Alright alright, let's have some fun...

Starting with some history:

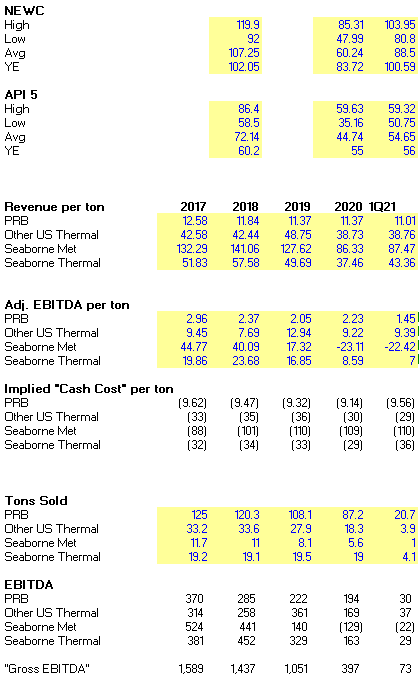

This is all from BTU filings, sorry the koala didn't populate some of it, the koala is selectively lazy...2017/18 was last real coal cycle...1/n

Starting with some history:

This is all from BTU filings, sorry the koala didn't populate some of it, the koala is selectively lazy...2017/18 was last real coal cycle...1/n

1st let's start with the PRB, margins in decline, volumes in decline, best case, you hold serve on volumes, maybe get back to ~$260MM EBITDA assuming peak margins in the segment from $194MM in '20, but w/e...

Ob-la-di, ob-la-da

Life goes on, bra

La-la, how the life goes on

2/n

Ob-la-di, ob-la-da

Life goes on, bra

La-la, how the life goes on

2/n

Other US Thermal, let's just mark it back to $250MM EBITDA, or you know what, $300MM EBITDA to be optimistic, so we got $560MM of "US Gross EBITDA"...we can take on export economics another time...3/n

So we get to Australia...let's chat seaborne thermal & met...(Shoal Creek, wake the koala up when its running again)...first thermal...let's just ack the obvious...let's start with seaborne thermal 4/n

Go to the filings

Need to back out the domestic tonnes (if you want to do that, go pull the preso on the BTU website, but the koala isn't here to do all the work)

Here is what matters, Seaborne Thermal ASP doesn't exceeds API 5 Avg PX for the period, all agreed? 5/n

Need to back out the domestic tonnes (if you want to do that, go pull the preso on the BTU website, but the koala isn't here to do all the work)

Here is what matters, Seaborne Thermal ASP doesn't exceeds API 5 Avg PX for the period, all agreed? 5/n

So let's discuss...you got ~20MM tonnes, probably 8 domestic but w/e...it's about API 5 price, so call it $75 spot, $40 margin on 12 MM tonnes, that's $500MM EBITDA, call it domestic breakeven on the other 8...we are at $1.1Bn Gross EBITDA at spot bese case 6/n

Met? Well, Let's just call it what it is post N Goonyella and Shoal being messed up. As spot its fantastice but honestly let's do it $40/t margin at 6MM tonnes, $240MM...we are at $1.3Bn Gross EBITDA...7/n

So we got a few corporate items...$85 SG&A, $100 of "other stuff", and call it ~$100 of capex ex-life extension...let's call it $300MM

No taxation b/c of NOLs

So call it $1Bn FCF if we assume shoot the moon for a yr on coal prices...awesome right? 8/n

No taxation b/c of NOLs

So call it $1Bn FCF if we assume shoot the moon for a yr on coal prices...awesome right? 8/n

Not going to bore on the cash waterfall post-cap structure restructuring late last yr, that deck is easily available on the company IR website

But you got ~$1.7Bn of net debt & ARO sitting around you have to work through.

9/n

But you got ~$1.7Bn of net debt & ARO sitting around you have to work through.

9/n

Realistically, US operations can hold serve on a lot of this, but let's assume US thermal just covers all the "below Gross EBITDA" line costs, and taxes remain 0%...

