It's the weekend!

Grab a cup of coffee, in this thread I will explain

1. What drives valuation of a company?

2. Why some companies are valued at high multiples while others aren't?

3. What you should be looking for while buying a business?

Lets dive right in.

Grab a cup of coffee, in this thread I will explain

1. What drives valuation of a company?

2. Why some companies are valued at high multiples while others aren't?

3. What you should be looking for while buying a business?

Lets dive right in.

Not so long ago, Maruti released an ad campaign - 'Kitna Deti Hai'? (What's the mileage?)

Here is one of the ad's from the campaign.

Here is one of the ad's from the campaign.

The ad was on point - Indians before buying a car or any vehicle obsess over the mileage the most among all the other specifications.

We as a society are very value conscious.

Nobody has to teach us to drive a good bargain.

We as a society are very value conscious.

Nobody has to teach us to drive a good bargain.

The logic for obsessing over mileage also checks out.

If a vehicle gives good mileage then over time as owners of the vehicle you will end up spending less on it in fuel and other added costs.

If a vehicle gives good mileage then over time as owners of the vehicle you will end up spending less on it in fuel and other added costs.

This ability to gauge long term value before buying something is magically lost when we enter stock market.

Here too you should be asking your stocks - 'Kitna deta hai'?

This time instead of obsessing over mileage, you should be obsessing over cash flows.

Here too you should be asking your stocks - 'Kitna deta hai'?

This time instead of obsessing over mileage, you should be obsessing over cash flows.

Just like manufacturing most fuel efficient cars drove the sales of Maruti during the 2000s, its the cash flows and ability of the company to incrementally increase its cash flows, is what drives a value of a business.

Lets take another example.

You have Rs 1 lakh that you want to invest.

Your objective is to generate Rs 1,000 of monthly income from your investment.

Your objective is to generate Rs 1,000 of monthly income from your investment.

Now ask yourself, what would be the first few metrics you will enquire before buying the business?

The answer should be.

1. What do I have to pay to buy the business in whole today?

2. How much income (cash) does that business generate?

1. What do I have to pay to buy the business in whole today?

2. How much income (cash) does that business generate?

The same rule applies when you're buying any stock.

Market Cap of the Stock = What you're paying to buy the business in whole today

Cash Flow from Operations = Income that business generates

Cash Flow from Operations = Income that business generates

Its shocking to me that so many investors do not look at market cap as the very first thing before they start evaluating a stock.

How do you know how much to pay per piece if you do not know what the entire business is worth?

How do you know how much to pay per piece if you do not know what the entire business is worth?

In our example from earlier, if the ice cream shop was valued at Rs 10 Lakh but could only generate an yearly income of Rs 10,000 - would you pay for it?

Your answer should be No!,

as it would take you 100 years to recoup your investment of Rs 10 lakhs.

By the time you get that money back, you and the possibly the shop won't be alive anymore.

as it would take you 100 years to recoup your investment of Rs 10 lakhs.

By the time you get that money back, you and the possibly the shop won't be alive anymore.

Now lets assume that the ice cream business was investing to build an app that lets customers directly order from the store.

Is the business now suddenly worth more cause it has an app?

Is the business now suddenly worth more cause it has an app?

The answer is No.

However, if the investment in that app also meant that sales could now grow at 100% every year for next 5 years, then yes! It can be worth more.

Why, you ask?

However, if the investment in that app also meant that sales could now grow at 100% every year for next 5 years, then yes! It can be worth more.

Why, you ask?

Because the business is now growing at a fast rate and that means it can generate more income.

Now your investment of Rs 10 Lakhs maybe worth it, as in year 10 of the business you maybe earning Rs 1 Lakh per year.

Now your investment of Rs 10 Lakhs maybe worth it, as in year 10 of the business you maybe earning Rs 1 Lakh per year.

Now imagine there is another ice cream shop across the street, that is available at the same price of Rs 10 lakh, already has an app and growing sales at 100% YoY as well.

