The two main Q's are

a) Is demand outpacing supply?

b) Are the margins of companies sustainable?

Answer to both the Questions and you can see the Investment thesis.

a) Is demand outpacing supply?

b) Are the margins of companies sustainable?

Answer to both the Questions and you can see the Investment thesis.

https://twitter.com/Investor_Mohit/status/1421364570552094730

Part A is answered, lots been written about it.

Google it. spend sometime understanding the energy sector and shift happening in the industry and you can see why and how demand is outpacing supply.

Good to be skeptic but also equally important to acknowledge facts and figures.

Google it. spend sometime understanding the energy sector and shift happening in the industry and you can see why and how demand is outpacing supply.

Good to be skeptic but also equally important to acknowledge facts and figures.

Part B can be answered if you look at international peers in this segment.

BR is the largest outside China and third largest in the world.

The only two peers above it are

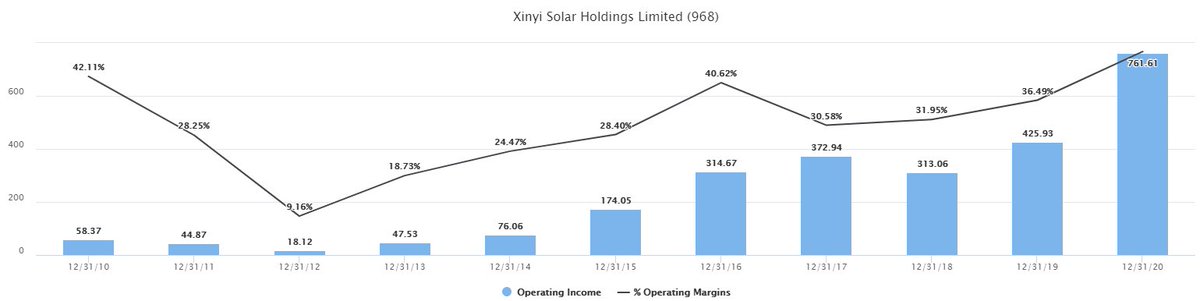

Xinyi Solar

Flat Glass

Here is their 10 year history.

BR is the largest outside China and third largest in the world.

The only two peers above it are

Xinyi Solar

Flat Glass

Here is their 10 year history.

Operating Margins have remains consistently above 30% since 2016.

Glass prices were high only in late 2016.

~30% Op. Margin is sustainable in this industry.

Glass prices were high only in late 2016.

~30% Op. Margin is sustainable in this industry.

Almost the same economics for Flat Glass.

When in doubt look for at international peers.

What happened in China 10 years ago is what will happen in India in next 10 years.

We are 20 yrs behind China. Study the country and you will know where to make money from.

Fin.

When in doubt look for at international peers.

What happened in China 10 years ago is what will happen in India in next 10 years.

We are 20 yrs behind China. Study the country and you will know where to make money from.

Fin.

• • •

Missing some Tweet in this thread? You can try to

force a refresh