Maybe you're a new follower, so just to be transparent — I did buy, right at the bottom in late March.

And we bought some other stuff along the way. Real-time tweets are below. 👇

And we bought some other stuff along the way. Real-time tweets are below. 👇

https://twitter.com/HalFiney/status/1423933457630175237

I personally backed up a truck on small-cap value ETF, which more than doubled from the lows.

Here is the thread. 👇

Here is the thread. 👇

https://twitter.com/TihoBrkan/status/1243177020558848001

We were also mega bullish on Oil & Gas small caps between late September and early November of 2020.

Few posts like these were written on the daily, showing just how attractive the sector was.👇

Few posts like these were written on the daily, showing just how attractive the sector was.👇

https://twitter.com/TihoBrkan/status/1316437537276284929

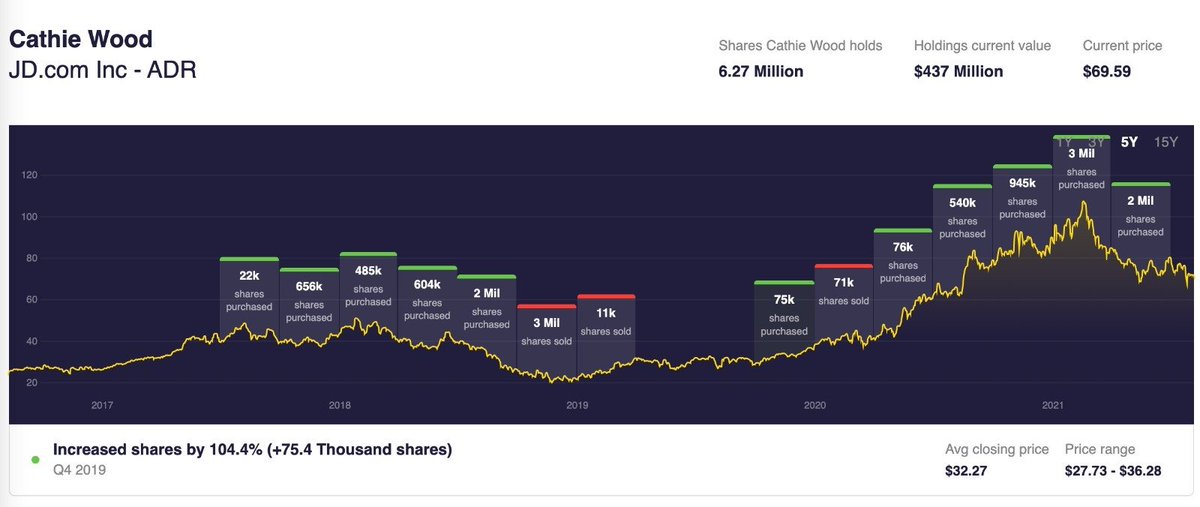

Just for the record, we are extremely bullish on the Chinese internet sector right now, including giants like Tencent and Alibaba.

https://twitter.com/TihoBrkan/status/1420107078379638802?s=20

So, to answer your question, not only do I follow my own advice but I bet real sums of money (skin in the game) on them and write about it here, in real time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh