1) Portfolio update Jul-end -

$ADYEY $AFTPY $AGC $CRWD $DLO $DOCU $FVRR $GLBE $LSPD $MELI $MTTR $OKTA $PATH $PLTR $QELL $ROKU $SE $SHOP $SNAP $SNOW $TWLO $ZI

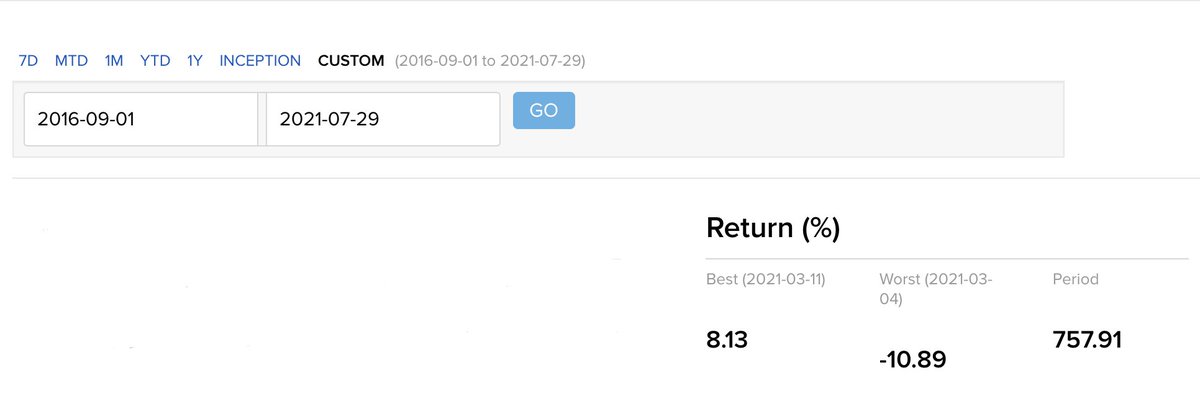

Return since 1 Sept '16 -

Portfolio +757.91% (54.78%pa)

$ACWI +74.84% (12.03%pa)

$SPX +102.50% (15.42%pa)

$ADYEY $AFTPY $AGC $CRWD $DLO $DOCU $FVRR $GLBE $LSPD $MELI $MTTR $OKTA $PATH $PLTR $QELL $ROKU $SE $SHOP $SNAP $SNOW $TWLO $ZI

Return since 1 Sept '16 -

Portfolio +757.91% (54.78%pa)

$ACWI +74.84% (12.03%pa)

$SPX +102.50% (15.42%pa)

2) YTD return -

Portfolio +32.17%

$ACWI +12.91%

$SPX +17.02%

Biggest positions -

1) $GLBE 2) $SE 3) $MELI 4) $SNOW 5) $ROKU

Contd....

Portfolio +32.17%

$ACWI +12.91%

$SPX +17.02%

Biggest positions -

1) $GLBE 2) $SE 3) $MELI 4) $SNOW 5) $ROKU

Contd....

Commentary -

July was a busy month as I objectively reviewed all my holdings and realised that I wasn't happy with all of them.

After witnessing the disaster show in Chinese stocks, I also realised how important governance is and that certain countries are inherently riskier..

July was a busy month as I objectively reviewed all my holdings and realised that I wasn't happy with all of them.

After witnessing the disaster show in Chinese stocks, I also realised how important governance is and that certain countries are inherently riskier..

...than others and why assets in such jurisdictions almost always appear 'cheap' and 'undervalued'.

Elsewhere, due to the spread of the COVID variants, I also realised how wonderful the recurring-revenue software businesses truly are, so I took advantage of the spring/...

Elsewhere, due to the spread of the COVID variants, I also realised how wonderful the recurring-revenue software businesses truly are, so I took advantage of the spring/...

....summer swoon and bought shares in $OKTA $PATH and $ZI. Furthermore, I also added to my positions in $PLTR and $SNOW.

It is my belief that these software businesses are truly special because they are mission critical for businesses, enterprises *need* them to function,....

It is my belief that these software businesses are truly special because they are mission critical for businesses, enterprises *need* them to function,....

...in most cases, they are deeply integrated into organisations' work flows, they have recurring revenues, they are growing like weeds, they have massive TAMs, most are Founder-led, they have super-juicy gross margins and at scale, they should generate 20-30% operating margins...