Would you prefer to buy this shop over the first one?

Answer is yes.

Why?

Cause its available today and shows returns today than 10 years down the line.

Answer is yes.

Why?

Cause its available today and shows returns today than 10 years down the line.

Lesson # 3

Market pays a higher value to businesses that can deliver earnings today than business that will deliver earnings in 10 years.

Market pays a higher value to businesses that can deliver earnings today than business that will deliver earnings in 10 years.

This business however has superior margins compared to the ice cream business you first saw.

While ice creams had a margin of 20%, this coffee business can do 35% margins. This business too has an app and can grow sales at 100% YoY.

While ice creams had a margin of 20%, this coffee business can do 35% margins. This business too has an app and can grow sales at 100% YoY.

Should this business command more in valuation compared to others?

Yes!

Why?

Cause it can generate more cash for the same sales as the ice cream business.

Yes!

Why?

Cause it can generate more cash for the same sales as the ice cream business.

Lesson # 4

Two business with same sales and economics, the one with higher margins will be more valuable.

Margins matter more than quantum of sales.

Thats why market is always looking for businesses with operating leverage.

Two business with same sales and economics, the one with higher margins will be more valuable.

Margins matter more than quantum of sales.

Thats why market is always looking for businesses with operating leverage.

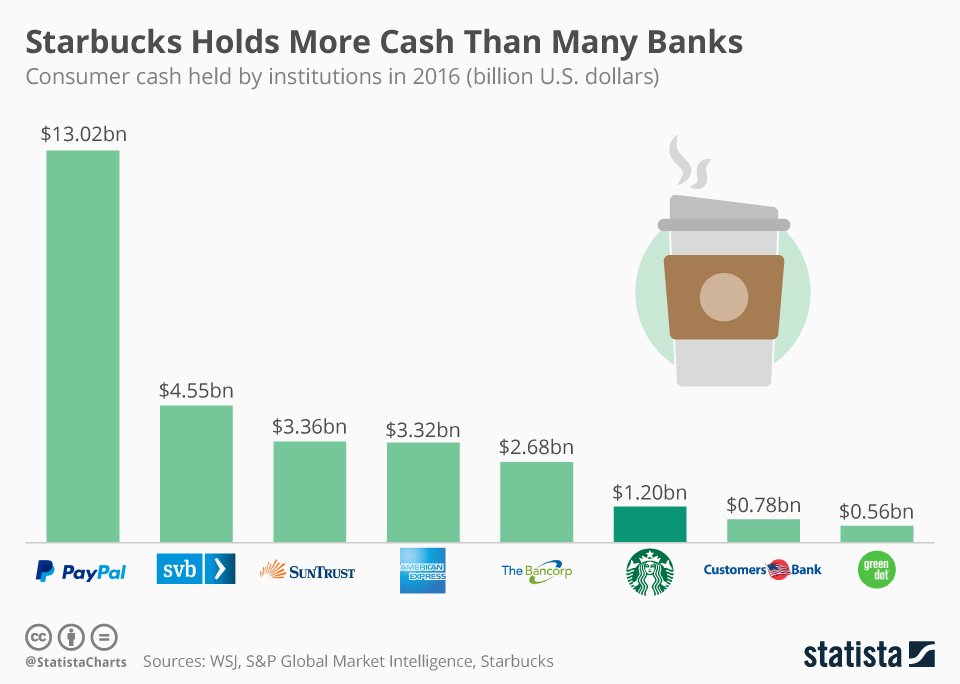

You now learn that the coffee business is also pivoting to a proven subscription model where your customers are loading their coffee cards upfront and using those to buy coffee from your shop.

Will this increase the value of your coffee business?

Yes!

Why?

Cause you now have increased certainty and longevity of cash flows from your business. Your customers are essentially paying you upfront for something they will use much later.

Yes!

Why?

Cause you now have increased certainty and longevity of cash flows from your business. Your customers are essentially paying you upfront for something they will use much later.

These are just some of the ways market gives value to a company, there are many more, but all of them focus on one simple thing - the ability to earn cash, grow it and protect those earnings over long durations.

Nothing else over long term will drive the valuation.

Nothing else over long term will drive the valuation.

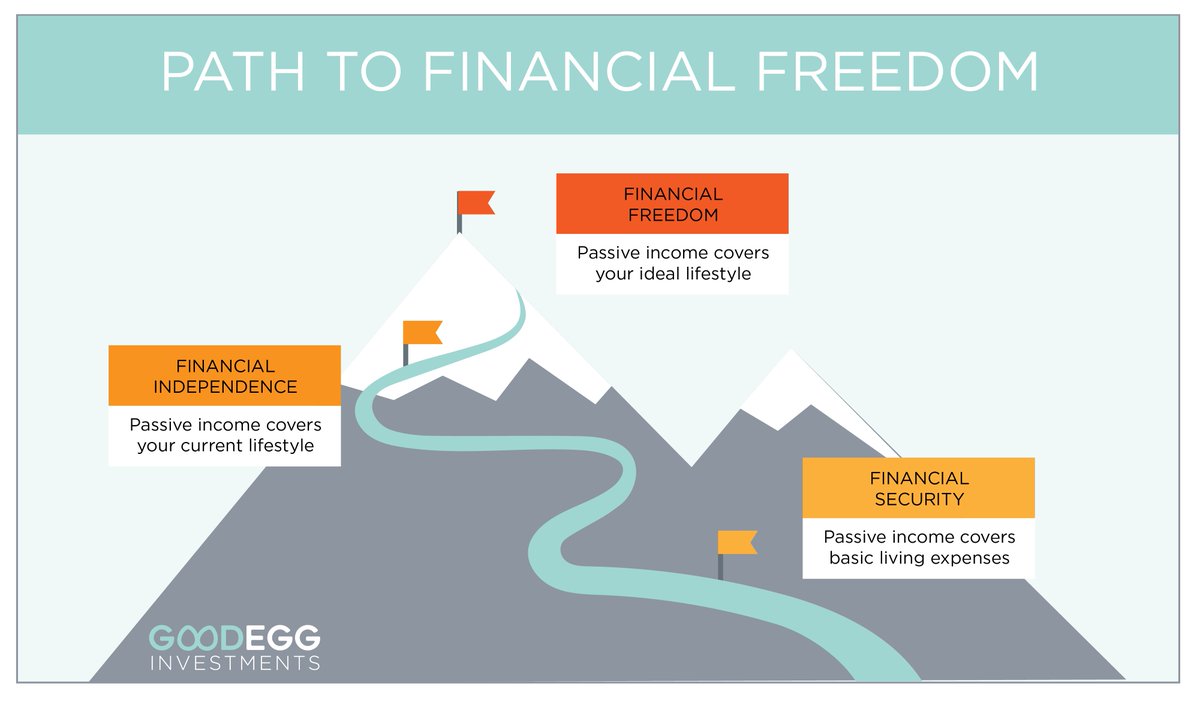

As an investor, look for business, that are

a. Increasing Earnings

b. Can Protect Those Earnings

c. Demonstrate certainty of those earnings

d. Have a business model that is more than just narratives and plans

e. Demonstrate Longevity of Earnings

a. Increasing Earnings

b. Can Protect Those Earnings

c. Demonstrate certainty of those earnings

d. Have a business model that is more than just narratives and plans

e. Demonstrate Longevity of Earnings

If you find a business that has the above characteristics and has a market cap that is reasonable or lower than it should get (not 100x Earnings) then you can buy and hold these businesses till they keep growing.

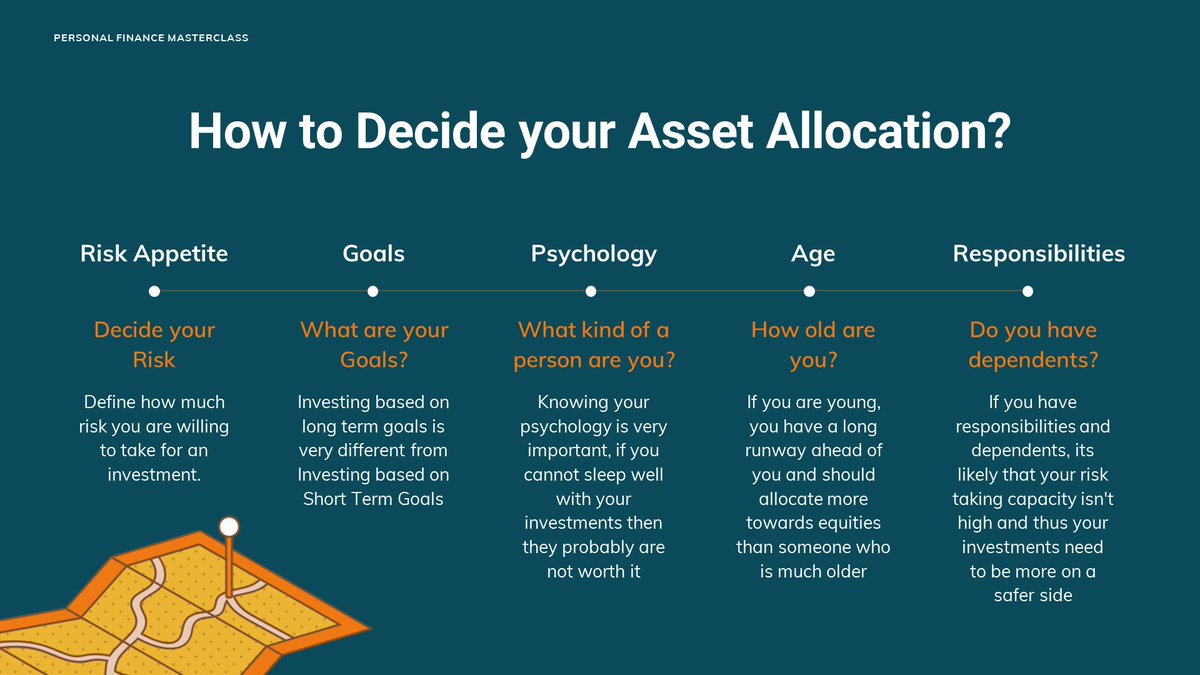

Valuation is more of an art than a formula, the models like DCF, Dividend Discount, Gordon Growth etc. are good for text books and make investment managers sound smart.

They will however, rarely help you in your own personal investment.

They will however, rarely help you in your own personal investment.

Following simple rules and asking common sensical questions will infact go a long way.

With this, we come to an end of this thread.

I hope this helped you understand the basics of valuation.

I hope this helped you understand the basics of valuation.

If you find this thread useful then follow me

@itsTarH

I write a new thread every weekend.

All my previous work, can be found here.

@itsTarH

I write a new thread every weekend.

All my previous work, can be found here.

https://twitter.com/itsTarH/status/1401095938945425410?s=20

I also teach a class on Personal Finance, if you're interested.

Sign up using the link below to get free 30 days access to it.

skl.sh/2Wjk7A7

Sign up using the link below to get free 30 days access to it.

skl.sh/2Wjk7A7

https://twitter.com/itsTarH/status/1419694448892514311?s=20

Also, write and publish long from articles on my substack.

Subscribe for free, if you're interested.

Thank you to the 2000+ of you who already have!

investkaroindia.substack.com/p/coming-soon

Subscribe for free, if you're interested.

Thank you to the 2000+ of you who already have!

investkaroindia.substack.com/p/coming-soon

Thank you for reading, please retweet the first tweet in this thread for a broader reach.

See you all next weekend!

See you all next weekend!

• • •

Missing some Tweet in this thread? You can try to

force a refresh