1/25 $IRBT has the home robotics market cornered.

They are about to breakout into a new industry that could easily double the company's value.

This comprehensive thread will cover everything you need to know about $IRBT and it's future potential.

Let's get started! 🧵👇

They are about to breakout into a new industry that could easily double the company's value.

This comprehensive thread will cover everything you need to know about $IRBT and it's future potential.

Let's get started! 🧵👇

2/25 One big investment theme of the 2020s will be automation. Millions labor jobs have already been decimated by robots, and millions more will be replaced in the future.

3/25 But there is one category of "work" that no one would be sad to see gone and done by a robot. One that virtually everybody experiences regularly, and no one enjoys.

Of course, I am talking about domestic tasks.

Of course, I am talking about domestic tasks.

4/25 The first versions of the Roomba were frankly limited. Not that smart, not that efficient, not enough battery duration, you name it. But the thing is … it did not matter.

Why?

Why?

5/25 There is a strong advantage a being the first at something and/or dominate the market. This is how a brand became synonymous with an entire concept.

If an entire class of devices is defined by a brand name, you automatically assume that said brand is the best option.

If an entire class of devices is defined by a brand name, you automatically assume that said brand is the best option.

6/25 In this industry, there is iRobot, and then everybody else. The only market where iRobot does not have more than 50% of the market seems to be China, which prefers cheaper, locally made models.

7/25 Does dominant but stable or declining market share mean the company is stagnating? Not at all. The market is growing at 25% or more almost every year, leaving plenty of room for new competitors without hurting iRobot revenues.

8/25 In Q1 2021, the sales of iRobot’s vacuums generated $270M.This was 58% growth from Q1 2020! Part of it is undoubtedly COVID-related, but still very impressive.

9/25 So, we now know how solid the vacuum segment for iRobot and its Roomba is. But is it all the company has to offer? Will it slowly evolve into a slower and more steady technological company that doles out dividends to its shareholders?

I don't think so.

I don't think so.

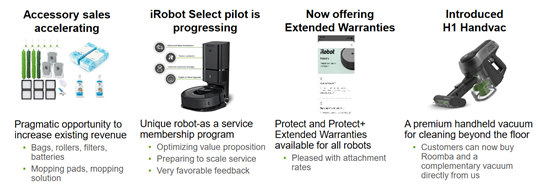

10/25 RaaS, or Robot-as-a-Service, is now a real thing.

It is the option to rent instead of buying a Roomba. Considering the high price point can be a deterrence, especially if you are not sure it will work in your home, this should drive up both revenues and future sales.

It is the option to rent instead of buying a Roomba. Considering the high price point can be a deterrence, especially if you are not sure it will work in your home, this should drive up both revenues and future sales.

11/25 But the house cleaning sector will only bring iRobot so far. There is only so much budget people will put into vacuum cleaners, no matter how smart or practical.

This is why the company is looking for greener pastures (pun intended) in a new sector: Lawn mowing.

This is why the company is looking for greener pastures (pun intended) in a new sector: Lawn mowing.

12/25 iRobot is not oblivious to this trend, as the technology is essentially the same, except a lawnmower blade replaces the vacuum system.

They had initially planned to launch the Terra robot lawnmower in 2020, but postponed it due to COVID-related delays.

They had initially planned to launch the Terra robot lawnmower in 2020, but postponed it due to COVID-related delays.

13/25 Because of the 2020 Terra's cancellation, most comments about iRobot are focused on the vacuum product line.

I think this is a mistake, as the return of the Terra, maybe in an upgraded version, is likely to become the next big thing for the company.

I think this is a mistake, as the return of the Terra, maybe in an upgraded version, is likely to become the next big thing for the company.

14/25 Fuel lawn mowers have especially inefficient and polluting engine, to the point that one hour of lawn mowing generate as much pollution as driving a car 100 miles.

This may qualify iRobot with the benefit of government subsidies in the future.

This may qualify iRobot with the benefit of government subsidies in the future.

15/25 With approximately 20 millions acres of lawn in just USA, this is actually a LOT of pollution right in residential areas!

16/25 The last year has seen a flurry of speculative activity from both professional and retail investors.

None got more attention and headlines than the short squeezes created by a group of Redditors in r/WallStreetBets, managing to corner several hedge funds.

None got more attention and headlines than the short squeezes created by a group of Redditors in r/WallStreetBets, managing to corner several hedge funds.

17/25 What does all this have to do with iRobot? Surprisingly, iRobot fell victim to this shorting scheme early this year.

In January, it rose by as much as 50% in a day.

In January, it rose by as much as 50% in a day.

18/25 As you can see, things have calmed down a little since, and the stock price is back to its 2017 levels.

To me, this makes very little sense, as the 2021 iRobot is a radically different company than 2017 one.

To me, this makes very little sense, as the 2021 iRobot is a radically different company than 2017 one.

19/25 Here are four things iRobot has accomplished since 2017 that make it a more valuable company today:

•Almost doubled revenues

•Limited exposure to the USA-China trade war

•Increased the value of its customers and brand

•Preparing to take on a whole new market.

•Almost doubled revenues

•Limited exposure to the USA-China trade war

•Increased the value of its customers and brand

•Preparing to take on a whole new market.

20/25 The domestic robot market and iRobot seem to be the safest way to bet on automation.

The recent speculative interest is potentially a way to make a quick buck, but the real value of iRobot is in its brand, its growth, and the low multiples at which the stock sells for.

The recent speculative interest is potentially a way to make a quick buck, but the real value of iRobot is in its brand, its growth, and the low multiples at which the stock sells for.

21/25 Components and technology will keep getting cheaper and better, almost guaranteeing the constant growth of the market.

With lower prices, the trouble of doing it manually will be less and less worth it.

Corporate use of robot cleaners is also likely to increase.

With lower prices, the trouble of doing it manually will be less and less worth it.

Corporate use of robot cleaners is also likely to increase.

22/25 A friend of mine lives in Estonia, and no less than two local startups are following the path of iRobot.

No one feels threatened either by the Starship Technology delivery robot, roaming around to deliver ice cream or a pizza. Or by the Cleveron parcel delivery robot.

No one feels threatened either by the Starship Technology delivery robot, roaming around to deliver ice cream or a pizza. Or by the Cleveron parcel delivery robot.

23/25 For now, the tight focus on vacuum and soon lawnmowers is commendable, but five years down the road, I see the potential for further growth in new sectors.

24/25 Tagging folks who may be interested in this iRobot $IRBT thread!

@BahamaBen9

@wolfofharcourt

@from100kto1m

@anandchokkavelu

@7investingSteve

@BruceKamich

@jameshatfield

@SteadyCompound

@JuntoInvestment

@BahamaBen9

@wolfofharcourt

@from100kto1m

@anandchokkavelu

@7investingSteve

@BruceKamich

@jameshatfield

@SteadyCompound

@JuntoInvestment

25/25 This was a small summary of my premium report on $IRBT.

Sign up for a premium subscription for more in depth-content like this!

👇 👇 👇

vintagevalueinvesting.com/membership/

Sign up for a premium subscription for more in depth-content like this!

👇 👇 👇

vintagevalueinvesting.com/membership/

Quick disclaimer: forgot to disclose that I do have a small, long position in $IRBT, and this is not investing advice.

Be sure to do your own research!

Be sure to do your own research!

• • •

Missing some Tweet in this thread? You can try to

force a refresh