Not going to be popular with this tweet, but the truth needs to be stated.

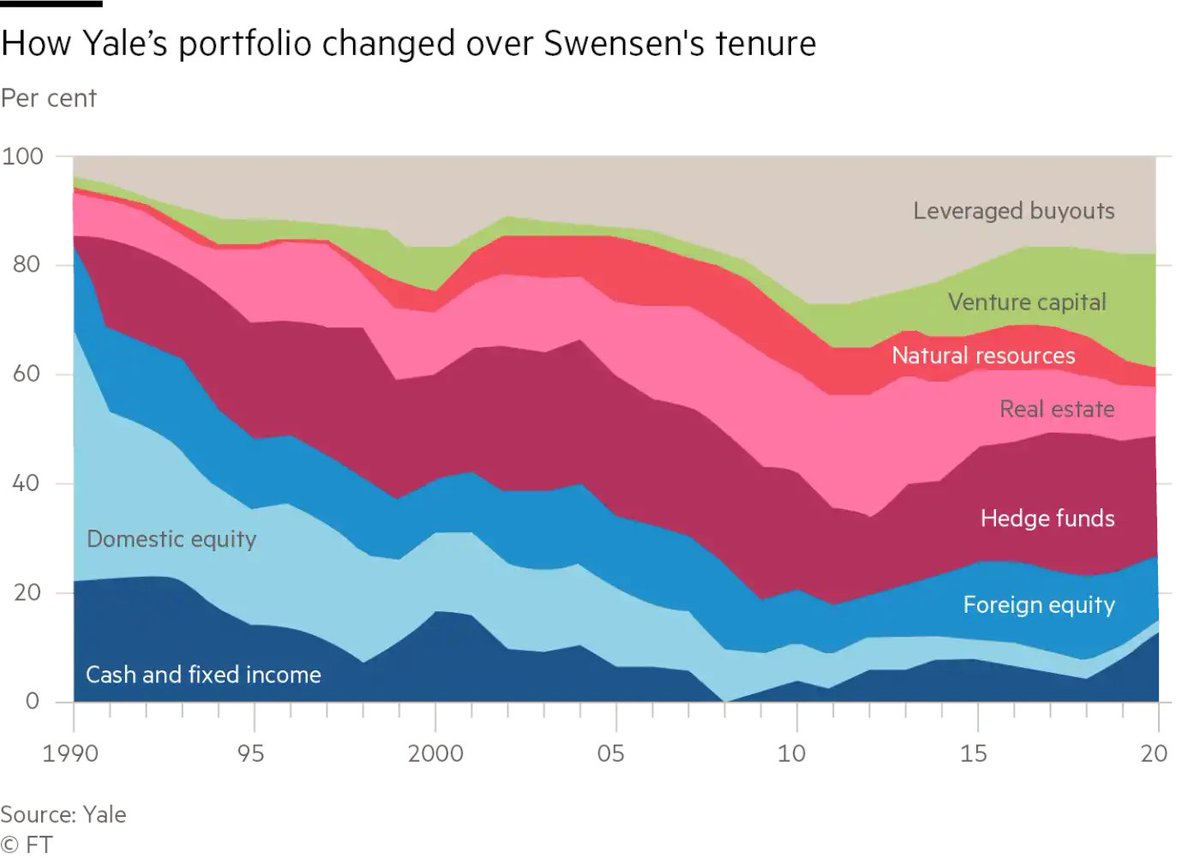

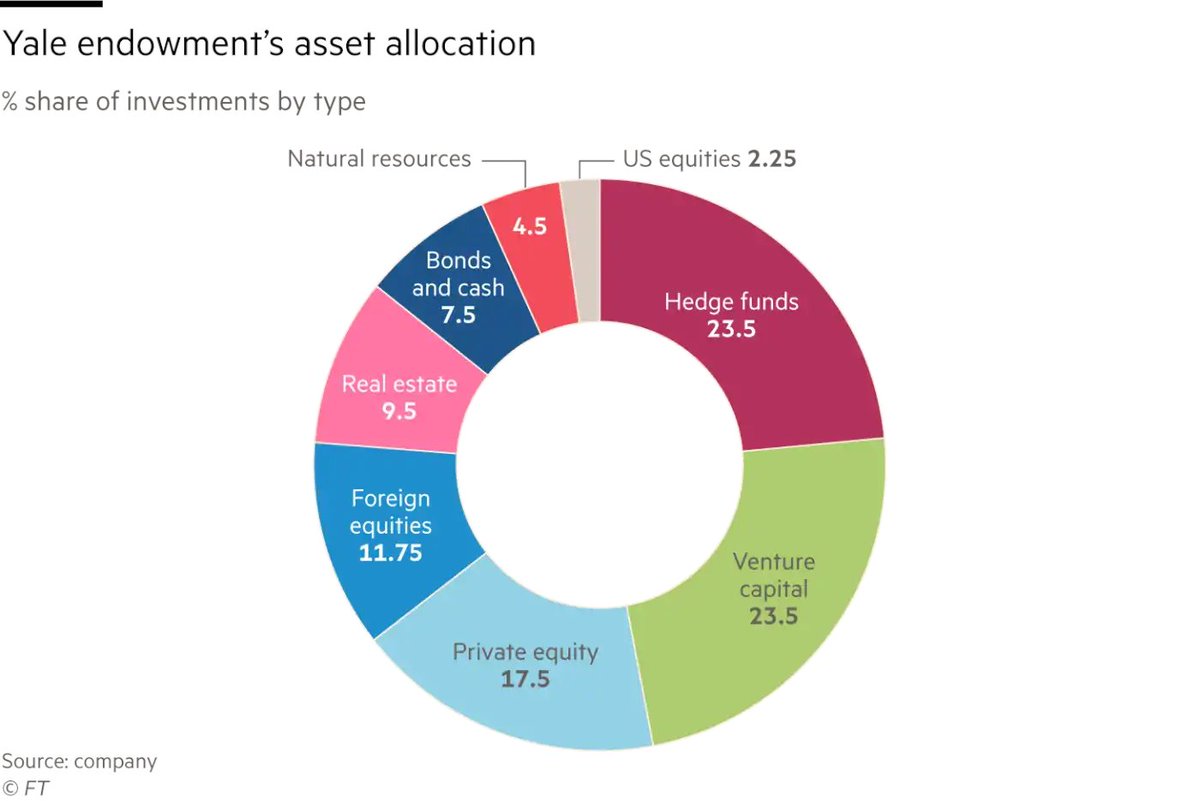

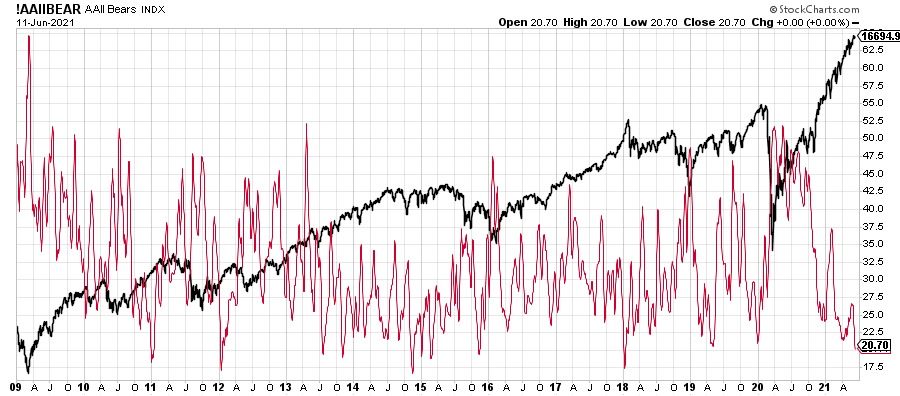

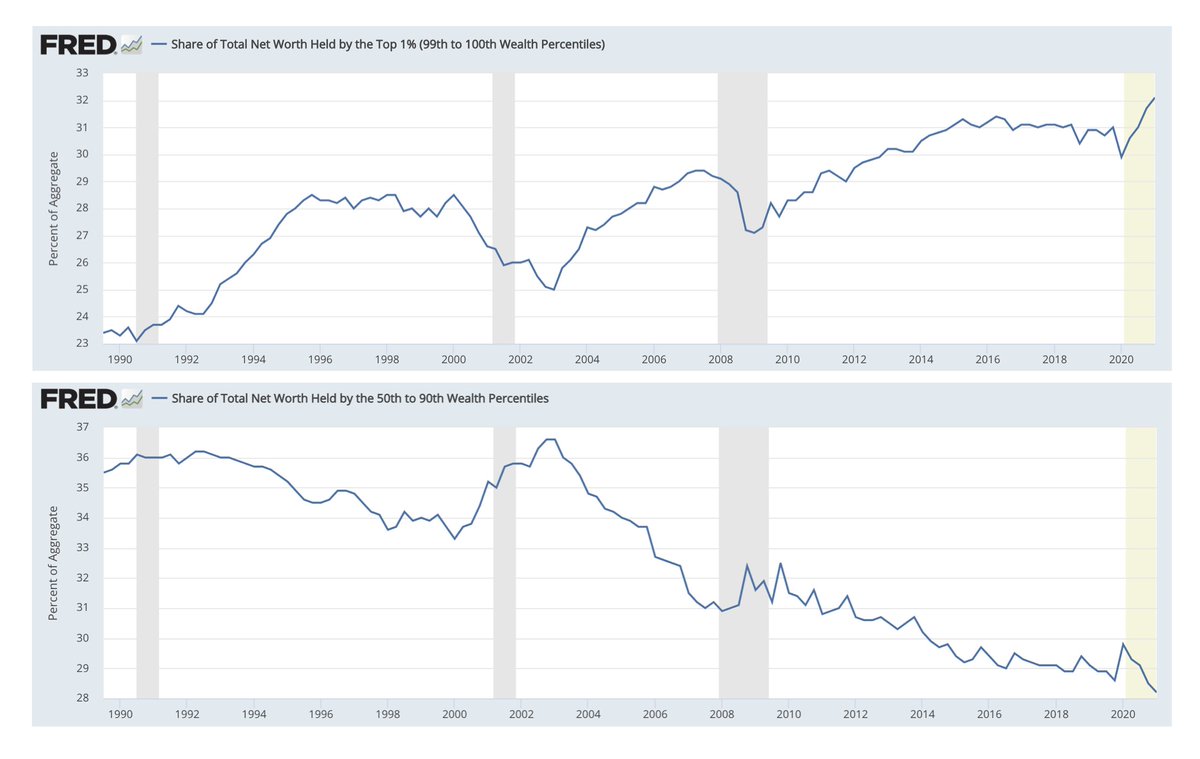

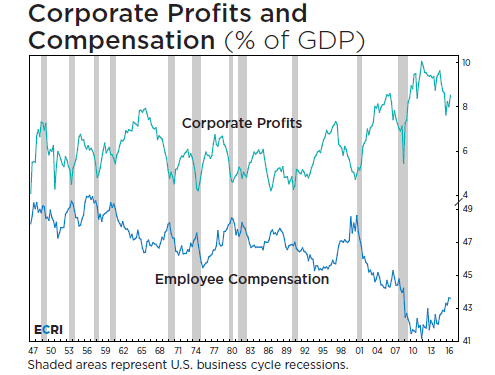

Central banks are creating massive inequality problems with 1% of asset holders (including myself) benefiting at the expense of the whole society.

I'm not a fan of taxes at all, let alone high taxes...

Central banks are creating massive inequality problems with 1% of asset holders (including myself) benefiting at the expense of the whole society.

I'm not a fan of taxes at all, let alone high taxes...

...as history shows they stifle future potential economic growth.

However, history also shows massive inequality (eventually) results in breaking social fabric via revolutions & civil wars.

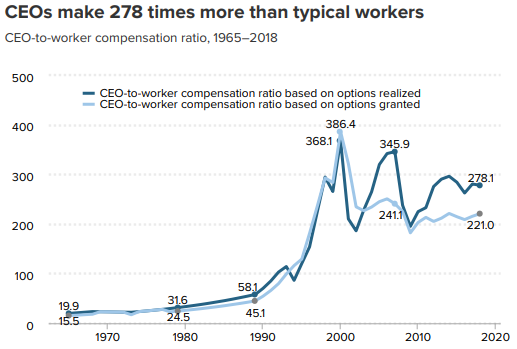

The few are benefiting over many with huge CEO compensations, low company tax rates...

However, history also shows massive inequality (eventually) results in breaking social fabric via revolutions & civil wars.

The few are benefiting over many with huge CEO compensations, low company tax rates...

...landlords & rent-seekers are not paying any taxes via special schemes (1031 & depreciation),

while many struggle to earn a minimum wage & cannot afford basic healthcare needs.

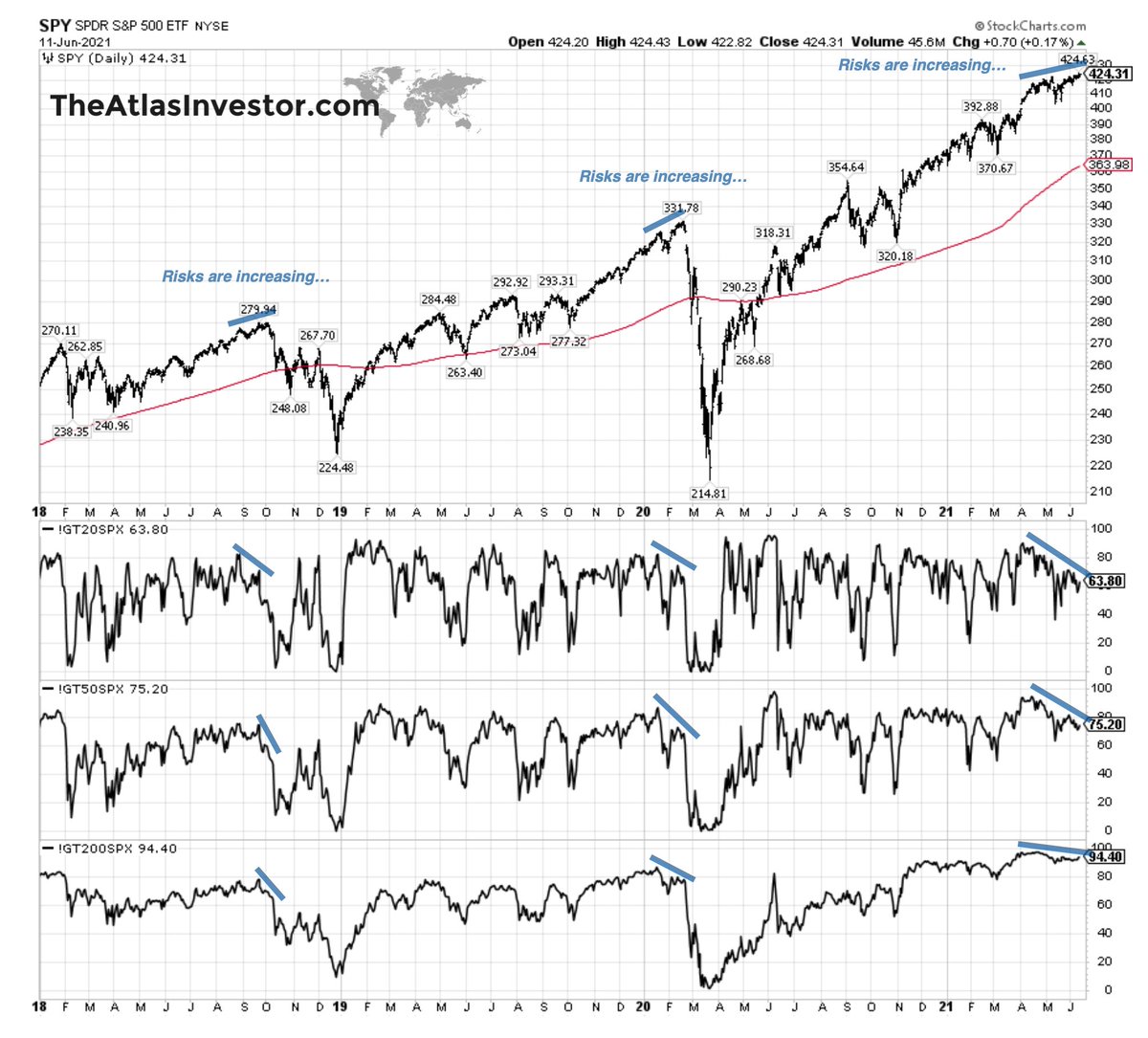

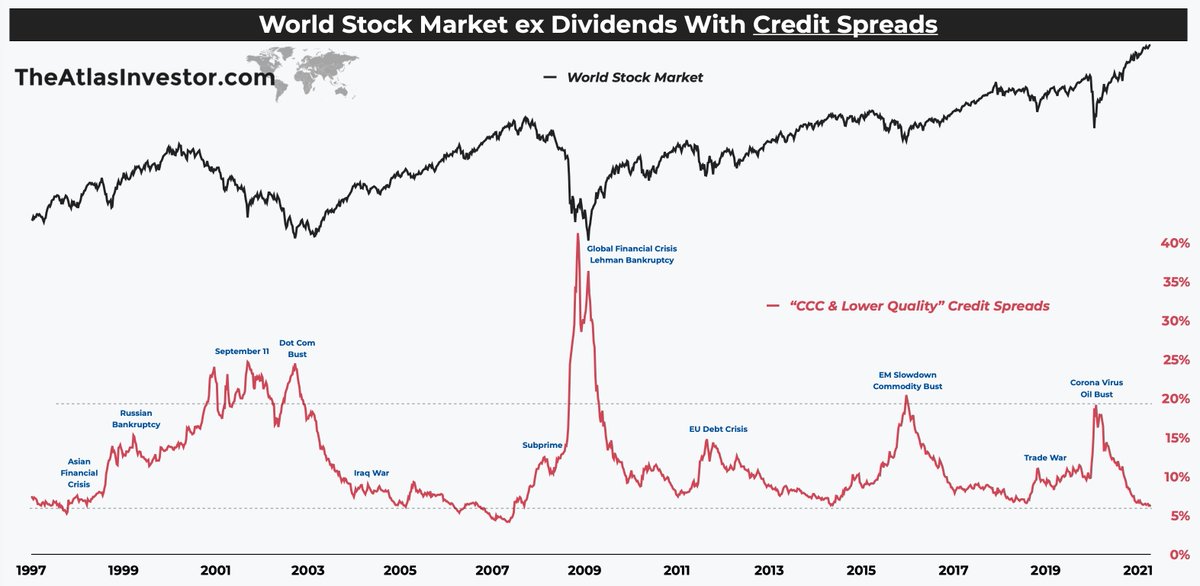

The system will never be in balance, but currently, it's completely one-sided with MASSIVE risks.

while many struggle to earn a minimum wage & cannot afford basic healthcare needs.

The system will never be in balance, but currently, it's completely one-sided with MASSIVE risks.

In the book titled “The Great Leveler” Stanford university professor observes major historical events where economic and social inequality was at extreme,

