Master Thread of all my threads!

Hello!! 👋

• I have curated some of the best tweets from the best traders we know of.

• Making one master thread and will keep posting all my threads under this.

• Go through this for super learning/value totally free of cost! 😃

Hello!! 👋

• I have curated some of the best tweets from the best traders we know of.

• Making one master thread and will keep posting all my threads under this.

• Go through this for super learning/value totally free of cost! 😃

1. 7 FREE OPTION TRADING COURSES FOR BEGINNERS.

https://twitter.com/AdityaTodmal/status/1332622022631772160?s=19

2. THE ABSOLUTE BEST 15 SCANNERS EXPERTS ARE USING

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

https://twitter.com/AdityaTodmal/status/1355102579735191556?s=19

3. 12 TRADING SETUPS which experts are using.

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

https://twitter.com/AdityaTodmal/status/1358346809718968324?s=19

4. Curated tweets on HOW TO SELL STRADDLES.

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on Straddles

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on Straddles

https://twitter.com/AdityaTodmal/status/1363455578899644418?s=19

5. A THREAD on . . . .

How @ITRADE191 selects strikes to trade in and how he follows risk management.

Short thread explained via pictures with the help of @niki_poojary.

How @ITRADE191 selects strikes to trade in and how he follows risk management.

Short thread explained via pictures with the help of @niki_poojary.

https://twitter.com/AdityaTodmal/status/1376398662453010434?s=19

6. Thread on how @ITRADE191 made 3 lakhs in 2 days.

You will need:

1. Pivots

2. Vwap

3. PDL/PDH (Previous day high/low)

4. Advance/Decline Ratio.

You will need:

1. Pivots

2. Vwap

3. PDL/PDH (Previous day high/low)

4. Advance/Decline Ratio.

https://twitter.com/AdityaTodmal/status/1331958164363698176?s=19

7. DJ @ITRADE191 multiple chart analysis for INTRADAY TRADING.

1. Core setup

2. Pivot points trades

3. PDH/PDL trades

4. Open interest addictions combined with rejections on charts.

5. Website to confirm bias

1. Core setup

2. Pivot points trades

3. PDH/PDL trades

4. Open interest addictions combined with rejections on charts.

5. Website to confirm bias

https://twitter.com/AdityaTodmal/status/1360923489423683592?s=19

8. @ITRADE191 Sir's set-up.

Set-up will help in:

• Capital protection

• Lower drawdowns

• Trending days can be captured

Me @AdityaTodmal & @niki_poojary contributed in making this.

Set-up will help in:

• Capital protection

• Lower drawdowns

• Trending days can be captured

Me @AdityaTodmal & @niki_poojary contributed in making this.

https://twitter.com/ITRADE191/status/1409029044423647240?s=19

9. BEST OPTIONS STRATEGY FOR CONSISTENT INCOME -

OPTIONS WHEEL STRATEGY

OPTIONS WHEEL STRATEGY

https://twitter.com/AdityaTodmal/status/1335219138256457728?s=19

10. Compilation of the best learnings from @BankniftyA through his tweets.

Have compiled his:

1. Expiry day trading.

2. Trade logics.

3. Multiple Charts analysis.

3. BTST criteria for stocks.

Have compiled his:

1. Expiry day trading.

2. Trade logics.

3. Multiple Charts analysis.

3. BTST criteria for stocks.

https://twitter.com/AdityaTodmal/status/1360597011112755201?s=19

11. A THREAD ON @SarangSood

Decoded his way of analysis/logics.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

Decoded his way of analysis/logics.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

https://twitter.com/AdityaTodmal/status/1368152706423037953?s=19

12. Opening Range Breakouts. (ORB)

Complied some tweets by the following handles for easy learning

1. Trade with Trend - @ST_PYI

2. Bhatia brothers - @ArjunB9591 @SANAMBHATIA99

Complied some tweets by the following handles for easy learning

1. Trade with Trend - @ST_PYI

2. Bhatia brothers - @ArjunB9591 @SANAMBHATIA99

https://twitter.com/AdityaTodmal/status/1354082502193930243?s=19

13. Tweets of @sourabhsiso19

Found awesome content: ⏬

1. Moneycontrol

2. Bank nifty Strangles/Straddles

3. Learnings

4. Expiry Trading

5. Directional trading

6. Long Term Investing

7. Pivot system

8. DHS pattern

9. Multiple trade management threads

Found awesome content: ⏬

1. Moneycontrol

2. Bank nifty Strangles/Straddles

3. Learnings

4. Expiry Trading

5. Directional trading

6. Long Term Investing

7. Pivot system

8. DHS pattern

9. Multiple trade management threads

https://twitter.com/AdityaTodmal/status/1371037791547662340?s=19

14. MASTER THREAD on Short Strangles.

Curated the best tweets on:

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

Curated the best tweets on:

