1) Thread 🧵 2/2 on $SQ | @Square + $AFTPY $AFTPF | @afterpay_au with commentary from @jack @AmritaAhuja @nmolnar and yours truly.

🧵 1/2 👇🏼

🧵 1/2 👇🏼

https://twitter.com/tpsojda/status/1424865405575700481

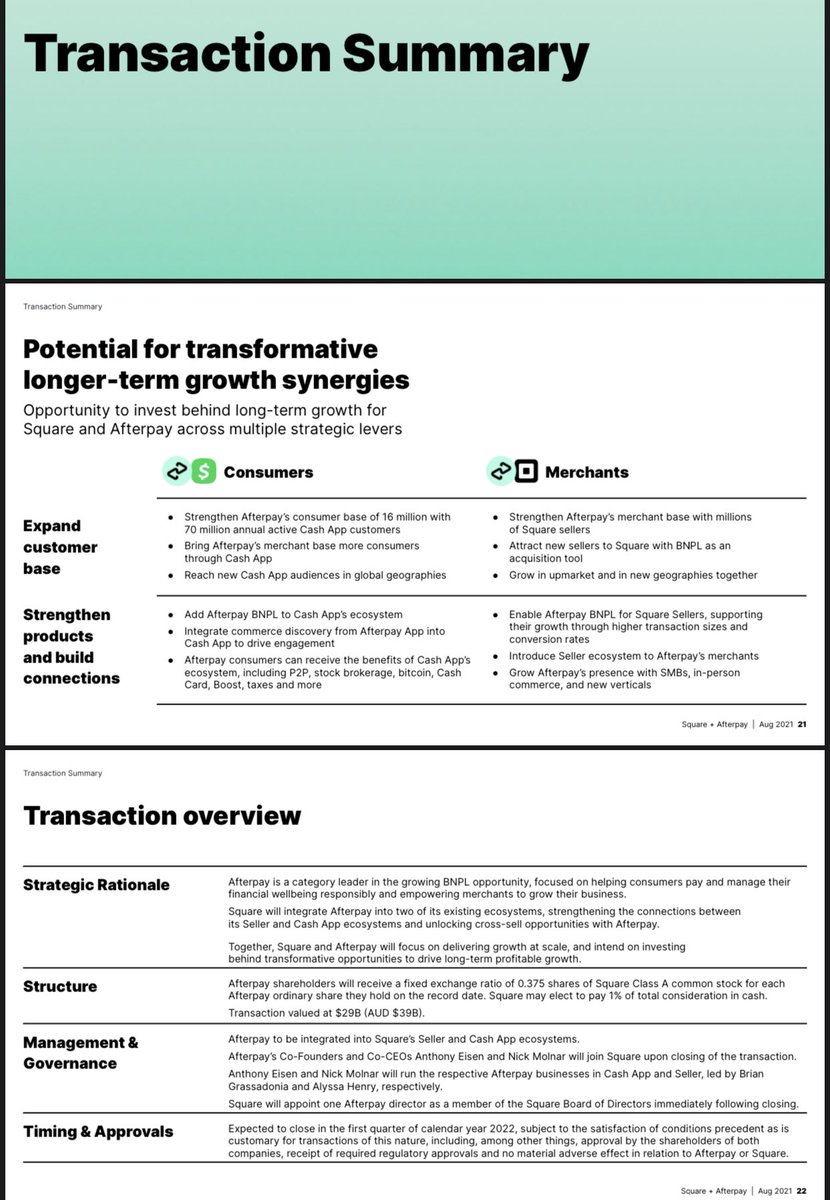

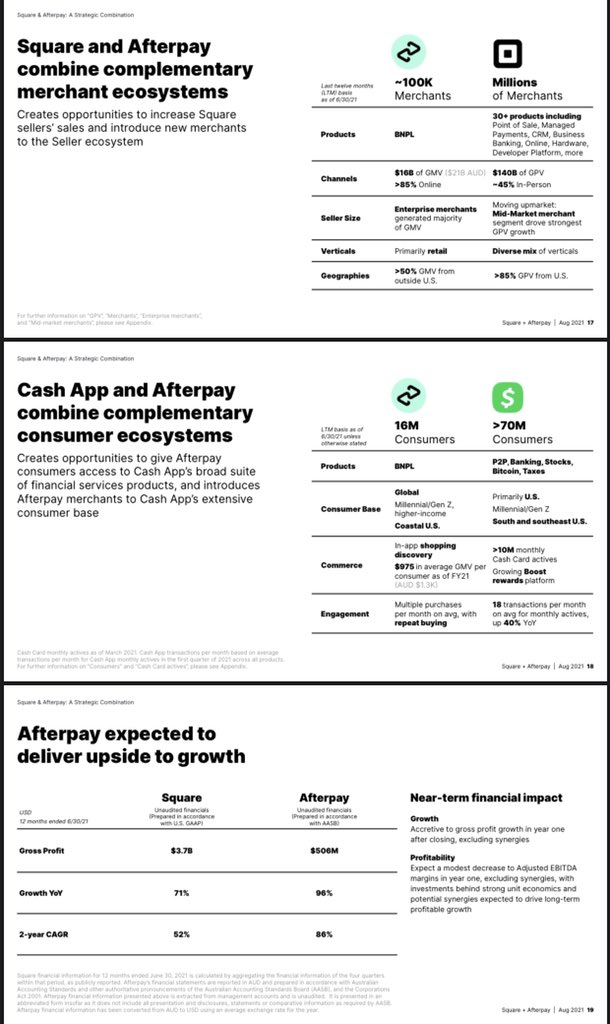

2a) 💭 DRIVES LT GROWTH 📈 SYNERGIES FOR BOTH CO’S

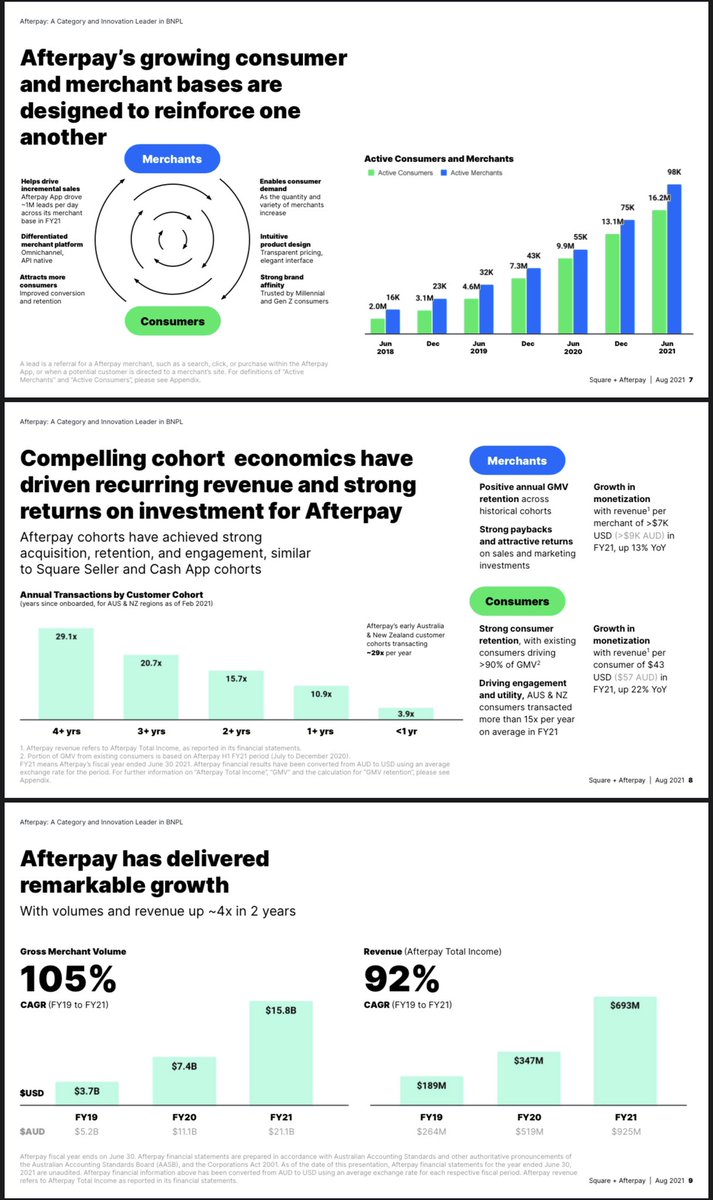

“💪🏼 consumer & merchant adoption has enabled @afterpay_au to deliver 🚀 📈 w/ rev up ~4x over the last 2 years. We 👀 a # of levers to help drive continued 📈 for them, 1st, in terms of ongoing secular 📈 of BNPL in eComm;…

“💪🏼 consumer & merchant adoption has enabled @afterpay_au to deliver 🚀 📈 w/ rev up ~4x over the last 2 years. We 👀 a # of levers to help drive continued 📈 for them, 1st, in terms of ongoing secular 📈 of BNPL in eComm;…

2b) and 2nd, in terms of @afterpay_au future 📈 adjacencies.” @AmritaAhuja

“their business has 💪🏼 cohort economics, providing a durable foundation for 📈 across its merchants & consumer base. Afterpay has delivered positive GMV retention & 📈 purchase freq over time…

“their business has 💪🏼 cohort economics, providing a durable foundation for 📈 across its merchants & consumer base. Afterpay has delivered positive GMV retention & 📈 purchase freq over time…

2c) … w/ strong paybacks & returns on acq spend. These fundamentals mirror the dynamics in our @CashApp and Seller ecosystem around 📈 engagement & 💪🏼returns.

Next, we're excited by our compelling cross-sell opportunities…

Next, we're excited by our compelling cross-sell opportunities…

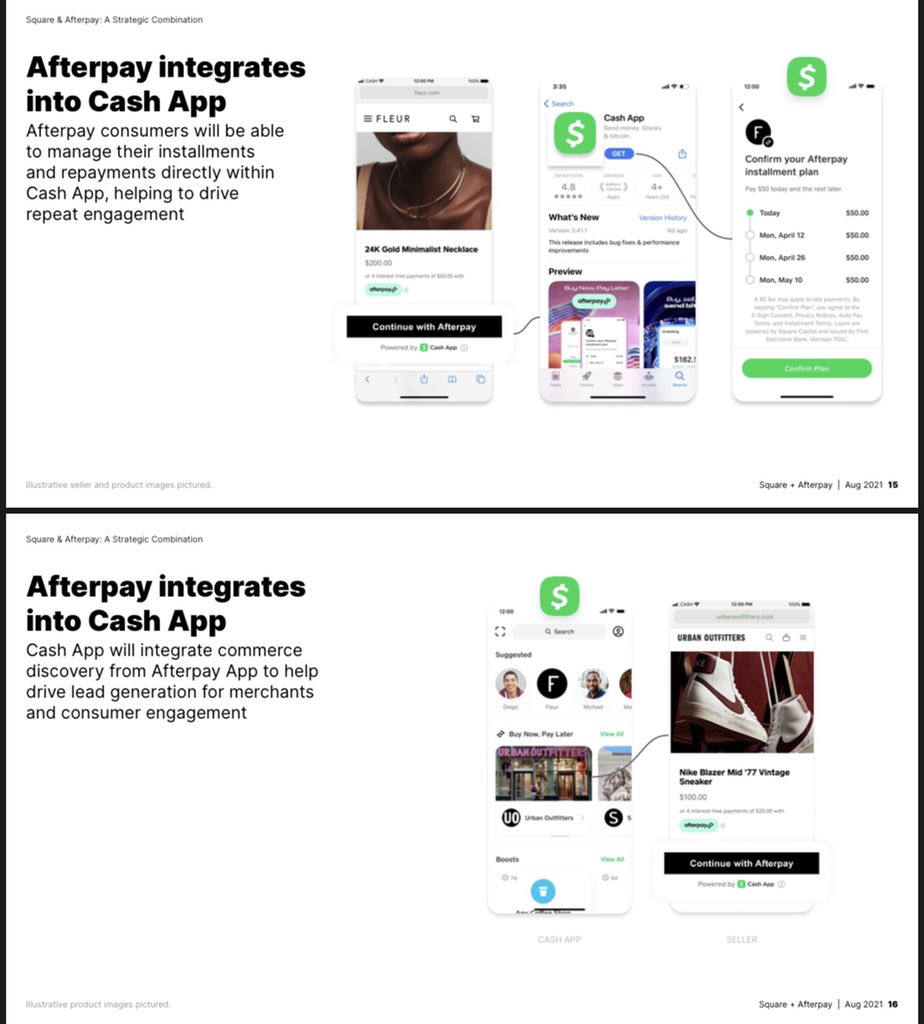

2d) …by integrating @afterpay_au directly into our @CashApp & Seller ecosystem, we can 📈 each brand's customer base, 💪🏼 each other’s products and build connections. On consumer side, the addition of Afterpay embeds commerce more directly into @CashApp…

2e) ..@afterpay_au merchant base will have 4x more consumers & @CashApp will have access to 16m Afterpay consumers who rep a complementary demo base. For merchants, we'll intro @Square Sellers to BNPL, which 📈 them more deeply in the new vert & in-person commerce.” @AmritaAhuja

2f) “excited about meaningful 📈 opportunity @Afterpay will add. With YoY GP 📈 of 96% in the last 12 mo ended Jun 30, we expect them to be accretive to GP 📈 in the first year after closing (est Q1 2022)…

2g)… @afterpay_au is a younger business and earlier in ramping its profitability, so we expect a modest 📉 to adj EBITDA margins in the 1st year after closing. Historically, our investments behind strong cohort economics have driven compounding profitable 📈…

2g) … We similarly intend to invest behind @afterpay_au strong return to unlock the significant synergies we see ahead.” @AmritaAhuja

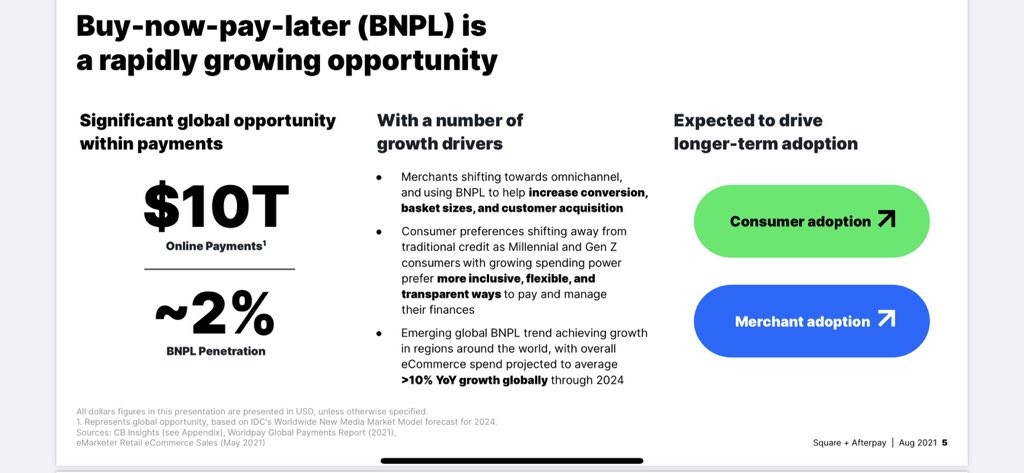

3a) 💭 BNPL IN 🔝 OF INNING 1, 0️⃣ OUTS

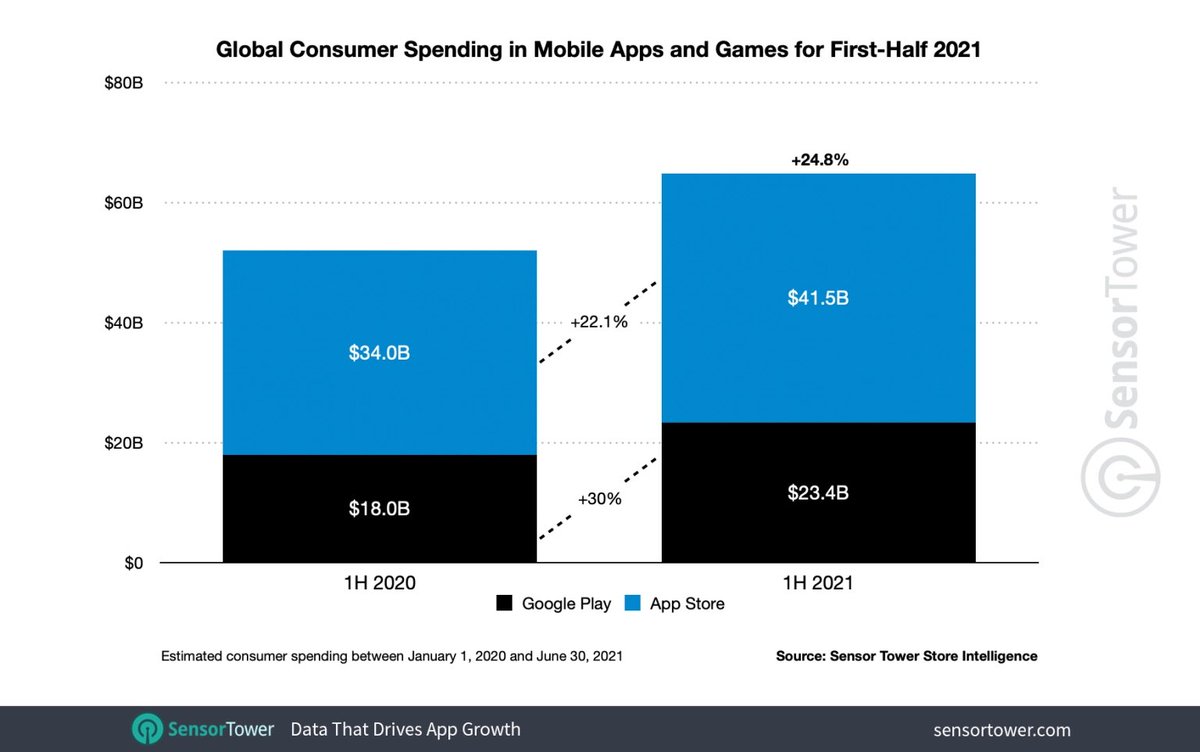

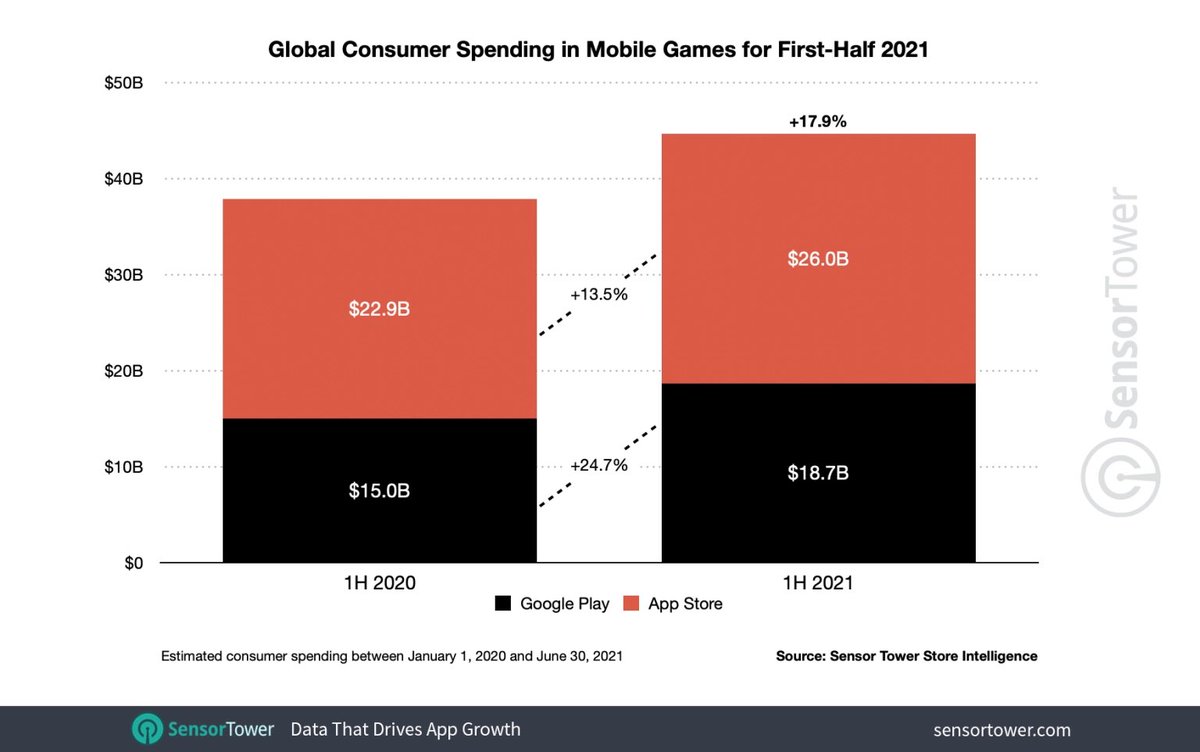

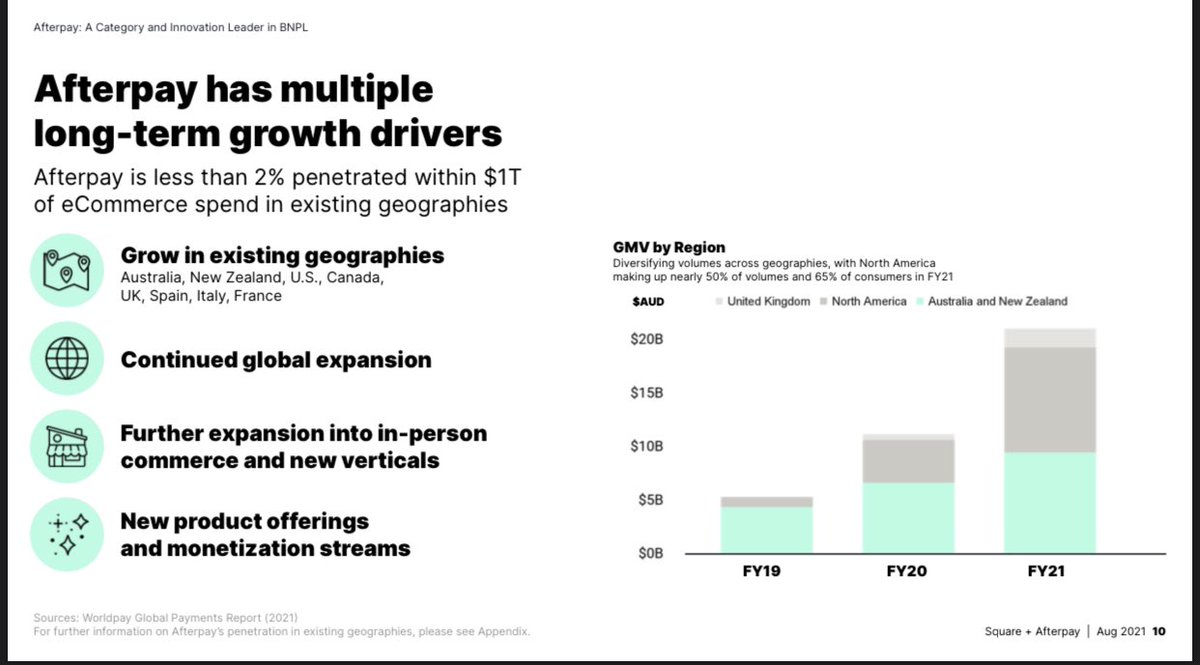

BNPL is only ~2% penetrated w/ $10T 🌐 online GPV by 2024.

Consumer pref shifting away from trad credit as Millennial & Gen Z consumers w/ 📈 spending power want more inclusive, flexible, & transparent ways to pay/manage finances

BNPL is only ~2% penetrated w/ $10T 🌐 online GPV by 2024.

Consumer pref shifting away from trad credit as Millennial & Gen Z consumers w/ 📈 spending power want more inclusive, flexible, & transparent ways to pay/manage finances

3b) Emerging 🌐 BNPL trend achieving 📈 in regions around the world, w/ overall eComm spend proj to avg 10% CAGR 🌐 thru 2024 -> deal gives them exposure to BNPL mid to large sellers/merchants, and eComm boon will ⛽️ future Ad Biz from discovery to consumer payment conversion.