and concludes solutions was eventually achieved in four different ways: warfare, revolution, state collapse, or plague.

and concludes solutions was eventually achieved in four different ways: warfare, revolution, state collapse, or plague.

I'm not sure there is a solution apart from history taking its own course of mean reversion (as it has before, evident in the book above).

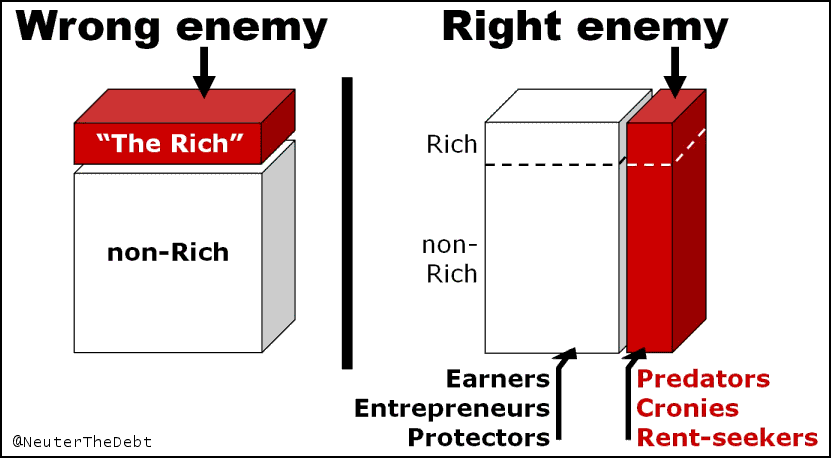

However, I did come across this image — which I wholeheartedly agree.

However, I did come across this image — which I wholeheartedly agree.

https://twitter.com/GabGrowth/status/1414174840525705218?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh