(1/31) [Mega thread]

I have not done a company deep-dive on Twitter yet, but this is the first time that I feel like there is an opportunity in front of me that could be similar to $TSLA 🚘trading at a $35B marketcap back in 2019

(Beware: this thread is pretty long)👇

#stocks

I have not done a company deep-dive on Twitter yet, but this is the first time that I feel like there is an opportunity in front of me that could be similar to $TSLA 🚘trading at a $35B marketcap back in 2019

(Beware: this thread is pretty long)👇

#stocks

(2/31) I will walk through the adoption of cryptocurrencies 🪙, traditional banking and network effects, to show why I currently believe there is a huge opportunity in $SI (Silvergate Capital).

Disclaimer: I currently hold a large chunk of my portfolio in this stock

Disclaimer: I currently hold a large chunk of my portfolio in this stock

(3/31) So first off, #cryptocurrencies.

Large volatility even for the big ones like $BTC and $ETH, speculative for most blockchains and cannot be valued on normal company metrics.

For this reason most investors steer clear of this asset class.

Large volatility even for the big ones like $BTC and $ETH, speculative for most blockchains and cannot be valued on normal company metrics.

For this reason most investors steer clear of this asset class.

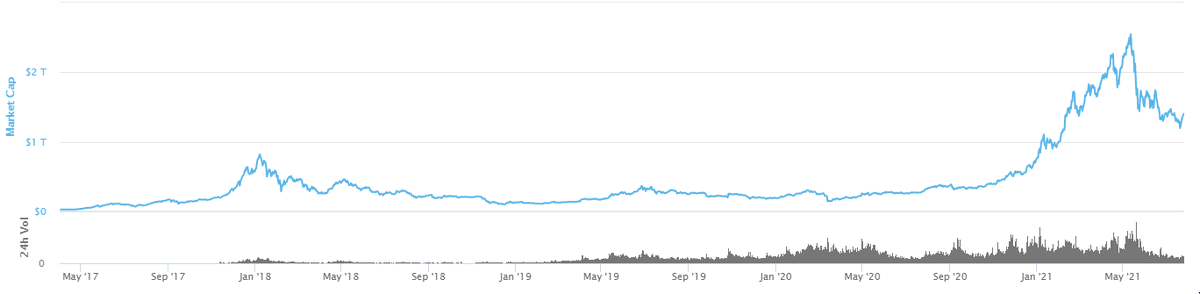

(4/31) But what is the most important question here, is if #blockchain adoption is increasing or not. Currently it definitely is the case, with institutional investors now having $BTC on their balance sheets and DAPPS (decentralized applications) growing in number and usage, etc.

(5/31) Can and will it continue?

I believe so, as new use-cases are discovered for the blockchain and DAPPS, and financial institutions embracing it to revamp part of their payment infrastructure.

If adoption grows, then the marketcap of all cryptos combined grows as well👇

I believe so, as new use-cases are discovered for the blockchain and DAPPS, and financial institutions embracing it to revamp part of their payment infrastructure.

If adoption grows, then the marketcap of all cryptos combined grows as well👇

(6/31) I intentionally wrote market cap and not price, as for $SI, as you will see, prices remaining flat while the supply expands is just as good.

Second, how does a traditional bank🏛️work?

Second, how does a traditional bank🏛️work?

(7/31) The concept is pretty straightforward, they take deposits and use that money to provide loans, buy government bonds or equities.

They make money💰on the difference in the yield of the deposits and the yield they receive on whatever they do with the deposits.

They make money💰on the difference in the yield of the deposits and the yield they receive on whatever they do with the deposits.

(8/31) So what does this all have to do with $SI?

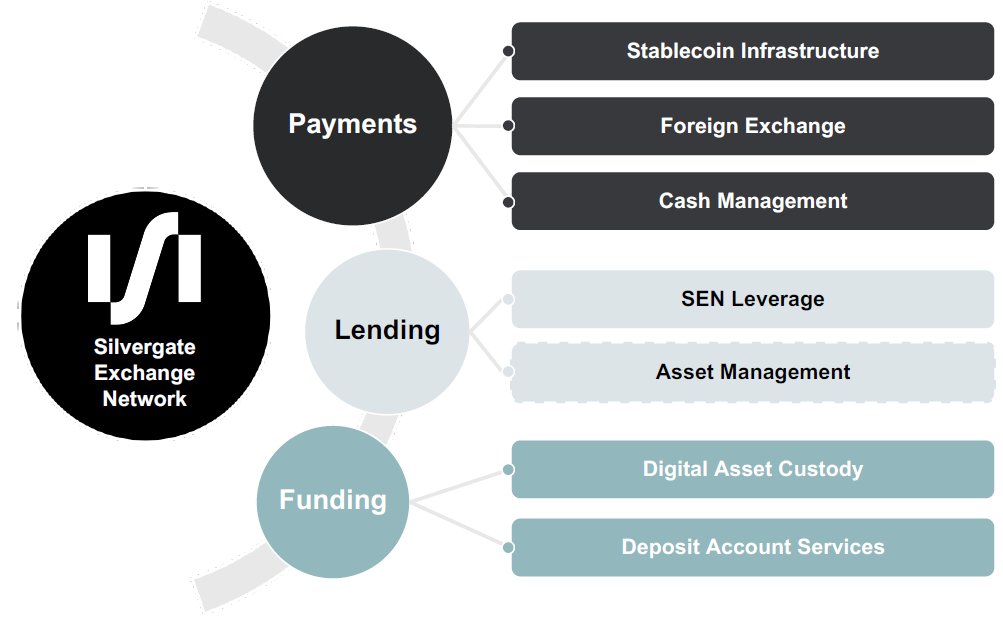

Silvergate is a traditional bank that bet on the widespread adoption of the blockchain and #cryptocurrencies several years ago and built a system called the SEN (Silvergate Exchange Network)

Silvergate is a traditional bank that bet on the widespread adoption of the blockchain and #cryptocurrencies several years ago and built a system called the SEN (Silvergate Exchange Network)

(9/31) The concept here is simple, the SEN is up 24/7 and its main purpose is for customers to be able to move USD from one account to another and utilize $SI's other services all around the clock.

This is perfect for crypto traders as cryptocurrencies trade all the time.

This is perfect for crypto traders as cryptocurrencies trade all the time.

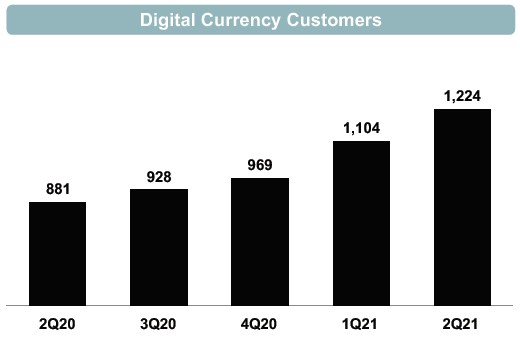

(10/31) As of 21Q2, $SI had 1224 digital currency customers, which comprise of crypto exchanges (ie. $COIN), institutional traders and developers of innovative software.

The SEN creates a powerful network effect, as it can only be used with companies that are also on the SEN

The SEN creates a powerful network effect, as it can only be used with companies that are also on the SEN

(11/31) So if you are a cryptocurrency exchange that wants to send USD to another entity instantly, you have to join the SEN yourself.

Competing products (of which there are not many, if any) would need to onboard every customer that $SI has to have the same value proposition

Competing products (of which there are not many, if any) would need to onboard every customer that $SI has to have the same value proposition

(12/31) So how does $SI make money?

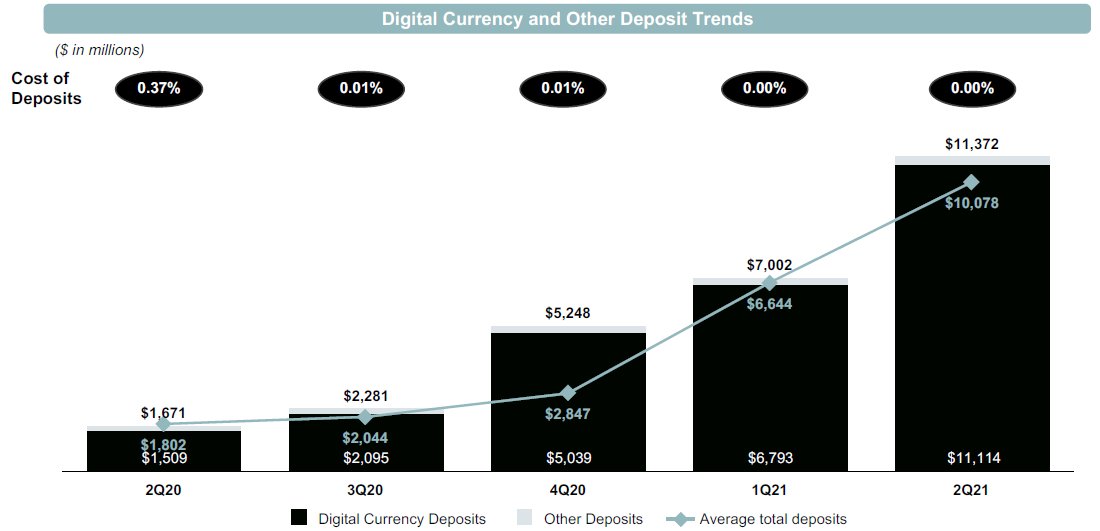

Well, first they are a traditional bank and collect deposits from their customers.

The awesome thing here is that their customers keep large sums of money on their accounts to be able to trade and Silvergate pays no interest on these deposits

Well, first they are a traditional bank and collect deposits from their customers.

The awesome thing here is that their customers keep large sums of money on their accounts to be able to trade and Silvergate pays no interest on these deposits

(13/31) Banks usually have only tiny amounts of zero-cost deposits, so this is hugely uncommon.

These deposits have taken off like a rocket🚀recently, growing 8x just in the past year alone!

This is insane😱!

These deposits have taken off like a rocket🚀recently, growing 8x just in the past year alone!

This is insane😱!

(14/31) So why have they grown that much and can this continue?

One reason is the consistent growth of customers on the SEN

One reason is the consistent growth of customers on the SEN

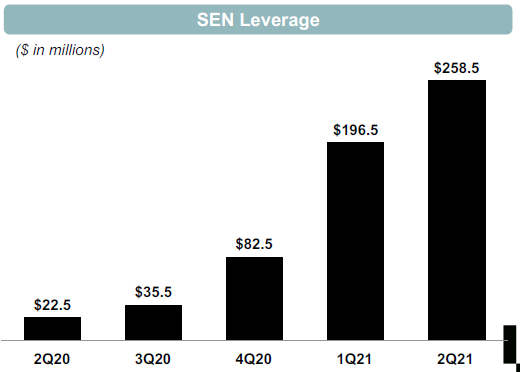

(15/31) Second, Silvergate keeps adding services to supplement crypto trading and deepen the value proposition of the SEN.

One example is SEN leverage, where $SI provides USD loans with $BTC being the collateral

One example is SEN leverage, where $SI provides USD loans with $BTC being the collateral

(16/31) Third reason is the price appreciation in $BTC and $ETH, as if the value of those goes up, customers of the SEN have more capital in cryptocurrencies 🪙 and they have to adjust their USD💵deposits as a percentage

(17/31) For this reason, the stock price in the past year has moved pretty much in-line with $BTC and $ETH.

But the latest quarter showed that $SI can grow even when crypto prices fall because of customer growth and increasing usage in the offerings of SEN.

But the latest quarter showed that $SI can grow even when crypto prices fall because of customer growth and increasing usage in the offerings of SEN.

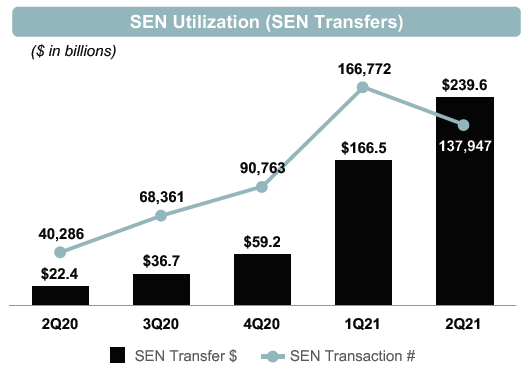

(18/31) The second source of income is fee-based revenue.

This comes from SEN usage fees, mainly as a percentage of the traded amount, which has grown 11x in the past year alone!

(Have I mentioned this is **** crazy?)

This comes from SEN usage fees, mainly as a percentage of the traded amount, which has grown 11x in the past year alone!

(Have I mentioned this is **** crazy?)

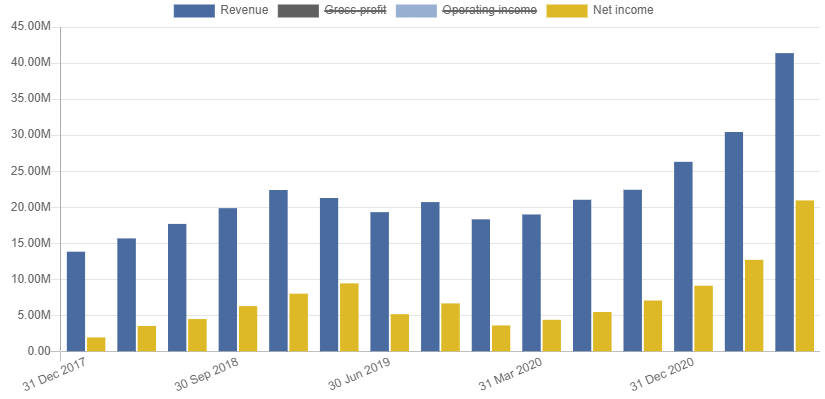

(19/31) Revenues and earnings are shooting up as you would expect, however they are trailing a bit.

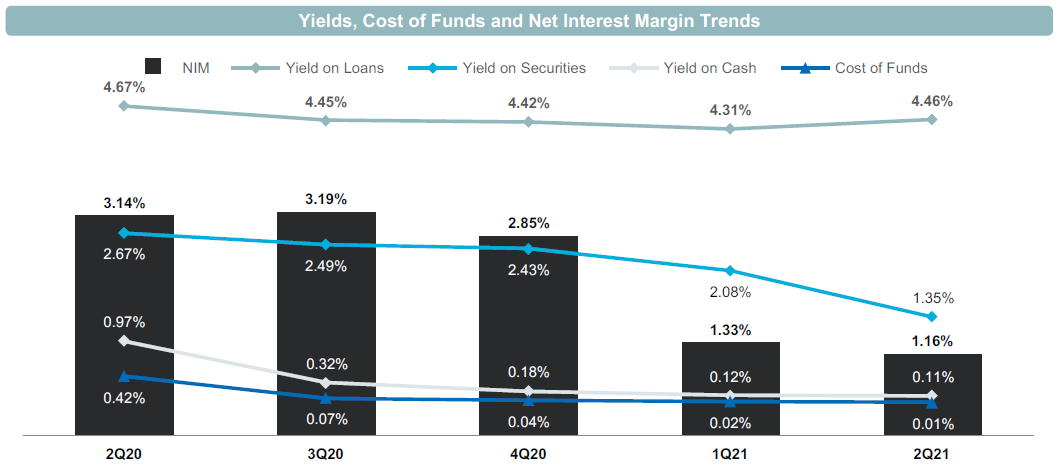

The reason for this is that the average yield that $SI makes on the deposits has fallen dramatically

