Capex chronicles - a thread on India Inc Capex across last 2 decades and 4 key trends

1. Trend#1- headline capex flatlining....Listed India Inc capex (incl M&A) has flatlined across most of last decade, with capex to sales falling to 6-7% from 11%.

1. Trend#1- headline capex flatlining....Listed India Inc capex (incl M&A) has flatlined across most of last decade, with capex to sales falling to 6-7% from 11%.

US S&P500 (ex fin) capex to sales has also been in a narrow band of 6-7% (post dotcom bust), however proportion of spends on R& D hv gone up materially. For eg, Apple Inc has taken R&D to sales from 2%(2011) to 8% (2020)

Trend#2: polarization 1.0

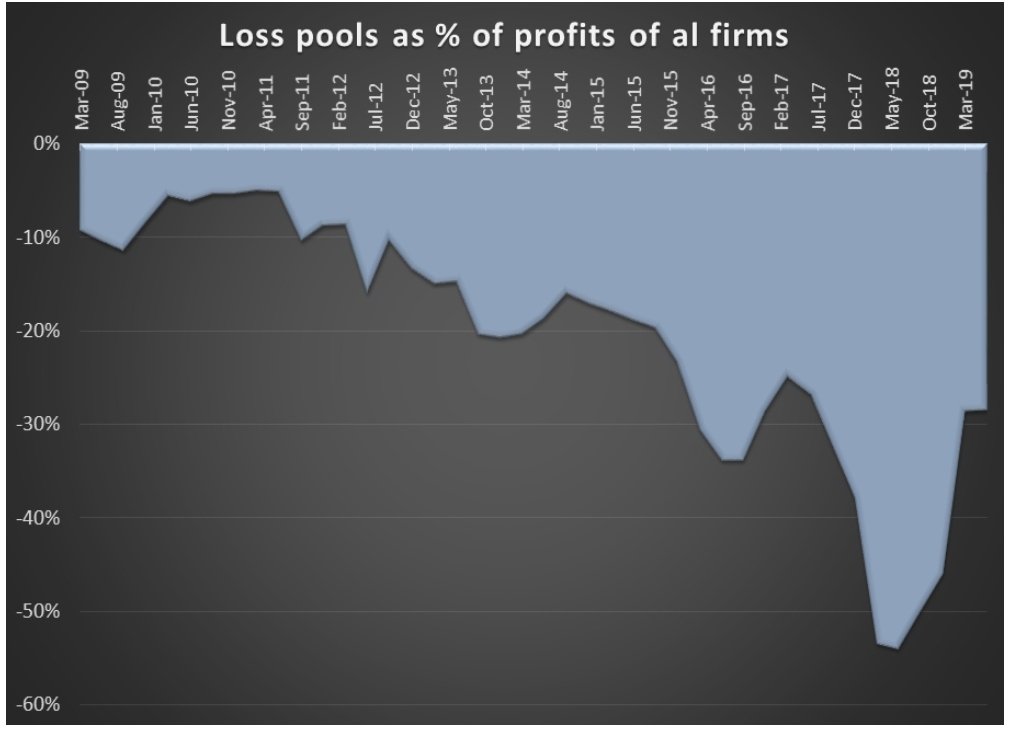

Thr hv been narratives arnd polarization, suggestive that only 20 firms account for 65-70% of profit share etc. I hv written bfr how such analysis are more optical due to burgeoning loss pools.

bit.ly/2QiXBBb

Thr hv been narratives arnd polarization, suggestive that only 20 firms account for 65-70% of profit share etc. I hv written bfr how such analysis are more optical due to burgeoning loss pools.

bit.ly/2QiXBBb

However,what is actually a manifestation of polarization is investment cycle.Share of Top 100 in overall listed India Inc capex surged from 40% to 70%,as previous cycle capital (mis) allocation meant many cos focus on right sizing B/S,& banks hesitant to grow beyond larger names

Trend #3: era of super giants - Polarization2.0.If one breaks all companies as belonging to 4 key cohorts (MNC/PSU/TOP 10 business houses/Rest of Private), one gets true sense of polarization.The top 10 biz houses are classified not on mkt cap or revenues, but on capex intensity

Share of these Top 10 biz houses has risen from 15% to 40% over last 2 decades! While few of them invested heavily pre 2013, many of them have persisted with significant investment post that too

