Alright, let's go

A thread on leveraged (!) sandwiching using flashswaps

A thread on leveraged (!) sandwiching using flashswaps

https://twitter.com/bertcmiller/status/1429999096987885572

Let's review what a normal 🥪looks like.

A victim attempts to trade on a DEX, buying asset X with ETH

1. A bot gets in front of them, buying X & raising the price of X

2. The victim's tx lands, further raising the price of X.

3. The bot sells X at this higher price for profit

A victim attempts to trade on a DEX, buying asset X with ETH

1. A bot gets in front of them, buying X & raising the price of X

2. The victim's tx lands, further raising the price of X.

3. The bot sells X at this higher price for profit

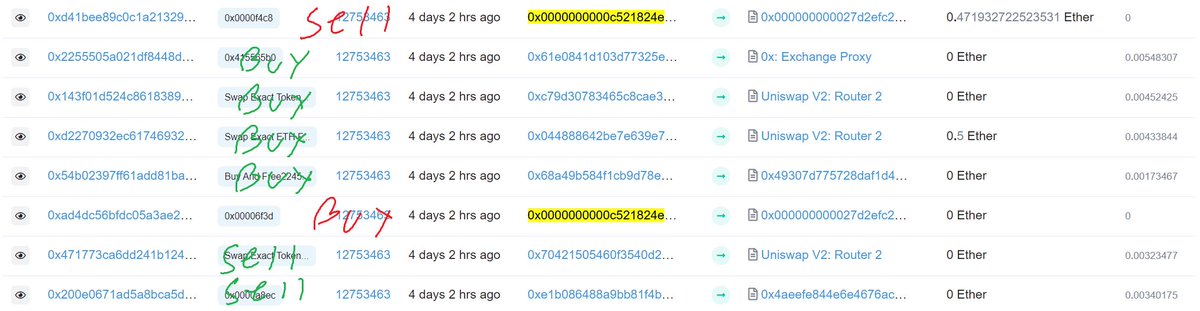

Two things to note here.

First, the bot starts and ends with WETH. That's because the victim was trading from WETH to another asset.

If victims are trading from a token to WETH it is harder to sandwich because bots don't hold random tokens.

First, the bot starts and ends with WETH. That's because the victim was trading from WETH to another asset.

If victims are trading from a token to WETH it is harder to sandwich because bots don't hold random tokens.

Second, the pair in the above sandwich example was relatively illiquid.

That meant the bot didn't need much WETH at all to push the price up and book a profit.

That meant the bot didn't need much WETH at all to push the price up and book a profit.

But not all trades are going to be from WETH to an illiquid token.

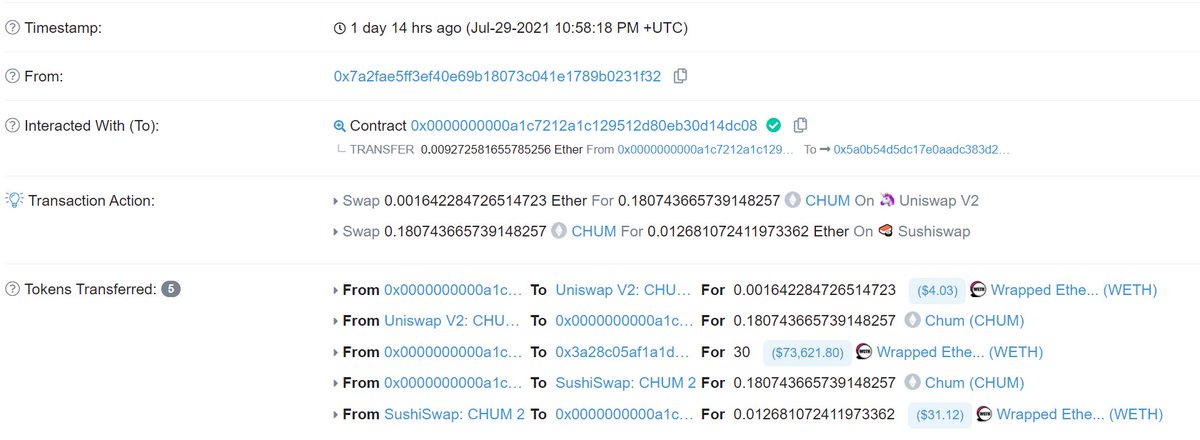

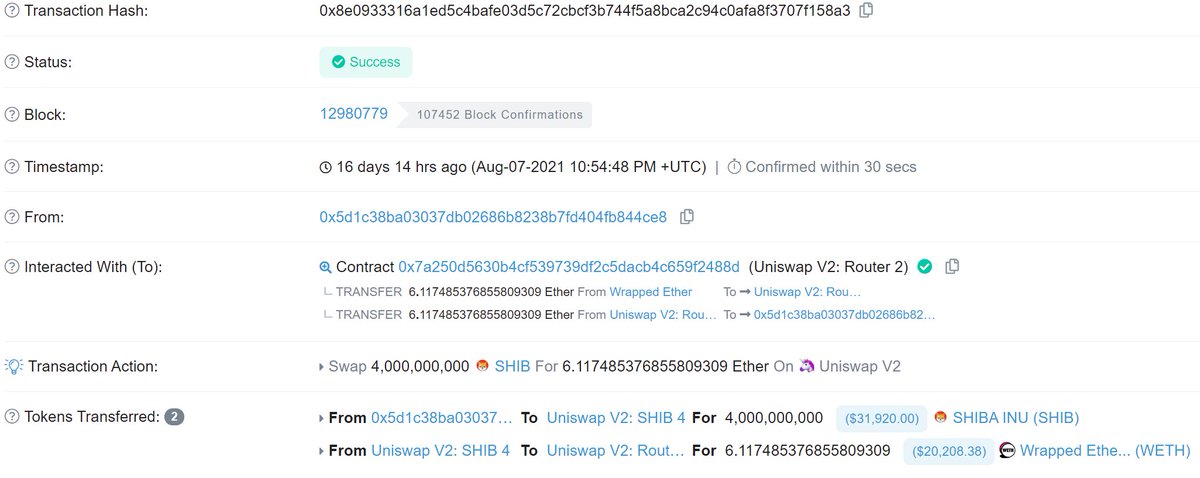

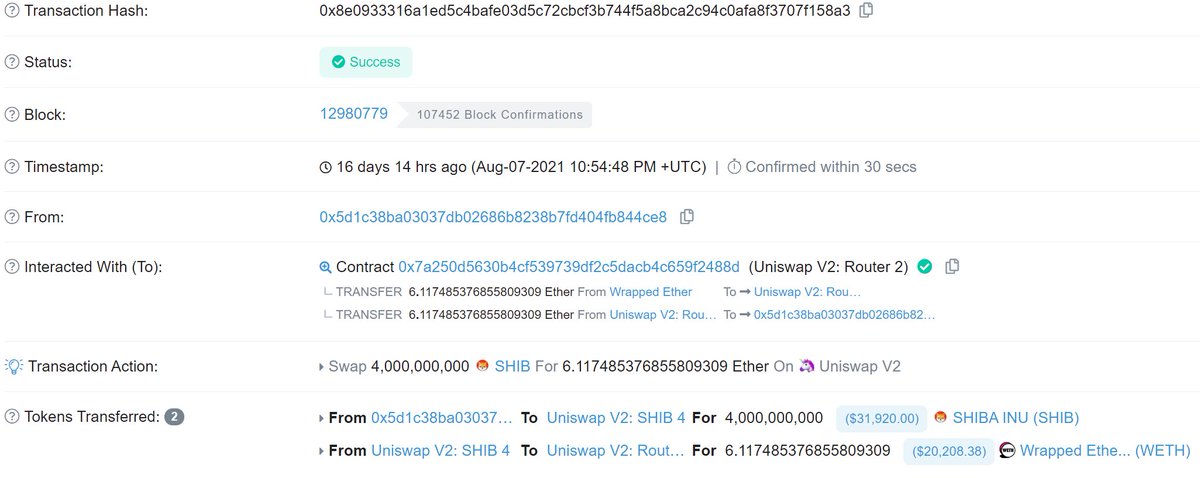

How might 🥪 bots deal with liquid trades in the other direction? For example, this victim's trade from SHIBU to WETH?

