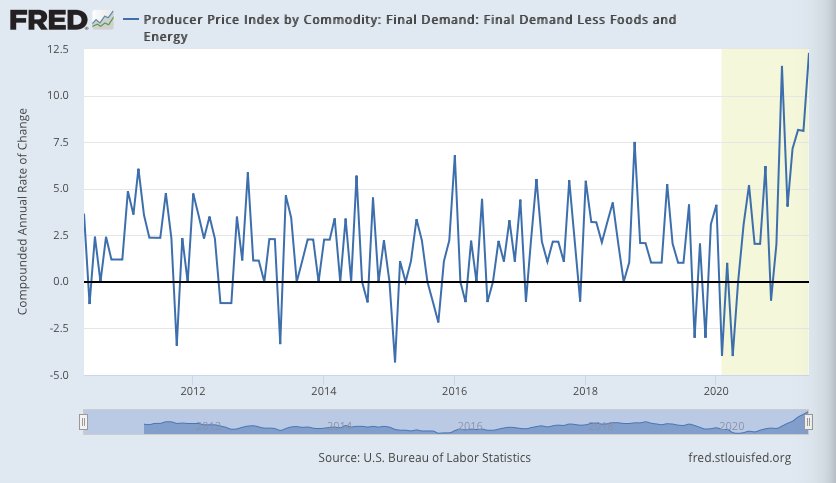

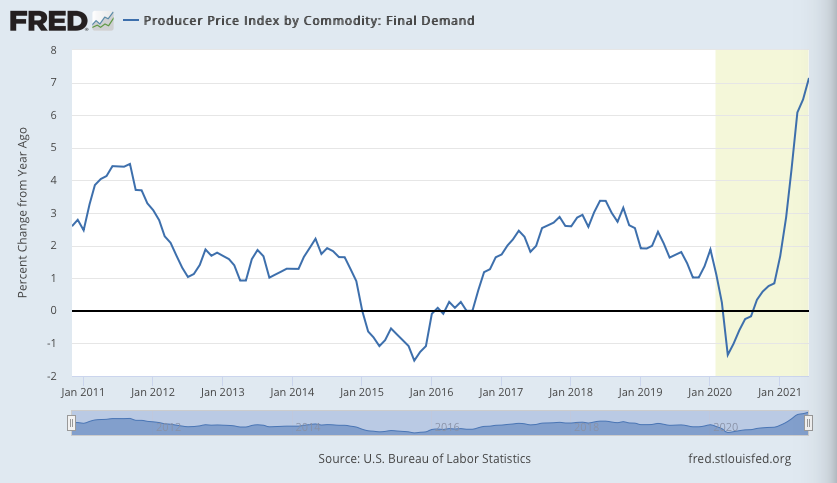

US producer prices (PPI - final demand) rose +1.0% m/m in June, up +7.1% from a year ago. PPI is often seen as a leading indicator of consumer inflation, though it is typically more volatile (bigger swings both up and down).

