The shortcomings of nominal GDP targeting are evidence from looking at @DavidBeckworth's estimate that the nominal GDP gap was closed in Q2.

Under his forward-looking NGDP target rates should be well above neutral--maybe around 4% or more right now.

mercatus.org/publications/m…

Under his forward-looking NGDP target rates should be well above neutral--maybe around 4% or more right now.

mercatus.org/publications/m…

Note in many versions of NGDP targeting (including the one proposed by @DavidBeckworth) you have to make up for past gaps. So would need very high interest rate for many years until NGDP got back onto its pre-pandemic path.

NGDP targeting has a lot of appeal relative to inflation targeting: (1) both behave similarly when facing a demand shock; (2) NGDP targeting does not require tightening against a supply shock; and (3) arguably NGDP targeting has better messaging than targeting higher inflation.

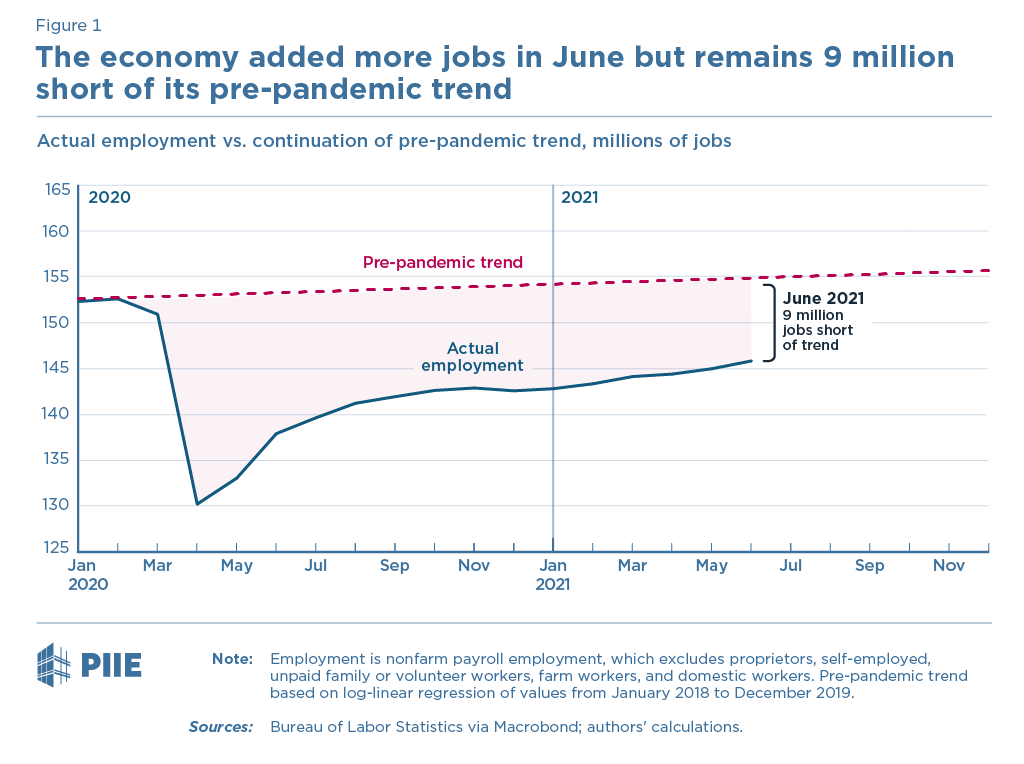

BUT, the problem with both NGDP & inflation/price targeting is that they are a single objective and neither one explicitly incorporates the second objective of maximum employment. The Fed, however, does which is why rate are (rightly) zero now because unemployment remains high.

No rule could fully survive contact with the strange economic events we've been going through, another argument for rules with more than 1 objective. (And this is not the only weirdness in NGDP targeting, another is if productivity speeds up it forces a monetary contraction.)

None of this is to pick on @DavidBeckworth: there are many proponents of NGDP targeting, he is just among the most detailed and transparent which is why this discussion is based on his construct.

• • •

Missing some Tweet in this thread? You can try to

force a refresh