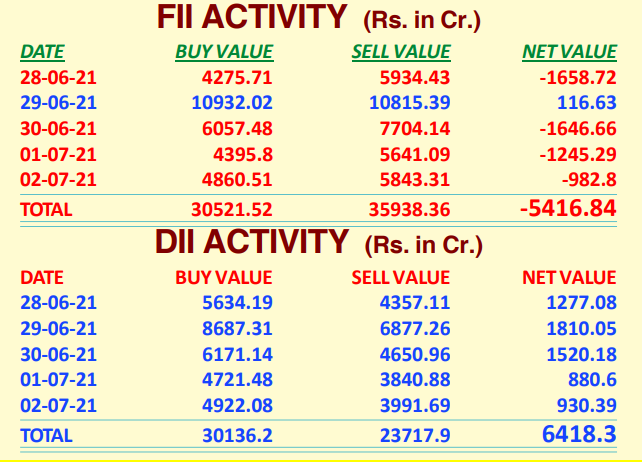

#BSE #Sensex 280 month (23+ yr) update!

Sensex trailing PE was 31.6x for July vs 32.2x for June

vs low of 15.67x on 23 Mar 2020

9th consecutive 30+PE month

after 0 instances of 30+ PE till FY20!

Highest earlier PE for July has been 28.5x in Fy01

#NSE #DII #FII #Nifty #nifty50

Sensex trailing PE was 31.6x for July vs 32.2x for June

vs low of 15.67x on 23 Mar 2020

9th consecutive 30+PE month

after 0 instances of 30+ PE till FY20!

Highest earlier PE for July has been 28.5x in Fy01

#NSE #DII #FII #Nifty #nifty50

#BSE #Sensex 280 month (23+ yr) update!

Sensex trailing PB was 3.4x for July vs 3.3x for June

P/B is in line with 23 year avg of 3.3x.

Lowest ever is 1.7x in Oct 1998

#NSE #DII #FII #Nifty #nifty50

Sensex trailing PB was 3.4x for July vs 3.3x for June

P/B is in line with 23 year avg of 3.3x.

Lowest ever is 1.7x in Oct 1998

#NSE #DII #FII #Nifty #nifty50

#BSE #Sensex 280 month (23+ yr) update!

Sensex trailing Dividend Yield was 1.03% in July vs. 0.97% in June

vs 23 year avg for 1.4%

Lower div yld means high valuation.

Finally crossed 1% after 8 consecutive months div yld less than 1%

#NSE #DII #FII #Nifty #nifty50

Sensex trailing Dividend Yield was 1.03% in July vs. 0.97% in June

vs 23 year avg for 1.4%

Lower div yld means high valuation.

Finally crossed 1% after 8 consecutive months div yld less than 1%

#NSE #DII #FII #Nifty #nifty50

#BSE #Sensex 280 month (23+ yr) update!

July was up 0.2% month-over-month vs

June was up 1% MoM

It's been a massive bull run, with almost no space for the bears - only 4 months are down MoM since April 2020!!

#NSE #DII #FII #Nifty #nifty50

July was up 0.2% month-over-month vs

June was up 1% MoM

It's been a massive bull run, with almost no space for the bears - only 4 months are down MoM since April 2020!!

#NSE #DII #FII #Nifty #nifty50

#BSE #Sensex 280 month (23+ yr) update!

Sensex year-on-year returns were up 39.8% in July vs 50.3% in June

5th best YoY return for July!

Avg YoY returns are around 16.5%

#NSE #DII #FII #Nifty #nifty50

Sensex year-on-year returns were up 39.8% in July vs 50.3% in June

5th best YoY return for July!

Avg YoY returns are around 16.5%

#NSE #DII #FII #Nifty #nifty50

#BSE #Sensex 280 month (23+ yr) update!

Summary of July over past years

#NSE #DII #FII #Nifty #nifty50

Summary of July over past years

#NSE #DII #FII #Nifty #nifty50

#BSE #Sensex 280 month (23+ yr) update!

Ok! July over

what about August for Sensex?

August is up 0.9% MoM and up 12.1% YoY on the average

In the last 10 yrs, August has been alternating with positive and negative returns

Will it continue trend?

#NSE #DII #FII #Nifty #nifty50

Ok! July over

what about August for Sensex?

August is up 0.9% MoM and up 12.1% YoY on the average

In the last 10 yrs, August has been alternating with positive and negative returns

Will it continue trend?

#NSE #DII #FII #Nifty #nifty50

#POLL

What will be #BSE #Sensex returns in August 2021?

Lets see what you all feel this month...

most of the prior polls have been spot on...! great to see!!

Your prediction for August is:

(pls retweet for greater reach and sample size)

#NSE #DII #FII #Nifty #nifty50

What will be #BSE #Sensex returns in August 2021?

Lets see what you all feel this month...

most of the prior polls have been spot on...! great to see!!

Your prediction for August is:

(pls retweet for greater reach and sample size)

#NSE #DII #FII #Nifty #nifty50

• • •

Missing some Tweet in this thread? You can try to

force a refresh