Judging by some of the comments on here, many would rather sit through a gut wrenching decline (40-50% drawdown in their portfolio) and pray than put up with a few whipsaws when the market reverses higher soon after putting on a hedge.

Strange logic...beats me but hey-ho!

Strange logic...beats me but hey-ho!

EVERY single stock market crash or major decline starts off as a 'normal pullback'. No way to differentiate which one(s) will turn out to be a hair-curler.

This is why best to take every signal and defend capital during every downtrend. Whipsaws are NORMAL and can't be avoided.

This is why best to take every signal and defend capital during every downtrend. Whipsaws are NORMAL and can't be avoided.

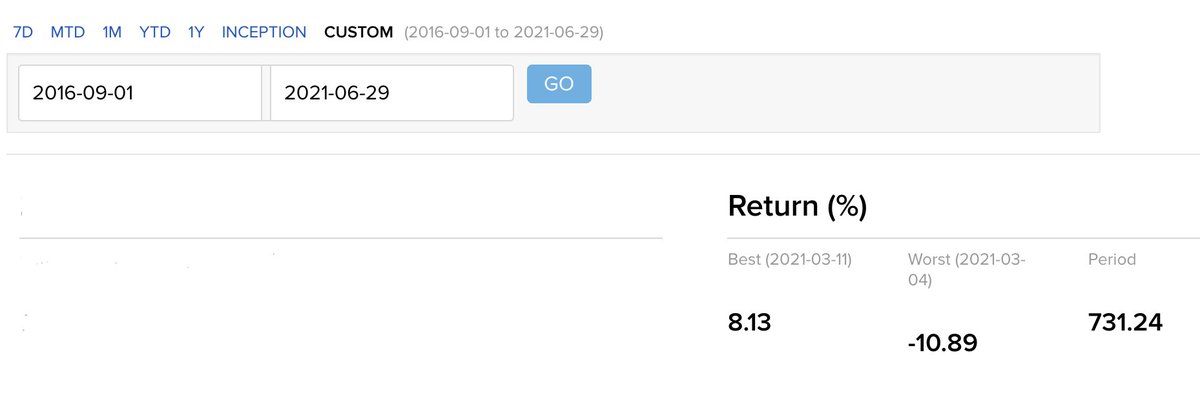

Whipsaws do NOT cause drawdowns in a portfolio, they simply cause one to miss out on some upside (portfolio stays more or less flat until hedges are removed).

When large declines come along (and they do), big profits from hedging tend to cover the whipsaw losses.

When large declines come along (and they do), big profits from hedging tend to cover the whipsaw losses.

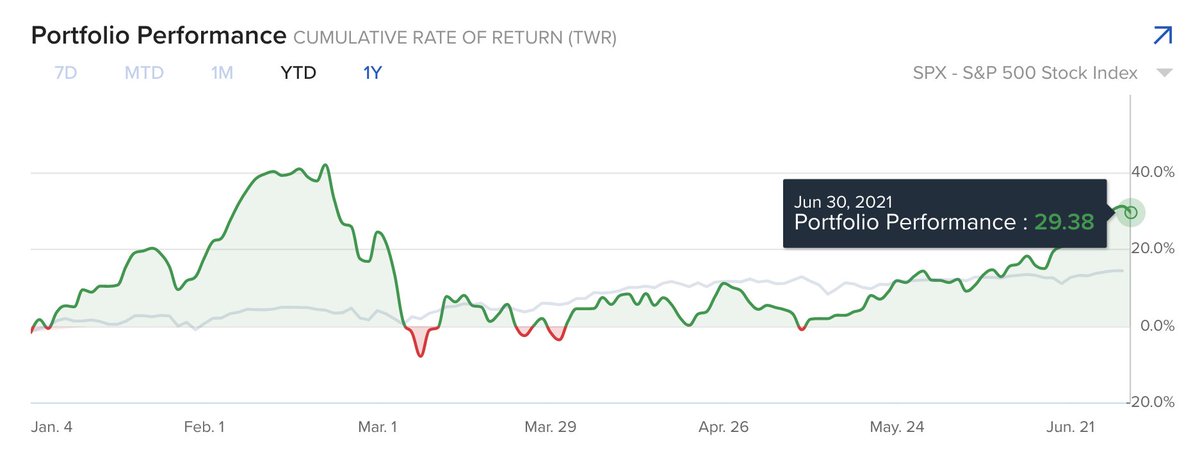

Everybody appears to be a genius during a QE-induced bull market. The litmus test is what one is left with after the complete stock market cycle (after the tide has gone out).

Protecting the downside is super important....secular bear-markets do come along and they aren't fun!

Protecting the downside is super important....secular bear-markets do come along and they aren't fun!

Previous secular bear -

'00-'13 - no gain in $SPX for 13 years!

The one before -

'68-'82 - no gain in $SPX for 14 years!

Both periods saw TWO massive (45-58%) declines!

'00-'13 - no gain in $SPX for 13 years!

The one before -

'68-'82 - no gain in $SPX for 14 years!

Both periods saw TWO massive (45-58%) declines!

• • •

Missing some Tweet in this thread? You can try to

force a refresh