THREAD on hedging -

A number of you have asked how to hedge, so here is a thread....

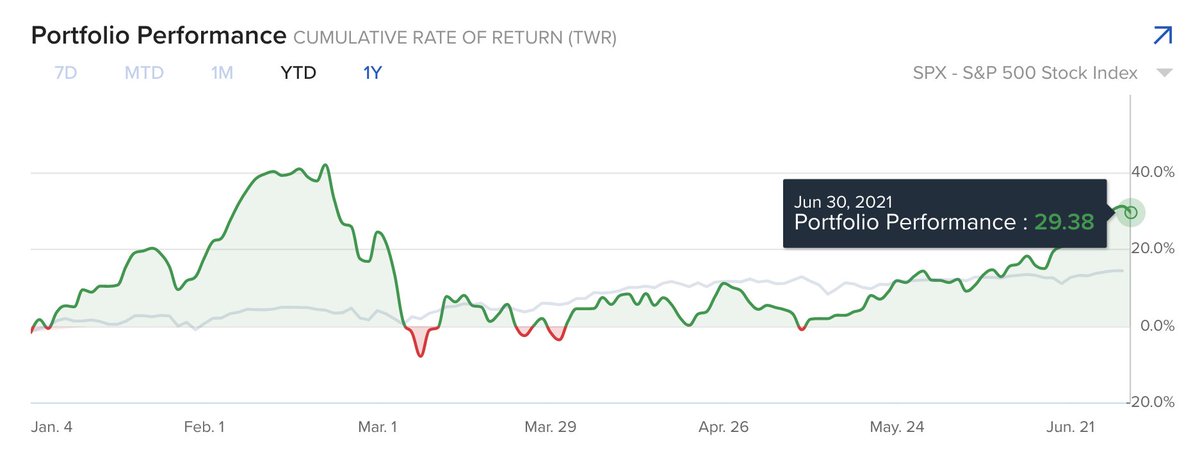

Hedging allows one to stay long (participate in the upside) during uptrends, but it makes the portfolio "market neutral" during downtrends.

Hedging isn't fool proof and doesn't work...

A number of you have asked how to hedge, so here is a thread....

Hedging allows one to stay long (participate in the upside) during uptrends, but it makes the portfolio "market neutral" during downtrends.

Hedging isn't fool proof and doesn't work...

...perfectly all the time. On some days, the portfolio goes up a little and on other days, it goes down a little (usually less than 50bps) *but* hedging does help in avoiding big drawdowns during stock market turbulence.

Hedging is akin to "fire insurance", it usually costs...

Hedging is akin to "fire insurance", it usually costs...

...in terms of some missed upside when the market quickly reverses higher but it pays off big time when there is a major stock market decline or crash.

In those instances, profits from the hedges can be invested in stocks (when they are severely beaten down) and this really...

In those instances, profits from the hedges can be invested in stocks (when they are severely beaten down) and this really...

...helps with juicing one's returns.

I hedge my portfolio 100% which means if my stock exposure is $100, then I sell short ARK ETFs so am also short $100 exposure (therefore market neutral).

Example - if ARKK is trading at $10 and I want to hedge $100 worth of long exposure...

I hedge my portfolio 100% which means if my stock exposure is $100, then I sell short ARK ETFs so am also short $100 exposure (therefore market neutral).

Example - if ARKK is trading at $10 and I want to hedge $100 worth of long exposure...

....then I'd sell short 10 units of ARKK ($100 / $10 = 10).

If one has a margin account with any online broker, then cash isn't required to put on the hedge. The broker uses the stock portfolio as collateral and when one shorts, cash is deposited into the account.

In terms...

If one has a margin account with any online broker, then cash isn't required to put on the hedge. The broker uses the stock portfolio as collateral and when one shorts, cash is deposited into the account.

In terms...

...of timing, I use a medium-term exponential moving average as my "trend filter". In simple terms, this means that as long as price is above this level, I do *not* hedge.

