The market continues to price many cyclicals as if the cycle has already ended (and will go back to troughs) whilst it prices many growth names for infinite growth.

Today's example: $BXC (FYI: this is more of a thought exercise than a pitch, but I am short $BXC ATM puts)

👇👇

Today's example: $BXC (FYI: this is more of a thought exercise than a pitch, but I am short $BXC ATM puts)

👇👇

$BXC distributes wood products. You don't have to be @IgnoreNarrative to know its a great time to be in this biz. Here is a live look at the state of their biz, directly from their last 10-Q:

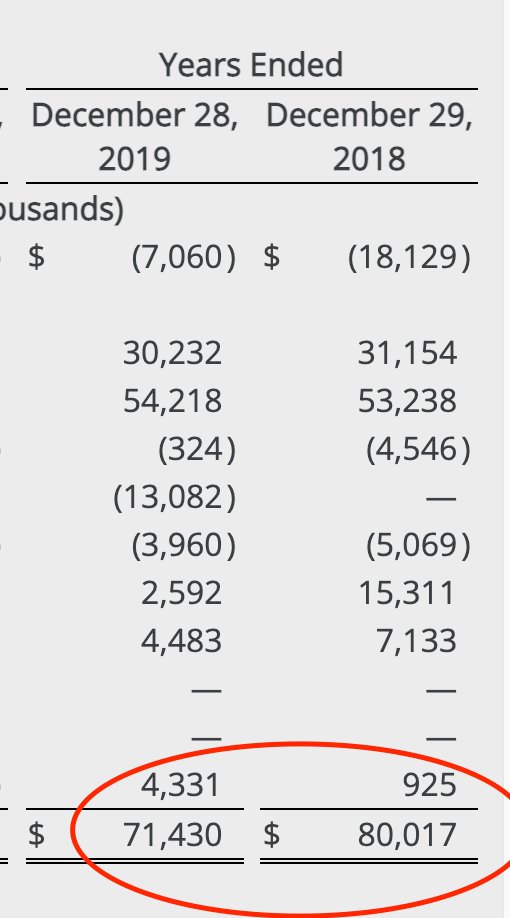

Putting a finer point on it, they just printed $166mm in EBITDA in 2Q ALONE. pre-COVID, let's take 2018-2019, they did $70-80mm in adjusted EBITDA (and lost money at the NI line) for the full year:

Everyone knows current run-rate earnings are wildly unsustainable, but what's interesting to me is how the mkt seems to value this biz as if the environment has already crapped out.

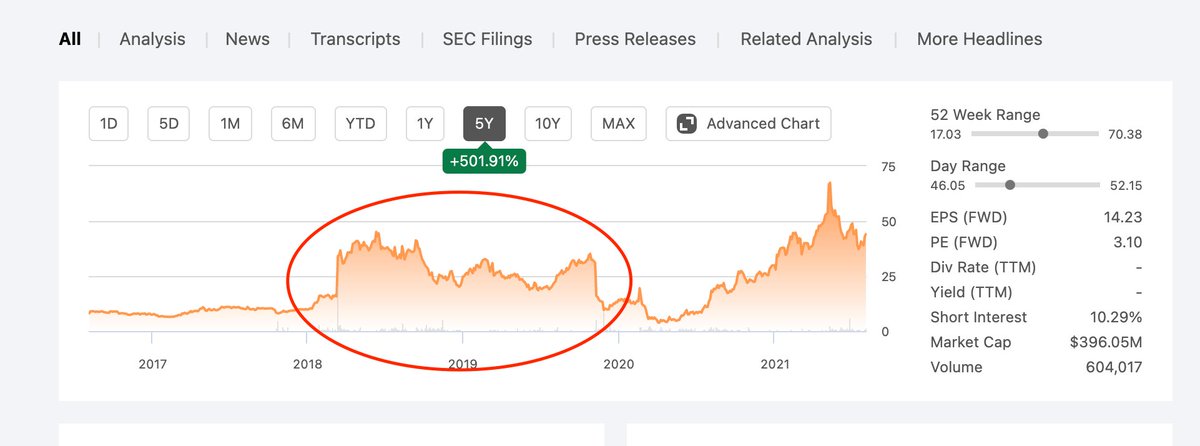

Consider - for most of 2018-19, this was a $15-30 stock:

Consider - for most of 2018-19, this was a $15-30 stock:

Let's be punitive and say avg stock px was $15 (ie low end of range). This implies $150mm mkt cap.

