BHP

Peabody

Elliott

Scot ready to rage in Barcelona

Rallying cry of "it's a call on $2 Henry Hub!!!"

Darling emerges from C11

N Goonyella

Failed JV

Oh btw, coal prices correct too

New CEO

WSB

Now here we are

& BTU is about to buy BHP's "Tier 2" coal book

Let's koala down...1/n

Peabody

Elliott

Scot ready to rage in Barcelona

Rallying cry of "it's a call on $2 Henry Hub!!!"

Darling emerges from C11

N Goonyella

Failed JV

Oh btw, coal prices correct too

New CEO

WSB

Now here we are

& BTU is about to buy BHP's "Tier 2" coal book

Let's koala down...1/n

So let's begin not with BTU but with BHP and the war that was launched in the spring of 2017. Elliott wanted BHP to do a couple things - collapse the dual listing (still own ~5% of the PLC, it's why once/yr we get a compression on "BHP will do something this yr") and...2/n

They wanted shale gone too (yea no shit, even BHP agreed with that)

And they wanted buybacks...let's go into the mind of BHP during this time.

The koala says let's remember the BHP interal acronym SPOM

Shale

Potash

Olympic Dam

Minera Escondida

The 4 ROIC laggards in the group 3/n

And they wanted buybacks...let's go into the mind of BHP during this time.

The koala says let's remember the BHP interal acronym SPOM

Shale

Potash

Olympic Dam

Minera Escondida

The 4 ROIC laggards in the group 3/n

M would be solved by the 3rd concentrator coming online

Potash - well shit, wtf was the plan with Jansen at that point, let's finish the shafts then figure out if the board has big boy pants or not

Shale - yea that was stupid

OD - sins of the "grandparents" of current mgmt 4/n

Potash - well shit, wtf was the plan with Jansen at that point, let's finish the shafts then figure out if the board has big boy pants or not

Shale - yea that was stupid

OD - sins of the "grandparents" of current mgmt 4/n

Well, in due time, shale was gone.

Potash - see you in August it's happening

OD - yea...who knows what eventually happens there

Escondida - like they said 3rd concentrator 5/n

Potash - see you in August it's happening

OD - yea...who knows what eventually happens there

Escondida - like they said 3rd concentrator 5/n

Anyways, it worked out overall as an investment. But open secret Elliott still yearns to get that DLC closing alpha as P&L. Never bothered to cross check it but koala views it as an open secret "Elliott owns 5% of the PLC line". 6/n

So let's go to the Peabody saga, Elliott & another HF the koala will not name basically ran that bankruptcy and won the court rulings such that they were Daddy when it went public again upon emergence. 7/n

BTU said all the right things, capital returns, and all that.

Then North Goonyella happened...

Thermal coal rolled over in Pacific

Turns out PRB structurally screwed by Nat Gas

Etc. Etc.

Anyways...8/n

Then North Goonyella happened...

Thermal coal rolled over in Pacific

Turns out PRB structurally screwed by Nat Gas

Etc. Etc.

Anyways...8/n

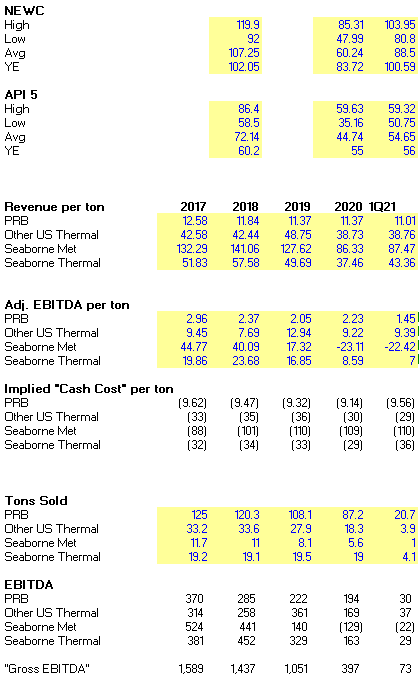

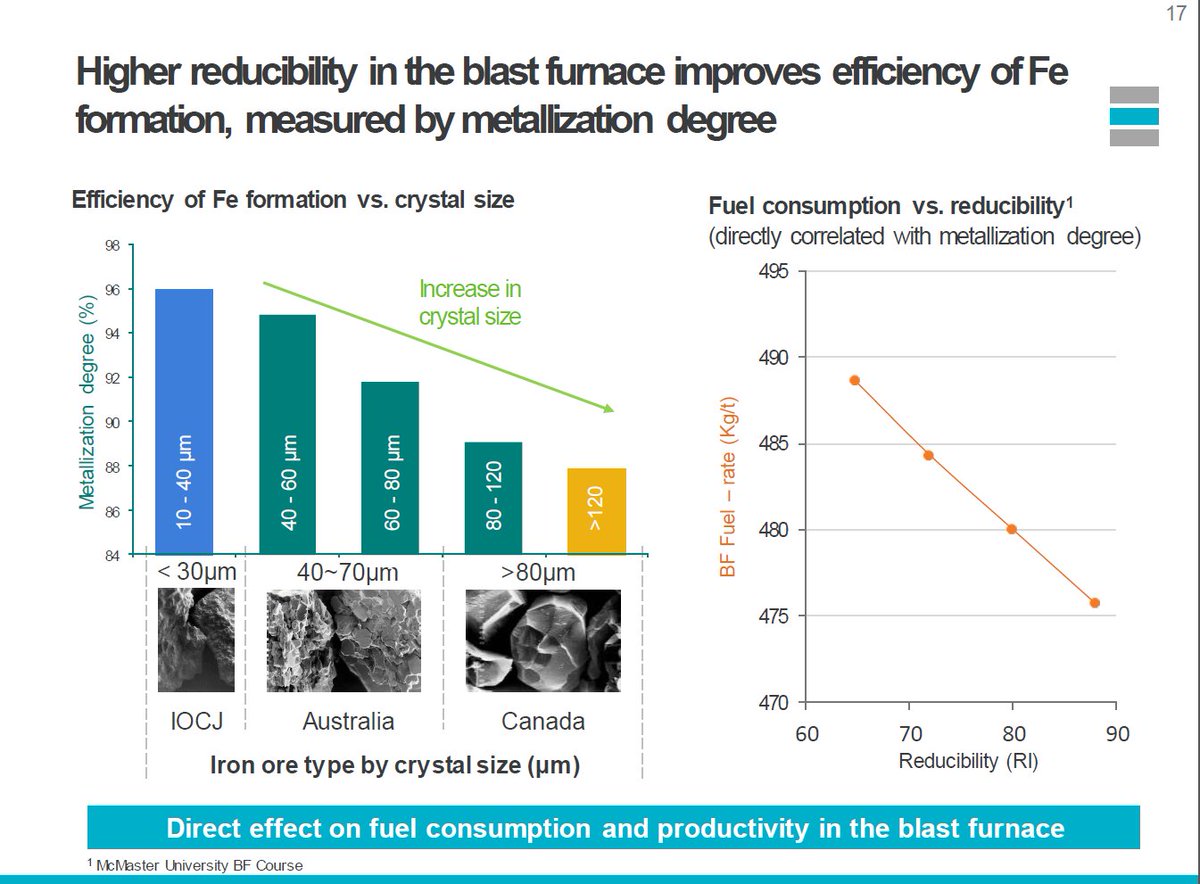

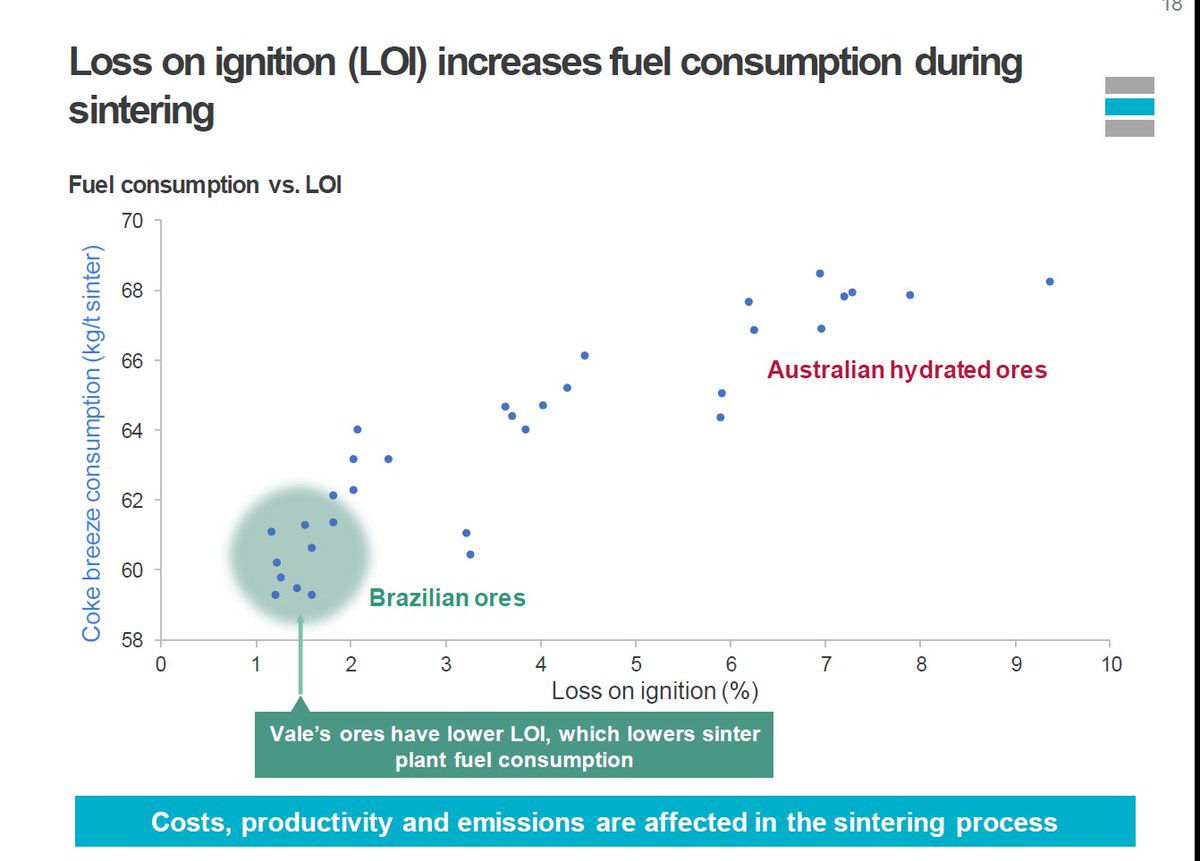

It's important to understand the difference in quality/energy content of thermal coals, because then things start to get strange 9/n

blah blah blah, we see an attempted PRB JV, a deal everyone has whispered about for a decade. And what do you know, a GOP administration blocks it. Who would have seen that coming 10/n

But now we circle back to BHP...who went from 2 Mackenzie's to 1 Mackenzie...

And like any Tier 1 "blue chip" they are listening to their Tier 1 institutional "investors"

And Elliott! 11/n

And like any Tier 1 "blue chip" they are listening to their Tier 1 institutional "investors"

And Elliott! 11/n

So we come to this "everything but BMA" coal divestiture...Cerrejon to Glencore, yea we called that from the jump. But everything else, what's the real motivation? Well, BHP took a writedown on Mt. Arthur in the LTM...and that matters...12/n

B/c one thing blocking a DLC collapse is tax advantages from Mt. Arthur, as the koala recalls, being held in the PLC (or the Ltd, doesn't matter which one) that a DLC collapse would wipe out.

Now Mt. Arthur is for sale with the BMC assets...13/n

Now Mt. Arthur is for sale with the BMC assets...13/n

Once these assets are free and clear of BHP books, BHP has what? A world class higher quality coking coal business and NOTHING ELSE in coal

AND...

A massive roadblock out of the way towards unifying the listings...and that matters...

14/n

AND...

A massive roadblock out of the way towards unifying the listings...and that matters...

14/n

Because (someone with a BBG do koala a solid here), plot RIO AU/RIO LN in USD v BHP AU/BHP LN in USD...post Juukan Gorge, Aussies have sold Rio hard and bought BHP (so BHP spread widened, Rio has compressed)...15/n

in part b/c Aussie investors are bitter the Rio board flipped them the bird and picked Jakob, a Dane. The really messed up part is one of the last time the koala was down under, over 12 months before JG, multiples Aussies flagged to the koala this was GOING to happen 16/n

Minor detail though, no one actually cared. BUT, the Aussies HATED a Frenchman (who was arrogant, but no shit, he was FRENCH!) ran Rio Tinto. But go chart those two DLC spreads, the Aussie behavior is notable. So why does that matter? 17/n