These top 10 hv grown their capex by 19% CAGR over last 2 decades,with PSU capex growing at 10% & rest of pvt sector capex growth at 12%.5 of these Top 10 hv primarily invested in commodity related sectors,whereas other 5 hv deployed incremental dollar into many new biz verticals

Share of MNC has dropped significantly, both in salience as well as their capex to sales ratio.PSU capex has been steady,but most of this capex is into energy value chain, & with significant changes in anvil,will be interesting to see transformation of this capex to newer areas

Sectorally, there are 4 sectors in past that pulled capex to sales ratio from 2007-12 - telecom, real estate, utilities, transportation. Most other sectors have had a steady movement of capex to sales across last 2 decades

Trend #4: "capex" surge in private space

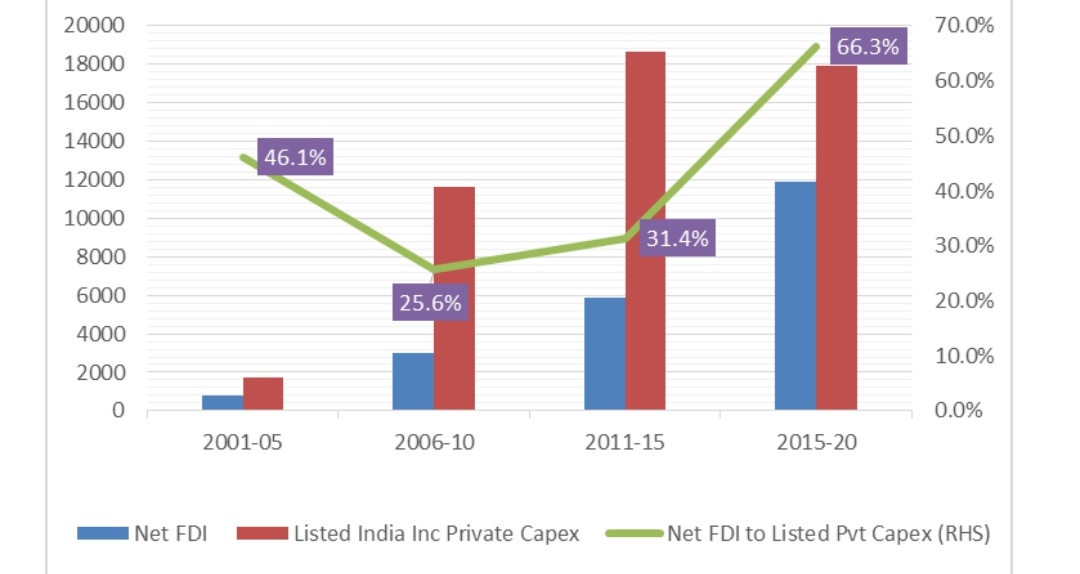

One proxy is to gauge net FDI and to see how it is attracting primarily to private space. Not all Net FDI goes into capex, some go into promoter buyout (esp REIT), some into loss funding and some into capex.

One proxy is to gauge net FDI and to see how it is attracting primarily to private space. Not all Net FDI goes into capex, some go into promoter buyout (esp REIT), some into loss funding and some into capex.

For most part of last so many decades, capital mkts were primary source of funding for most biz. However, last 10 years hv changed that dramatically, whr for a few years like 2018/19, net FDI was almost 80% of all listed private capex.

Over the last few years, India Inc has gone thru significant B/S repair, loss pools hv declined, and while thr may still be some more deleveraging reqd in some sectors, aggregate India Inc is in reasonably good shape to relook at investment plan outlays

"You sow what you reap"! Capital allocation is single most important decision for captains of India Inc, as an investment done right is source for future profit streams.Similarly, in fast paced disruptive world, thr is only so much cash flows to be milked from legacy investments

Cos that don't invest (& investment cd be intangibles, IP, R&D, talent etc)are likely to be even more marginalised in times to come, IMO, as they struggle to keep pace with larger companies out-investing as well as many private cos cmg mainstreamed in times to come

Lastly, this analysis is for listed space. From overall investment POV, household capex is an even larger constituent, and revival in that space can also get the overall capex cycle moving

Data source : Net FDI from RBI, US data from Bloomberg, data on listed companies from capitaline , raw data sourced from ICICI Securities

FIN!🙏

Of course, it shd read : " you reap what you sow" and not the other way around! 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh