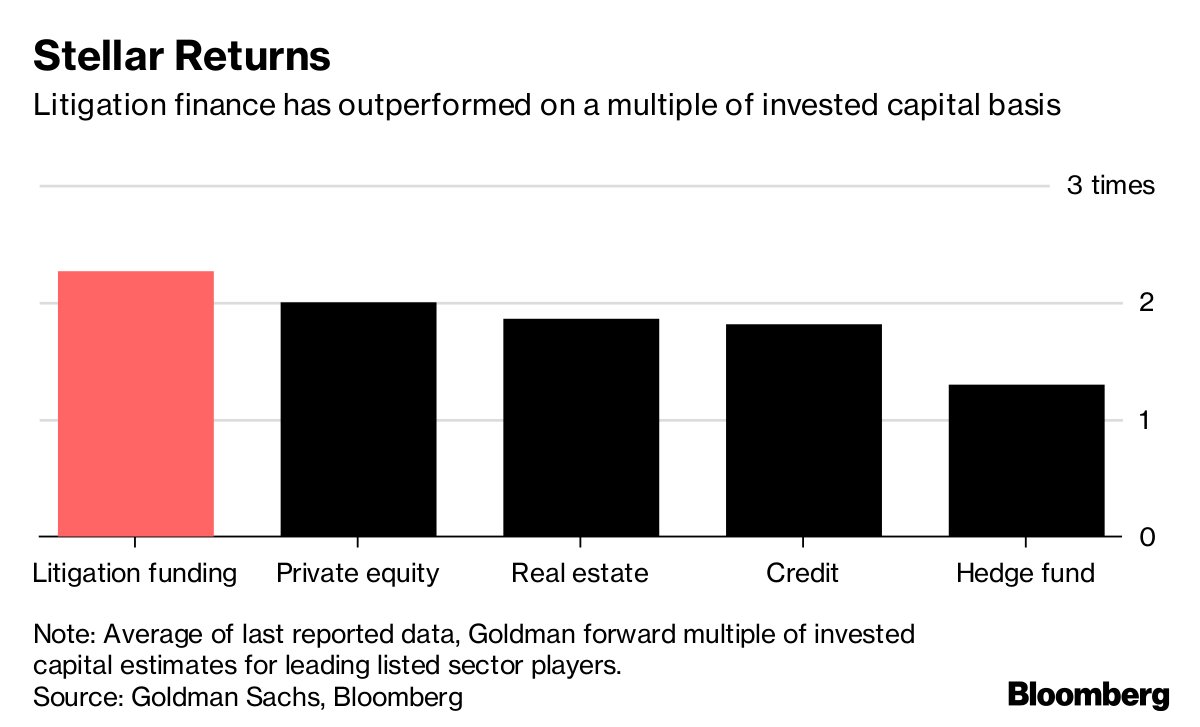

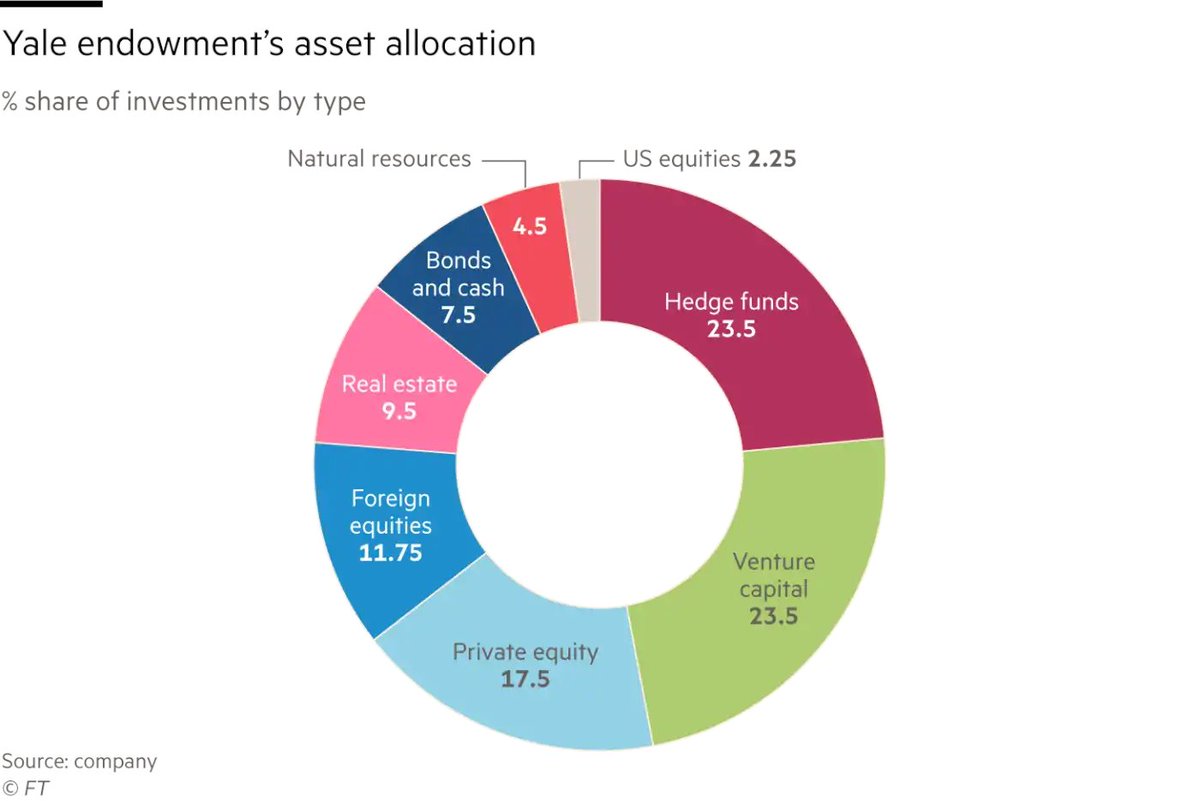

What is popular and sexy is often not very profitable (questionable whether you'll even break even?).

Glance over the statistics for start-up, angel & venture capital returns. You'll realize you might as well donate your capital to a charity — better use of it.

Glance over the statistics for start-up, angel & venture capital returns. You'll realize you might as well donate your capital to a charity — better use of it.

https://twitter.com/Julian/status/1419360006076461056

Short and brief, written 9 years ago but useful today just as it was in 2012.

techcrunch.com/2012/09/30/why…

techcrunch.com/2012/09/30/why…

Another oldie worth reading, since not much has changed.

An investment strategy that loses money broadly speaking, inability to outperform even an index fund, awful alignment of interest, long lock-up periods, with very high fees.

hbr.org/2014/08/ventur…

An investment strategy that loses money broadly speaking, inability to outperform even an index fund, awful alignment of interest, long lock-up periods, with very high fees.

hbr.org/2014/08/ventur…

"Given the persistent poor performance of the industry, there are many VCs who haven’t received a carry check in a decade, or if they are newer to the industry, ever.

These VCs live entirely on the fee stream. Fees, it turns out, are the lifeblood of the VC industry..."

These VCs live entirely on the fee stream. Fees, it turns out, are the lifeblood of the VC industry..."

Watch what they do, not what they say.

"VCs don’t ask how much they can invest, but rather, how little. They seek a minimum, not a maximum.

When it comes time to put their own money where their mouth is, there’s a surprising lack of both interest & capital."

"VCs don’t ask how much they can invest, but rather, how little. They seek a minimum, not a maximum.

When it comes time to put their own money where their mouth is, there’s a surprising lack of both interest & capital."

• • •

Missing some Tweet in this thread? You can try to

force a refresh