All 8 transactions here - including some from unexpected places - are a part of one sandwich!

A thread on the increasingly complex sandwich bots we're seeing

A thread on the increasingly complex sandwich bots we're seeing

https://twitter.com/bertcmiller/status/1412566588419608577

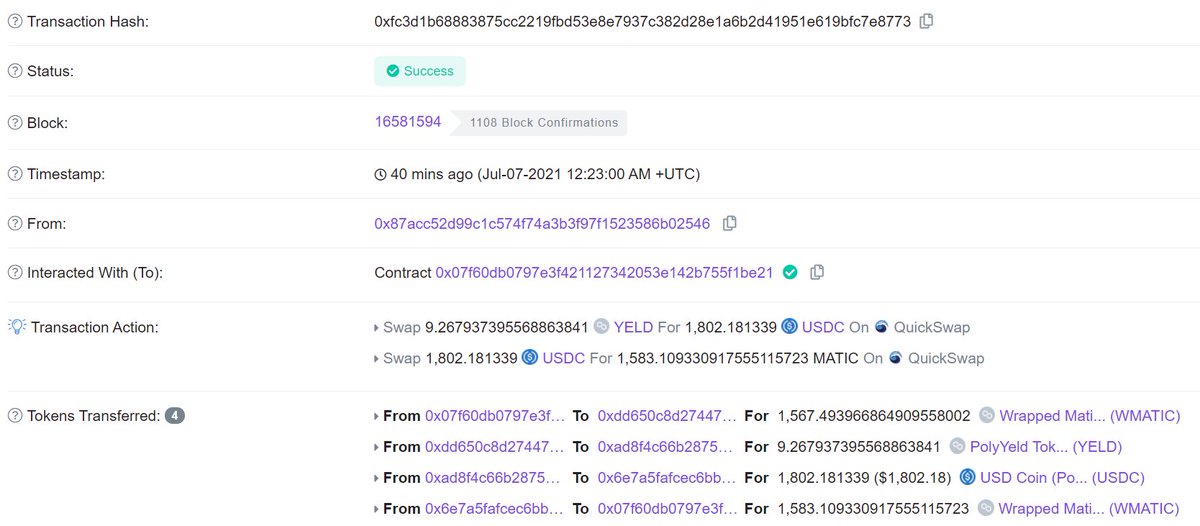

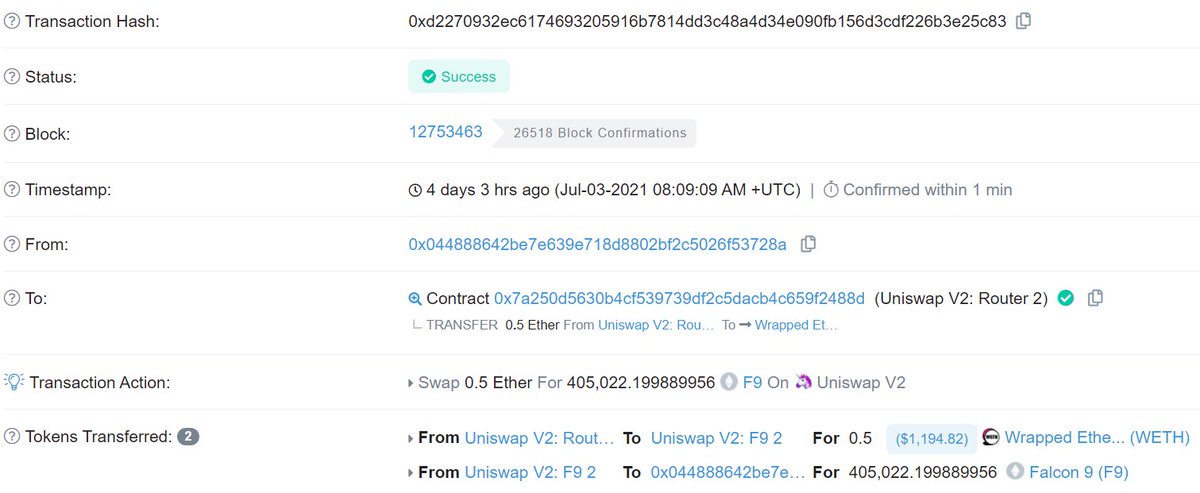

A normal 🥪 bot looks like this

🥪 frontruns a user, buying the asset they intend to and increasing the price. The user gets less tokens now.

The user's buy is then included, pushing the price up more

🥪 sells after the user's tx at the higher price, thus capturing profit

🥪 frontruns a user, buying the asset they intend to and increasing the price. The user gets less tokens now.

The user's buy is then included, pushing the price up more

🥪 sells after the user's tx at the higher price, thus capturing profit

🥪 bots will watch the mempool for users trading with high slippage that they can frontrun. Until recently 🥪 bots would only do this with one trade, and with the Uniswap v2 or Sushiswap router.

But they've leveled up.

But they've leveled up.

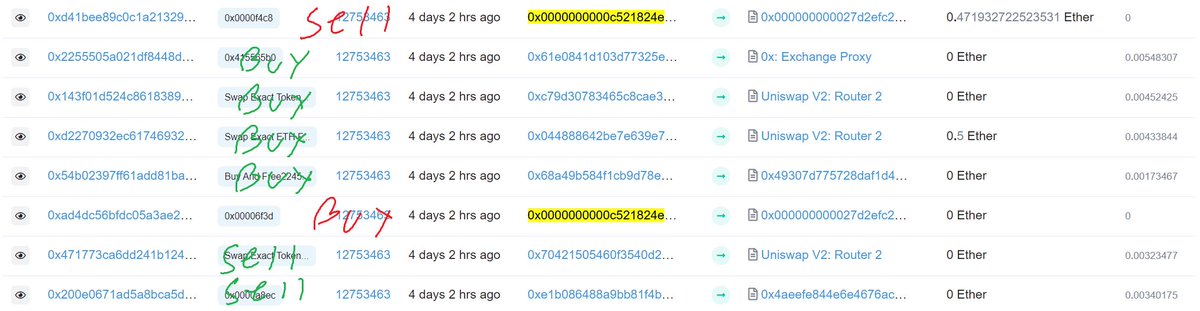

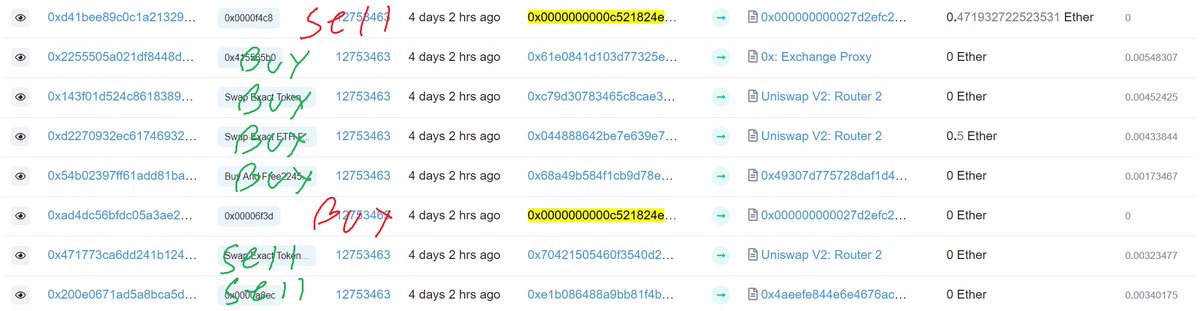

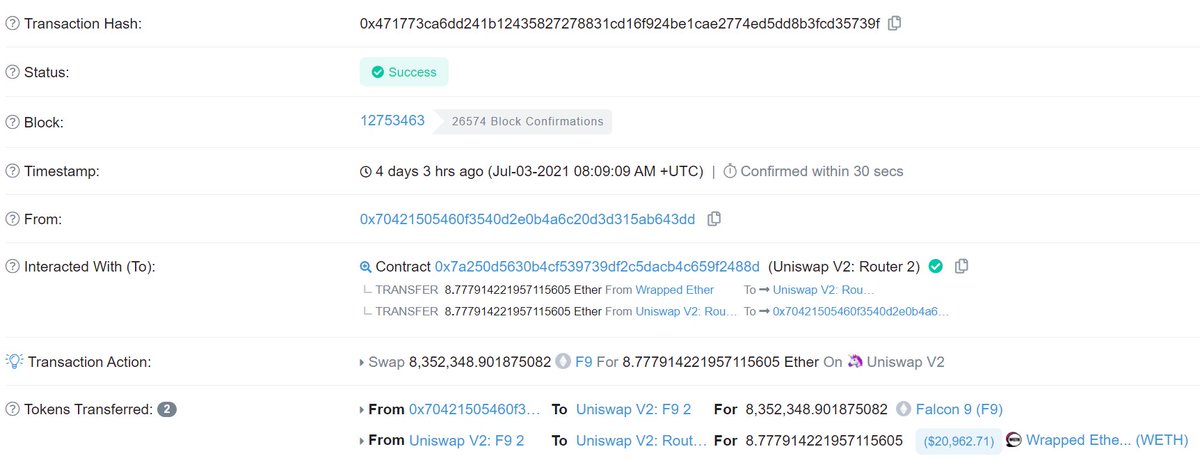

The 🥪 bot here has their address highlighted in yellow, and I annotated the transactions in red. As you can see they included 4 (!) transactions between their buy and sell!

But why?

But why?

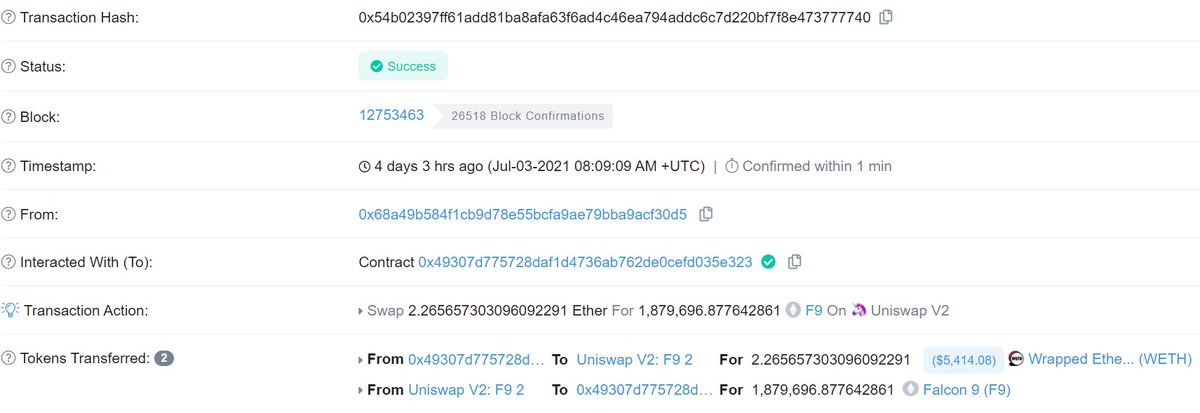

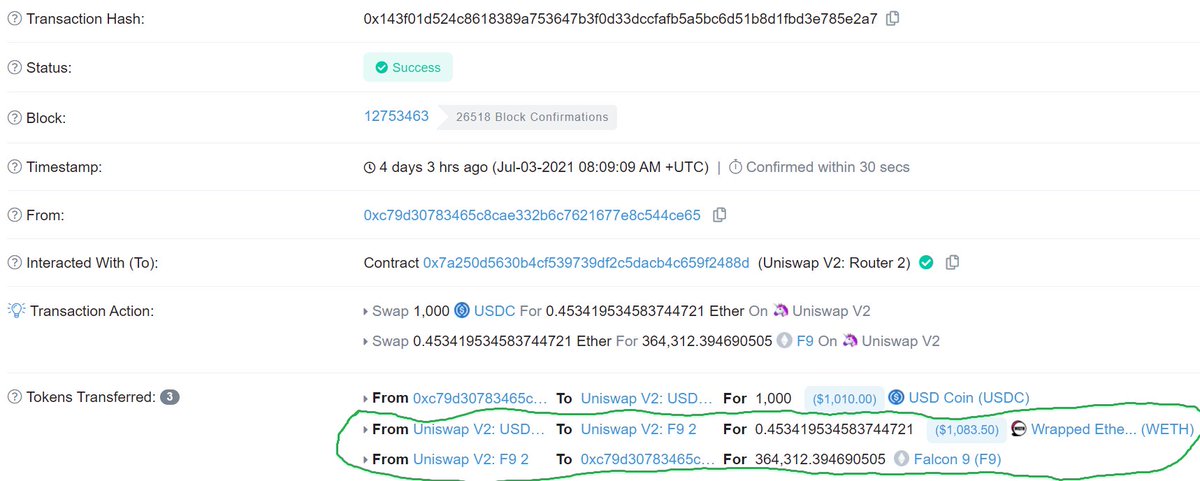

Each of these four, in part, did the same thing. They bought F9 token with ETH. By stacking these F9 buys together, this 🥪 bot was essentially using other users to drive the price up higher for the last trade.

