.@nytimes @bencasselman @jeannasmialek write interesting article stressing distinctions btw 1960s when inflation accelerated & present moment. In fact, I think most factors point to more cause for concern now than in 1966 when inflation accelerated 3-4 pts in 4 yrs. Consider this

https://twitter.com/bencasselman/status/1413175291887882248

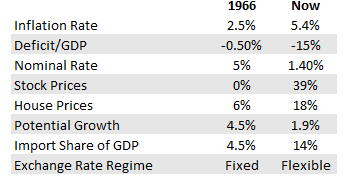

1/Then, the deficit was in range of 3 percent. Now the deficit is in the range of 15 percent.

2/Then, nominal and real interest rates then were significantly positive and Fed has no big balance sheet. Now, nominal rates are essentially 0, real rates are negative and the Fed is growing its balance sheet at a rate of more than a trillion a year.

3/Then, there was no saving overhang, no housing price boom and no major asset price inflation. Now, all three are present to an almost unprecedented degree.

4/Then, because of the labor force and productivity growth, supply potential was growing at 3.5 percent. Now it’s less than 2.

5/Then, there was no risk of import inflation because we had few imports and a fixed exchange rate. Now, we have a flexible exchange rate, huge external debts and much larger imports.

6/Then the argument was that measured inflation would not accelerate too much from 2 percent. Now it is that inflation will substantially decelerate from 5 percent.

The similarities between the 1960s and now are more political than economic: a deeply divided country with a progressive, experienced, legislatively ambitious President; economists blaming special factors for each worrying number; a socially ambitious Fed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh