Global markets will likely crash in the next ~2 months, and how I believe #Bitcoin & #crypto will be affected.

/thread

/thread

https://twitter.com/godeLives/status/1407478804742914048

/1. Unemployment Benefits Ending

Enhanced unemployed benefits for ~14m+ (in US alone) are scheduled to end completely by Sept. (~10 states have ended early).

Transfer payments are a big component of 'CARES' act that helped boost incomes above normal levels since the pandemic.

Enhanced unemployed benefits for ~14m+ (in US alone) are scheduled to end completely by Sept. (~10 states have ended early).

Transfer payments are a big component of 'CARES' act that helped boost incomes above normal levels since the pandemic.

/2. Rent Eviction Moratoriums, Mortgage Forbearance, Student Loans Deferment Periods, etc

Along with the phase out of Enhanced UI benefits / PUA, we have a number of factors on the opposite side of the equation that will increase expenses / debt payments for millions.

Along with the phase out of Enhanced UI benefits / PUA, we have a number of factors on the opposite side of the equation that will increase expenses / debt payments for millions.

/3. These factors will act as a headwind, preventing capital from finding its way into many parts of the economy.

Higher Expenses (debt payments) = Credit Contraction = Currency Destruction (i.e. less discretionary spending for risk-on assets) / Lower Inflation

Higher Expenses (debt payments) = Credit Contraction = Currency Destruction (i.e. less discretionary spending for risk-on assets) / Lower Inflation

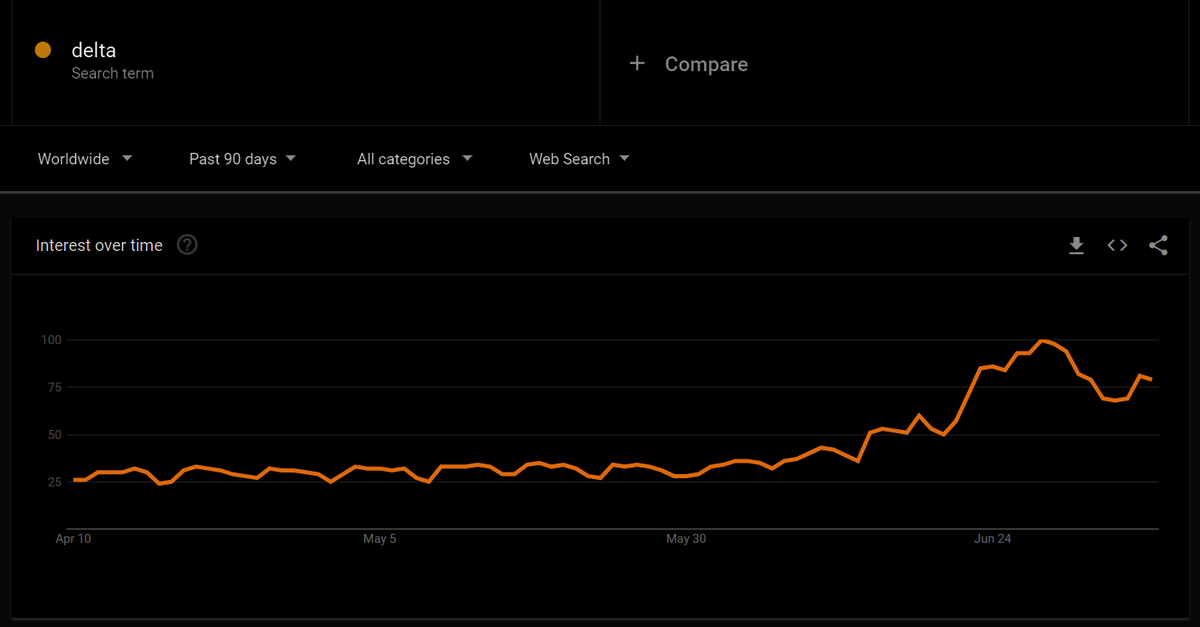

/4. Delta Cases as a Black Swan

COVID 'Delta' variant case numbers have thus far been hidden under 'normal' COVID cases (hiding their increase).

The 'Delta' strain is also much more contagious, & seems novel enough to exhibit resiliency against readily available vaccinations.

COVID 'Delta' variant case numbers have thus far been hidden under 'normal' COVID cases (hiding their increase).

The 'Delta' strain is also much more contagious, & seems novel enough to exhibit resiliency against readily available vaccinations.

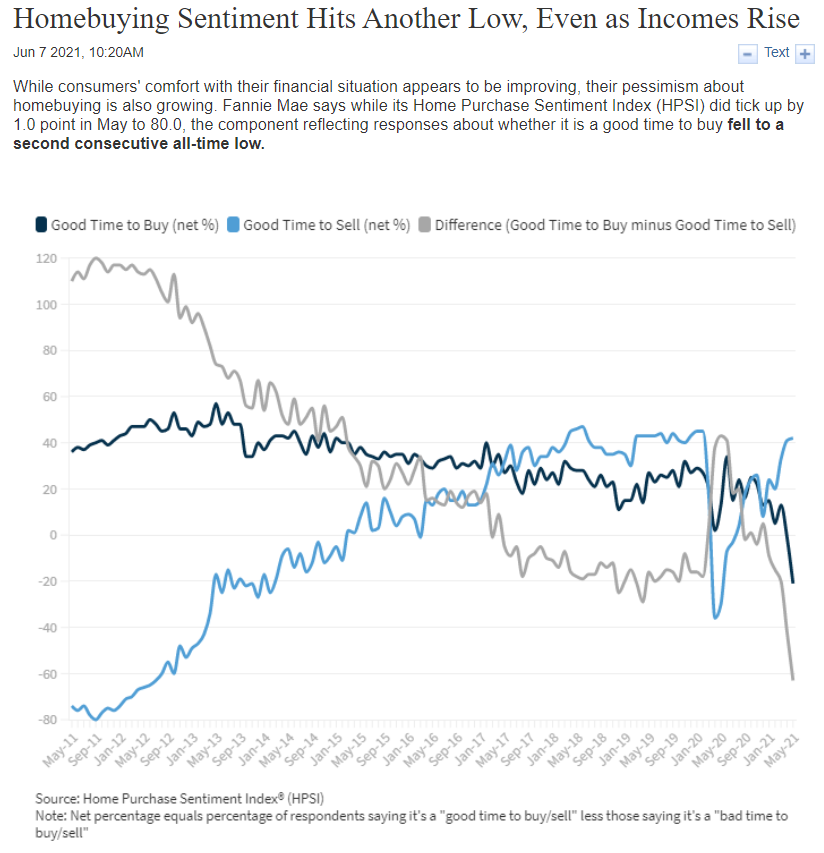

/5. Housing Market Topping ?

a.) Home buyer sentiment (leading indicator) - hits all time low, even as incomes risk. What will happen when incomes fall off a cliff in Sept?

b.) Weeks of work needed to buy median home reaches near record high - Levels not seen since 2008 GFC.

a.) Home buyer sentiment (leading indicator) - hits all time low, even as incomes risk. What will happen when incomes fall off a cliff in Sept?

b.) Weeks of work needed to buy median home reaches near record high - Levels not seen since 2008 GFC.

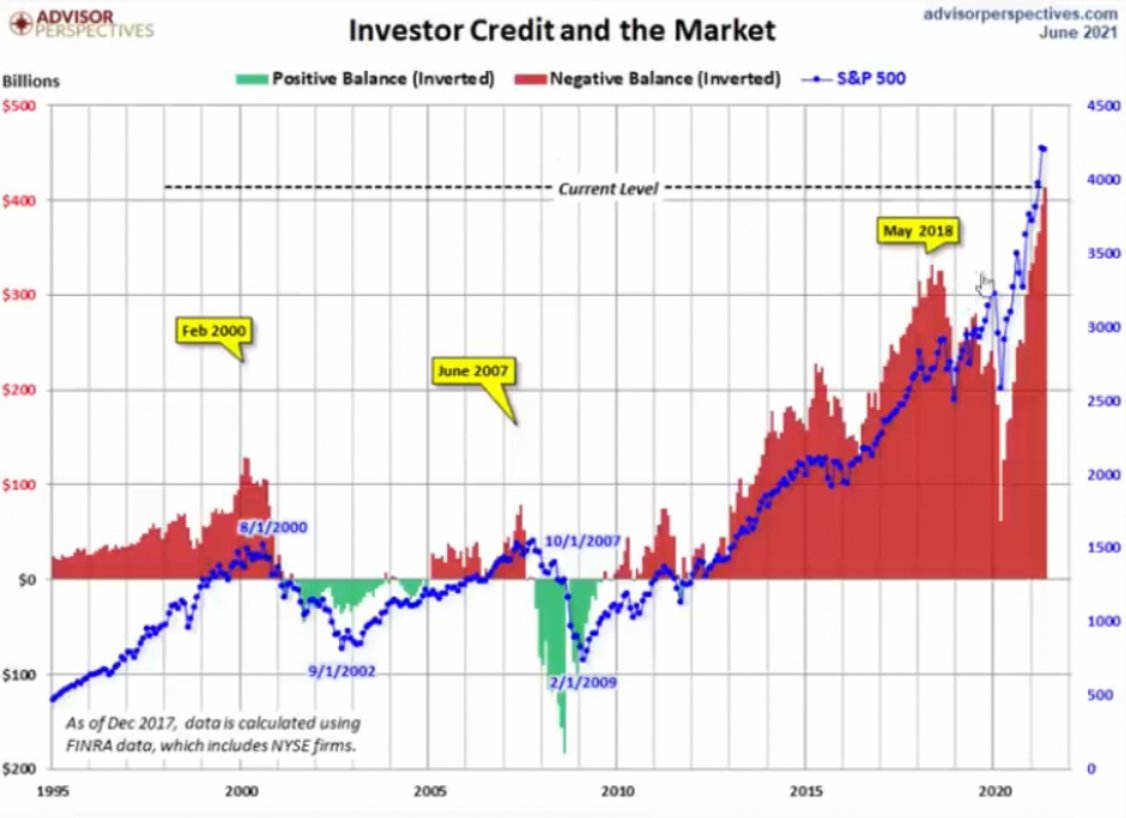

/6. Leverage Near All-Time Highs

Traders borrowing funds that they do not own (margin credit), to purchase speculative assets in hopes that they will continue to go up forever is at record levels.

Traders borrowing funds that they do not own (margin credit), to purchase speculative assets in hopes that they will continue to go up forever is at record levels.

/7. Brokers & Exchanges assign 'buying / leverage' power based on current value of the underlying held account assets.

This is great when said underlying assets continue to go up (more margin is allowed as collateral value increases) - when this reverts, the opposite occurs.

This is great when said underlying assets continue to go up (more margin is allowed as collateral value increases) - when this reverts, the opposite occurs.

/8. Bond Market Bullish & Lower Yields

When financial conditions get tight, yields head lower (as demand for credit decreases) - therefore, when yields lower, equities soon follow.

When financial conditions get tight, yields head lower (as demand for credit decreases) - therefore, when yields lower, equities soon follow.

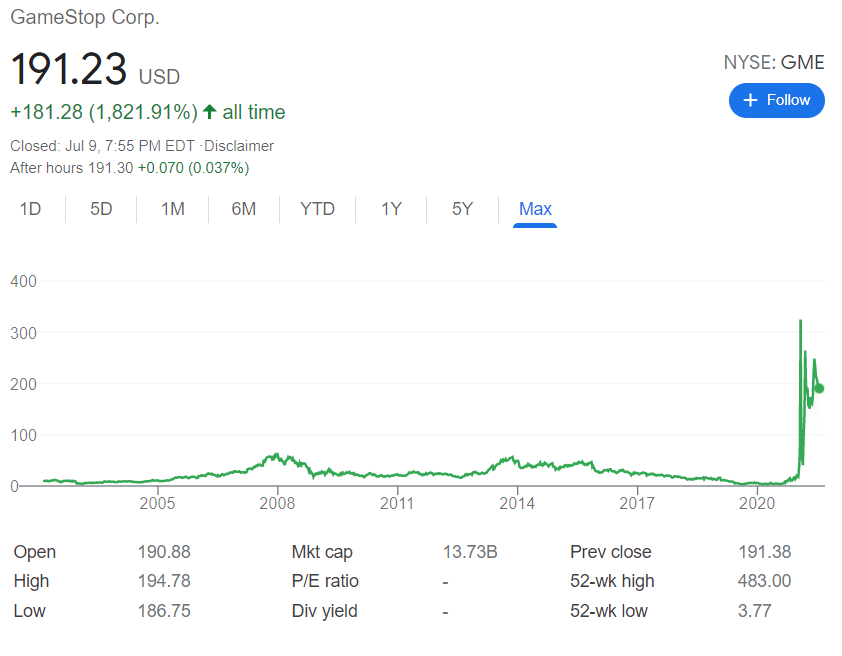

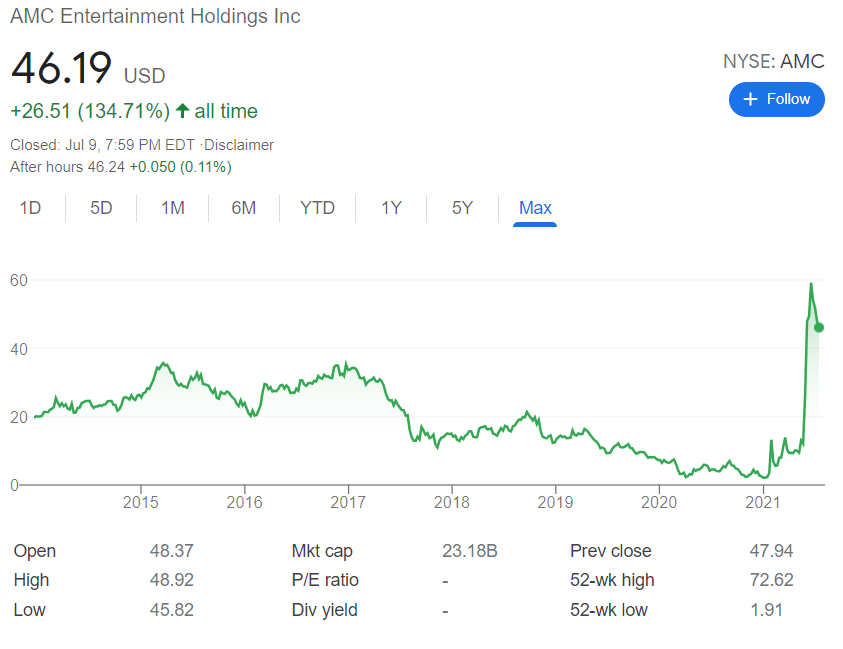

/9. High-Spec Retail Saturated Meme Stocks Topping

One of the most relatable signs of the current reflation trade has been signature 'Meme' stocks such as Gamestop (GME) & AMC.

One thing is easily identifiable : Everyone in retail who 'wanted a piece', has already had a chance.

One of the most relatable signs of the current reflation trade has been signature 'Meme' stocks such as Gamestop (GME) & AMC.

One thing is easily identifiable : Everyone in retail who 'wanted a piece', has already had a chance.

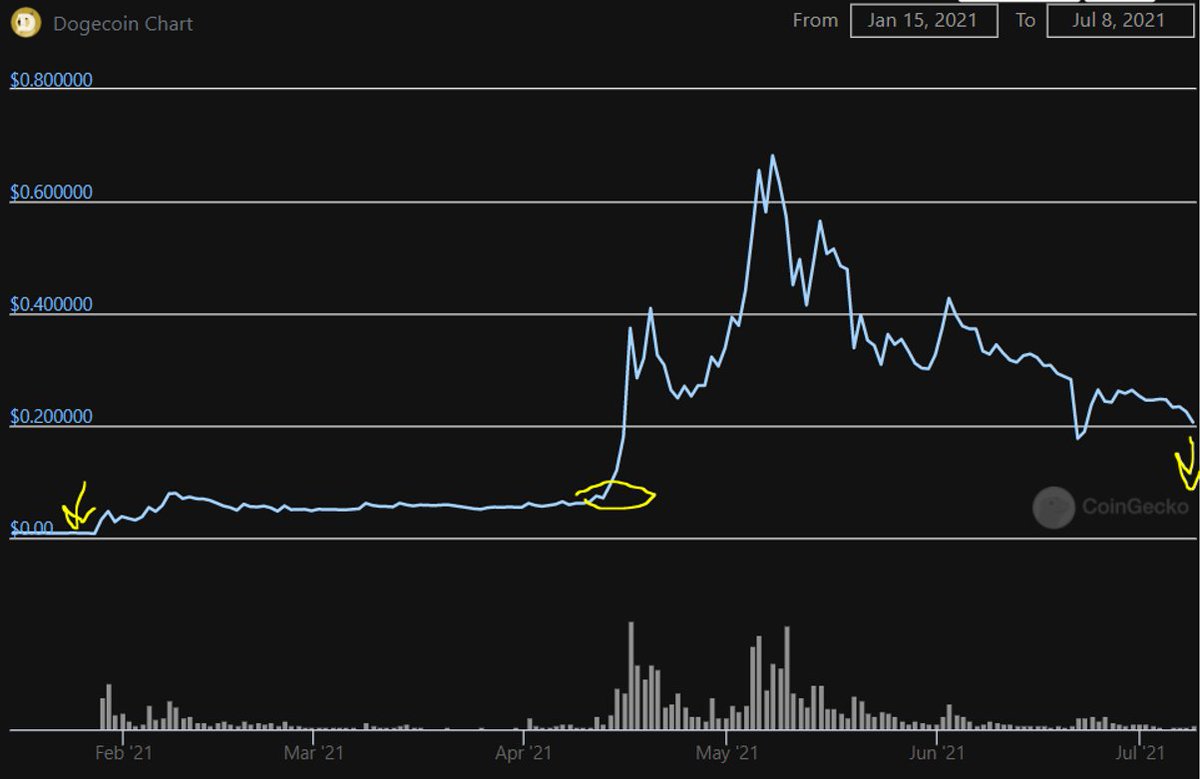

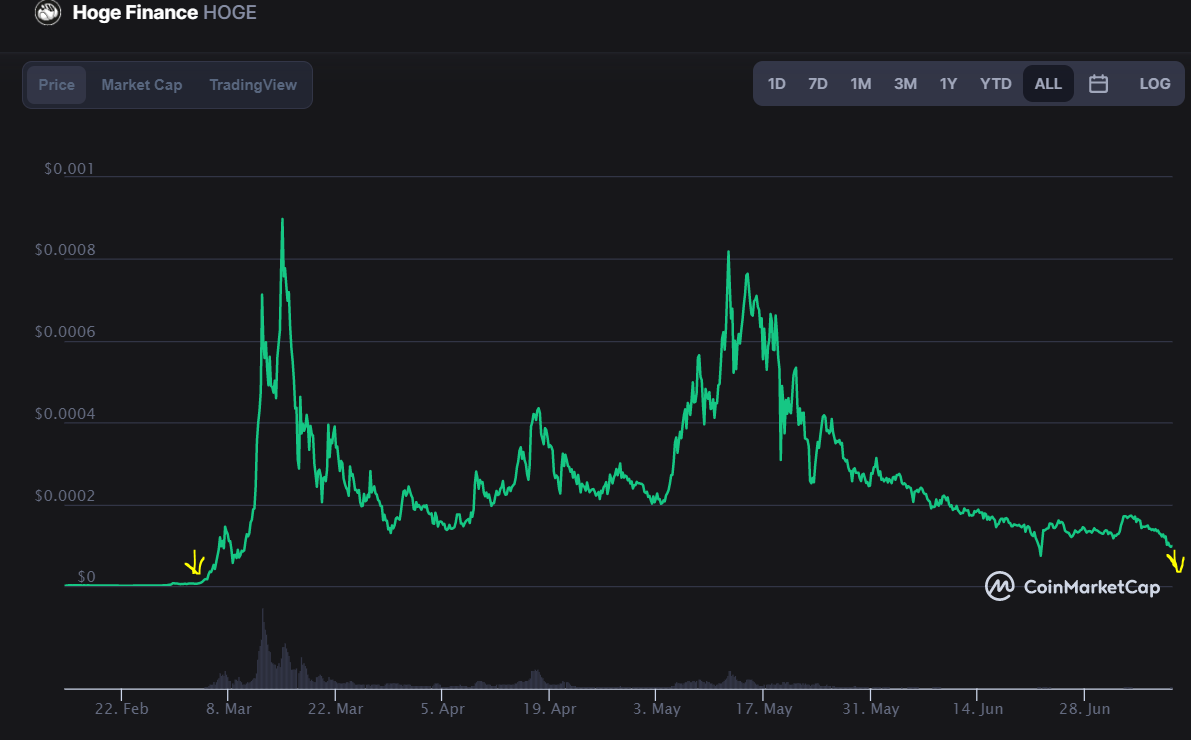

/10. High-Spec Retail Saturated Cryptos Reverting

Alts, especially hype driven 'retail friendly' alts, love to revert to their prior break-out points post hype cycle. Typically this means a complete cycle retrace.

One look at the charts on many, and it's clear to see.

Alts, especially hype driven 'retail friendly' alts, love to revert to their prior break-out points post hype cycle. Typically this means a complete cycle retrace.

One look at the charts on many, and it's clear to see.

/11. How Will $BTC / #Alts be affected ?

A relevant comparison could be the March '20 COVID crash - a margin-driven liquidity evt. affecting markets.

One pro in crypto's corner : A ~50% haircut from ATH's has already taken place, so further selling could be muted below $30k.

A relevant comparison could be the March '20 COVID crash - a margin-driven liquidity evt. affecting markets.

One pro in crypto's corner : A ~50% haircut from ATH's has already taken place, so further selling could be muted below $30k.

/12. With that said however, it is not unreasonable to assume aforementioned high-spec retail driven 'meme' altcoins to suffer most dramatic volatility during any market event.

$BTC could fair best (ala March '20), rallying off oversold levels - giving an entry of a lifetime.

$BTC could fair best (ala March '20), rallying off oversold levels - giving an entry of a lifetime.

/13. Conclusion

Many believe inflation (on assets, goods & services) is here to stay, at least in short-term.

The data shows this likely not to be the case.

$BTC & #Crypto could take a brief hit in this scenario, but selling pressure could be muted as many are well off highs.

Many believe inflation (on assets, goods & services) is here to stay, at least in short-term.

The data shows this likely not to be the case.

$BTC & #Crypto could take a brief hit in this scenario, but selling pressure could be muted as many are well off highs.

• • •

Missing some Tweet in this thread? You can try to

force a refresh