The last trade has a set amount of slippage. Frontrunning it can only push the price so high. The 🍞 could increase the price without other transactions too.

So why include them? Because by having other users drive the price up it saves the 🥪 on the 0.3% fee v2 charges. Clever!

So why include them? Because by having other users drive the price up it saves the 🥪 on the 0.3% fee v2 charges. Clever!

Note the tradeoff here: they save on the Uniswap LP trading fees, but increase the gas used of the bundle. It won't always make sense to do this.

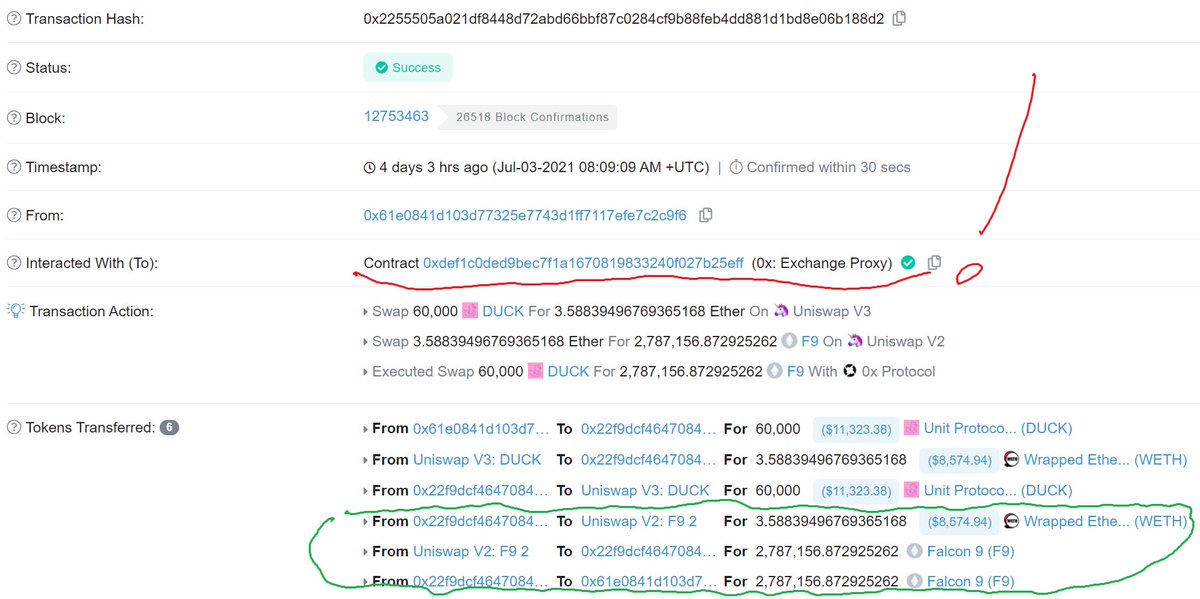

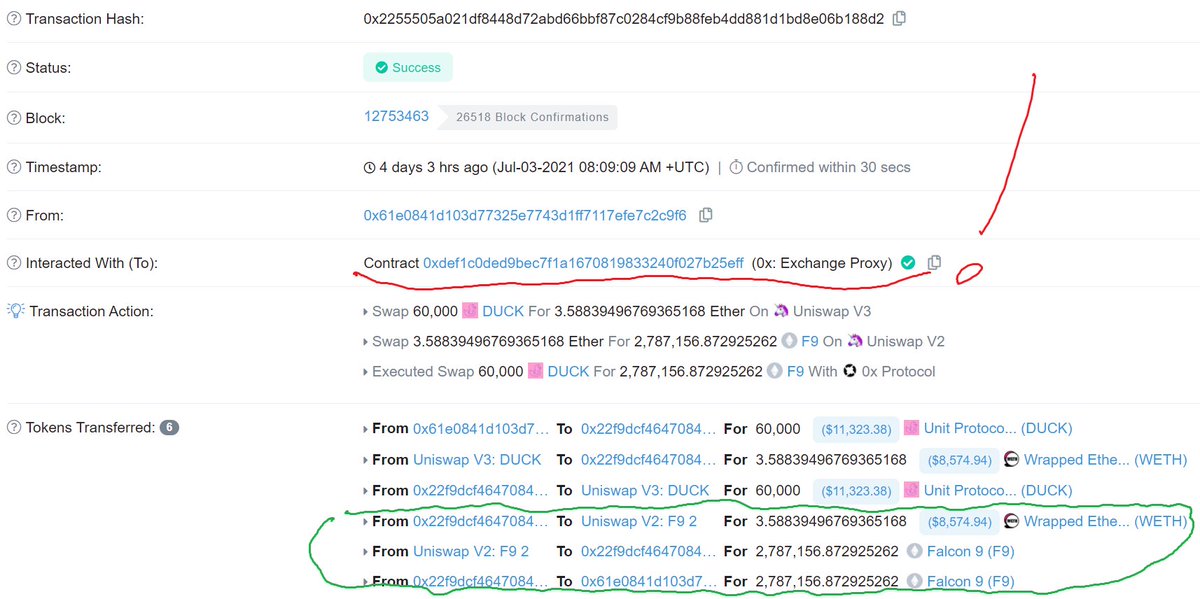

Also, did you catch the other unique factor there? The 🥪 bot included a trade to the 0x proxy.

0x traded on Uniswap v2 F9/WETH pair on the users' behalf, and the 🥪 bot here was able to figure this out and frontrun just the Uniswap v2 part of that trade cc: @willwarren89

0x traded on Uniswap v2 F9/WETH pair on the users' behalf, and the 🥪 bot here was able to figure this out and frontrun just the Uniswap v2 part of that trade cc: @willwarren89

We are not done just yet. Just before the 🥪 buy there are 2 sells of F9 token for ETH. These lower the price of that pair and the 🥪 bot is backrunning them to get a better price for their buy

So the 🥪 buy ends up being part 🥪 AND backrunning arbitrage. Some 🧈 for the 🍞.

So the 🥪 buy ends up being part 🥪 AND backrunning arbitrage. Some 🧈 for the 🍞.

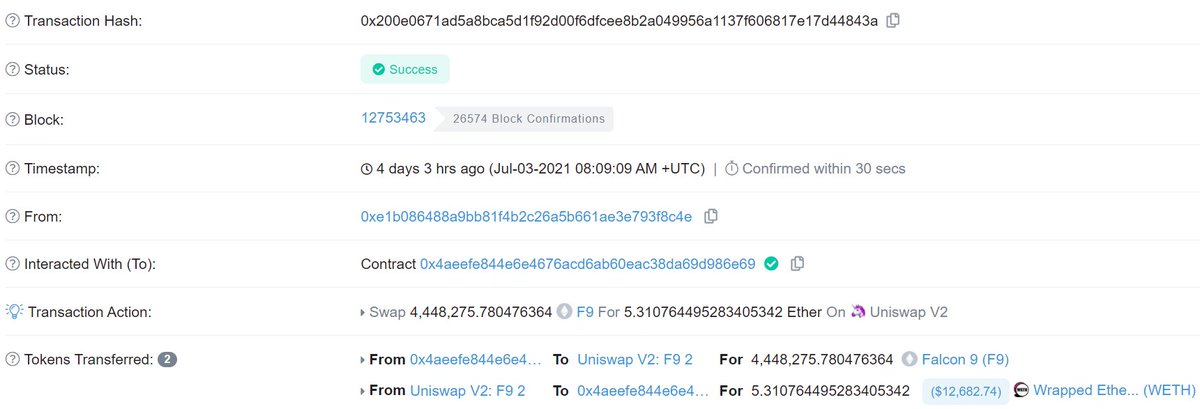

Finally, it seems that two of the transactions here came from what appear to be rare mempool 🥪 bots

etherscan.io/address/0x4aee…

etherscan.io/address/0x4930…

etherscan.io/address/0x4aee…

etherscan.io/address/0x4930…

The block itself if you want to dig into this more

etherscan.io/txs?block=1275…

etherscan.io/txs?block=1275…

Finally I’ll note that we used to only see trades directly to Uniswap v2 and Sushiswap’s router get 🥪d. Now bots watch a range of aggregators and frontrun them conditional on what the aggregators trades too.

h/t: @SiegeRhino2 for raising this block to me

• • •

Missing some Tweet in this thread? You can try to

force a refresh