The reason for this is that the average yield that $SI makes on the deposits has fallen dramatically

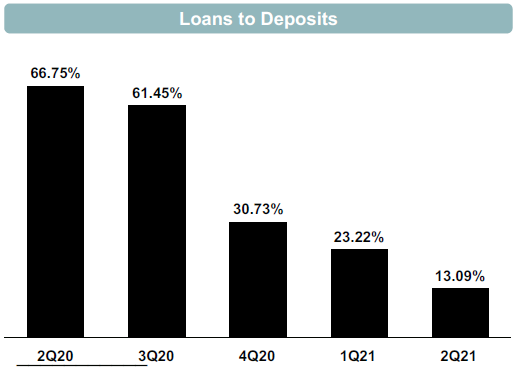

(20/31) This is a consequence of lower yields available on securities and a much greater amount of cash💵held at other banks as the company is unable to deploy loans as fast as deposit growth (a ridiculous problem to have)👇

(21/31) So even if deposit growth for some reason comes to a screeching halt, the company will keep on increasing its earnings for quite a while as it deploys the capital.

And here is why I think this is a great opportunity👇

And here is why I think this is a great opportunity👇

(22/31) $SI trades at a VERY attractive valuation.

Even while the one-year return on the stock is 650%(!!)(This in itself usually disqualifies a stock for me), deposits have grown 8x during that same period, which makes the Price to book ratio almost in line with average banks

Even while the one-year return on the stock is 650%(!!)(This in itself usually disqualifies a stock for me), deposits have grown 8x during that same period, which makes the Price to book ratio almost in line with average banks

(23/31) Fee income has also grown 5x, so the PE based on the latest quarter's earnings is 35, but as I mentioned the company needs some time to deploy all of its capital

(24/31) Also, $FB and the Diem association selected $SI to be the exclusive issuer of its Diem #StableCoin.

This shows the leading position of $SI and they will be able to collect fees from the minting of the coins and they will handle the reserves.

fool.com/investing/2021…

This shows the leading position of $SI and they will be able to collect fees from the minting of the coins and they will handle the reserves.

fool.com/investing/2021…

(25/31) So even while I am extremely optimistic here, I have to mention the things that could derail this.

First off, if the world decides that blockchains are not all that great and adoption decreases, then this bank will not be in a great position, as this is their only focus

First off, if the world decides that blockchains are not all that great and adoption decreases, then this bank will not be in a great position, as this is their only focus

(26/31) If a competitor comes out with a superior product to SEN and manages to onboard current customers, then $SI could lose out on business, but even in this case with growing crypto adoption there is certainly room for multiple players and even then $SI could continue growing

(27/31) If the bank mismanages its deposits while crypto prices plummet, it could put them in a bad situation, however they have shown to be very prudent with how they allocate capital.

So in summary👇

So in summary👇

(28/31) $SI is a bet on the blockchain and cryptocurrencies overall without owning any actual $BTC, $ETH, etc having a level of downside protection from falling crypto prices, while using fundamental valuation metrics for the company and trading (IMO) at a very attractive price👇

(29/31) A growing customer base, an extending suite of services, the issuance of #StableCoins and increasing #Crypto prices add up to result in a crazy exponential growth potential for the company

(30/31) Their earnings report presentations are really great and visual.

Actually they are so great that I think you should read this one instead of the stock page on our service (though it's at iocharts.io/stocks/SI if you want to take a look🙂)

s23.q4cdn.com/615058218/file…

Actually they are so great that I think you should read this one instead of the stock page on our service (though it's at iocharts.io/stocks/SI if you want to take a look🙂)

s23.q4cdn.com/615058218/file…

(31/31) Let me know what you think, a RT is always appreciated if you found it useful and as always, nothing written here is financial advice, so please do your own DD!

Thanks for reading!

Thanks for reading!

• • •

Missing some Tweet in this thread? You can try to

force a refresh