Because anything that clears the way for BHP to have no excuse but to collapse the DLC (dual listing corporate structure in London/Australia) would be a massive free windfall for Elliott. Mt. Arthur is a MAJOR roadblock to it 18/n

And thanks to how thermal coal is viewed now, and how Mt. Arthur is viewed by several logical bidders, very few qualified bidders. And qualified matters here b/c if the buyer comes in and makes a mess, PM is calling Melbourne saying "you still own this BHP" 19/n

Same reason Nickel West never sold, Ranger, Argyle were never punted to juniors. When your cash cow is in a country, not going to risk some junior muppets fucking up on a minor asset in same country, angering your host. You just run it/close & rehab it w/e you need to do 20/n

Anyways, longwinded way of saying Elliott can win both ways here on BHP sale. They get one obstacle taken away on a BHP DLC collapse. They also park some real assets into Peabody that are not captive PRB/ILB assets in the USA. AND they'll get it done at intriguing valuation 21/n

Here is where it gets weird. Elliott got Glenn at BTU fired/gone. Got the balance sheet restructured such in worst case Australia thermal could be hived off. But yea funny thing is...there is a reason this BHP assets are as the koala says "Tier 2"...the quality isn't good 22/n

Mt. Arthur is the biggest coal mine in Australia (it's Saturday night so if the koala is off a little here, w/e), but...ex the WICET dynamic, what's different from Rolleston? Like honestly...) So then we get to BMC, not great coking coal...just yea...23/n

But for BTU, a portfolio of assets that potentially opens doors for a lifeline. For BHP, a <5% market cap cash/value inflow for assets not worth mgmt time to a proven coal operator and leaves BHP with better ESG metrics...24/n

Still, not getting benchmark coking or thermal coal px for the product out of these assets.

But this deal will happen prob announced before BHP FY results in August

How will Peabody retail investors react?

Koala bets there is a big equity raise involved to finance the deal 25/n

But this deal will happen prob announced before BHP FY results in August

How will Peabody retail investors react?

Koala bets there is a big equity raise involved to finance the deal 25/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh