Here's Boris Johnson's remakrs today opening the G7.

Says after global financial crisis policy mistakes were made & "the recovery was not uniform across all part of society"...

gov.uk/government/spe…

Says after global financial crisis policy mistakes were made & "the recovery was not uniform across all part of society"...

gov.uk/government/spe…

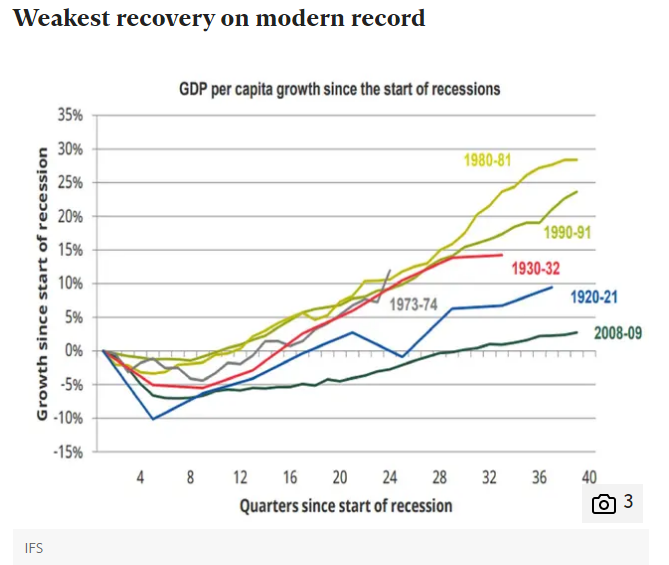

...actually what mainly characterised the period after 2008 was how feeble it was relative to previous UK recoveries, rather than how unequal it was 👇

independent.co.uk/news/business/…

independent.co.uk/news/business/…

...inequality, as measured by the Gini co-efficient, was broadly flat in the decade after 2008... ons.gov.uk/peoplepopulati…

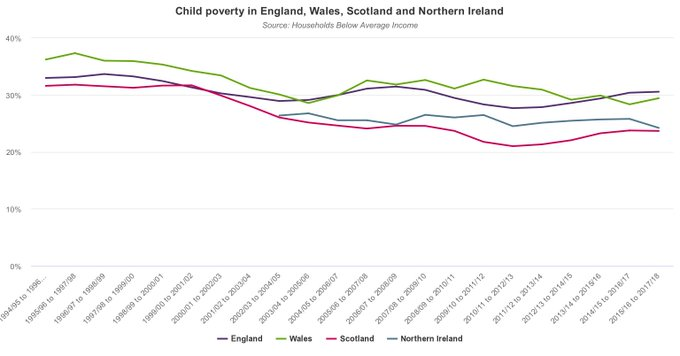

...although child poverty has risen, mainly as a result of the Government's benefit cuts...

jrf.org.uk/data/poverty-l…

jrf.org.uk/data/poverty-l…

• • •

Missing some Tweet in this thread? You can try to

force a refresh