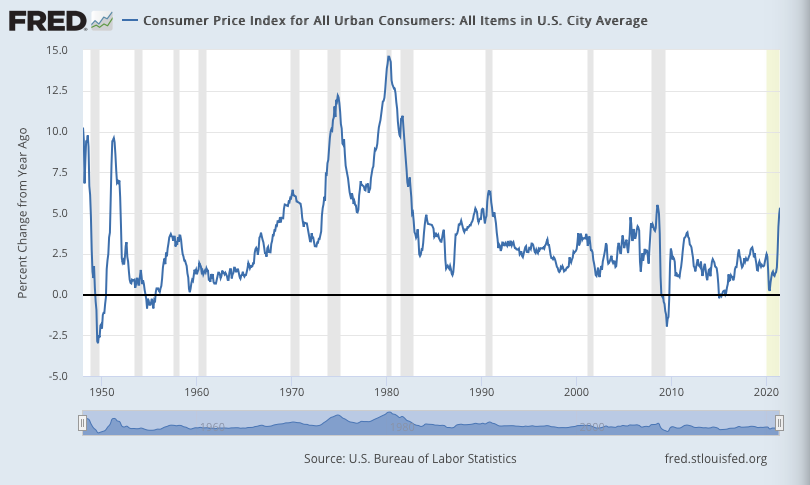

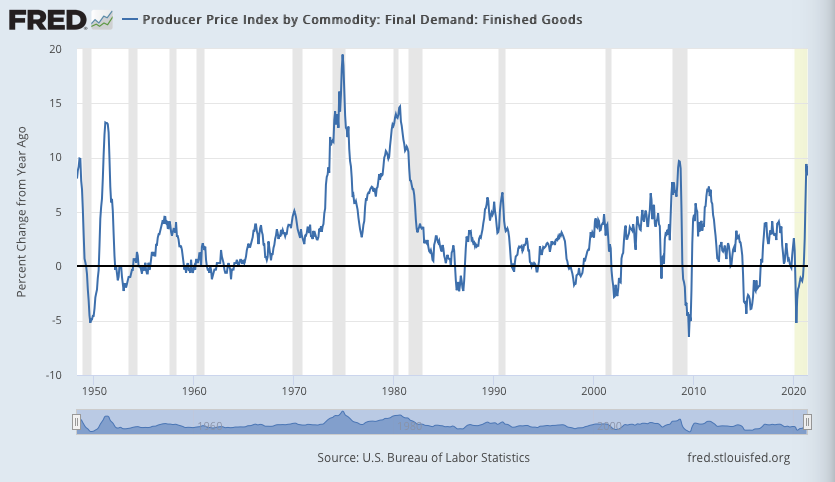

The chart of y/y PPI for finished goods, which goes back to 1947, gives a better historical perspective of where PPI currently stands.

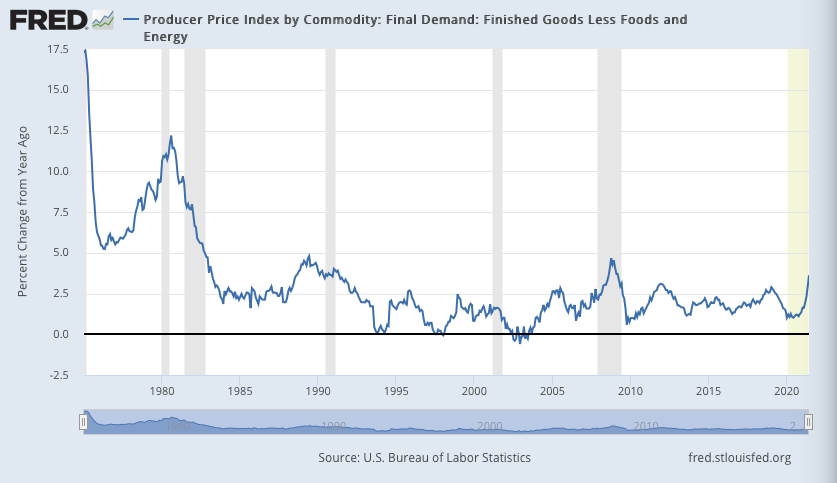

Again, Core PPI for finished goods, which goes back to 1947, shows the current numbers in historical perspective. Check out that serious but short-lived surge in inflation after WW2 which I was talking about yesterday.

