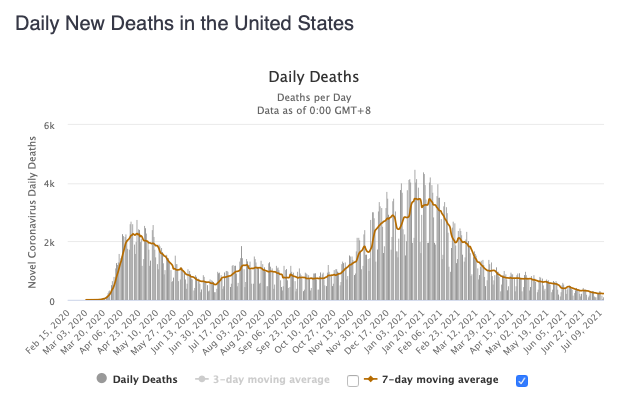

I've noticed that the consistency/reliability of timely COVID-19 data in the US has deteriorated over the past few weeks, due to patchy reporting by various states. This is making it harder to tell a story about what is happening. Even the CDC data gets constantly revised.

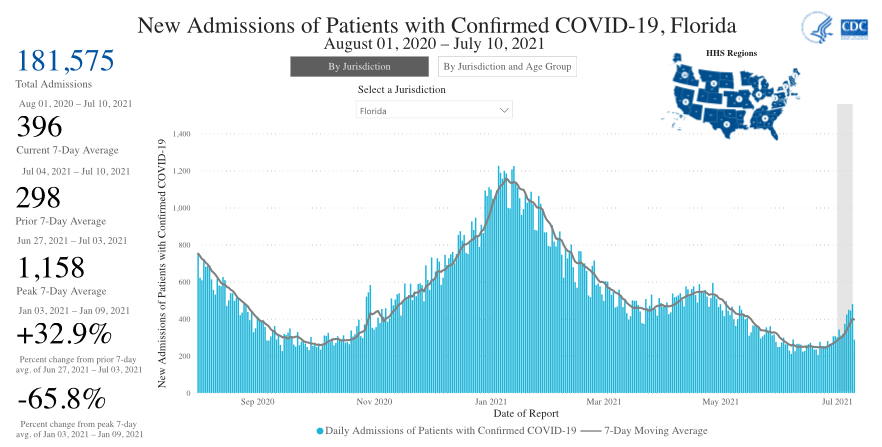

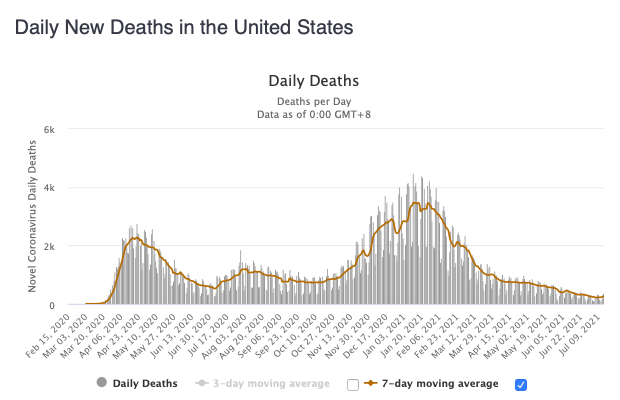

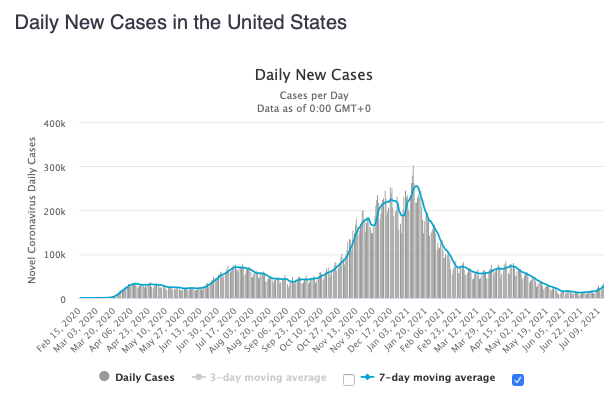

According to Worldometer, the US reported +129 coronavirus yesterday, bringing the total to 623,029. But several states, including Florida, are still missing. The 7-day moving average rose slightly to 216 deaths per day. CDC still isn't posting a number for yesterday.

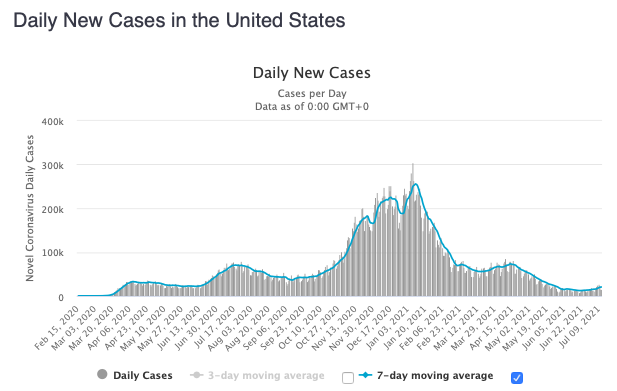

The US reported +14,715 new confirmed cases of COVID-19 yesterday. The data is more complete than deaths, but Florida, Michigan, and a few others still missing. Still, the 7-day moving average rose to above 20,000 new cases per day, for the first time since late May.

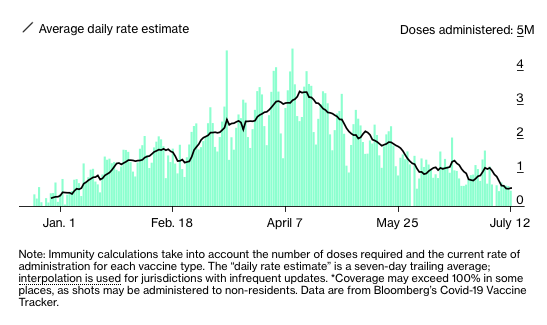

You can see here what the patchy data looks like - at a critical moment when MAYBE we are seeing a renewed inflection upwards in cases, due to the Delta variant.

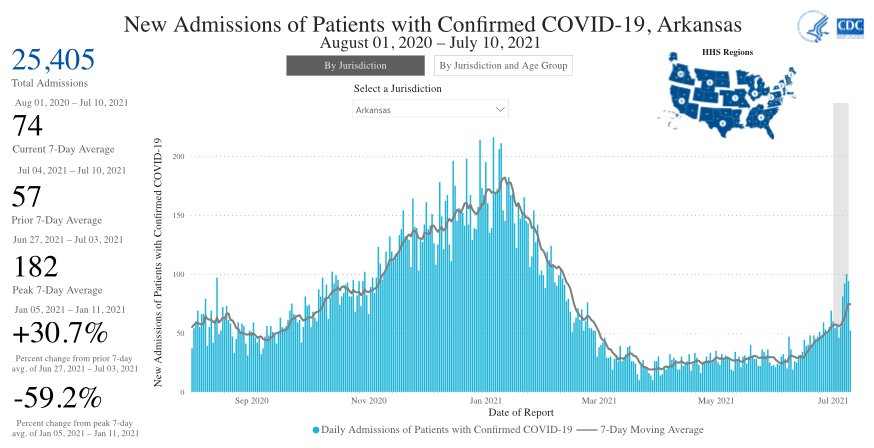

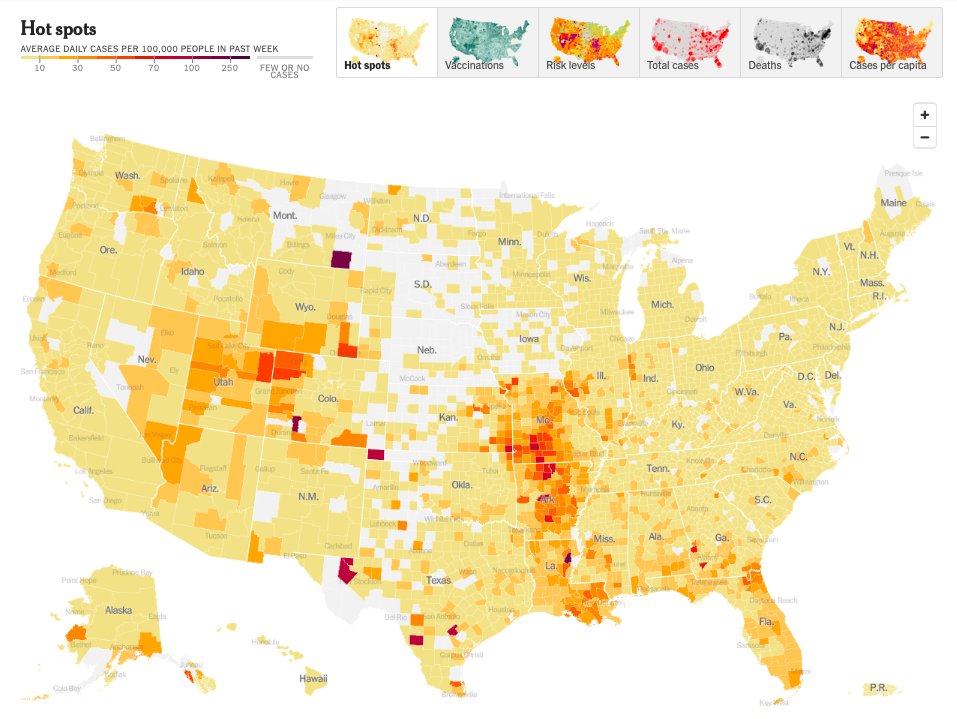

What we can see is a growing hotspot in the Ozark region (Missouri, Arkansas), as well as along the Gulf Coast into Florida, and in Colorado/Utah.

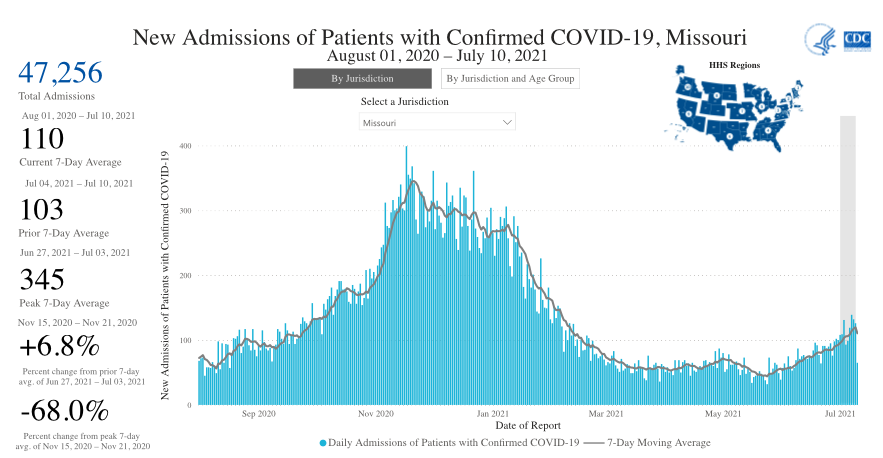

New hospital admissions in Missouri due to COVID-19 are up +6.8% from a week ago, but that was because they were already rising more steadily.

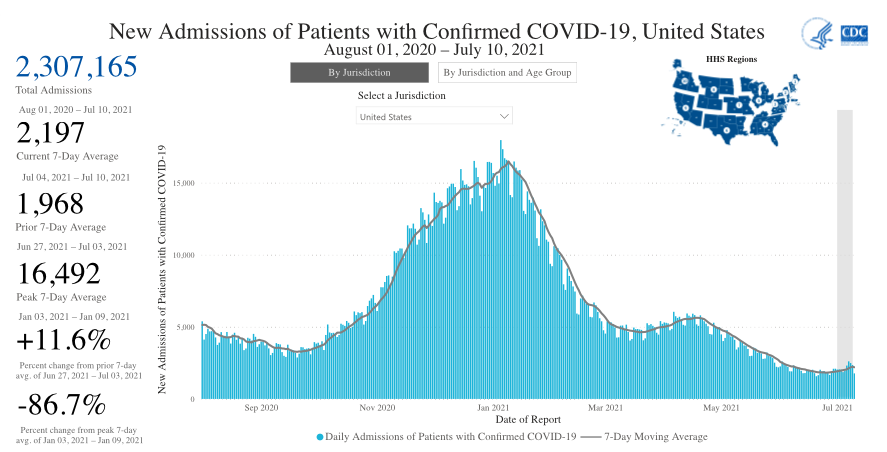

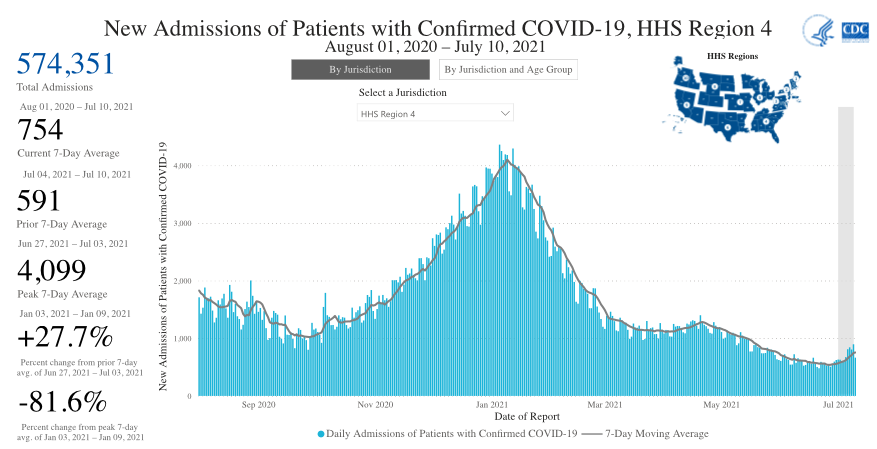

New hospital admissions in the Southeastern US as a region, due to COVID-19, are up +27.7% from a week ago.

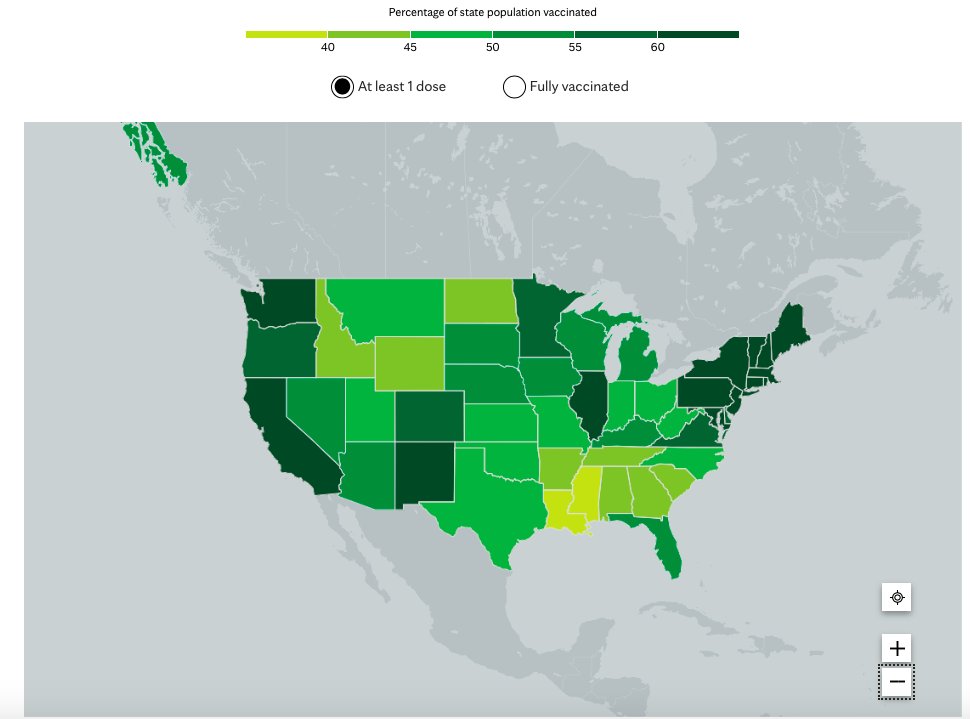

This is also the region with the lowest vaccination rates, often below 45%. mayoclinic.org/coronavirus-co…

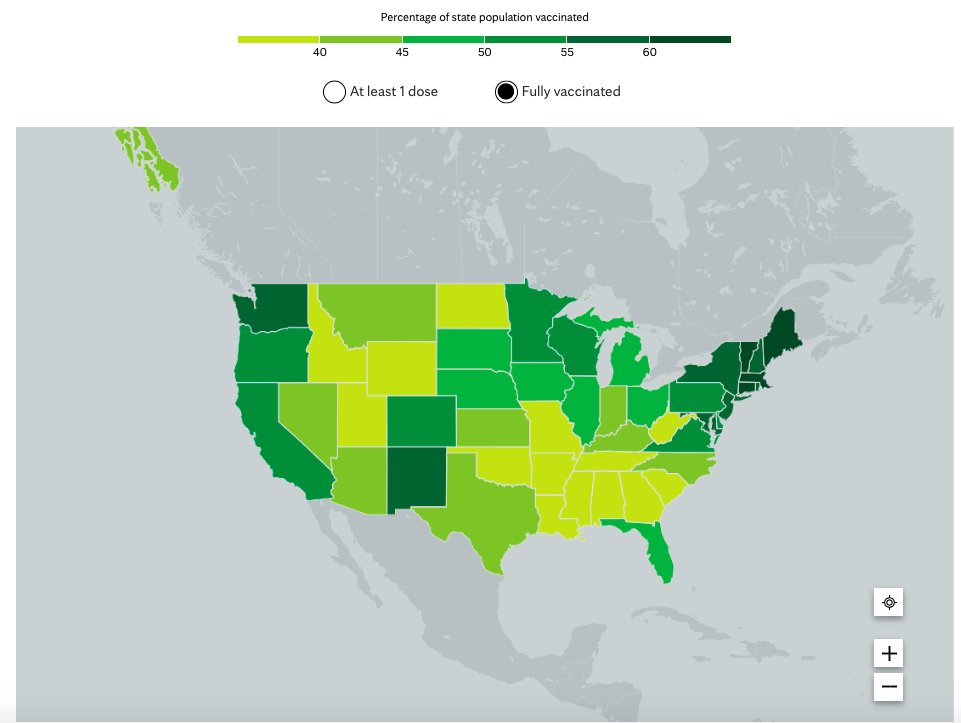

The "fully vaccinated" rate - particularly relevant to protect against the Delta variant - is even worse.

The US administered 449,000 vaccine shots yesterday, bringing the total to 335 million, or 100.8 doses per 100 people. The 7-day moving average rose slightly to 527,000 shots per day.

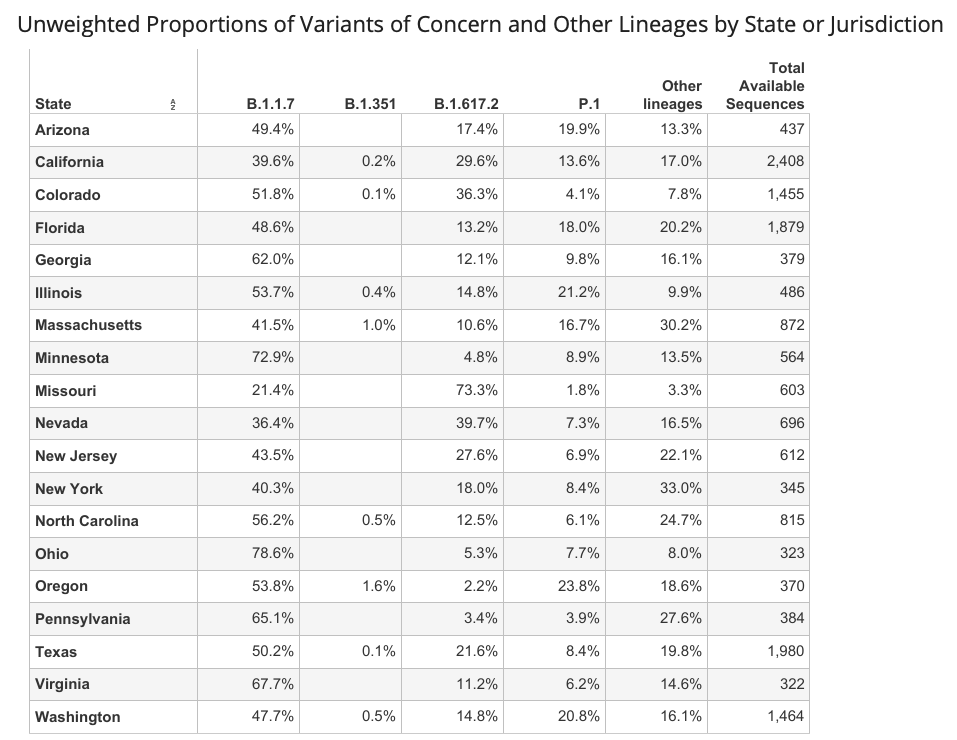

The Delta variant now accounts for 73% of new cases in Missouri, as well as 40% in Nevada and 36% in Colorado.

• • •

Missing some Tweet in this thread? You can try to

force a refresh