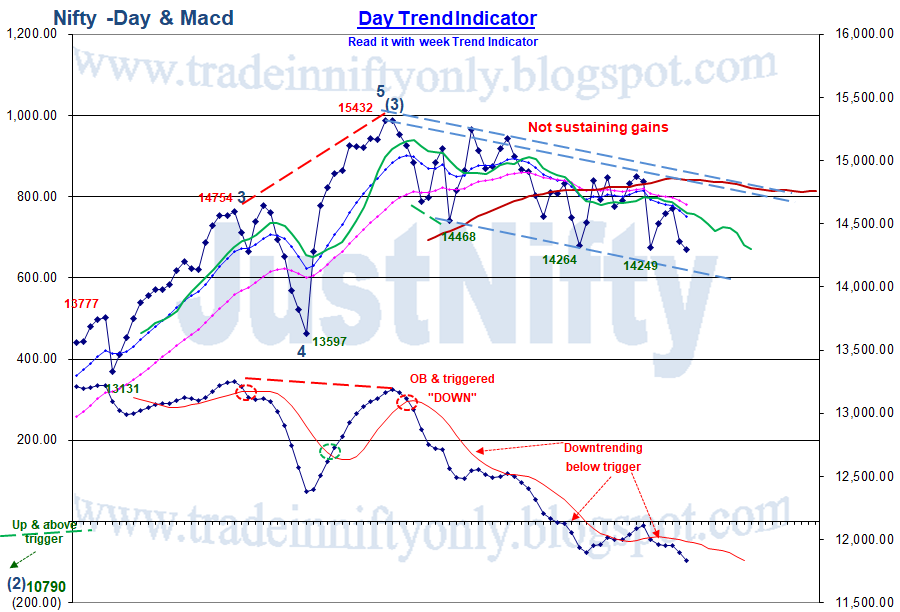

78.6% retrace of 15962-15579 fall is "15880", high is 15876

Bearish view remains

However, the structure from 15579 to 15876 is of 5 waves & not "abc"

However, we keep a sl below 50% retrace of this rise @ 15728

Presently (2)nd wave unfolding holding "15725"

Keep both options open

Bearish view remains

However, the structure from 15579 to 15876 is of 5 waves & not "abc"

However, we keep a sl below 50% retrace of this rise @ 15728

Presently (2)nd wave unfolding holding "15725"

Keep both options open

Whenever you find 2 scenarios in play, wait for "resolution"

Aggressively, you could initiate a trade at critical reversal zone

For Eg: Rise fm 15769 was part of (iii)rd as per 1 scenario and 1st of that would pause at 15864-884 as per pivots. you sell & cover @ ivth, 15769

Aggressively, you could initiate a trade at critical reversal zone

For Eg: Rise fm 15769 was part of (iii)rd as per 1 scenario and 1st of that would pause at 15864-884 as per pivots. you sell & cover @ ivth, 15769

Don't think much. Plan based on simple objective observation of price pattern. Don't imagine things.

When you find a compelling pattern, initiate a trade, knowing fully that if fails, your risk is INR. xx & acceptable & then, plunge. Key in your target or an amt & end the trade.

When you find a compelling pattern, initiate a trade, knowing fully that if fails, your risk is INR. xx & acceptable & then, plunge. Key in your target or an amt & end the trade.

• • •

Missing some Tweet in this thread? You can try to

force a refresh