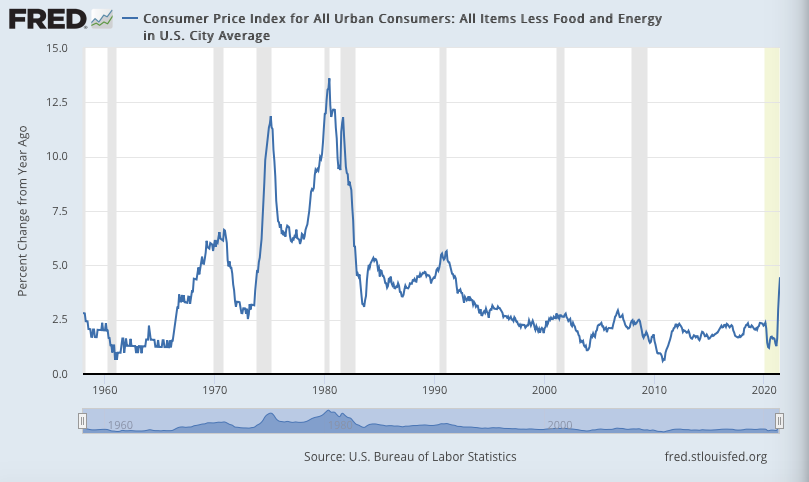

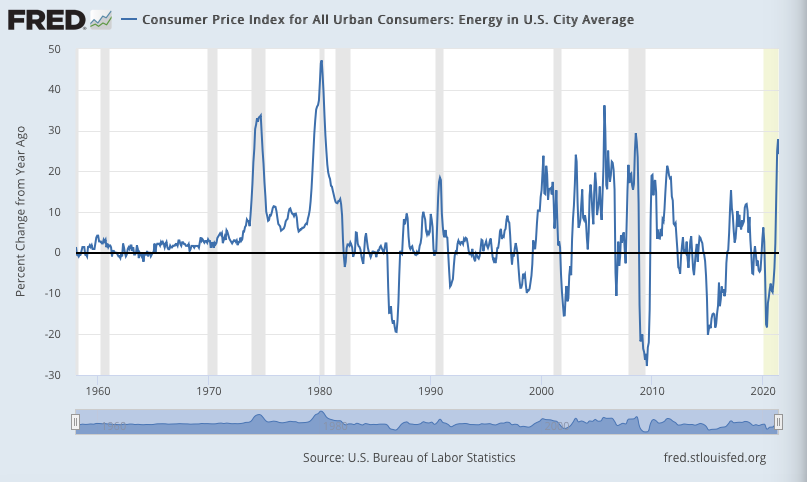

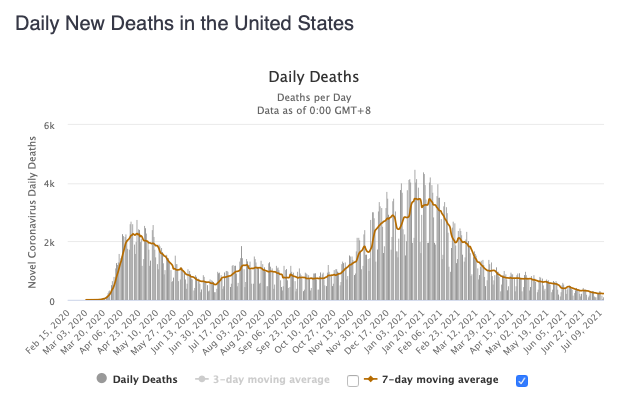

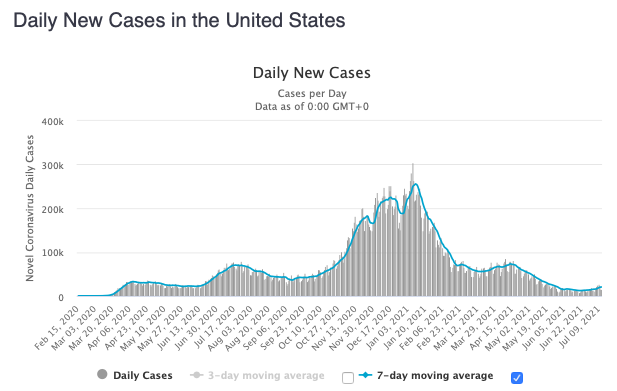

In short, the recent surge in inflation, at least so far, has been sharp and noticeable, but hardly unprecedented, especially considering the bout of deflation that took place last year with COVID.

If it persists for more than this year, or greatly intensifies, of course, that evaluation may change.

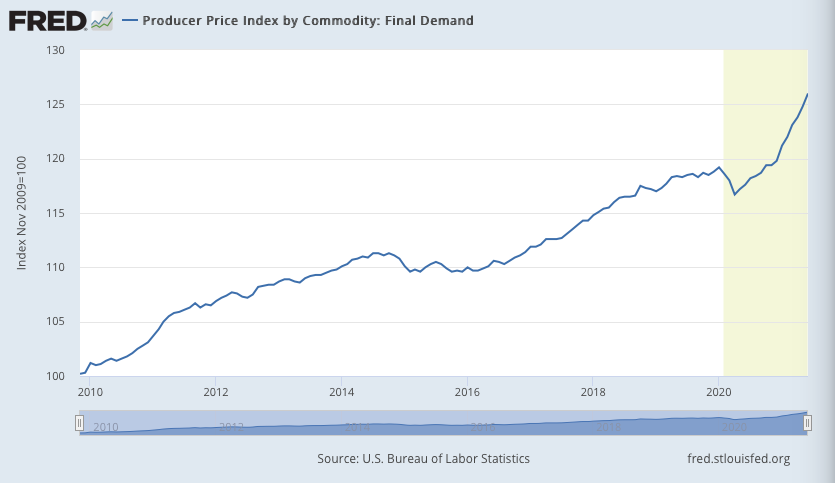

Someone asking if this could just be "base effect noise" (prices dropped last year, so any recovery looks like a large gain over last year). Not entirely, no. This is the absolute index:

As you can see, it's starting to break past pre-COVID trend. And even such a sharp recovery to trend would be painful.

The key question is whether it's mainly the product of short-term bottlenecks, which will eventually resolve themselves (as they did after WW2) or longer-term constraints on growth (as was the case in the 1970s).

• • •

Missing some Tweet in this thread? You can try to

force a refresh