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

https://twitter.com/AdityaTodmal/status/1409022633417474048?s=19

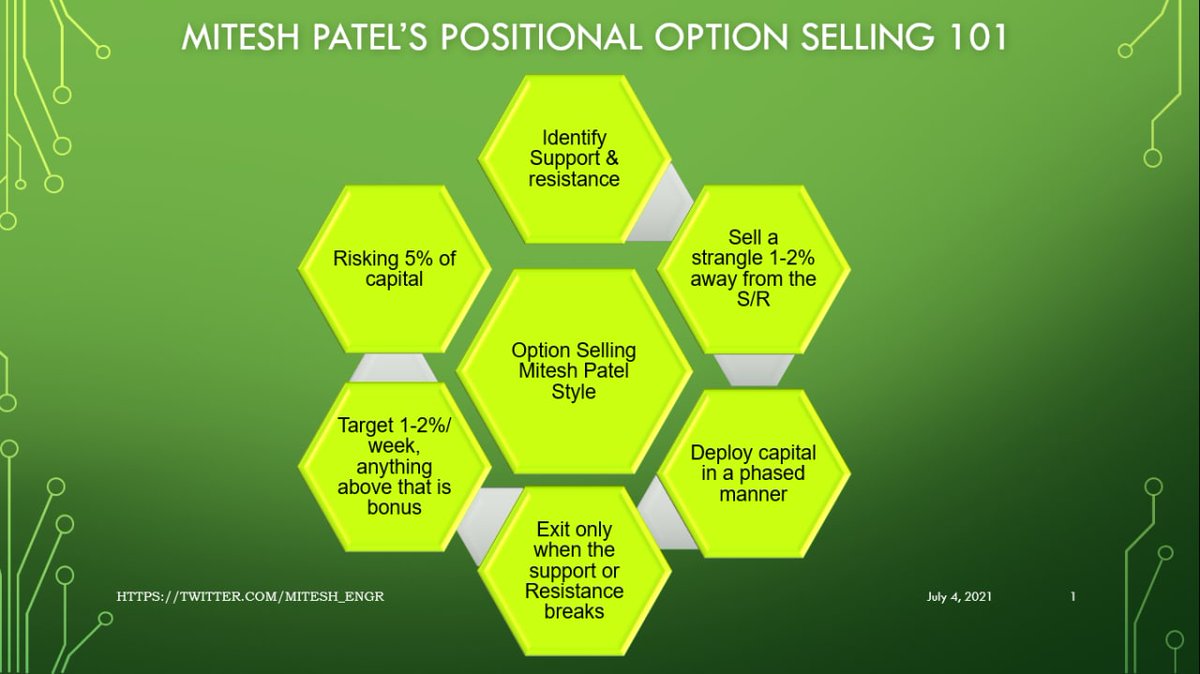

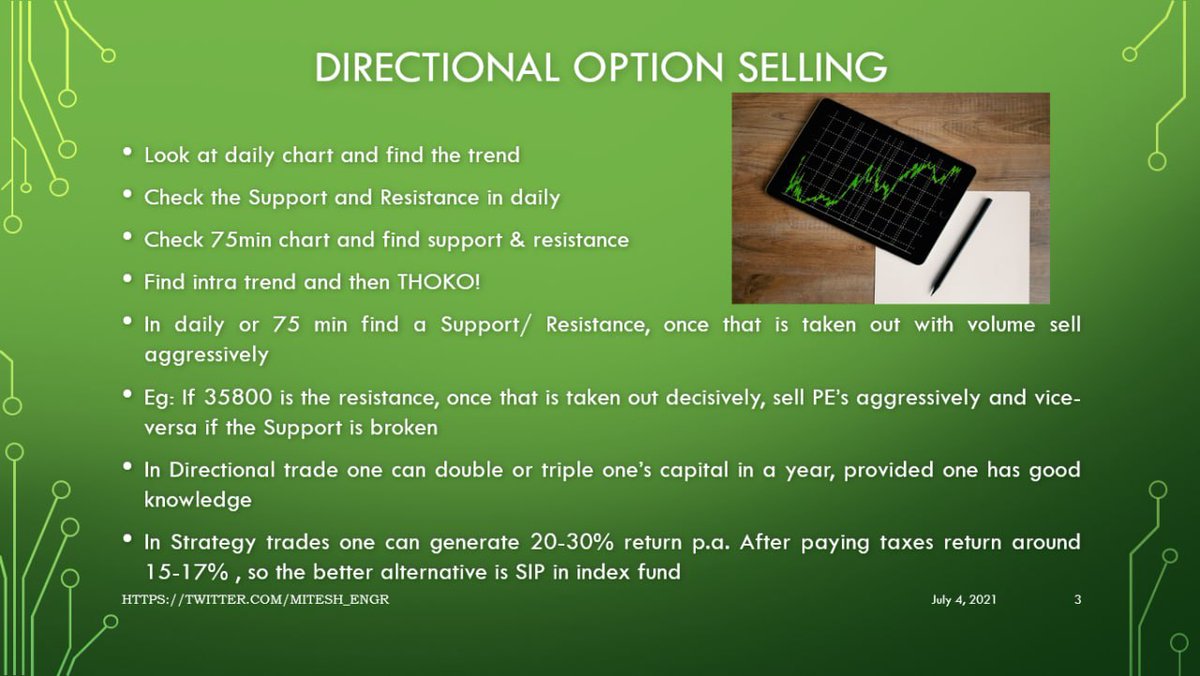

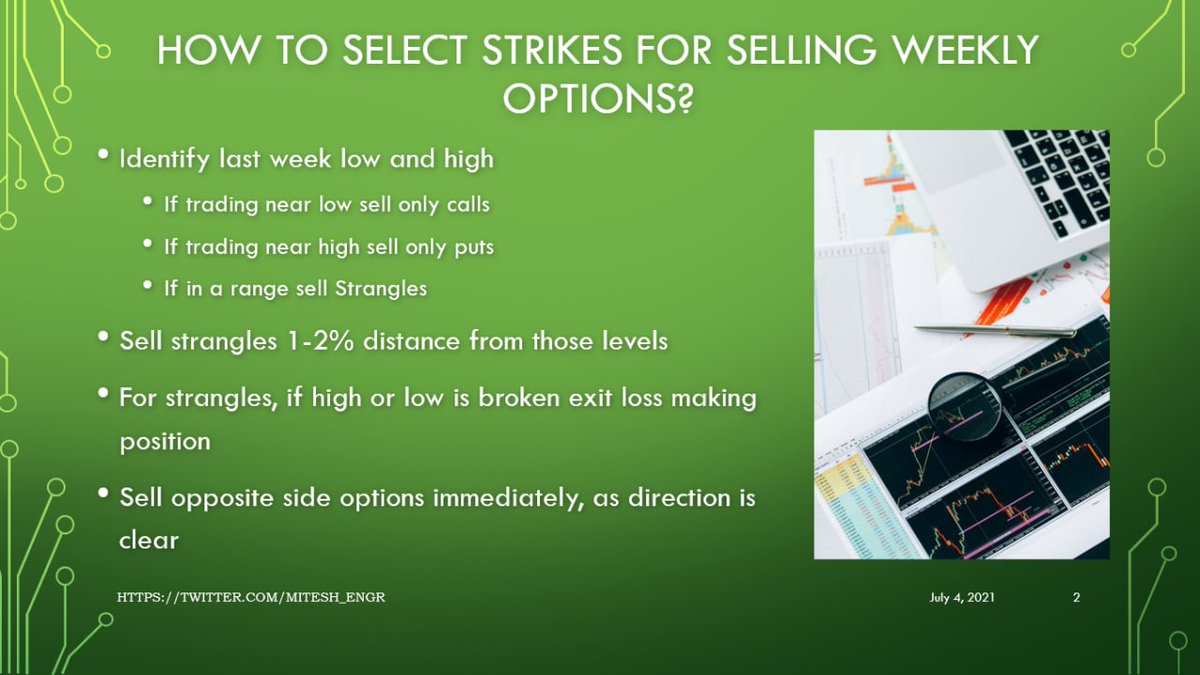

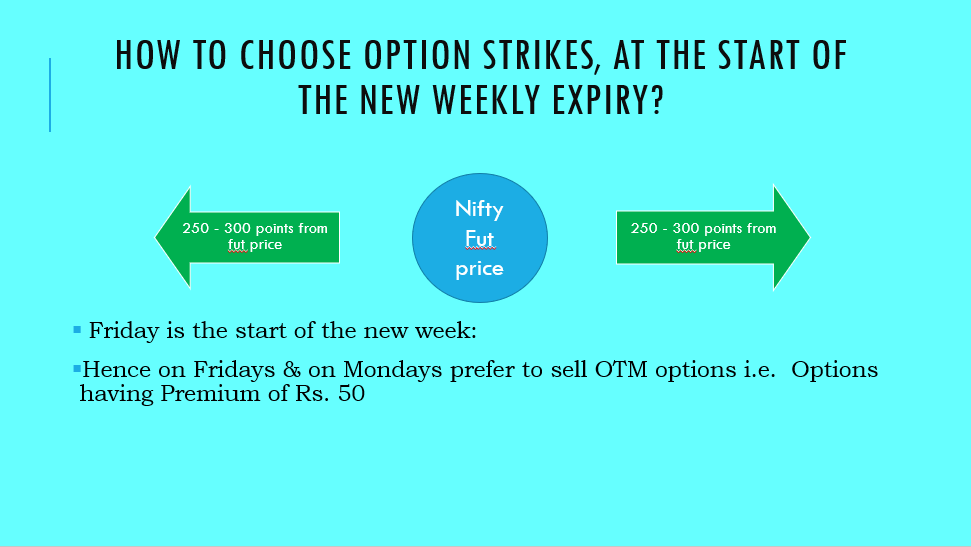

15. A Thread on Boss @Mitesh_Engr

Mitesh Sir's Positional Option Selling 101:

• How to find direction

• Which option to sell

• How to deploy capital

• Exit criteria

• What ROI he targets

• What % risk he takes

Done with the help of @niki_poojary

Mitesh Sir's Positional Option Selling 101:

• How to find direction

• Which option to sell

• How to deploy capital

• Exit criteria

• What ROI he targets

• What % risk he takes

Done with the help of @niki_poojary

https://twitter.com/AdityaTodmal/status/1411611006535487490?s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh