We're 3 days into Ethereum's integration of EIP-1559.

I've been constantly checking the burn. Thus far, the number of ETH lost to the ether has been impressive.

For all those still learning about this change, I wanted to condense all resources here.

A 🧵

I've been constantly checking the burn. Thus far, the number of ETH lost to the ether has been impressive.

For all those still learning about this change, I wanted to condense all resources here.

A 🧵

First off, a brief recap explainer + context for those out of the loop:

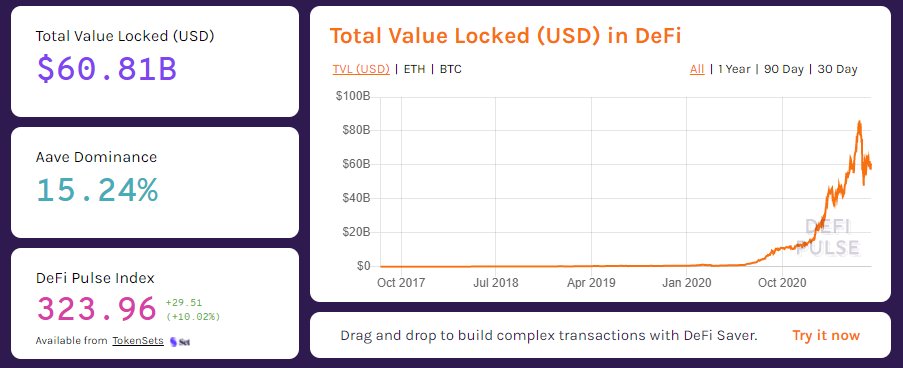

Aside from lost coins, there is no way for ETH to be removed from circulation. Further, every block, coins are minted by miners. There are also no built-in "halvenings" into ETH's supply schedule.

Aside from lost coins, there is no way for ETH to be removed from circulation. Further, every block, coins are minted by miners. There are also no built-in "halvenings" into ETH's supply schedule.

This means that there is no upper bound to Ethereum's supply as there is with Bitcoin.

EIP-1559 changes that to some extent by allowing ETH to be *burned* every block, permanently removing that supply from circulation.

EIP-1559 changes that to some extent by allowing ETH to be *burned* every block, permanently removing that supply from circulation.

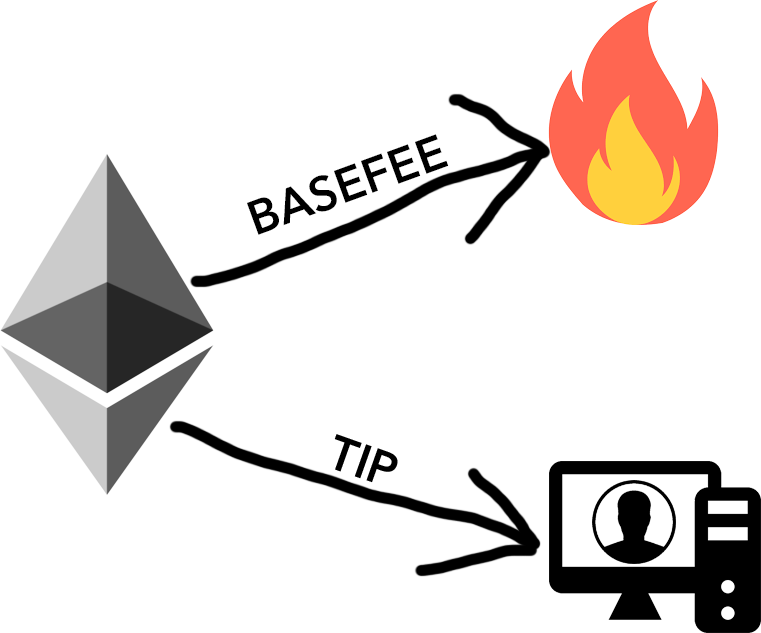

EIP-1559 introduces 2 concepts known as the "base fee" and "miner tip."

The base fee is a fixed price that each transaction must pay.

To keep it simple, the fee is adjusted on a block-by-block basis based on demand for Ethereum transactions.

Base fees are *always burned*.

The base fee is a fixed price that each transaction must pay.

To keep it simple, the fee is adjusted on a block-by-block basis based on demand for Ethereum transactions.

Base fees are *always burned*.

In times of low network congestion, the base fee across all transactions within any specific block may be low, leading to a low amount of ETH burned.

In times of high network congestion, the base fees can eclipse the 2 ETH currently being minted by the network per block.

In times of high network congestion, the base fees can eclipse the 2 ETH currently being minted by the network per block.

The miner tip (or "priority fee") allows for prioritization within the mempool.

Miners are paid via the tip (and through block rewards).

Those looking to arbitrage markets, capture liquidations, or mint NFTs can increase their tip to get their tx through quicker.

Miners are paid via the tip (and through block rewards).

Those looking to arbitrage markets, capture liquidations, or mint NFTs can increase their tip to get their tx through quicker.

One important nuance to highlight is:

EIP-1559 doesn't make the Ethereum supply deflationary but disinflationary—at least under current market conditions.

In the context of ETH:

Deflation = decreasing supply

Disinflation = decreasing amounts of inflation

EIP-1559 doesn't make the Ethereum supply deflationary but disinflationary—at least under current market conditions.

In the context of ETH:

Deflation = decreasing supply

Disinflation = decreasing amounts of inflation

EIP-1559 also allows for elastic block size limits.

Miners can increase their blocks past the target size set by the protocol, though the base fee will increase for each full block.

As the base fee is burned, miners are disincentivized from manipulating the base fee higher.

Miners can increase their blocks past the target size set by the protocol, though the base fee will increase for each full block.

As the base fee is burned, miners are disincentivized from manipulating the base fee higher.

Elastic block sizes and their effect on the base fee can make transacting on Ethereum more predictable for users and wallets.

More predictable fee estimation can prevent overbidding, reducing fees paid by users overall.

More predictable fee estimation can prevent overbidding, reducing fees paid by users overall.

With all that being said, where can one learn more about the intricacies of EIP-1559?

Also, where can one see how much Ethereum is being taken off the market each minute?

Some resources ahead 👇

Also, where can one see how much Ethereum is being taken off the market each minute?

Some resources ahead 👇

These three links are a good place to start to see the real-time burn of Ethereum via EIP-1559:

ethburned.info

ultrasound.money

watchtheburn.com

ethburned.info

ultrasound.money

watchtheburn.com

@MSilb7 also created a very granular dashboard for EIP-1559 on Dune Analytics.

There are some interesting statistics about the % of Ethereum blocks that are deflationary, the net emission rate of the network, and more.

dune.xyz/msilb7/EIP1559…

There are some interesting statistics about the % of Ethereum blocks that are deflationary, the net emission rate of the network, and more.

dune.xyz/msilb7/EIP1559…

EIP-1559 also impacts the Ethereum user experience, MEV, and the security of the network.

A comprehensive explanation of those impacts can be found here by @hasufl and @gakonst:

insights.deribit.com/market-researc…

A comprehensive explanation of those impacts can be found here by @hasufl and @gakonst:

insights.deribit.com/market-researc…

Related to the above, solid podcast hosted by @TimBeiko, @TrustlessState, and @RyanSAdams on these more unknown yet still important effects.

Something else to think about is the intersection of ETH2 and EIP-1559.

The removal of PoW via ETH2 will result in a ~90% reduction in issuance by block producers. Burns then become exponentially more impactful.

@BanklessHQ with a good explainer here:

newsletter.banklesshq.com/p/ultra-sound-…

The removal of PoW via ETH2 will result in a ~90% reduction in issuance by block producers. Burns then become exponentially more impactful.

@BanklessHQ with a good explainer here:

newsletter.banklesshq.com/p/ultra-sound-…

For those looking for more of a technical review of why EIP-1559 makes sense from a technical and economic perspective, Vitalik's notes here are great:

notes.ethereum.org/@vbuterin/eip-…

notes.ethereum.org/@vbuterin/eip-…

That's all the resources that are top of my mind for me when it comes to EIP-1559, though I'm sure I'm missing some. Feel free to share any I missed below.

Anyway, hats off to all the developers and community members that made EIP-1559 happen.

Go Ethereum!

Anyway, hats off to all the developers and community members that made EIP-1559 happen.

Go Ethereum!

• • •

Missing some Tweet in this thread? You can try to

force a refresh