...If you recall, the Sage of Omaha has made his fortune by owning dominant businesses with predictable cash flows (insurance, consumer staples/brands, utilities etc) and he has largely stayed away from boom & bust, commodity-type businesses.

Well, in today's day and age....

Well, in today's day and age....

....the software companies not only offer super stable recurring revenues + predictable cash flows, they are also re-investing and growing rapidly!

In addition to software, the dominant ecommerce and online payments businesses also offer similar business characteristics..

In addition to software, the dominant ecommerce and online payments businesses also offer similar business characteristics..

...i.e. repeat purchases from customers throughout the business cycle, sticky customers (who tend to stay), capital light operations, network effects, decent margins and fairly predictable cash flows.

IMHO, these businesses are the "modern-day utilities on steroids"....

IMHO, these businesses are the "modern-day utilities on steroids"....

... and some of them are the best asset-light compounding machines ever created in the history of capitalism.

Speaking of online payments, a couple of weeks ago, I also invested in D-Local $DLO which appears to be a fantastic high-growth South American payments business!...

Speaking of online payments, a couple of weeks ago, I also invested in D-Local $DLO which appears to be a fantastic high-growth South American payments business!...

$DLO is run by founders (collectively, they own ~50% of the company's shares!) and it helps enterprise customers in doing business/accepting payments in the developing markets.

Its customer-list is super impressive and currently, it derives approximately 90% of its revenue...

Its customer-list is super impressive and currently, it derives approximately 90% of its revenue...

...from South America. Fortunately, the company is expanding in other parts of the world and some analysts are pitching it as the "Adyen of the emerging markets".

The business is very early innings, its penetration rate amongst its enterprise customers is still mid single...

The business is very early innings, its penetration rate amongst its enterprise customers is still mid single...

...digits of their total payments (versus mid-30% for Adyen) so the growth runway is quite long.

As an added kicker, the company is already profitable and both revenues and profits are expected to grow rapidly over the next 3-5 years.

Turning to the eVTOL space, I recently..

As an added kicker, the company is already profitable and both revenues and profits are expected to grow rapidly over the next 3-5 years.

Turning to the eVTOL space, I recently..

came across a promising founder-led business "Lilium" which has a formidable management team and board (ex-CEO of Airbus, key executives from Airbus, Boeing and Rolls Royce etc) and was quite impressed by their company culture and aircraft design!

After researching...

After researching...

...the business and learning about its long-term plans, I decided to change my horse in this race. I sold shares of Joby Aviation $RTP and invested in Lilium $QELL.

In order to raise cash for these new investments, during July I sold some of my lower-conviction holdings $DKNG $OZON $PINS $SOFI $UPST

As usual, I'm simply trying to allocate my capital to my highest-conviction, highest quality businesses which I can find and it is...

As usual, I'm simply trying to allocate my capital to my highest-conviction, highest quality businesses which I can find and it is...

...inevitable that I'll continue to make mistakes along the way.

In fact, I can guarantee you that I'll pick some lemons (bad apples) in the future and I will also sell out of some companies which will turn out to be big winners.

Unfortunately, since investing is all...

In fact, I can guarantee you that I'll pick some lemons (bad apples) in the future and I will also sell out of some companies which will turn out to be big winners.

Unfortunately, since investing is all...

...about the future and tomorrow is largely unknowable, mistakes are normal in this business and I'll also do some dumb things in the future.

However, I remain hopeful that I'll do more right than wrong and hang onto the rights for long periods of time so they more than...

However, I remain hopeful that I'll do more right than wrong and hang onto the rights for long periods of time so they more than...

...compensate me for my mistakes.

In any event, given the information known to me today, I firmly believe that my capital is currently invested in the most promising businesses but of course, when new data emerges, I reserve the right to change my mind.

This is why nobody...

In any event, given the information known to me today, I firmly believe that my capital is currently invested in the most promising businesses but of course, when new data emerges, I reserve the right to change my mind.

This is why nobody...

...should blindly follow my moves or invest in my companies without doing adequate homework.

After all, only you know your circumstances, volatility tolerance, financial objectives and most importantly, your financial future is on the line.

Hope this has been helpful.

END.

After all, only you know your circumstances, volatility tolerance, financial objectives and most importantly, your financial future is on the line.

Hope this has been helpful.

END.

• • •

Missing some Tweet in this thread? You can try to

force a refresh