How in the world did we end up with billions of doses of COVID-19 vaccines manufactured by Pfizer/ BioNTech, Moderna, AstraZeneca, and Johnson & Johnson?

My latest, with @TomBollyky 1/ 🧵

piie.com/publications/w…

My latest, with @TomBollyky 1/ 🧵

piie.com/publications/w…

First, an update:

Roughly 4 billion doses of COVID-19 vaccines have now been administered worldwide. Most required a two-dose regimen—if that trajectory continued, close to 14 billion shots would be needed to inoculate the global population. 2/

Roughly 4 billion doses of COVID-19 vaccines have now been administered worldwide. Most required a two-dose regimen—if that trajectory continued, close to 14 billion shots would be needed to inoculate the global population. 2/

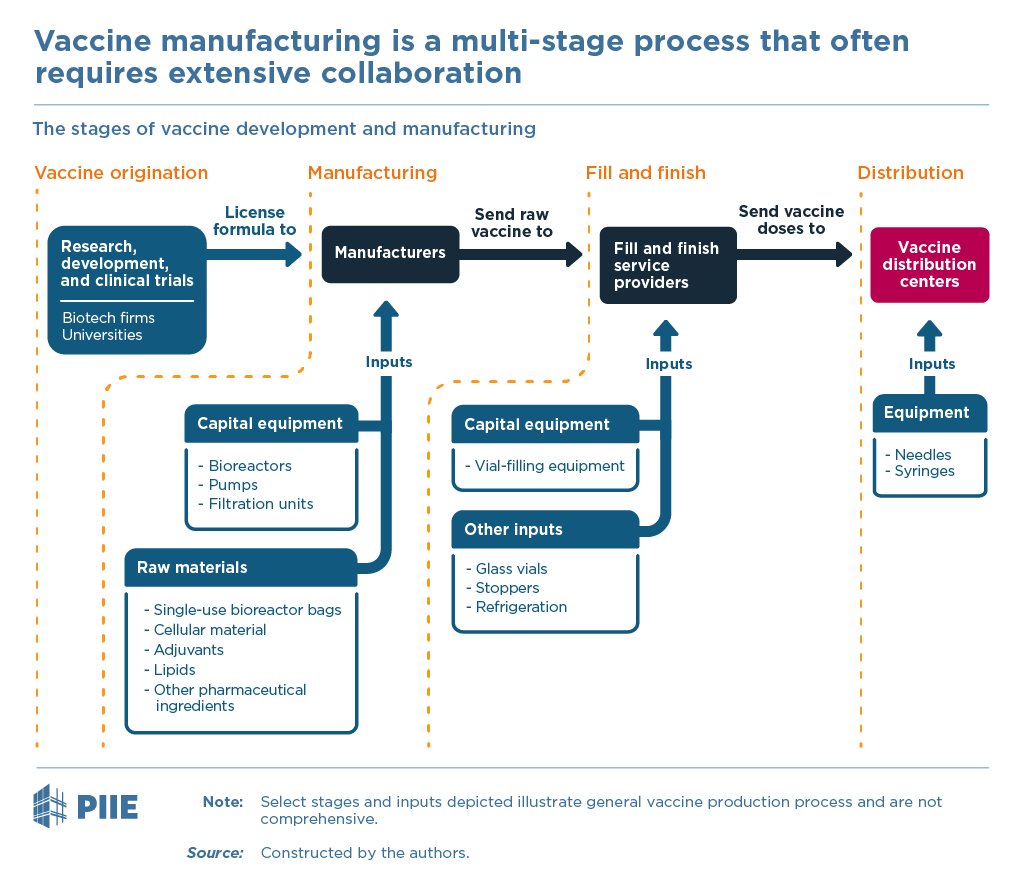

Getting a new vaccine from beginning to end — from concept to delivering shots into the public’s arms — requires five steps associated with five, largely separable, sets of fixed costs. 3/

When you think about vaccines, perhaps Big Pharma comes to mind.

Big, integrated pharmaceutical companies certainly played a role during the pandemic. But Big Pharma was far from the dominant model for how COVID-19 vaccine manufacturing scaled up... 4/

Big, integrated pharmaceutical companies certainly played a role during the pandemic. But Big Pharma was far from the dominant model for how COVID-19 vaccine manufacturing scaled up... 4/

Contract development and manufacturing organizations (CDMOs) could be hired to handle just the production, covering the third or fourth steps of the process of figure 1.

CDMOs like Lonza and Catalent played incredibly important roles in manufacturing during the pandemic... 5/

CDMOs like Lonza and Catalent played incredibly important roles in manufacturing during the pandemic... 5/

How exactly did the COVID-19 vaccine manufacturing supply chains of Pfizer/BioNTech, Moderna, AstraZeneca/Oxford, Johnson & Johnson, Novavax and CureVac emerge in 2020 and 2021?

Most started from scratch, long before their vaccines were authorized by regulators... 6/

Most started from scratch, long before their vaccines were authorized by regulators... 6/

For Pfizer and BioNTech, production initially took place through a web of existing plants, most of them belonging to Pfizer.

But when demand boomed, they quickly expanded their supply network... 7/

But when demand boomed, they quickly expanded their supply network... 7/

FUN FACT:

In March the Financial Times reported that UK exports of lipid nanoparticles to the Pfizer/BioNTech plants in the EU was the input dependence that kept the European Commission from imposing export restrictions on AstraZeneca vaccines.

The data confirm this... 8/

In March the Financial Times reported that UK exports of lipid nanoparticles to the Pfizer/BioNTech plants in the EU was the input dependence that kept the European Commission from imposing export restrictions on AstraZeneca vaccines.

The data confirm this... 8/

Moderna took a very different approach from Pfizer and BioNTech to create its manufacturing supply chain.

Unlike those companies, it had to start from scratch, contracting Lonza and other CDMOs to scale up as demand for its vaccine also grew... 9/

Unlike those companies, it had to start from scratch, contracting Lonza and other CDMOs to scale up as demand for its vaccine also grew... 9/

FUN FACT:

Data confirm a substantial increase in exports of vaccines from Switzerland to first Spain and then France in 2021, consistent with Moderna’s drug product being exported to those two countries for fill and finish... 10/

Data confirm a substantial increase in exports of vaccines from Switzerland to first Spain and then France in 2021, consistent with Moderna’s drug product being exported to those two countries for fill and finish... 10/

AstraZeneca was at the heart of four controversies—each a case study of vaccine manufacturing problems.

AstraZeneca built a very different global supply network from, say, Pfizer.

It coordinated multiple CDMOs, rather than operating as an integrated pharma company... 11/

AstraZeneca built a very different global supply network from, say, Pfizer.

It coordinated multiple CDMOs, rather than operating as an integrated pharma company... 11/

One AZ controversy involved the Serum Institute of India (SII).

SII curtailed exports to COVAX. Its CEO also accused the US of imposing an “embargo of raw material exports".

Although input shortages likely affected SII, there was never a US export embargo...12/

SII curtailed exports to COVAX. Its CEO also accused the US of imposing an “embargo of raw material exports".

Although input shortages likely affected SII, there was never a US export embargo...12/

AstraZeneca’s most public spat was perhaps with the European Union. It was caught in the crossfire of Brexit, the departure of Britain from the European Union that was finally nearing completion after five years of acrimonious, on-and-off negotiations...13/

Johnson & Johnson developed its supply chains through a network of CDMOs, in addition to its Leiden plant.

Despite a seemingly successful supply chain setup, the Johnson & Johnson vaccine ran into challenges, none bigger than the Emergent BioSolutions plant in Baltimore... 14/

Despite a seemingly successful supply chain setup, the Johnson & Johnson vaccine ran into challenges, none bigger than the Emergent BioSolutions plant in Baltimore... 14/

Novavax developed a supply chain strategy similar to the AstraZeneca model.

However, despite promising clinical trials, regulators have not yet authorized its vaccine for use.

Was Novavax tying up facilities that could be used for other vaccines...15/

However, despite promising clinical trials, regulators have not yet authorized its vaccine for use.

Was Novavax tying up facilities that could be used for other vaccines...15/

CureVac is a German biotech that developed a promising mRNA COVID-19 candidate similar to BioNTech/Pfizer and Moderna.

But in June, CureVac reported devastating Phase 3 data.

What to do with that supply chain capable of producing 300m doses in 2021 and 1b doses in 2022? ... 16/

But in June, CureVac reported devastating Phase 3 data.

What to do with that supply chain capable of producing 300m doses in 2021 and 1b doses in 2022? ... 16/

Then, there were the policy interventions. Billions of dollars of government support

• US Operation Warp Speed and the Defense Production Act

• United Kingdom

• European Union, Germany, other governments

• CEPI

• US Operation Warp Speed and the Defense Production Act

• United Kingdom

• European Union, Germany, other governments

• CEPI

This is how the global supply chains for 6 different COVID-19 vaccines emerged to quickly scale up production during the pandemic.

But these experiences raise six (6) additional questions... 18/

But these experiences raise six (6) additional questions... 18/

1) Were at-risk investments sufficiently large, diverse & geographically distributed?

2) Was there excessive concentration of input suppliers & insufficient public investment upstream?

3) In the face of scarcity, were inputs & available capacity reallocated efficiently?

... 19/

2) Was there excessive concentration of input suppliers & insufficient public investment upstream?

3) In the face of scarcity, were inputs & available capacity reallocated efficiently?

... 19/

4) How did learning by doing arise? Within firms? Across plants? Across firms?

5) How did CDMOs and the modular, fragmented structure of the industry affect scaling up?

6) Did international interdependence prevent worse outcomes from arising?

...20/

5) How did CDMOs and the modular, fragmented structure of the industry affect scaling up?

6) Did international interdependence prevent worse outcomes from arising?

...20/

That's where we are.

US and EU increasingly administered the mRNA vaccines. Take-up of Johnson & Johnson was much more limited. In the EU, AstraZeneca peaked in mid-April at roughly 22% percent of all doses administered. (The US did not authorize AstraZeneca for use.)

...21/

US and EU increasingly administered the mRNA vaccines. Take-up of Johnson & Johnson was much more limited. In the EU, AstraZeneca peaked in mid-April at roughly 22% percent of all doses administered. (The US did not authorize AstraZeneca for use.)

...21/

Elsewhere the story was different:

• India's vaccinations were dominated by SII’s local production of AstraZeneca

• China administered only domestic vaccines from Sinovac & Sinopharm

• Africa administered only about 60m doses, covering about 3% of its population... 22/

• India's vaccinations were dominated by SII’s local production of AstraZeneca

• China administered only domestic vaccines from Sinovac & Sinopharm

• Africa administered only about 60m doses, covering about 3% of its population... 22/

As increasingly detailed data emerge, additional research must shed light on two critical questions:

Could more vaccine doses have been manufactured more quickly some other way?

Would alternative policy choices have made a difference? ENDS/

piie.com/publications/w…

Could more vaccine doses have been manufactured more quickly some other way?

Would alternative policy choices have made a difference? ENDS/

piie.com/publications/w…

• • •

Missing some Tweet in this thread? You can try to

force a refresh