1/ Introducing the price to earnings (P/E) ratio!

A natural next step after the price to sales (P/S) ratio.

A thread 👇

tokenterminal.substack.com/p/introducing-…

A natural next step after the price to sales (P/S) ratio.

A thread 👇

tokenterminal.substack.com/p/introducing-…

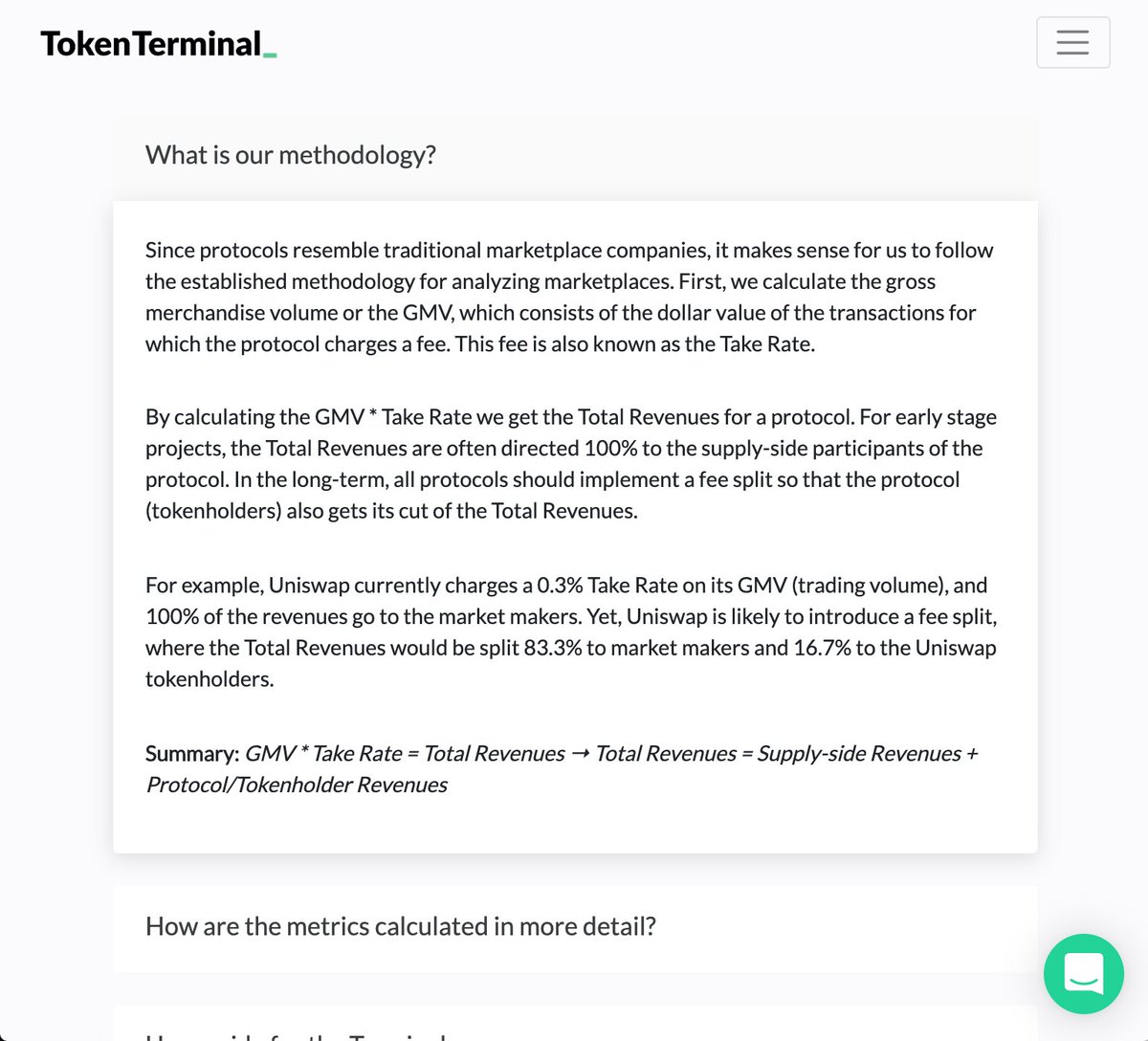

2/ The 'E' in the P/E ratio will initially be based on protocol revenue, i.e. money generated from the protocol’s business & subsequently allocated to its treasury or distributed to its token holders.

*In the beginning, the P/E ratio won't take into account a protocol's costs.

*In the beginning, the P/E ratio won't take into account a protocol's costs.

3/ How should I use the P/S and P/E ratios when analyzing a protocol?

We’ll go through 3 different scenarios, which highlight the possible revenue distributions of a protocol, and how the distribution affects the two ratios.

We’ll go through 3 different scenarios, which highlight the possible revenue distributions of a protocol, and how the distribution affects the two ratios.

4/ I. Protocols that have only supply-side revenue

For protocols like @Uniswap, where all trading fees currently go to the liquidity providers (supply-side), there won’t be a P/E ratio available.

For protocols like @Uniswap, where all trading fees currently go to the liquidity providers (supply-side), there won’t be a P/E ratio available.

5/ II. Protocols that have only protocol revenue

For protocols like @MakerDAO, where all interest payments currently go to the protocol & are subsequently distributed to MKR holders through buybacks, the P/S and P/E ratios will be the same.

For protocols like @MakerDAO, where all interest payments currently go to the protocol & are subsequently distributed to MKR holders through buybacks, the P/S and P/E ratios will be the same.

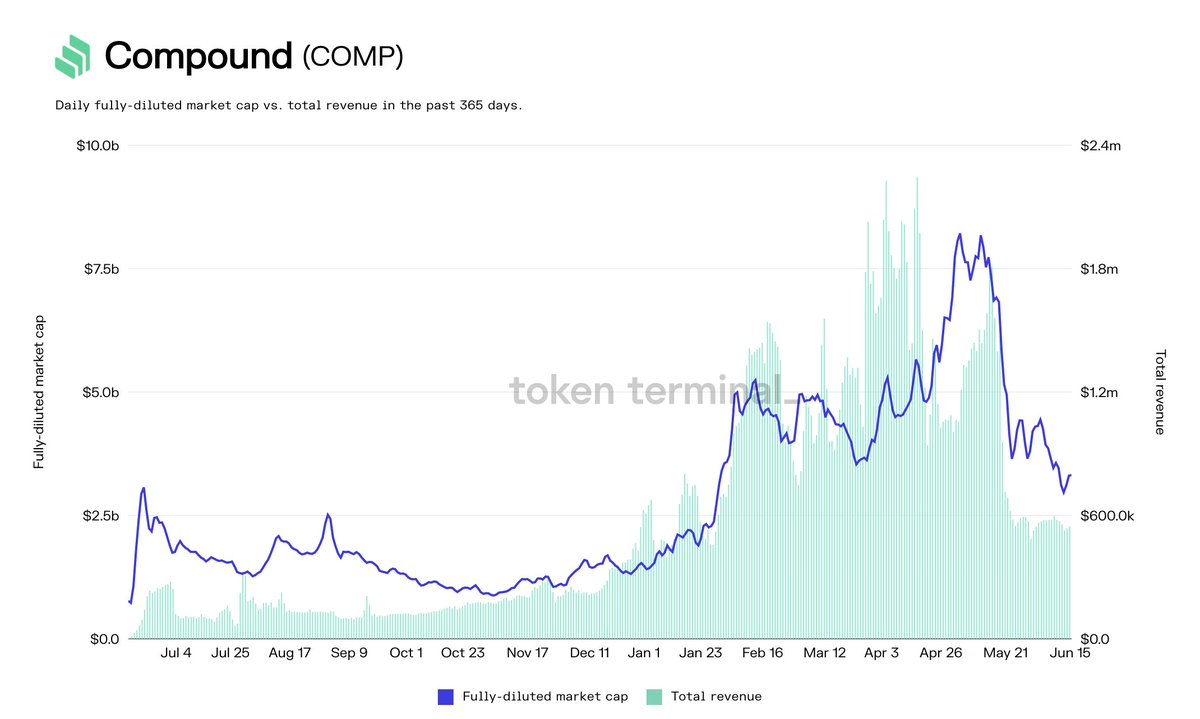

6/ III. Protocols that have both supply-side & protocol revenue

For protocols like @compoundfinance, where interest payments are divided between lenders (supply-side) and the protocol’s treasury (managed by COMP holders), there will be both a P/S and a P/E ratio available.

For protocols like @compoundfinance, where interest payments are divided between lenders (supply-side) and the protocol’s treasury (managed by COMP holders), there will be both a P/S and a P/E ratio available.

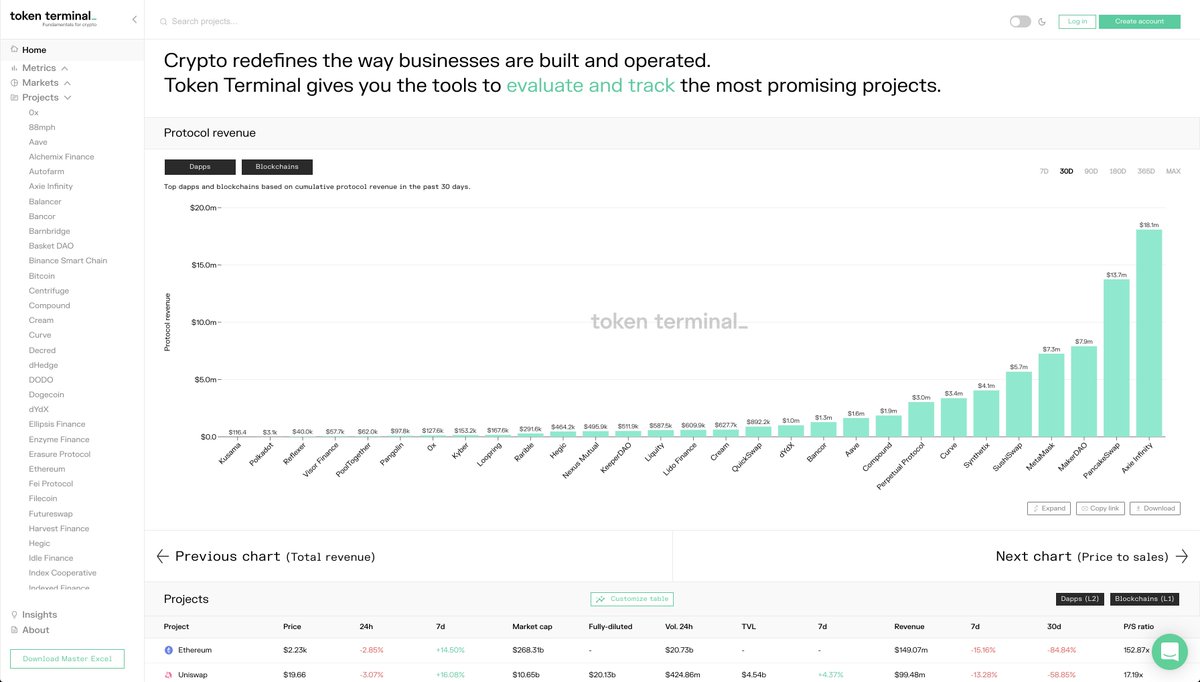

fin/ Finally, make sure to check out our new price to earnings (P/E) ratio dashboard here 👇

tokenterminal.com/terminal/metri…

tokenterminal.com/terminal/metri…

• • •

Missing some Tweet in this thread? You can try to

force a refresh