Tonight on @BBCNewsnight we'll be taking a closer look at the politics and economics of the Triple Lock in light of the @OBR_UK warning today that it could add £3bn to state pension bill next year unexpectedly.

Some thoughts on the figures...

bbc.co.uk/news/business-…

Some thoughts on the figures...

bbc.co.uk/news/business-…

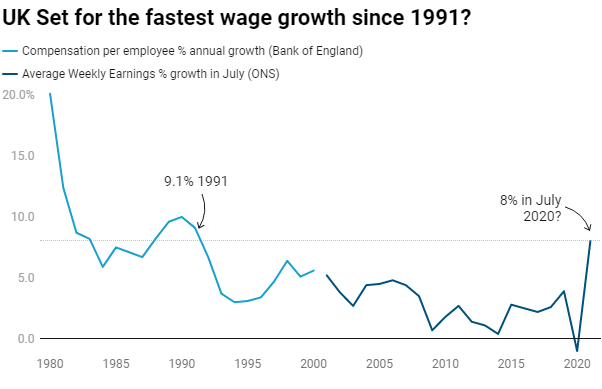

...If average wages do rise at a rate of 8% year-on-year in July, a possibility flagged by the OBR, that would be the highest growth rate in the records of the ONS's Average Weekly Earnings (AWE) current series going back to 2000...ons.gov.uk/employmentandl…

...but what about beyond that?

Haven't got a monthly series, but using the BoE's dataset, which has annual estimates of compensation per employee & splicing it with the July AWE growth rates from the ONS it looks like it would be the fastest rate since the early 1990s...

Haven't got a monthly series, but using the BoE's dataset, which has annual estimates of compensation per employee & splicing it with the July AWE growth rates from the ONS it looks like it would be the fastest rate since the early 1990s...

...although bear in mind that this 8% in July - if it happens - is expected to fall away very quickly because of pandemic-related statistical distortions.

The most recent 2021 full year average earnings forecast from the OBR in March is just 1.9%....

The most recent 2021 full year average earnings forecast from the OBR in March is just 1.9%....

...and the Bank of England in *May* projected -0.5%!

Yes, negative growth - check it here... 👇

bankofengland.co.uk/-/media/boe/fi…

Yes, negative growth - check it here... 👇

bankofengland.co.uk/-/media/boe/fi…

...I suspect that Bank estimate will get revised up.

But it's still unlikely to be anywhere close to 8%...

But it's still unlikely to be anywhere close to 8%...

...And that's the point about the Triple Lock - by taking the figures from May-July each year the government is set this year could be set to get a massively distorted figure for up-rating next years' state pension...

....which is why many suspect the Chancellor will try to use a smoothed figure, which adjusts for this distortion and hope that no one cries foul over the Tories breaking the Triple Lock manifesto promise.

More on @BBCNewsnight from 2230 on BBC TWO

More on @BBCNewsnight from 2230 on BBC TWO

• • •

Missing some Tweet in this thread? You can try to

force a refresh