$FIVN a thread...

Lede

Spotlight Top Pick Five9 (FIVN) has been acquired by Zoom in an all stock transaction.

Story

Five9 was a Spotlight Top Pick placing it in the second circle of this logic diagram:

We added the company to Top Picks for $63.69 on 8-26-2019.

/1

Lede

Spotlight Top Pick Five9 (FIVN) has been acquired by Zoom in an all stock transaction.

Story

Five9 was a Spotlight Top Pick placing it in the second circle of this logic diagram:

We added the company to Top Picks for $63.69 on 8-26-2019.

/1

This entry date and price has been verified by the third-party audit firm Krost. Please feel free to visit their website.

As of this writing the stock is trading at $177.6, up 179% since added to Top Picks in less than two-years.

/2

As of this writing the stock is trading at $177.6, up 179% since added to Top Picks in less than two-years.

/2

The stock will likely close higher tomorrow, and we will make that final mark at the close.

Conclusion

When we added Five9 to Top Picks, it had little fanfare and little social media disturbances.

/3

Conclusion

When we added Five9 to Top Picks, it had little fanfare and little social media disturbances.

/3

While the cognoscenti saw it for it was, much of the ‘find a great stock with a scanner’ crowd never minded Five9.

That was to our benefit.

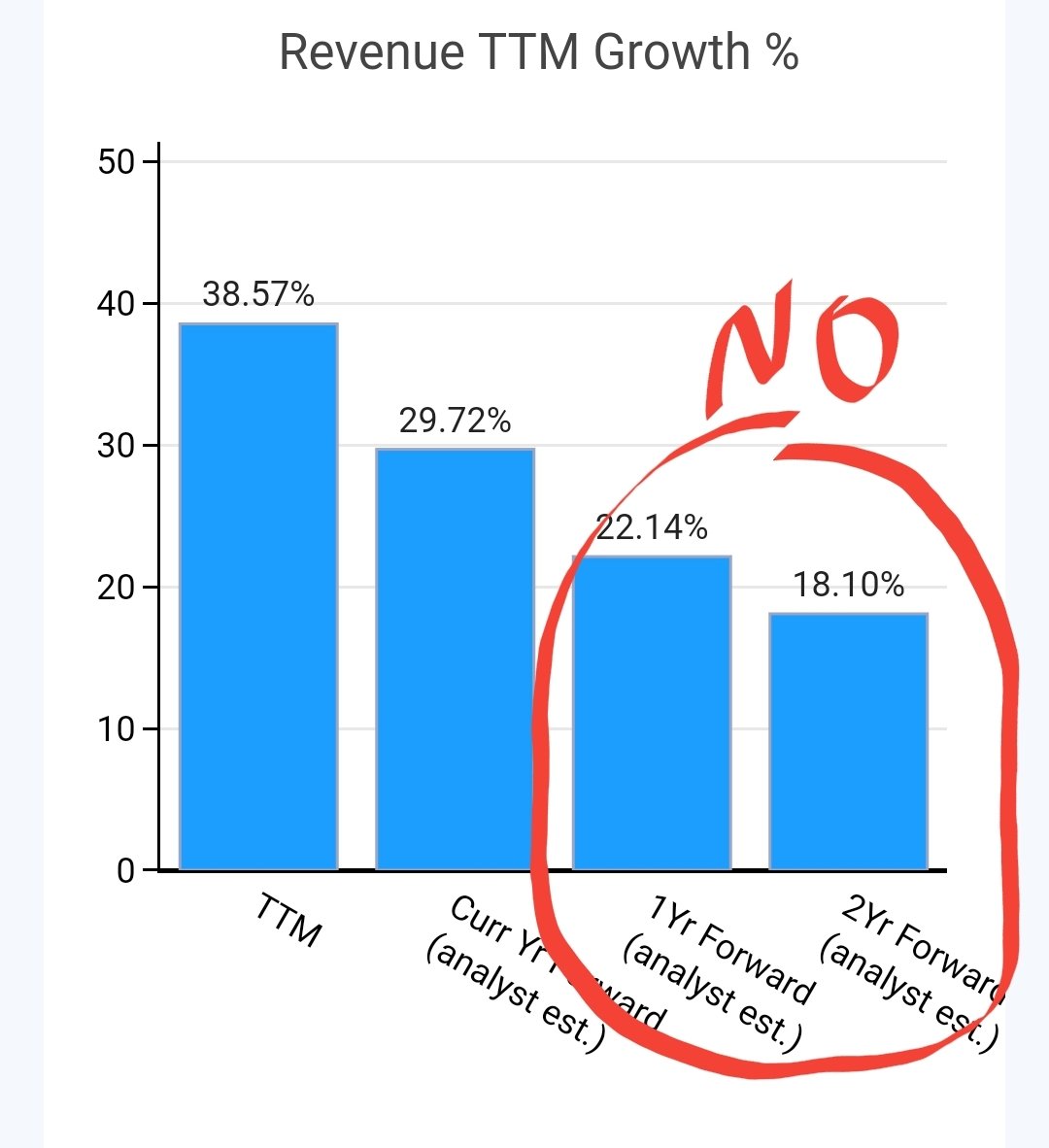

The company obliterated the 20% revenue growth estimates to grow 45% last year while driving higher and higher profitability.

/4

That was to our benefit.

The company obliterated the 20% revenue growth estimates to grow 45% last year while driving higher and higher profitability.

/4

We believed that call centers were a massive industry spread across the globe. The vast majority are not cloud based, and most are nothing but telephony.

This leaves customers unhappy, and costs spiraling out of control.

/5

This leaves customers unhappy, and costs spiraling out of control.

/5

Along comes a new player with a new idea — turn the customer service portion of the business into a technology hub — insert AI, go beyond telephony, add data analytics, put it in the cloud, and turn it all into a profit center.

/6

/6