How might 🥪 bots deal with liquid trades in the other direction? For example, this victim's trade from SHIBU to WETH?

Most people know flashloans. Uniswap v2 has a similar functionality called flashswaps.

You can flash-borrow tokens in a pair provided at the end of a transaction you:

1. Return the token w/ a fee

or

2. Return enough of the other token such that the x*y=k invariant holds

You can flash-borrow tokens in a pair provided at the end of a transaction you:

1. Return the token w/ a fee

or

2. Return enough of the other token such that the x*y=k invariant holds

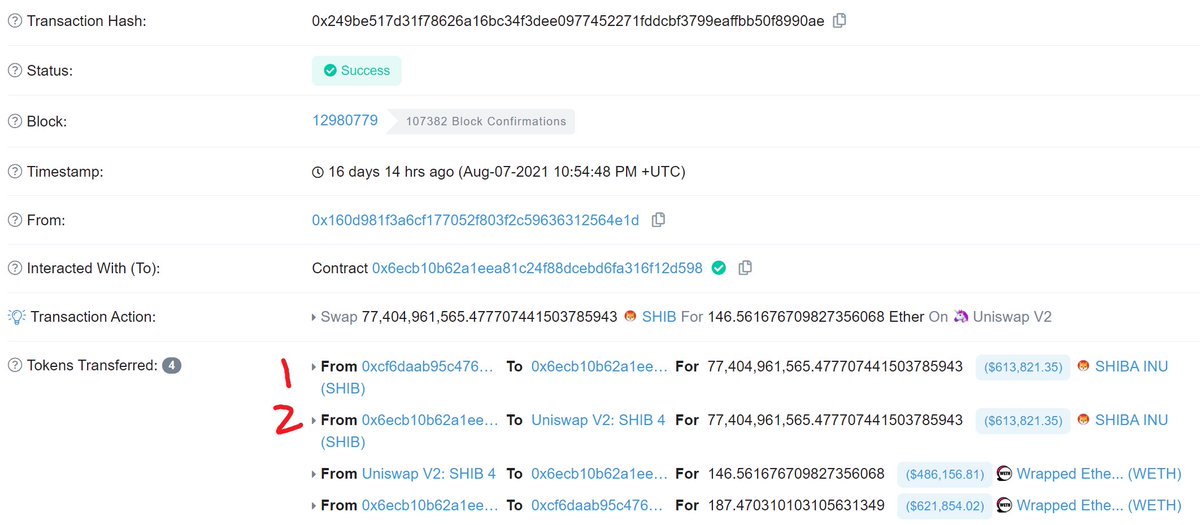

Lets break down how this is used in the context of a sandwich. Recall that the victim's trade is from SHIB *o ETH.

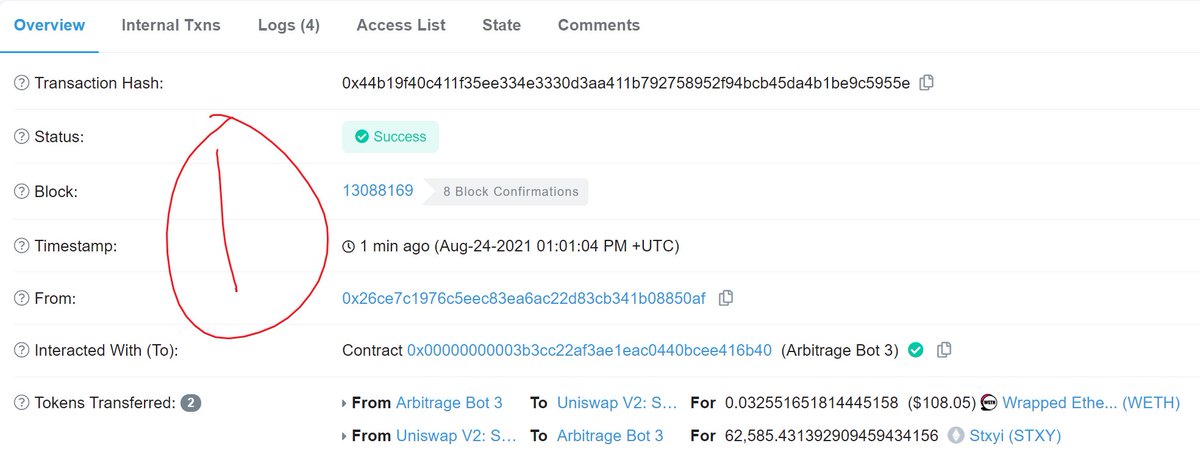

First the bot flashswaps SHIB from the Sushiswap pool. They must return either this SHIB or ETH later.

Second it transfers SHIB to the Uniswap SHIB/ETH pool.

First the bot flashswaps SHIB from the Sushiswap pool. They must return either this SHIB or ETH later.

Second it transfers SHIB to the Uniswap SHIB/ETH pool.

Third it trades SHIB for 140 ETH, pushing up the price

Now the bot needs to close out their SHIB flashswap. But pool needs 180 ETH to be balanced! Otherwise it will throw a revert.

In the fourth step the bot returns 180 ETH total to the Sushi pool, fronting 40 of their own ETH

Now the bot needs to close out their SHIB flashswap. But pool needs 180 ETH to be balanced! Otherwise it will throw a revert.

In the fourth step the bot returns 180 ETH total to the Sushi pool, fronting 40 of their own ETH

That is where the leverage comes from.

The bot only had 40 of their ETH at risk but they moved the price of the relevant pool with 140 ETH worth of SHIB.

I wonder how leveraged you can get with a trade like this.

The bot only had 40 of their ETH at risk but they moved the price of the relevant pool with 140 ETH worth of SHIB.

I wonder how leveraged you can get with a trade like this.

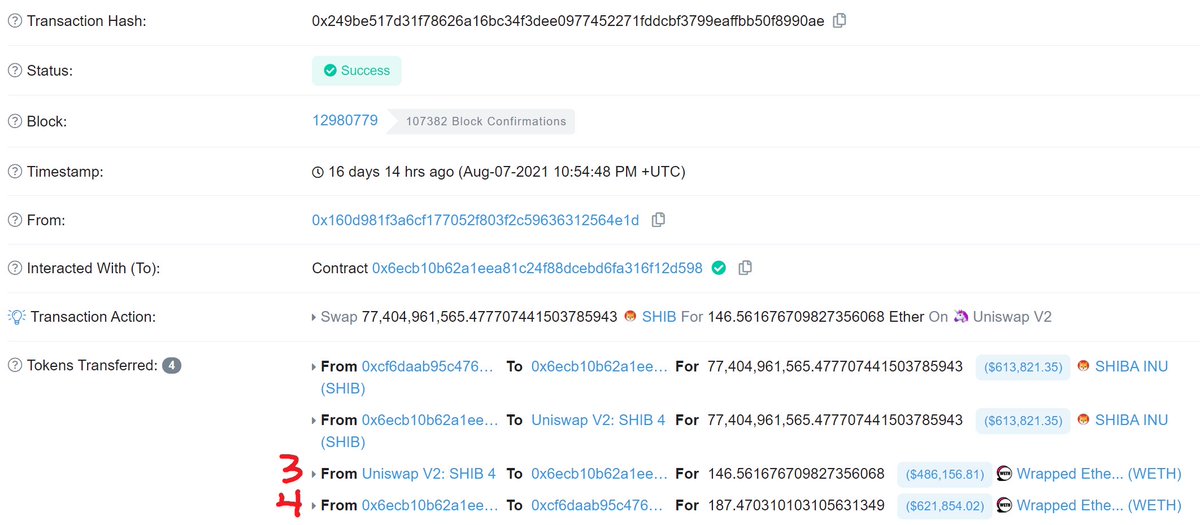

At this point the victim's transaction trading SHIB for ETH lands on-chain at the inflated price post-sandwich buy, and brings the price higher still.

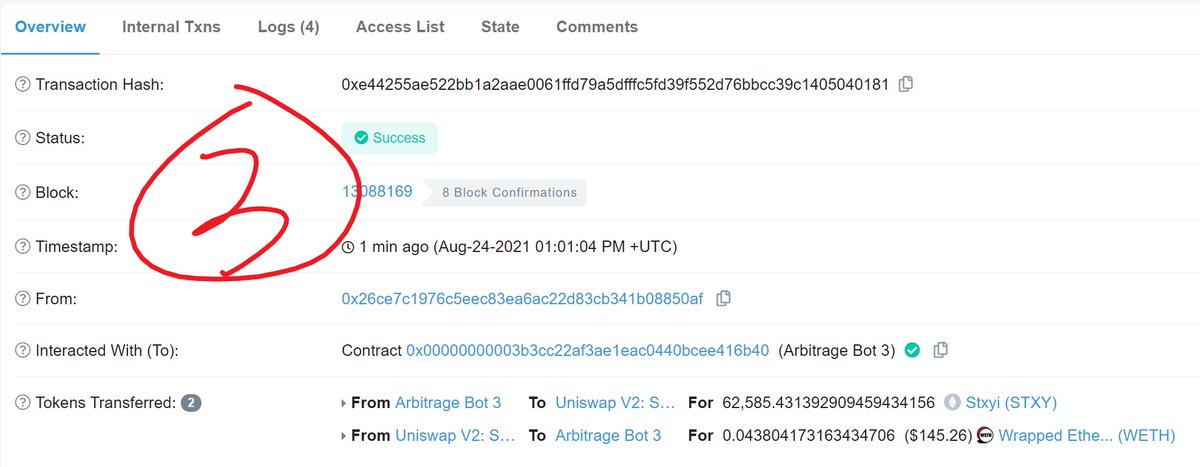

Now the bot needs to close out their position for a profit. That works similarly to how they opened it.

Now the bot needs to close out their position for a profit. That works similarly to how they opened it.

First the bot flashswaps SHIB from the Uniswap pool, where their 40 ETH had been fronted before.

Second and third that SHIB is transferred to a Sushi pool, where it is swapped at a high price for 193 ETH.

Fourth, 151 ETH is returned to the Uniswap pool to balance it post-swap.

Second and third that SHIB is transferred to a Sushi pool, where it is swapped at a high price for 193 ETH.

Fourth, 151 ETH is returned to the Uniswap pool to balance it post-swap.

How do the economics work out here?

193 (from the swap) - 151 (returned to the pool) = 42 ETH

42 - 40 (what was fronted by the bot) = 2 ETH

2 - 0.7 (miner payment) = 1.3 ETH in profit for the bot

193 (from the swap) - 151 (returned to the pool) = 42 ETH

42 - 40 (what was fronted by the bot) = 2 ETH

2 - 0.7 (miner payment) = 1.3 ETH in profit for the bot

Note also that the bot is paying via gas price instead of coinbase transfer, which makes it more gas efficient

https://twitter.com/mevintern/status/1416858843649171456

That's it for today.

Let's illuminate the dark forest together. Learn more about Flashbots and how to get involved on our Github repo:

github.com/flashbots/pm

Let's illuminate the dark forest together. Learn more about Flashbots and how to get involved on our Github repo:

github.com/flashbots/pm

• • •

Missing some Tweet in this thread? You can try to

force a refresh