10/n

10/n

You need seaborne thermal to deliver. $25/t margin at ~20MM tons, holy fucking shit...you just get close to the promised land if met coal margin bleed can just stop, but then we get into reserve lives and all that fun stuff 11/n

But anyways, here is the core question, you need to believe in a super cycle for both met & thermal coal for 2-3 years, think spot holds serve sort of good...if not, these EBITDA/FCF compress rapidly then we get into reserve lives, etc. 12/n

The koala, to be clear, has no position in BTU either direction. But just observationally, can sleep at night (or day) in the eucalyptus tree, expressing coal views through Glencore & Whitehaven for thermal, Teck/Warrior/Arch for coking coal knowing...13/n

Even if its a slightly slower or not as perfect coal cycle, it will still be a good investment.

With that said, bravo to the Peabody brigade, P&L is P&L. No one is more results oriented then the koala 14/n

With that said, bravo to the Peabody brigade, P&L is P&L. No one is more results oriented then the koala 14/n

This is a place of discussing both tactical and strategic big picture. The question the koala ponders is what happens if/when a BTU/BHP deal does happen? Does the math start to be done more formally? 15/n

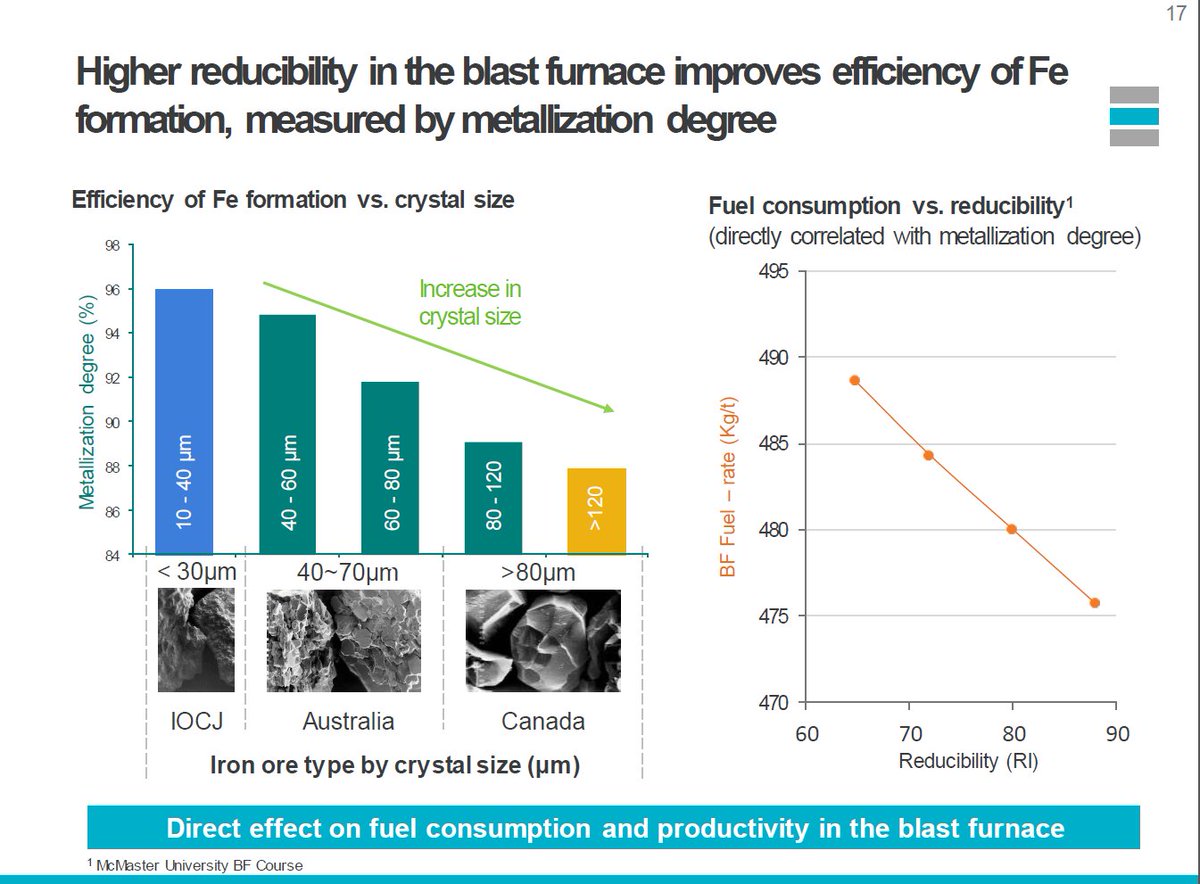

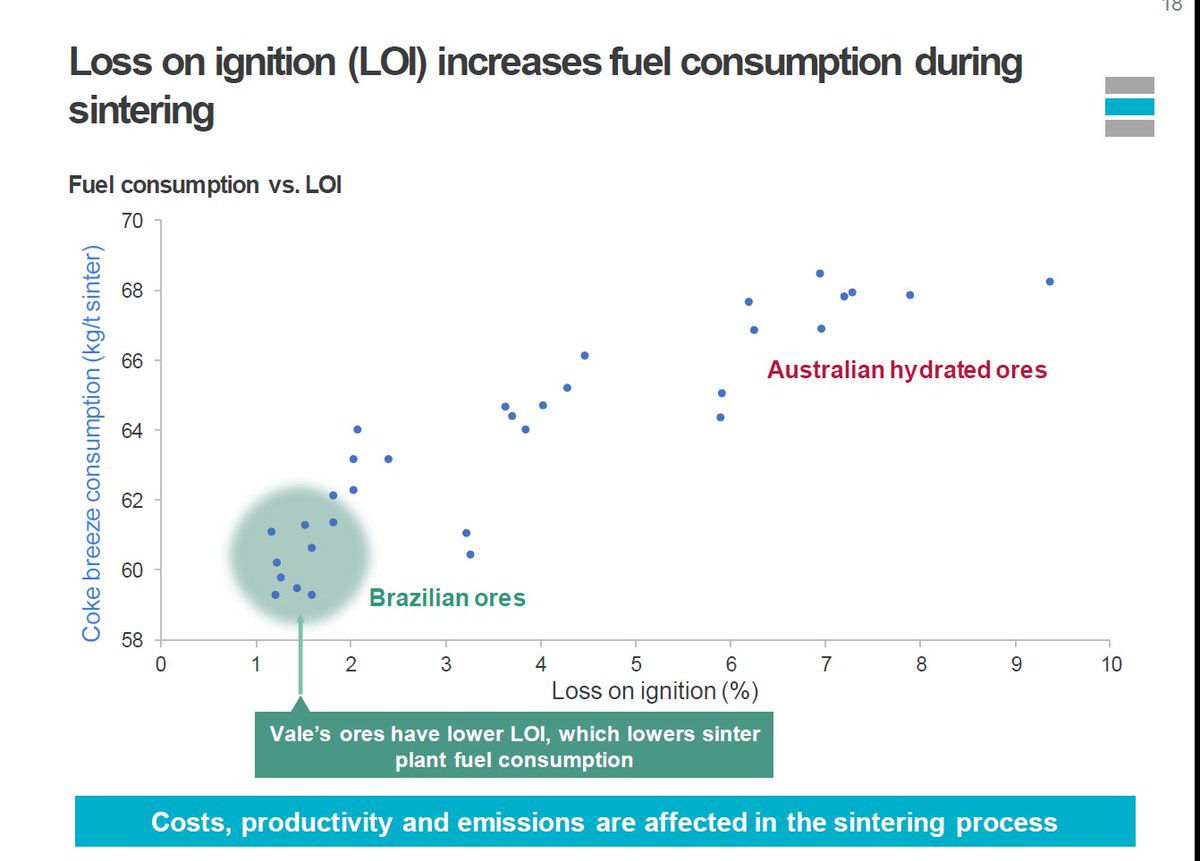

Because like the koala said last night, coal quality is becoming super important. Almost if not more important then iron ore quality. 16/n

Anyways, koala respects the scoreboard, and is long coal. Just in a less torqued risk/reward. And wants to point out some thoughts and concerns on BTU. 17/17

• • •

Missing some Tweet in this thread? You can try to

force a refresh