🧵 The good, the bad, and the ugly of self storage

What makes it so attractive and profitable for investors?

And why do some consider it the outcast of real estate?

👇

What makes it so attractive and profitable for investors?

And why do some consider it the outcast of real estate?

👇

Self storage is among the newer faces in real estate.

The modern industry was born in the 1960s, when a facility in Texas started using garage style doors.

Now there are about 50k facilities in the US with 2.3 billion rentable square feet.

Here are its most attractive aspects:

The modern industry was born in the 1960s, when a facility in Texas started using garage style doors.

Now there are about 50k facilities in the US with 2.3 billion rentable square feet.

Here are its most attractive aspects:

The ability to raise rent on day 1

Unlike apartments, storage facilities tend to have all units on month-to-month leases.

The new owner to adjust rents on day 1, if they choose, instead of having to wait for each lease to expire.

This speeds up timelines and returns.

Unlike apartments, storage facilities tend to have all units on month-to-month leases.

The new owner to adjust rents on day 1, if they choose, instead of having to wait for each lease to expire.

This speeds up timelines and returns.

Faster rent growth. Compare:

$1500 apartment: 3% rent increase = $45/month. Some tenants will spend $500 to move to a cheaper place.

$80 storage unit: 5% rent increase = $4/month. Nobody will move over this, or even notice.

So, storage has faster rent growth

$1500 apartment: 3% rent increase = $45/month. Some tenants will spend $500 to move to a cheaper place.

$80 storage unit: 5% rent increase = $4/month. Nobody will move over this, or even notice.

So, storage has faster rent growth

Expansion opportunity

It is far easier and cheaper to add units to a storage facility than to build a new phase of apartments or a new add to an office/industrial park.

A storage expansion can be done for ~$50/sf.

It is far easier and cheaper to add units to a storage facility than to build a new phase of apartments or a new add to an office/industrial park.

A storage expansion can be done for ~$50/sf.

Highly fragmented market

For nicer, newer facilities, there are several large REITS: Life Storage, Extra Space, Public Storage, to name a few.

But for older class B & C facilities, there's a long tail of small operators. That means weaker competition.

For nicer, newer facilities, there are several large REITS: Life Storage, Extra Space, Public Storage, to name a few.

But for older class B & C facilities, there's a long tail of small operators. That means weaker competition.

Mom & Pop Operators

Sophisticated owners employ professional management using the best practices and latest software.

That's not always the case in storage. It's not uncommon to see an owner self managing a large facility with paper books.

They leave a lot of meat on the bone.

Sophisticated owners employ professional management using the best practices and latest software.

That's not always the case in storage. It's not uncommon to see an owner self managing a large facility with paper books.

They leave a lot of meat on the bone.

What sorts of meat do these owners leave on the bone?

• No website and no internet marketing

• Friction in the booking process

• Extremely high occupancy

• Opportunity to expand

• Rents under market

• Manager grift

• No website and no internet marketing

• Friction in the booking process

• Extremely high occupancy

• Opportunity to expand

• Rents under market

• Manager grift

Taken together, these points show how the right storage facility at the right price can be a bonanza for investors.

But before going all in, it's important to understand some of the potential pitfalls.

But before going all in, it's important to understand some of the potential pitfalls.

Storage has weaker intrinsic demand

• People need places to live

• Businesses need a place to do business

Storage has benefitted from consumerism and cheap imported goods.

Will these trends continue? Will we always need to store extra stuff?

• People need places to live

• Businesses need a place to do business

Storage has benefitted from consumerism and cheap imported goods.

Will these trends continue? Will we always need to store extra stuff?

The land is unlikely to appreciate

Storage facilities tend to be placed on the outskirts of town, in less desirable locations.

That makes it pretty unlikely a developer will be interested in the land.

So most are not a great covered land play.

Storage facilities tend to be placed on the outskirts of town, in less desirable locations.

That makes it pretty unlikely a developer will be interested in the land.

So most are not a great covered land play.

The buildings are single purpose

Hotels can be convered into apartments. Residential to assisted living. Industrial space is flexible by design.

Storage units are corrugated steel boxes that don't have much optionality, should the storage market weaken.

Hotels can be convered into apartments. Residential to assisted living. Industrial space is flexible by design.

Storage units are corrugated steel boxes that don't have much optionality, should the storage market weaken.

Constant threat of new competition

With land and structures so cheap, it's easy for a developer to see how well you're doing and build new facilities to compete with you.

An undersupplied market can quickly turn into an oversupplied market and crush your pricing power.

With land and structures so cheap, it's easy for a developer to see how well you're doing and build new facilities to compete with you.

An undersupplied market can quickly turn into an oversupplied market and crush your pricing power.

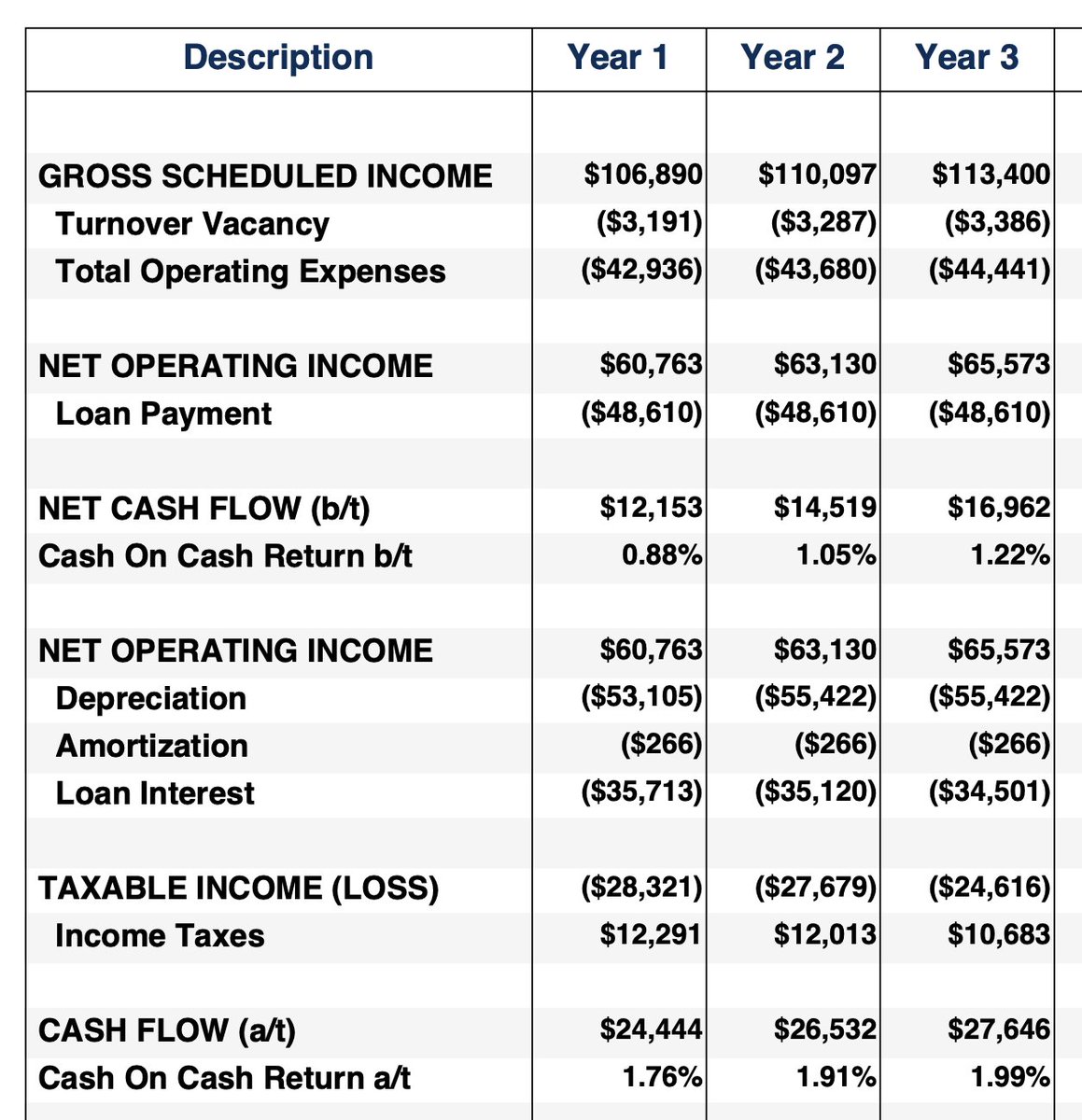

Finally, know that broker pricing has gone crazy.

Storage facilities typically traded at cap rates 150-200 bps than similar class apartments. Today, that spread has almost disappeared.

Brokers are selling on pro forma 5 caps, as opposed to in-place 7.5 caps.

Storage facilities typically traded at cap rates 150-200 bps than similar class apartments. Today, that spread has almost disappeared.

Brokers are selling on pro forma 5 caps, as opposed to in-place 7.5 caps.

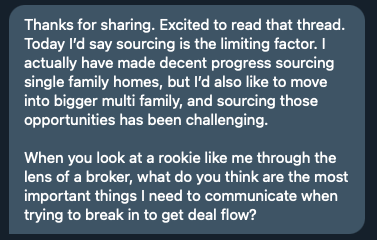

For more storage content, these folks post regularly

@sweatystartup

@roblabonne

@AjOsborne1

@ZachQuick12

@sweatystartup

@roblabonne

@AjOsborne1

@ZachQuick12

@sweatystartup @roblabonne @AjOsborne1 @ZachQuick12 I'll be turning this into a longer form newsletter post this weekend.

Subscribe here if you'd like to read it

bytestobricks.substack.com

Subscribe here if you'd like to read it

bytestobricks.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh