1) After analyzing the $SQ | @Square Q2 call and @afterpay_au commentary, he’s my big takeaways I’ve derived from @jack @AmritaAhuja and @nmolnar.

It’s long so it will be 2 🧵s here’s 🧵#1 👇🏼

It’s long so it will be 2 🧵s here’s 🧵#1 👇🏼

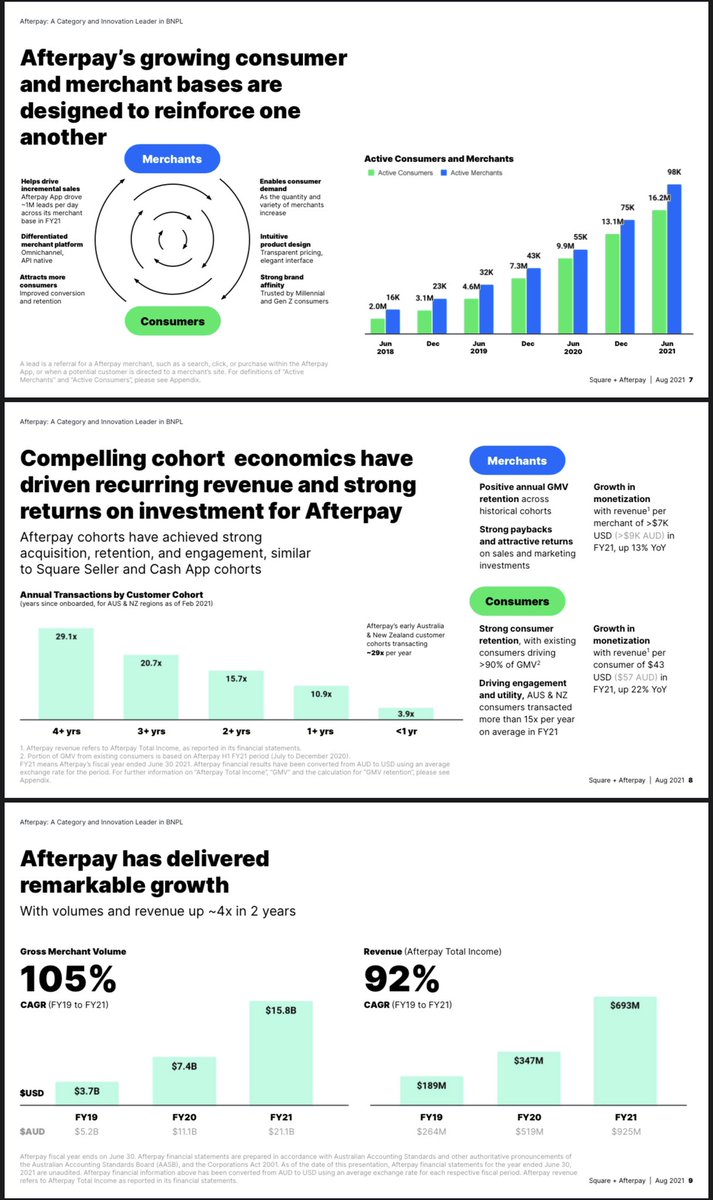

2a) 💭 GEOGRAPHIC SYNERGIES ⛽️ 🌎 EXPANSION

🌐 expansion top prority of @Square. Geo presence is complimentary to @afterpay_au.

$SQ can help @afterpay_au w/ SMBs in in-person & other verticals not currently in

$SQ helps ⛽️ @afterpay_au priorities of LT 📈, esp in 🇺🇸

🌐 expansion top prority of @Square. Geo presence is complimentary to @afterpay_au.

$SQ can help @afterpay_au w/ SMBs in in-person & other verticals not currently in

$SQ helps ⛽️ @afterpay_au priorities of LT 📈, esp in 🇺🇸

https://twitter.com/tpsojda/status/1421977962757255171

2b) $SQ impressed w/ international expansion @afterpay_au has demonstrated, showing ability to 📈 both consumers & merchants quickly in new regions, including 🇺🇸, it’s fastest 📈 market to date. Also 💪🏼 📈 in 🇦🇺, 🇳🇿, 🇨🇦, & 🇬🇧, as well as recent launches in Euro: 🇪🇸, 🇫🇷, & 🇮🇹…

2c) vast maj of $SQ @CashApp & seller GPV in 🇺🇸 today, but already exp to new markets. Sellers for markets outside 🇺🇸 are close to 🇺🇸 payback levels, and they’re closing the product parity gap. 👀 growth rates in those markets 2x that of the 🇺🇸 & entering new markets in 🇫🇷 🇮🇪…

2d) “w/ @afterpay_au 👣 & expertise, can further ⛽️ $SQ expansion whether in geographies where both present as well as new geographies together. That opportunity to strengthen combined product offering & acq new customers will be profound when you think globally. “

@AmritaAhuja

@AmritaAhuja

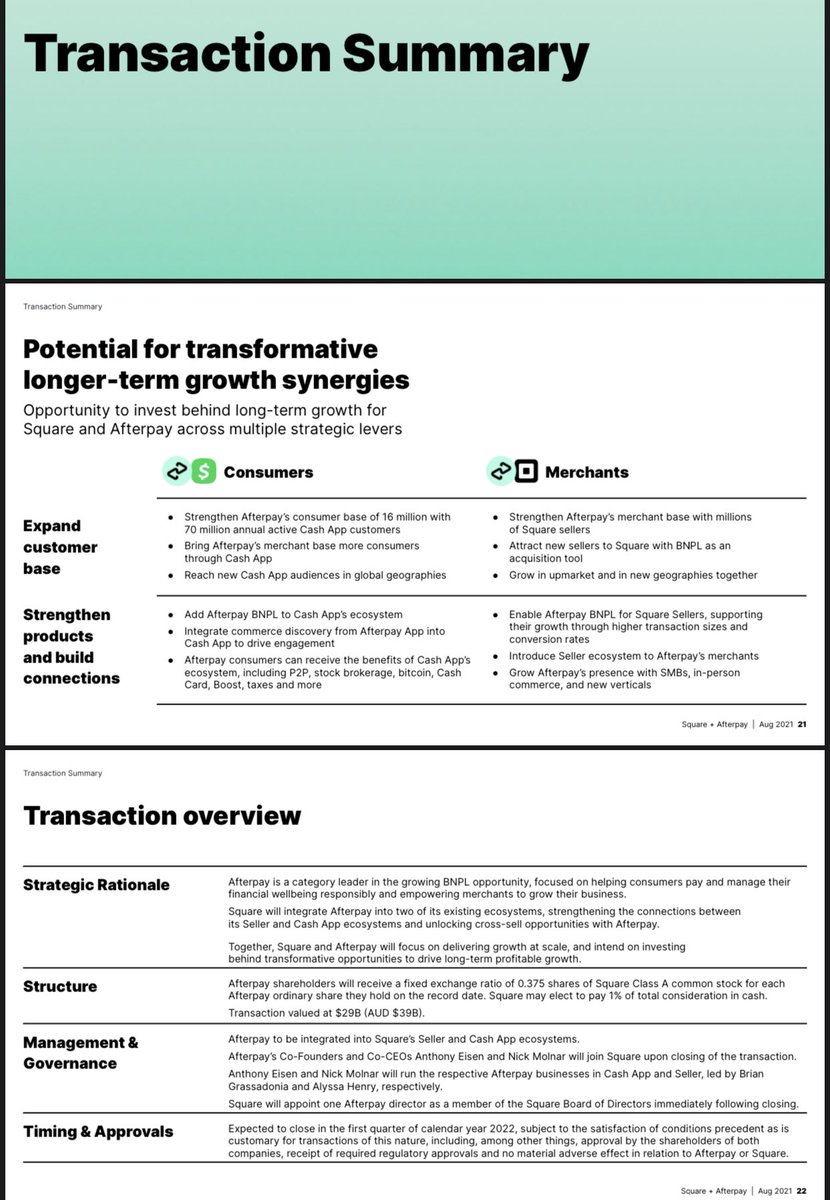

3a) 💭 📈ENGAGEMENT > ✅ UTILITY > 📈 MONETIZATION > 📈 INFLOWS > 📈 PRODUCT ADOPTION > 📈 ARPU/GP

“On @CashApp, weekly actives (WAU) are steadily 📈 as a % of MAUs over time, now WAUs are 2/3 of MAUs or avg of 40m WAUs in Jun—GP per TAU 📈2.5x vs 2Q2019 & 1.5x vs Q42020…

“On @CashApp, weekly actives (WAU) are steadily 📈 as a % of MAUs over time, now WAUs are 2/3 of MAUs or avg of 40m WAUs in Jun—GP per TAU 📈2.5x vs 2Q2019 & 1.5x vs Q42020…

3b) … Avg. cust. who adopts 2 or more products in @CashApp gen 3-4x GP vs avg P2P customer—Integration of @afterpay_au into @CashApp 📈 greater utility for customers and ultimately LTV/ARPU over time” @AmritaAhuja

“@afterpay_au integ in @CashApp will 📈 commerce discovery,…

“@afterpay_au integ in @CashApp will 📈 commerce discovery,…

3c) 📈consumer engagement, which benefits merchants in form of lead gen, & helps consumers browse merchants…… purchase goods/services within @CashApp & use BNPL at checkout, to pay for interest, pre-installments directly from app, 📈more recurring engagement.” @nmolnar

4a) 💭@afterpay_au Merchant Discovery 🔑 to deal, helps 🔁 Seller & @CashApp ecosystem & marketing 🛠 like spending & rewards (Boost), 📈 more sales for sellers and will ⛽️ what I think will be a 🔥 Ad Biz as they to monetize as they mature w/ great & unique conversion insights!

4b) “the consumer side is going to be focused on discovery, 1st & foremost, will give @CashApp a way to provide more daily value, something that people want to open every day to check out what’s new and to see our entire ecosystem w/ services within @CashApp as well” @jack

4c) “great marketing cust acq channel for 🌐 retailers in attracting highly val next-gen customer base—drives an avg of 1m leads/day—as a result of 16m active over last 12 mo—will only 📈 as they grow collective base to 70m transacting w/ @CashApp” @jack @AmritaAhuja @nmolnar

4d) “ext of @CashApp re: spending & rewards. On spending, 💪🏼 adoption w/ 💵 Card at 10m MAUs in Mar & 7m WAUs w/ spend per cust 📈over time. On rewards, Boost is an engagement & merchant marketing 🛠, scale as a great acq tool🛠 for sellers & 📈utility for full ecosystem.” @jack

5a) 💭 Gen Z & Millennial Demo 🔑 to deal & aligned, enhancing value of acquisition over its lifetime.

75% of BNPL users are Gen Z & millennials.

Young demo acq & 💪🏼 ecosystem, will 📈 LTV of base, 📈 inflows & ARPU/GP & guide business 🗺 towards economic impairment.

75% of BNPL users are Gen Z & millennials.

Young demo acq & 💪🏼 ecosystem, will 📈 LTV of base, 📈 inflows & ARPU/GP & guide business 🗺 towards economic impairment.

https://twitter.com/tpsojda/status/1422703091577540610

5b) “Post global financial crisis, many millennial and Gen Z concurred we’re looking for alt to traditional credit, saw a way to empower them to responsibly buy what they wanted with their own money and drive incremental value to merchants” @nmolnar on building @afterpay_au

5c) “Both @Square & @afterpay_au resonate w/ Gen Z & millennial consumers, excited about oppt for BNPL product to be offered to 📈base of >70m annual active @CashApp customers who’s lifestyles, preferences, and views are aligned w/ combined business.” @nmolnar

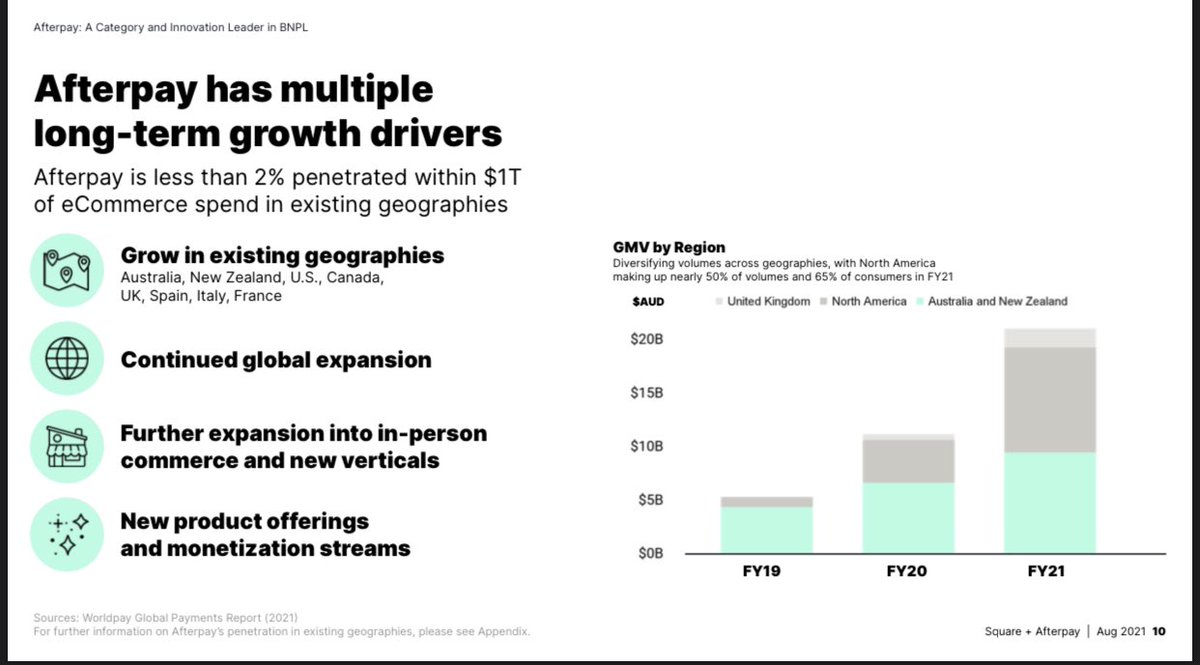

6a) 💭 @afterpay_au BNPL 📈 ORDER FREQ, AVG ORDER VALUE, & HELPS $SQ MIX-SHIFT STRAT TO 🤝 MORE MID/LARGE SELLERS

BNPL proven to 📈 order freq and payment installments have them re-visiting app to ensure payments processed & view more deals.

BNPL proven to 📈 order freq and payment installments have them re-visiting app to ensure payments processed & view more deals.

https://twitter.com/tpsojda/status/1397351062986760192

6b) “on avg, 🔝 10% consumers 🌐 used @afterpay_au >30x in the 🇺🇸 & 60x in 🇦🇺 in 2021. For merchants, whether large enterprise or SMBs, helps 📈their businesses. Have 📈 higher avg order values, 📈 basket sizes, & ++ new/repeat customers within 24-48 hrs of going live” @nmolnar

6c) “on vol metrics $SQ did, @afterpay_au demonstrated w/ merchants to 📈 trans size by 25%, and 📈 conversion rates and order frequency by 20%” @AmritaAhuja

6d) “@afterpay_au provides access to a # of enterprise & retail merchants w/ a 🌐 presence, where sellers can help move to omnichannel & 📈 to more in-person comm. It gives us a 📈 🧰 to sell to enterprise, larger 🌐 retail merchants in a way we haven’t been able to in the past…

6e) …And again, why that matters is b/c we can intro them to the larger ecosystem as well” @jack

“We believe where we’re most differentiated is our combined ecosystem, is ecosystem 🔌. Very few competitors have both seller & consumer ecosystems…

“We believe where we’re most differentiated is our combined ecosystem, is ecosystem 🔌. Very few competitors have both seller & consumer ecosystems…

6f) … having BNPL ability along w/ entire suite of 🧰, is magical & saves a lot of time connecting vendors together. Imp for SMBs but more critical for large co, 🌐 enterprise” @jack

7a) 💭 @Square 🏦 PRIORITY & BNPL HELPS TO 📈 BOTH SELLER & CONSUMER LENDING SUITE

“By offering central 🏦 🧰 that integrate seamlessly w/ seller suite like payments & $SQ payroll, sellers now have unified view of their payments, balances, expenses, & financing options” @jack

“By offering central 🏦 🧰 that integrate seamlessly w/ seller suite like payments & $SQ payroll, sellers now have unified view of their payments, balances, expenses, & financing options” @jack

7b) @afterpay_au product/approach is simple to sign up in min, make 1st purchase via in-store, online, or app, and repay in 4 = installments. No credit check conducted at sign up. Based on trust. Start w/ lower spending limit that 📈over time & reflects good payment behavior

7c) $SQ began offering loans to sellers in 🇦🇺 in Q2, the 1st intl market for Square Loans.

“a survey of 🇦🇺 small biz conducted by @Square found that only 1/4 small biz used funding via a financial institution, while >1/2 had to rely on friends & family or personal finances.”

“a survey of 🇦🇺 small biz conducted by @Square found that only 1/4 small biz used funding via a financial institution, while >1/2 had to rely on friends & family or personal finances.”

7d) repayment behavior will help @square 🏦 understand credit risk profiles of both consumers, but also with seller adjacencies long term.

@afterpay_au BNPL connects either checking, DC or CC AMEX, will help 📈 DD inflows by 📈 deposit/credit limits, a priority for @jack 👇🏼

@afterpay_au BNPL connects either checking, DC or CC AMEX, will help 📈 DD inflows by 📈 deposit/credit limits, a priority for @jack 👇🏼

https://twitter.com/tpsojda/status/1397351056317718529

🏷 my $SQ / BNPL bulls: @MaxTheComrade @plantmath1 @caleb_investTML @jablamsky @BlaineCapital @Couch_Investor @InvestmentTalkk @ian_invest19 @mukund @NickGreenCC @qcapital2020 @SatoshiAlien @Matt_Cochrane7 @alexkagin @clueless_1337

Tim’s Emoji legend:

🧵 = thread

🌐🌎 = global

📈 = growth, increase, expansion

🛠 = tool

🧰 = suite of tools

💪🏼 = strong/strength

👣 = footprint

🏦 = bank

⛽️ = fuel(s)

🗺 = product roadmap

🔑 = keys to success @djkhaled

LMK if I missed any @NickGreenCC

I have @jack to thank.

🧵 = thread

🌐🌎 = global

📈 = growth, increase, expansion

🛠 = tool

🧰 = suite of tools

💪🏼 = strong/strength

👣 = footprint

🏦 = bank

⛽️ = fuel(s)

🗺 = product roadmap

🔑 = keys to success @djkhaled

LMK if I missed any @NickGreenCC

I have @jack to thank.

typos: customers** were**

Link to thread 2 of 2. Sorry y’all, this marks the end of my $SQ reign today

https://twitter.com/tpsojda/status/1424931819258929152

• • •

Missing some Tweet in this thread? You can try to

force a refresh