Make customers happier, faster — make corporations more profitable.

This is the thematic shift coming to the call center and Five9 is leading the charge. The market is huge – it’s changing, and we believe Five9 will be the winner.

/7

This is the thematic shift coming to the call center and Five9 is leading the charge. The market is huge – it’s changing, and we believe Five9 will be the winner.

/7

Now, the giant in the communications space, Zoom (ZM) has voted with us, for a price tag of nearly $15 billion.

At CML Pro we focus on the future — not as in the next year, or even 3-years, but as in the next decade, or even two decades...

/8

At CML Pro we focus on the future — not as in the next year, or even 3-years, but as in the next decade, or even two decades...

/8

We focus on the world changing trends that will occur, irrespective of recessions, booms and busts, interest rates, even wars.

A stock scanner isn’t alpha — but when others use them it does provide us an opportunity to generate alpha by...

/9

A stock scanner isn’t alpha — but when others use them it does provide us an opportunity to generate alpha by...

/9

... doing research that goes deeper, and ventures to think critically.

It’s the companies that power these trends, that are the pick-axes to the gold rush, that we have identified as our Top Picks. Let volatility happen, and markets crash.

...

/10

It’s the companies that power these trends, that are the pick-axes to the gold rush, that we have identified as our Top Picks. Let volatility happen, and markets crash.

...

/10

Let recessions happen, and economies spasm. That’s natural — and it will happen.

We are focused on how the world is changing, and in that space, we have confidence that nothing can stop these trends.

/11

We are focused on how the world is changing, and in that space, we have confidence that nothing can stop these trends.

/11

Five9 has graduated.

We will find others, and they will be ignored, and that’s exactly how we like it.

Learn more about CML Pro

bit.ly/CMLPro

We will find others, and they will be ignored, and that’s exactly how we like it.

Learn more about CML Pro

bit.ly/CMLPro

• • •

Missing some Tweet in this thread? You can try to

force a refresh