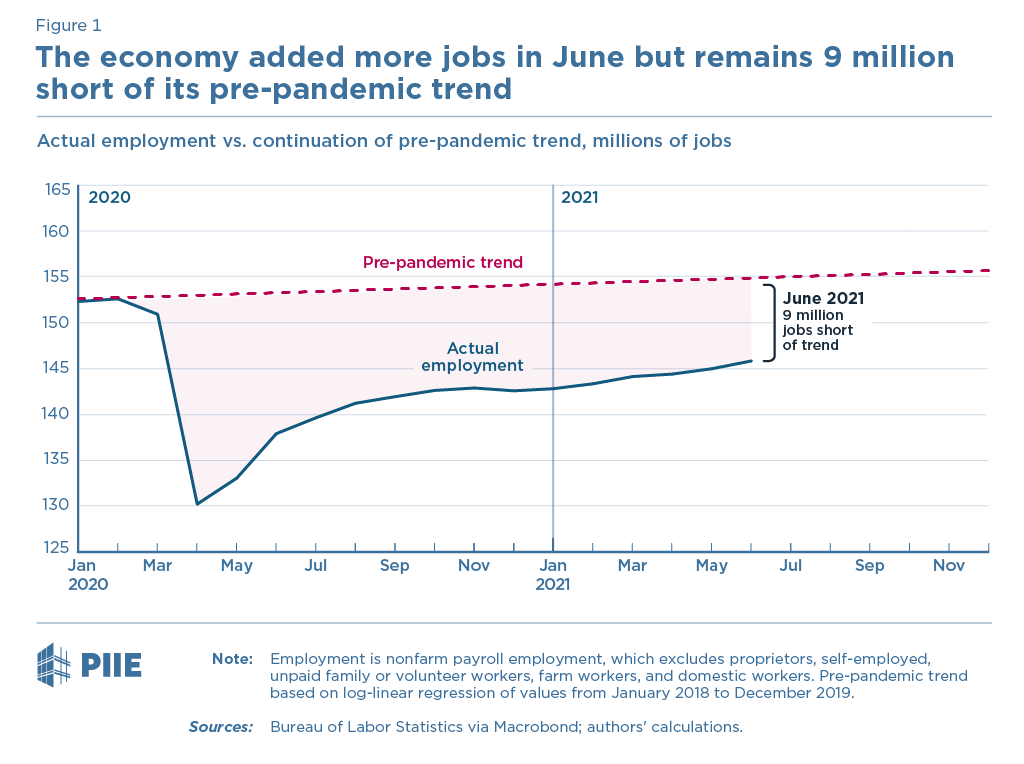

Supply will likely be down because not all jobs will return over the next yr due to early retirements/other leaving the labor force, changed business practices, continued dislocations/scarring--with a huge question mark that productivity could go the other direction.

Why does any of this matter? It should not matter for the current fiscal debate. It does matter for monetary policy & I'm worried that policy is being based on over-optimism about inflation being transitory that could cause some painful re-alignments to reality.

But, I also think we should raise the inflation target. This will be hard to do but this could be the best shot at it for a while. And as hard as it would be for the Fed to shift to a higher target, if inflation ends up ~3% it could be even harder to bring it back down to 2%. FIN

• • •

Missing some Tweet in this thread? You can try to

force a refresh