The beating heart of every blockchain is how space is allocated within a block.

With major changes to how Ethereum's blockspace market works in the near and medium term we'd like to share how Flashbots thinks about designing MEV marketplaces.

medium.com/flashbots/on-t…

With major changes to how Ethereum's blockspace market works in the near and medium term we'd like to share how Flashbots thinks about designing MEV marketplaces.

medium.com/flashbots/on-t…

Mining today consists of 2 jobs.

1st: create the most profitable block.

2nd: attest to this with a proof-of-work and propagate it to the network.

Prior to widespread MEV extraction, the 1st job was mainly ordering txs by their gas price, with optimization at the network lvl.

1st: create the most profitable block.

2nd: attest to this with a proof-of-work and propagate it to the network.

Prior to widespread MEV extraction, the 1st job was mainly ordering txs by their gas price, with optimization at the network lvl.

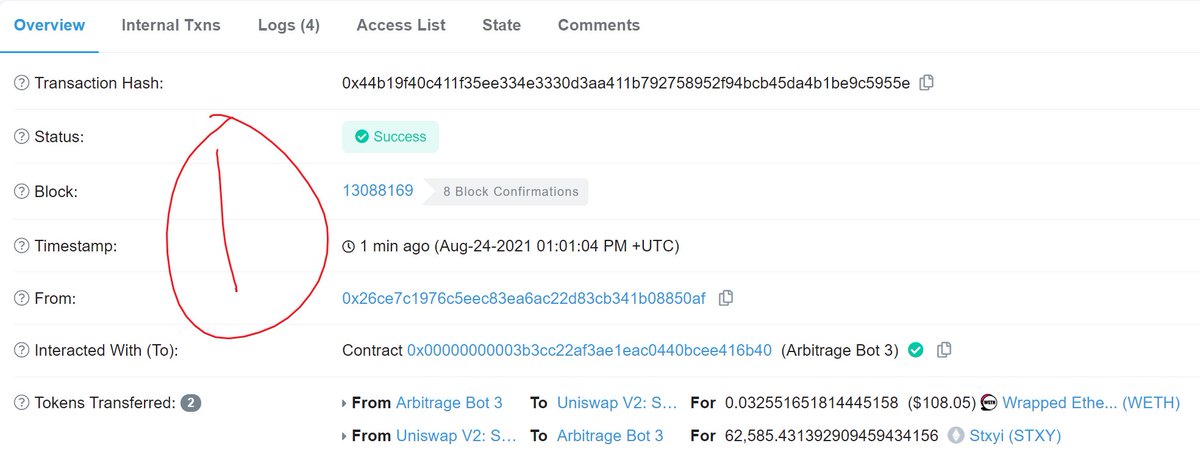

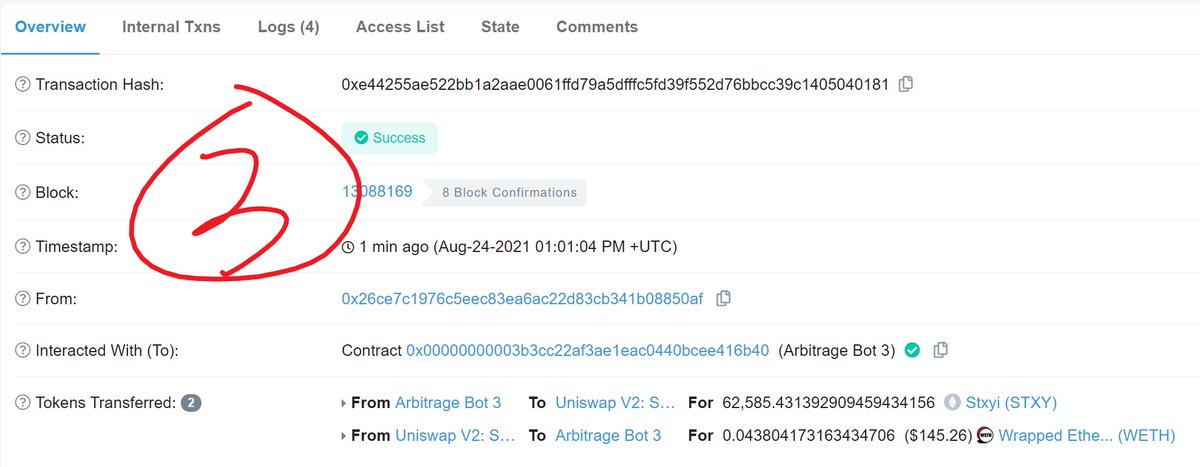

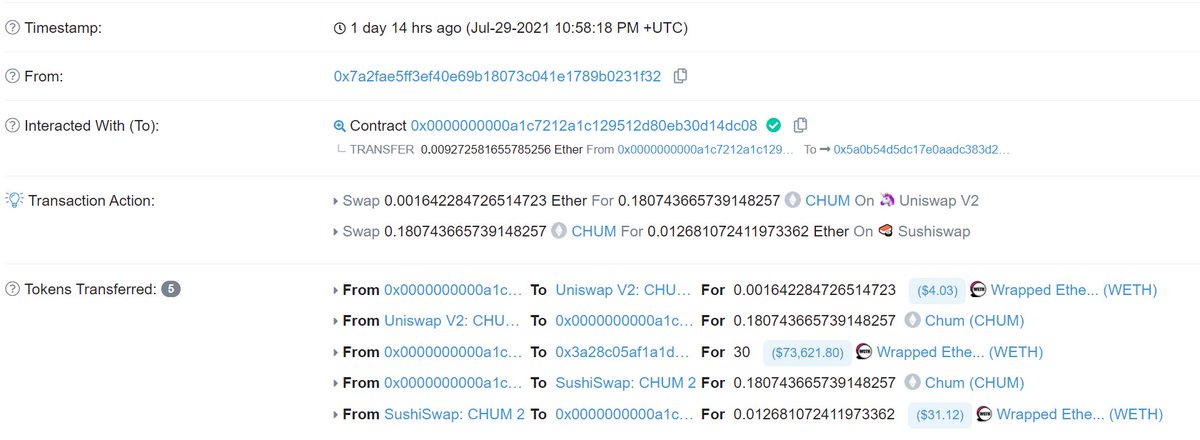

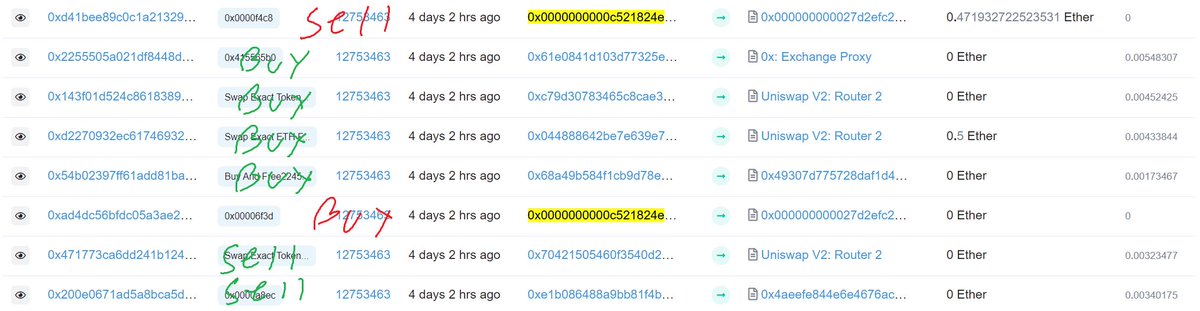

However, since MEV extraction is widespread now, the the job of miners has changed. Now to produce the most profitable block miners must find the optimal ordering of transactions within a block.

This is exponentially more difficult than sorting by gas price.

This is exponentially more difficult than sorting by gas price.

As a result an entire industry (searching) has spawned to provide this service to miners. Revenue from this industry makes up a significant share of miner income even pre-1559.

It is essential to the Ethereum network's security that all miners can build the most profitable blocks.

Otherwise large miners could use their $ to optimize MEV more than others. In turn they could use MEV $ to grow more & further cement dominance.

Otherwise large miners could use their $ to optimize MEV more than others. In turn they could use MEV $ to grow more & further cement dominance.

https://twitter.com/bertcmiller/status/1406976986027905027

At Flashbots we are focused on building long term incentive aligned systems.

We believe the best way to create such a MEV marketplace that is long term incentive aligned and sustainable is to separate the party that *proposes* a block and the party that *builds* a block.

We believe the best way to create such a MEV marketplace that is long term incentive aligned and sustainable is to separate the party that *proposes* a block and the party that *builds* a block.

In this model block proposers would outsource block building to a marketplace of specialized third parties, who would get a fee in return.

All block proposers - large and small - would then have access to competitively profitable blocks.

All block proposers - large and small - would then have access to competitively profitable blocks.

Beyond this high level architecture, how should this system be designed?

How can we ensure long term incentive-alignment for all stakeholders?

What are the properties that we are optimizing for?

How can we ensure long term incentive-alignment for all stakeholders?

What are the properties that we are optimizing for?

We expound on four key dimensions for MEV marketplaces in our post:

- Efficiency

- Avoiding capture

- Permissionlessness

- Privacy

I really really encourage you to read the full description of each of these.

- Efficiency

- Avoiding capture

- Permissionlessness

- Privacy

I really really encourage you to read the full description of each of these.

Flashbots believes that MEV-SGX together with a cryptoeconomic solution for a separation of block proposers and builders meet all of these properties.

Read proposals for those systems here:

ethresear.ch/t/mev-sgx-a-se…

ethresear.ch/t/proposer-blo…

Please read and comment on these too!

Read proposals for those systems here:

ethresear.ch/t/mev-sgx-a-se…

ethresear.ch/t/proposer-blo…

Please read and comment on these too!

Moreover, we believe that building in public gives us the best chance of creating a democratic and efficient MEV marketplace, and we try to embody that in everything we do.

That's why we publish open source code, open research, and have public events like MEV Roasts.

That's why we publish open source code, open research, and have public events like MEV Roasts.

We hope the community holds us to this standard of openness as we collectively navigate Ethereum's future.

We also hope for your engagement on designs for MEV marketplaces.

Lastly, we caution against sudden changes to MEV marketplaces without careful consideration and study.

We also hope for your engagement on designs for MEV marketplaces.

Lastly, we caution against sudden changes to MEV marketplaces without careful consideration and study.

• • •

Missing some Tweet in this thread? You can try to

force a refresh