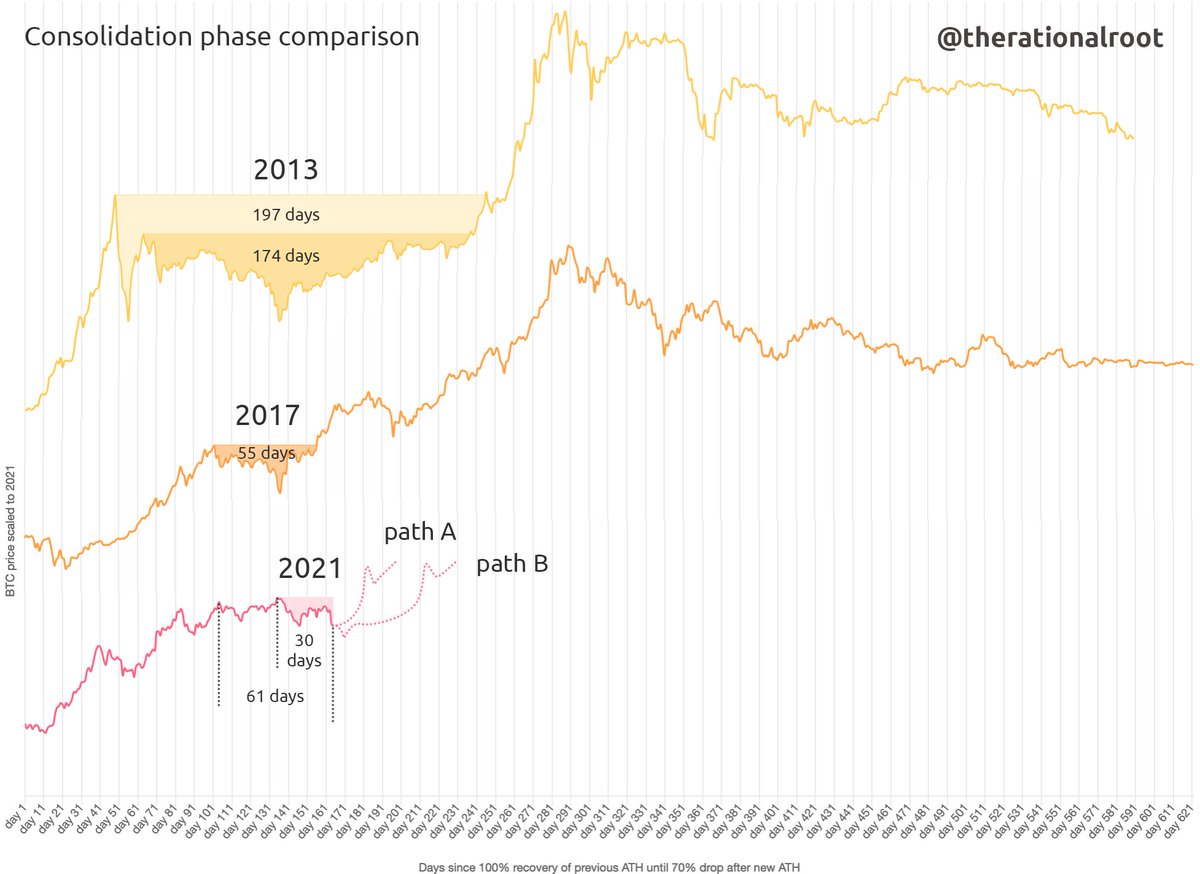

It took a month longer than in 2013 for the trend to change as this time we had 3 consecutive months in a downtrend making a low on June's close.

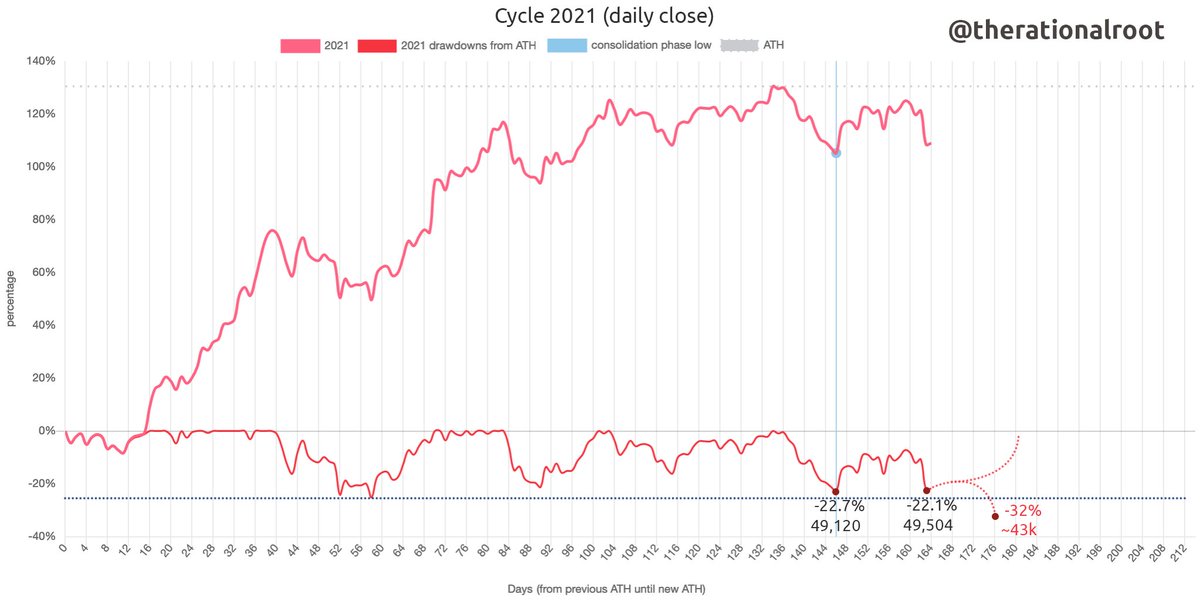

Like previous cycles we now have a steep recovery with July's close at 64. If history is any indicator we should go to the RSI 90's from here over the next 6 months.

Most likely we'll close higher each month from here, although we did have a flat month in 2013. Closing a month significantly lower would be worrisome.

Note: the 2021 cycle in this chart is scaled to a top of 140k, instead of eg. 300k which would simulate 2017, based on a conversation with @Geertjancap. It is better to be conservative, right?

• • •

Missing some Tweet in this thread? You can try to

force a refresh