Five things that can keep crude prices in check. The conversation around crude prices will not be complete till one takes a closer look at the supply possibilities. The last tweet touched about Iran. Note here that the end of Iran sanctions is expected to bring...(1/7)

...about a near-term increase of 0.5-0.7mbpd of Iranian crude into global supply. It is interesting to learn that Iran used to export 2.4 mbpd, compared to the current level of 0.1 mbpd. Now, the numbers get even more interesting when one looks at US shale. The...(2/7)

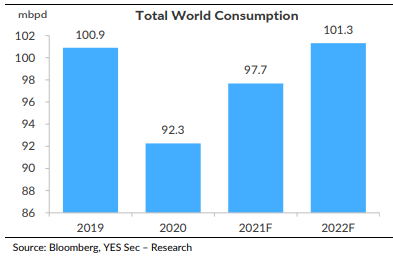

...break-even for shale is around $60/bbl and for some smaller shale sources like Bakken, the break-even is even lower at around $45/bbl. Therefore, the longer crude prices stay elevated, higher is the probability/incentive for shale production to make a comeback. Total...(3/7)

...shale production in the US has been rising and is inching much closer to Mar'20 levels of around 8.5mbpd. However, it is interesting to note here that this increase is not on the back of an increase in active oil rigs. It is on the back of a much higher operational...(4/7)

...efficiency from each rig. Some numbers to highlight the above. In 2014, the US had $8.5mbpd of production from 1,500 oil rigs in action. In 2019, 750 rigs were active, but produced 12.3mbpd. And currently, 330 rigs are operational, and produce around...(5/7)

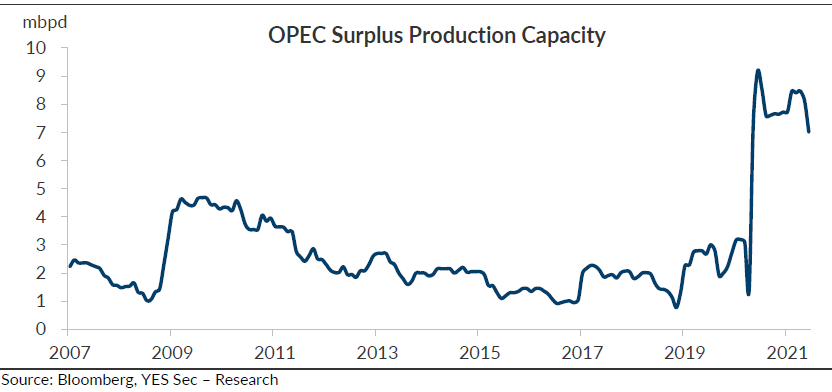

...11mbpd. In short: large spare capacities available with the OPEC, the Iran wild card, rising operational efficiency of shale rigs and increasing incentive for shale (if prices remain elevated), all seem to be strong variables that can help keep...(6/7)

...crude prices in check. This is over and above any concerns around the infections curve globally that can soften demand in the near term.(7/7)

• • •

Missing some Tweet in this thread? You can try to

force a refresh