Given the immense interest in this #investment #process thread about how to get investment ideas, thought of creating a logical follow-up 🧵

Given that I have an idea & some sense for valuation & growth, how do i construct a portfolio?

If you like the thread, plz RT.

Given that I have an idea & some sense for valuation & growth, how do i construct a portfolio?

If you like the thread, plz RT.

https://twitter.com/sahil_vi/status/1412235035671875585

First thing worth mentioning is that I am only describing my own process. Others can follow a different process which could work for them.

Opposite of a good idea can also be a good idea

Opposite of a good idea can also be a good idea

Before understanding the process itself, it is important to understand the problems the process is being designed to solve for. What are the key hurdles or troubles I have faced in designing my PF.

Hurdles

1. At any given point in time (in the past) i have only known deeply about 5% of the listed universe in India, or lower. When I say know deeply I mean read an annual report, an investor presentation, a concall, understood why the business is how it is.

1. At any given point in time (in the past) i have only known deeply about 5% of the listed universe in India, or lower. When I say know deeply I mean read an annual report, an investor presentation, a concall, understood why the business is how it is.

2. I only started my corporate life 4 years ago, so my pf size is small compared to yearly savings. This means that I need to deploy large incremental capital every year at least for next few years. This cant be a buy & track pf, this is a keep buying & tracking for a few yrs pf

3. Often, for the kind of companies I am looking for (more on this later) Valuations run ahead of fundamentals. (Example: Saregama 🎶🎵🎹)

Having talked about the hurdles, let us also quickly recap from previous thread, the kind of companies i WANT in my portfolio.

1. Visibility of Growing profits at 20%+ CAGR for next 3-4 years at least. Largely driven by top line growth.

2. Good unit economics or clearly improving unit economics (ROCE). For some cos ROCE might be optically depressed due to several reasons. Need to look beyond these.

2. Good unit economics or clearly improving unit economics (ROCE). For some cos ROCE might be optically depressed due to several reasons. Need to look beyond these.

3. Some source of durable competitive advantages, a way to defend & expand their market share. A way to fight the forces of capitalism which always want to push ROCE downward with higher competition.

4. Industry tailwinds. If industry itself is growing in double digits, it is very difficult for the company to mess up too badly. (Example: Look at how fast digitization is growing. #Mastek cant mess up too badly even if they tried to. Business downside limited)

5. the company has to be undervalued. I want to own a great quality business run by great quality management in an industry with high tailwinds, & i want to buy it cheap.

When I say cheap, what I mean is that in my understanding, there is room for rerating.

Example: #RACL was at a P/E of 3-4 during march-april-may last year. What is the P/e multiple now? Business & management quality was equally good back then too.

Example: #RACL was at a P/E of 3-4 during march-april-may last year. What is the P/e multiple now? Business & management quality was equally good back then too.

Evaluating Candidates

Now imagine that I already own a portfolio of 15 companies (more on this later). How do I decide where and whether to place this new business I am excited about into the portfolio?

Now imagine that I already own a portfolio of 15 companies (more on this later). How do I decide where and whether to place this new business I am excited about into the portfolio?

I realized the only way is to do the grungy work of building out some sort of a model for what returns I expect each pf stock to give in next K years, & compare all PF stocks based on that metric with the candidate.

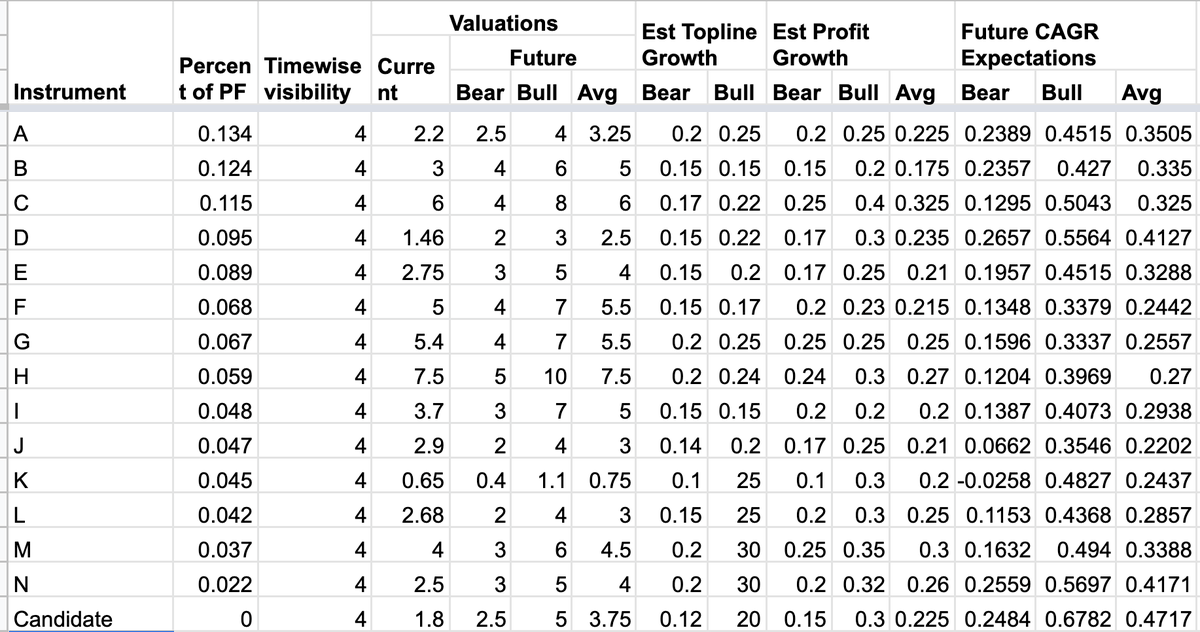

This is what that looks like. Will Explain this table in next few tweets. A to N are existing portfolio companies, 'Candidate' is a new candidate for portfolio.

Essentially what I do is to track current/entry valuations for each co, what I believe exit valuations might look like (a bear case and a bull case) and also what bottomline growth I can expect both in bear and bull case.

Combining these in the proportion of allocation size/CMP gives me the expected future pf returns both in bear and bull scenarios and thus in average scenario.

For any 'candidate' pf addition, I find a candidate to delete from the pf. I wont add a new co unless i can sell off an old co. Why? because concentration builds wealth. We'd want to allocate highest possible capital to our biggest winners. That cant be done if i own 50 stocks

Under what conditions would i replace 'D' (an example PF company) with the 'candidate'? A few different conditions must be met.

1. expected future price return in 'Candidate' must be significantly higher than 'D' otherwise the noise in the estimation process can lead to a bad decision. Bias is towards holding existing co. Typically I expect at least 10-15% higher CAGR for the new co for me to consider it

2. The PF diversity must not go down. We want PF companies to be highly uncorrelated to each other. This is only way to 'diversify' cashflows we own. Investors that own 60-70% in 1-2 sectors risk getting adversely affected by any sector specific headwinds.

In practice what this means is that if i already own 3 pharma/healthcare cos I wont sell a financial to buy a 4th heathcare co. That increases pf risk which I dont want to do. Ideally each co should belong to a different sector. That is of course hard to achieve in practice

3. I dont want more than 33-40% of PF value to be in illiquid microcaps. More on microcaps later. But sizable part of pf has to be in liquid counters (it is subjective what us liquid) so that it is easy to move on, if the need arises.

If these conditions are being met, I am ok to replace an existing pf company with the candidate due to higher (business) risk adjusted returns.

When to sell

The most obvious condition under which I would sell is if I can find a better opportunity. I also sell on severe overvaluation. 15% top line growth 20% bottomline growth does not deserve 80 p/e regardless of the industry structure, or anything else, in my books.

The most obvious condition under which I would sell is if I can find a better opportunity. I also sell on severe overvaluation. 15% top line growth 20% bottomline growth does not deserve 80 p/e regardless of the industry structure, or anything else, in my books.

Why is overvaluation a trigger to sell?

If something is valued at 80 p/e, even if overvaluation continues, stock returns would mirror the bottomline growth. If i can find better opportunities, then it does not make sense to stick to something which can only offer me 20% growth

If something is valued at 80 p/e, even if overvaluation continues, stock returns would mirror the bottomline growth. If i can find better opportunities, then it does not make sense to stick to something which can only offer me 20% growth

Is Over-valuation always a trigger to sell?

No. I am ok to hold an over-valued co if clear growth of 20% exists + i can see some optionalities which have high probability of playing out.

No. I am ok to hold an over-valued co if clear growth of 20% exists + i can see some optionalities which have high probability of playing out.

Best example is Saregama 🎶🎵🎹. Overvalued, but clear growth triggers like shift from ad to subscription based can & will accelerate the growth.

Best example for when I sold on over-valuation is polymed sold for Kilpest added. I did that because polymed has much worse unit economics, high capex requirement for continued growth, previous history of multiple collapsing when people realize it wont grow more than 15-20%.

Now if you own polymed, please dont defend it, remember what prof bakshi has taught us: The opposite of a good idea can also be a good idea.

Other reasons for selling are if we can see business execution faltering and investment thesis not playing out as per our estimates.

One primary reason i have to sell on overvaluation is as we would remember, i have to deploy large incremental capitals. At P/e of 25-30 polymed was a clear candidate for rerating given the consistent growth both in past and future.

At p/e of 90, it is a candidate for derating. My only fidelity is to my hard earned capital. How can i, in good faith, deploy large capital to a co growing at 15-20% with average unit economics and expected price returns even lower due to derating.

Position sizing

One of the most important elements of pf construction. I start my positions small, typically 2-3% of pf for a microcap & 5% of pf for a liquid small/midcap. I average up as per management execution.

One of the most important elements of pf construction. I start my positions small, typically 2-3% of pf for a microcap & 5% of pf for a liquid small/midcap. I average up as per management execution.

Best possible scenario is one where execution is improving but price is becoming worse. Believe it or not, this happens.

Saregama 🎶🎵

Neuland 🌋🌋

Kilpest 🧬💉

all feel after Q4 results despite my understanding that business was becoming better. I averaged up.

Saregama 🎶🎵

Neuland 🌋🌋

Kilpest 🧬💉

all feel after Q4 results despite my understanding that business was becoming better. I averaged up.

Higher position sizing based on higher conviction based on higher visibility of business change (durable competitive advantages, growth, unit economics) based on higher learning about the business (concalls, ARs, competitors material, industry outlook)

This is the way my position sizing works.

Example: I own #IDFCFIRSTB 🏦 for > 1.5 years now. Initially allocated position size was hardly 1-2% of net worth, it is now close to 5% now.

Example: I own #IDFCFIRSTB 🏦 for > 1.5 years now. Initially allocated position size was hardly 1-2% of net worth, it is now close to 5% now.

Position size ⤴️ when

Conviction ⤴️ when

Business Visibility ⤴️ when

Business learning/Understanding ⤴️ when

I work hard.

This is why I continue to work hard even for cos i already own.

Conviction ⤴️ when

Business Visibility ⤴️ when

Business learning/Understanding ⤴️ when

I work hard.

This is why I continue to work hard even for cos i already own.

Churn: Love it or hate it, cant avoid it.

Many investors brag about their holding period of cos. I personally cant do that yet. Why? Coz churn helps me in 2 ways.

Many investors brag about their holding period of cos. I personally cant do that yet. Why? Coz churn helps me in 2 ways.

1. Think about the fact that I have constructed my PF with best risk adjusted return opportunities I have found from 5% of the listed universe I have studied. Can I ever claim that thes 15 are the best that there are? What about the rest of the 95% of universe?

As i continue to learn more about new sectors and new opportunities, i continue to find cos which i previously did not know about. Cos which are better on durable competitive advantage, growth AND valuation.

It would be weird for me to stick to the sub-optimal opportunity just because i found the existing PF company first.

do also read about ownership bias if you haven't.

en.wikipedia.org/wiki/Endowment…

do also read about ownership bias if you haven't.

en.wikipedia.org/wiki/Endowment…

2. Churn helps me avoid deploying money into cos where valuations are very out of whack with fundamentals (with little to no clear growth optionalities) & where future expected returns are low.

Warren Buffett owned 400 stocks in the 50s. That was also one of his highest CAGR return period. As an investor with small capital size & large incremental capital addition who also happens to be a noob (might have read <5% of listed universe) I cannot avoid churn.

Having said that I expect churn to go down over time due to 2 factors:

1. With time I learn more & understand myself better as an investor. Sahil of 1 year ago was ok to own NCC. Today's sahil vastly prefers predictable cashflows guarded by DCAs.

1. With time I learn more & understand myself better as an investor. Sahil of 1 year ago was ok to own NCC. Today's sahil vastly prefers predictable cashflows guarded by DCAs.

Probably wont evaluate direct infra plays again for a long time.

2. As the current bull market proceeds and participation becomes wider opportunity set shrinks. Until 2-3 months ago, microcaps were a clear area of inefficiency in the market (this is also why I love owning them)

2. As the current bull market proceeds and participation becomes wider opportunity set shrinks. Until 2-3 months ago, microcaps were a clear area of inefficiency in the market (this is also why I love owning them)

No more. Very little is hidden or #unseen any more.

300cr cos are moving 50% in 3 days after concalls. (Brownie points to those who can guess what I am referring to).

300cr cos are moving 50% in 3 days after concalls. (Brownie points to those who can guess what I am referring to).

In short, churn helps me avoid Hurdle 1 and 3.

Having shared in gory details my thoughts on PF construction, I am happy to now share my current portfolio.

Standard disclaimers apply: I can sell or buy anything anytime without prior notice. Do your own due diligence before buying anything. I will help any way I can.

Standard disclaimers apply: I can sell or buy anything anytime without prior notice. Do your own due diligence before buying anything. I will help any way I can.

The reason I have added my average buying price is that that people dont clone blindly.

If you ask me : Sahil, is X looking ok to buy at these levels? I will have to pass up on that conversation. Please do your own due diligence then reach your own conclusions. 🙏🙏🙏

If you ask me : Sahil, is X looking ok to buy at these levels? I will have to pass up on that conversation. Please do your own due diligence then reach your own conclusions. 🙏🙏🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh