Some FinTwit accounts keep claiming I'm a fraud and a con artist...

According to them, I didn't really own a stake in my first investment management firm (I was merely an employee) and that my trades/performance are all made up.

I run this account for free, don't charge...

According to them, I didn't really own a stake in my first investment management firm (I was merely an employee) and that my trades/performance are all made up.

I run this account for free, don't charge...

....anybody a cent, don't do any paid marketing, don't even accept any offers to run funds, share my research for FREE and don't run any paid service....yet, I'm accused of being a fraud!

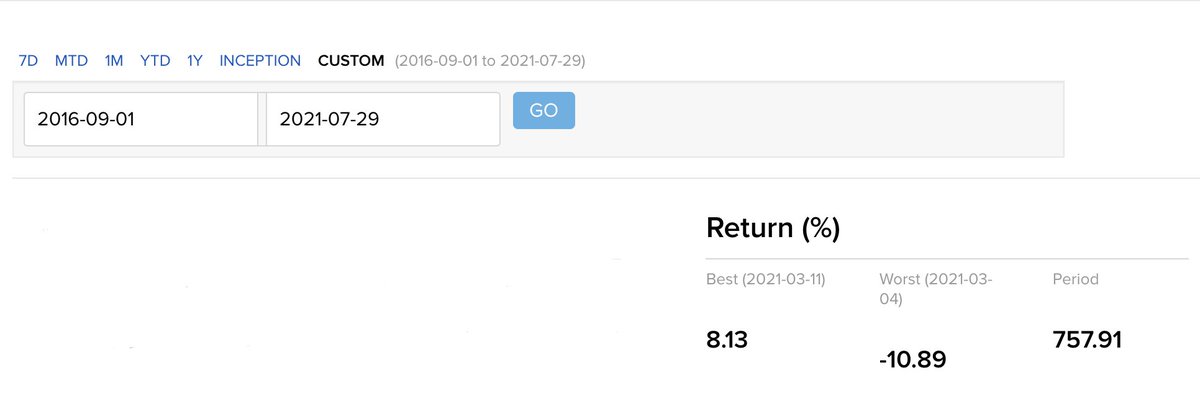

My $1m wager to get my portfolio CAGR verified by CPA is still available...no takers yet.

My $1m wager to get my portfolio CAGR verified by CPA is still available...no takers yet.

If anyone has any doubts whatsoever about my career history, you can look up my name on Hong Kong Securities & Futures Commission website (public register). Here is the link -

Hope this is helpful.

sfc.hk/en/

Hope this is helpful.

sfc.hk/en/

For the record -

I was one of three founders, 30% shareholder, Director, SFC regulated Responsible Officer for my first investment management firm which we set up in 2001.

In 2005, I resigned from that firm and set up my boutique investment management firm which...

I was one of three founders, 30% shareholder, Director, SFC regulated Responsible Officer for my first investment management firm which we set up in 2001.

In 2005, I resigned from that firm and set up my boutique investment management firm which...

...I ran until 2016.

After 11 years of managing portfolios for family offices, companies and high net worth individuals, I retired from the inv. mgt. business and my company was bought by a Hong Kong-listed asset management firm. Since then, I've just managed my own capital.

After 11 years of managing portfolios for family offices, companies and high net worth individuals, I retired from the inv. mgt. business and my company was bought by a Hong Kong-listed asset management firm. Since then, I've just managed my own capital.

I was a licensed Responsible Officer with the Securities & Futures Commission of Hong Kong (SFC) for 15 years (2001-2016) and had a perfectly clean track record (no disciplinary actions against me) and after conducting extensive due diligence, a listed and SFC-regulated...

...asset management firm bought my company, yet on FinTwit some haters/clowns claim I am a fraud!

Not sure what their motives are but their claims are both ridiculous and untrue.

Hope this clarifies the situation.

Not sure what their motives are but their claims are both ridiculous and untrue.

Hope this clarifies the situation.

Final thoughts -

A lot of 'deep value' accounts on here are horrified that my 'overvalued' stocks keep going higher and higher. A couple of years ago, they claimed I was a loser and now, they say "oh! he just got lucky."

These guys/girls cannot accept the notion that perhaps...

A lot of 'deep value' accounts on here are horrified that my 'overvalued' stocks keep going higher and higher. A couple of years ago, they claimed I was a loser and now, they say "oh! he just got lucky."

These guys/girls cannot accept the notion that perhaps...

...by investing in high-growth, innovative companies and hedging my portfolio (to reduce drawdowns), I was onto something. No, they hide behind their anonymous Twitter accounts (with their sheer hatred and jealousy on full display) and they now try and smear my reputation.

Sad.

Sad.

• • •

Missing some Tweet in this thread? You can try to

force a refresh