Back then $BXC had ~$700-750mm of all-in net debt (incl leases which is the way mgmt defines debt for the biz).

So 'all-in' rough EV during this period was say $850-900mm...

Back then $BXC had ~$700-750mm of all-in net debt (incl leases which is the way mgmt defines debt for the biz).

So 'all-in' rough EV during this period was say $850-900mm...

...for a biz doing say $80mm EBITDA, levered 10x, w/ interest coverage barely 2x, and loss-making at the net level.

Yes of course, you say, but mkt was looking towards improving earnings/synergies w/ Cedar Creek etc...

Yes of course, you say, but mkt was looking towards improving earnings/synergies w/ Cedar Creek etc...

Let's be even more generous and say - despite shite historical execution - mkt was capitalizing $100m in run-rate EBITDA, ie was putting the biz on say 8x EV/EBITDA (but still with 6-7x of net leverage), ie, huge going concern risk.

Let's fast forward to today. LTM EBITDA is $392mm - it will be closed to $450mm by end-3Q.

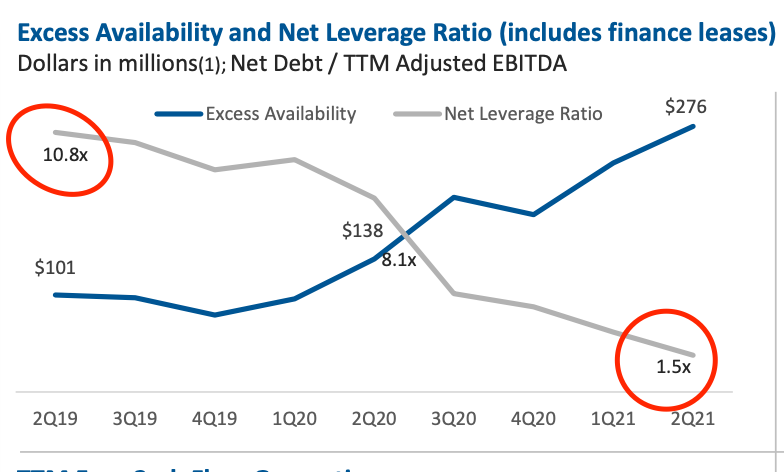

More importantly net debt today is $600mm meaning the biz is - suddenly - UNDER levered:

More importantly net debt today is $600mm meaning the biz is - suddenly - UNDER levered:

Forget the EBITDA number for a sec. We know this is gonna backslide, hard (lumber price inflation was a big component of outsized earnings last Q). I want to focus on the BALANCE SHEET.

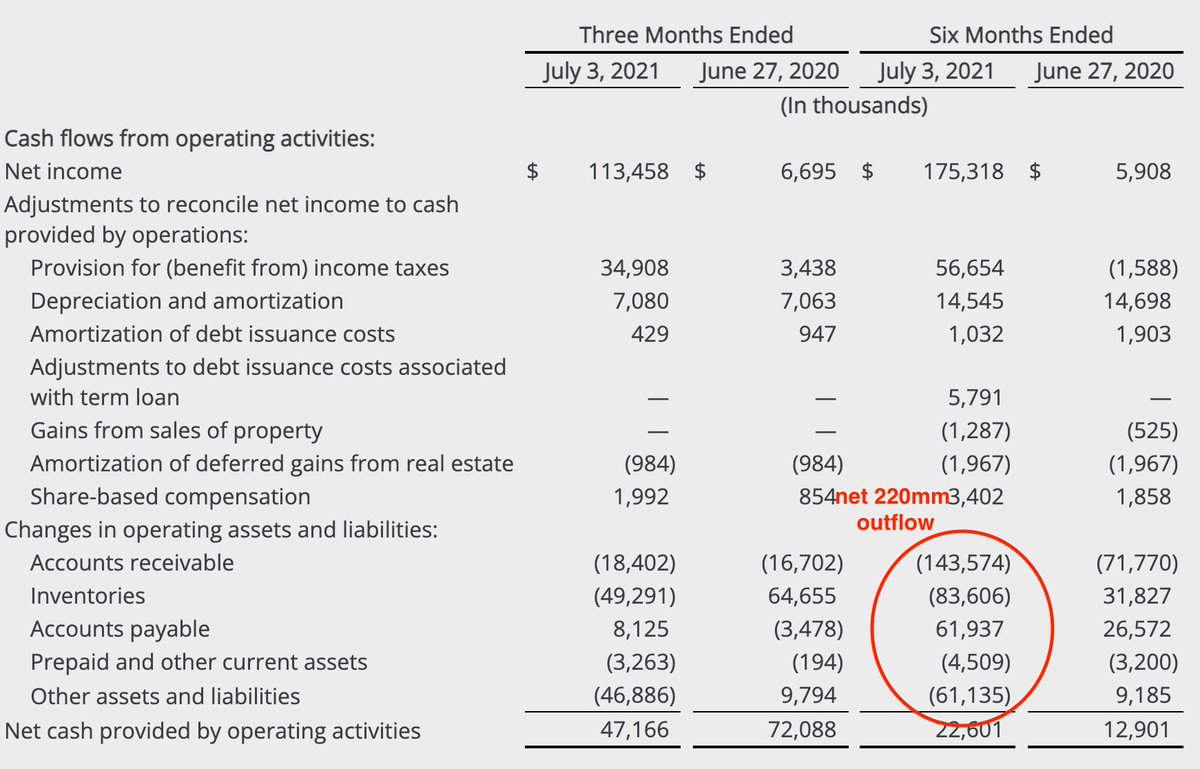

W/C exploded due to price inflation, as captured on the cash flow statement:

W/C exploded due to price inflation, as captured on the cash flow statement:

$BXC mgmt said $130mm of this rough $220mm is pure price inflation and most of this (presumably) comes back during 2H (since prices have correctly) and thus turns into cash. Obviously the biz remains strong too.

We need to run W/C payback thru the B/S to appreciate the r/r here.

We need to run W/C payback thru the B/S to appreciate the r/r here.

Stock price today is $47.5 (mkt cap $460mm) and they have the $600mm of net debt. Let's add back $150mm for W/C unwind in 2H (but assume not much for ongoing cash gen) - so adjusted EV more like $900mm...

...Importantly - and assuming this all reduces debt - net leverage EVEN ON 'normalized' earnings power is now much much lower (say $450mm net debt against $100-150mm EBITDA, ie 3-4.5x vs 8-10x pre-COVID).

But let's just assume earnings (EBITDA) craters back to $100mm annualized.

But let's just assume earnings (EBITDA) craters back to $100mm annualized.

This was be -75% vs current LTM EBITDA, and not much north of cyclical troughs pre-COVID.

Whatever - at that level $BXC today is basically at 8-8.5x EV/EBITDA and has only 3-4x of leverage...essentially cheaper, or in line, with how it was priced pre-COVID.

That seems insane.

Whatever - at that level $BXC today is basically at 8-8.5x EV/EBITDA and has only 3-4x of leverage...essentially cheaper, or in line, with how it was priced pre-COVID.

That seems insane.

Putting it another way, post W/C unwind, the all-in EV is something like $850-900mm - or the SAME today as it was back in 2018-19, or lower, in absolute terms. Again - pretty crazy given biz/environment improvement here.

Other than zero going concern risk now, obviously the net income picture is completely different.

Deleveraging means run-rate interest expense is more like $31mm (vs ~$50mm pre-COVID).

Meaning even on $100mm EBITDA, cash FCF to equity is still ~$45mm - basically $4+ per share..

Deleveraging means run-rate interest expense is more like $31mm (vs ~$50mm pre-COVID).

Meaning even on $100mm EBITDA, cash FCF to equity is still ~$45mm - basically $4+ per share..

Again this is what you get if the market has basically fully corrected ALREADY. No growth, no ongoing cycle, no optionality, no capital returns. You get 10x FCF and no going concern risk...

As I said this is more of a thought exercise than a pitch. Stock is obvi up a lot, and near-term numbers have peaked. That said the balance sheet improvement is so massive I have a hard time seeing much downside below mid-40s.

Vol is still 95v hence I've been selling ATM puts.

Vol is still 95v hence I've been selling ATM puts.

If I'm missing anything pls let me know. My first read is this should be closer to an $80 stock once mkt shakes out. This precludes anything further accretive to actually grow the baseline biz too....

GLTA, DYODD

GLTA, DYODD

• • •

Missing some Tweet in this thread? You can try to

force a refresh