🟥MEV negative externalities🟥

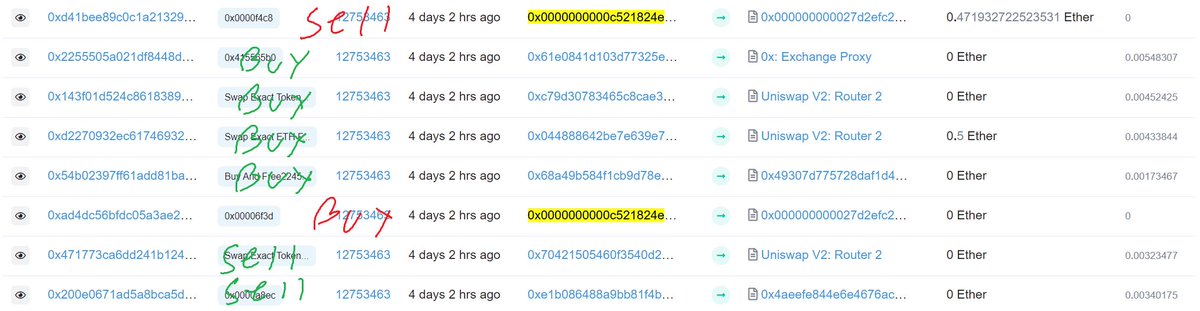

This Polygon bot has been active since June 29th & has sent ~2m transactions, failing *almost* all the time

These failures cost close to nothing but bloat the state, while the few successes pay for the failures many times over

This Polygon bot has been active since June 29th & has sent ~2m transactions, failing *almost* all the time

These failures cost close to nothing but bloat the state, while the few successes pay for the failures many times over

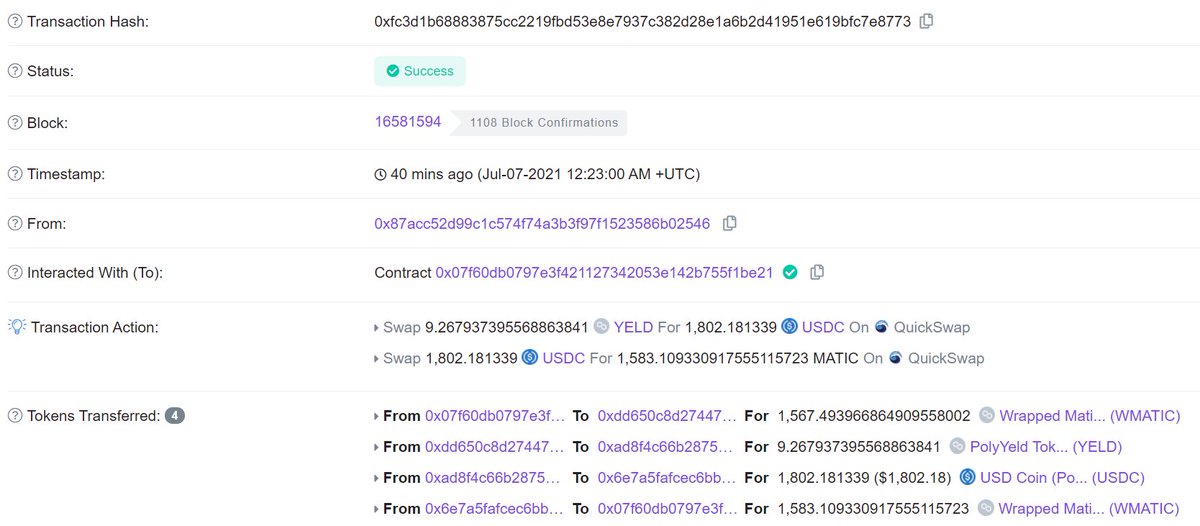

Success transaction:

polygonscan.com/tx/0xfc3d1b688…

One of the many failures: polygonscan.com/tx/0x989a72bce…

polygonscan.com/tx/0xfc3d1b688…

One of the many failures: polygonscan.com/tx/0x989a72bce…

The tricky thing for this bot is it needs to land right behind another user's tx to succeed

Since it can't express those ordering preferences and because the costs of a transaction are so low, it chooses to spam the network with transactions and hope one lands in the right place

Since it can't express those ordering preferences and because the costs of a transaction are so low, it chooses to spam the network with transactions and hope one lands in the right place

It performs a check of the reserves of a Quickswap/Sushiswap pair to ensure it has landed in the right place. Otherwise it cancels itself to save gas. That's why this bot has so many txs that do nothing!

But these consume gas & take up space while adding nothing to the chain.

But these consume gas & take up space while adding nothing to the chain.

As others (@shegenerates, @_marcinja) are noting in the replies MEV-Geth would help reduce the negative externalities of MEV extraction here by moving the auction for blockspace/ordering off-chain and keeping wasted chain space like the above off-chain.

To clarify a bit here by failures I meant transactions that failed to land where they wanted, but didn't revert because of a check in contract for that ordering.

Also should have said wasted block space, not state.

Also should have said wasted block space, not state.

• • •

Missing some Tweet in this thread? You can try to

force a refresh