In addition to this trend filter, I also use two shorter-term exponential moving averages (5/7)...

In addition to this trend filter, I also use two shorter-term exponential moving averages (5/7)...

...which generate my trading signals.

So, if price is below my trend filter and 5ema is also below 7ema, I put on my hedge. When 5ema closes above 7ema *or* if price goes back above my trend filter, I cover my short and close my hedge.

One doesn't have to use these...

So, if price is below my trend filter and 5ema is also below 7ema, I put on my hedge. When 5ema closes above 7ema *or* if price goes back above my trend filter, I cover my short and close my hedge.

One doesn't have to use these...

....exponential moving averages, as long as an investor/trader uses one medium-term exponential moving average as his/her "trend filter" and two shorter-term ones to generate trading signals, it'll do the job.

Most of my hedging signals produce losses (missed upside) and...

Most of my hedging signals produce losses (missed upside) and...

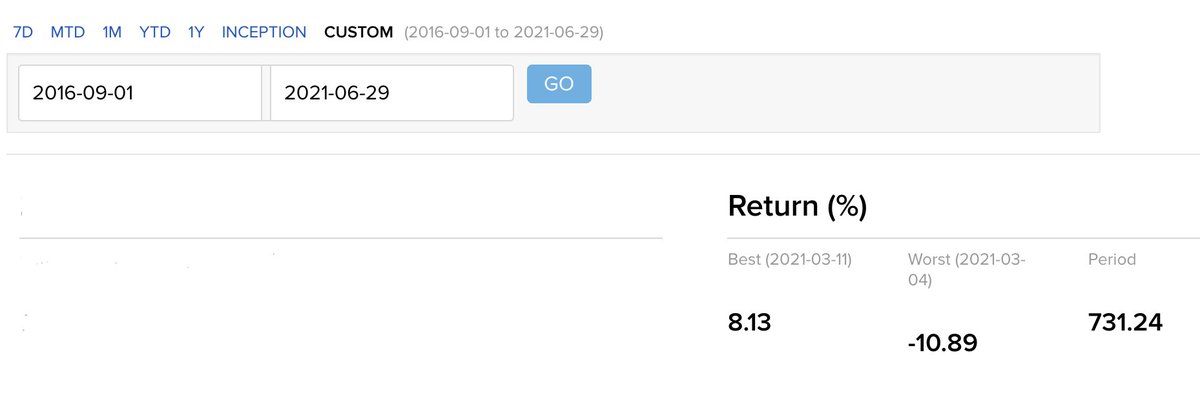

...only ~35% hedges hand out profits *but* over several years, the hedges tend to pay for themselves and if you take into account the re-investment in stocks (with hedging profits) after big declines, then I'd say this strategy becomes profitable - which is very good...

...considering hedging is an insurance policy. Normally, one has to pay for insurance...

Should you do it?

This is a personal decision which only you can answer. Personally, I do it because it reduces my drawdowns and stress during market turbulence; and allows me to sleep...

Should you do it?

This is a personal decision which only you can answer. Personally, I do it because it reduces my drawdowns and stress during market turbulence; and allows me to sleep...

...well at night. Hedging also improves portfolio CAGR because lower drawdowns mean the portfolio doesn't have to do too much work to get back to its high-water mark.

Finally, I hedge off ARK ETFs because they are most correlated to my stocks but if one's portfolio..

Finally, I hedge off ARK ETFs because they are most correlated to my stocks but if one's portfolio..

...is comprised of different types of stocks, he/she should hedge off those ETFs or futures which are more correlated to his/her holdings.

Thats about it, hedging is "fire insurance" and removes stress - and over time, doesn't cost an arm and a leg.

Hope this is helpful.

Thats about it, hedging is "fire insurance" and removes stress - and over time, doesn't cost an arm and a leg.

Hope this is helpful.

• • •

Missing some Tweet in this thread? You can try to

force a refresh