Founder-led, capital light, non-cyclical high growth businesses with big TAMs, long runways, recurring revenues/sticky customers and high margins are almost always "overvalued".

Why should such companies be cheap?

Even during COVID-crash, the best names were richly valued.

Why should such companies be cheap?

Even during COVID-crash, the best names were richly valued.

Not investing because of "overvaluation" has been a big mistake for ~20 years! All the big winners looked overvalued + stayed rich for years.

Even during the GFC crash-low, the highest quality compounders were "overvalued".

In the long run, business quality > valuation.

Even during the GFC crash-low, the highest quality compounders were "overvalued".

In the long run, business quality > valuation.

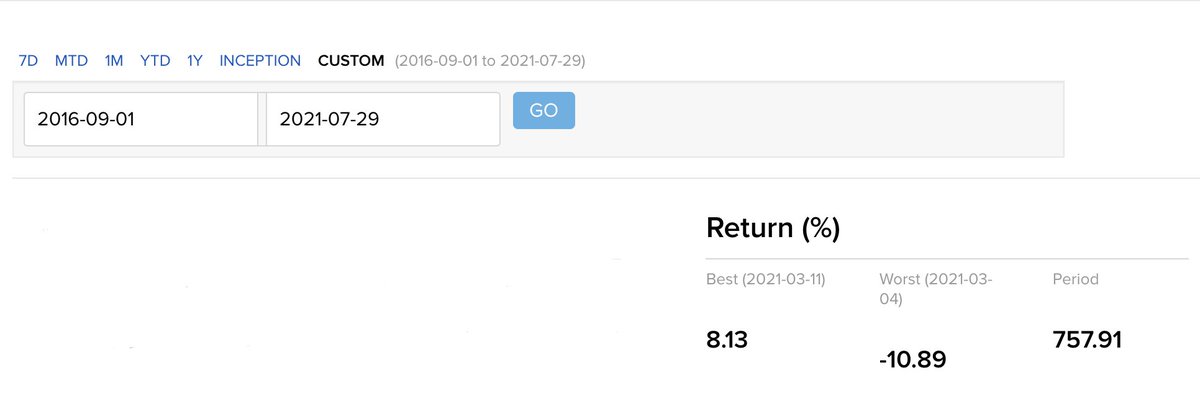

Valuation matters obviously - the lower the valuation at the time of 'entry', the higher the subsequent return.

However, the most promising businesses are hardly ever 'undervalued' and the best time to buy into them is during stock market sell-offs, when they get marked down.

However, the most promising businesses are hardly ever 'undervalued' and the best time to buy into them is during stock market sell-offs, when they get marked down.

Even if one 'overpays', if the business is truly a long-term compounder, time will bail this person out i.e. the business will grow into its valuation.

However, by not investing in such companies, one misses out on life-changing long term returns.

Better to pay up for quality.

However, by not investing in such companies, one misses out on life-changing long term returns.

Better to pay up for quality.

• • •

Missing some Tweet in this thread? You can try to

force a refresh