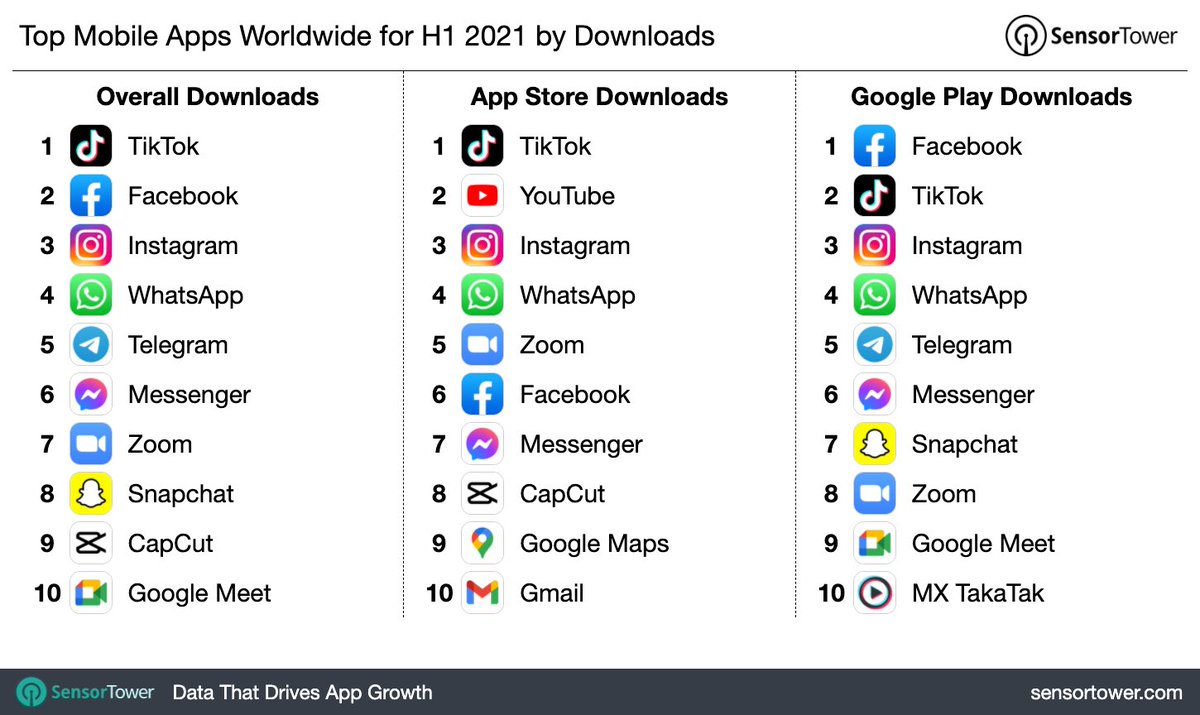

3c) now this is a part where most on #FinTwit & even $SQ & $AFTPY didn’t 🗣 out on Gen Z & Millenial concentration.

🔥 take: 125m youths turned 18 yrs of age 🌐 in 2020, w/ ~5m in the 🇺🇸. BNPL will not only infuse ecosystem w/ Gen Z / millennials today w/ current installs…

🔥 take: 125m youths turned 18 yrs of age 🌐 in 2020, w/ ~5m in the 🇺🇸. BNPL will not only infuse ecosystem w/ Gen Z / millennials today w/ current installs…

3d) but they will have a revolving 🚪 of new youths who don’t like traditional credit & BNPL will give them a quick way to get lending w/ no credit check to generate purchases and make flexible payments with pay as you behave functionality! By the time they’ve reached maturity..

3e) … $SQ will be able to offer new lending products as they make their journey thru life, meeting them where they’re at today & in the future, creating a connected consumer journey for 🔑 milestones in life incl 🏦 loans, CC, mortgages, auto loans, all while still offering BNPL

3f) my mentor was resp for rev optimization at @AAAnews & he always preached customer lifetime value (CLV) & how 🔑 it was to get them in ecosystem early on as its easier to retain as they go thru life, builds loyalty if you can meet their needs thru life, which 📉 CAC & CLV.

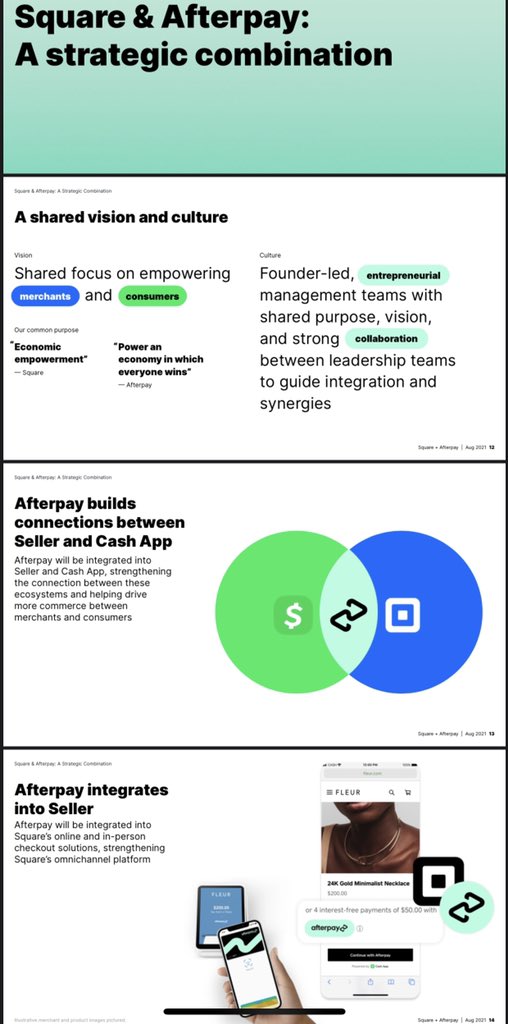

4a) 💭WHY BUY @afterpay_au & NOT BUILD @jack?

“space is getting more and more crowded. Lots of dif services in BNPL, but ultimately impressed w/ @nmolnar & Ant’s ambitious, entrepreneurship, and cutting edge innovation others in space benchmark off of” @jack

“space is getting more and more crowded. Lots of dif services in BNPL, but ultimately impressed w/ @nmolnar & Ant’s ambitious, entrepreneurship, and cutting edge innovation others in space benchmark off of” @jack

4b) “helps 🔁 in to 2 biggest ecosystems, Seller and @CashApp. And this was a clear fit in a way that they built their model out, a simple marketing 🛠 and some incredible discovery for consumers. So for consumers, Afterpay offers truly interest-free products…

4c) … that don't require any credit history, something vastly different from what we've seen w/ other BNPL products— for merchants, $SQ has always asked the ❓, how can we help our merchants make more sales? And that was exactly the question that @Afterpay has been asking…

4d) …providing them a way to generate leads through the app, which has helped them 📈 conversion rates, 📈 their transaction sizes and led to repeat purchases and repeat customers. So this allowed Afterpay to reach more than 60 million consumers and 100,000 merchants globally…

4e) So we're – looking at the deal, this was an obvious 🤝 between the Seller and @CashApp. Ant and Nick have built on top of an ecosystem model. There's a clear fit into our model that makes it even 💪🏼 for us.” @jack

4f)🔥 take on val concerns: best compliment vs other BNPL synergy wise & others will get bid up by larger players, some of which will be directly competing in 🇺🇸 & intl markets. $SQ & $AFTPY will ⛽️ each other both now & even more in the collective ecosystem. Deal will 👀 cheap!

🏷 my $SQ BNPL BFFs @caleb_investTML @BlaineCapital @MaxTheComrade @NatHarooni @Matt_Cochrane7 @jbs5 @SpecialSitsNews @ParrotStock @plantmath1 @mukund @LukeDonay @InvestmentTalkk @qcapital2020 @SatoshiAlien @InvestiAnalyst @ian_invest19 @clueless_1337 @Couch_Investor

🚨Correction: 📉CAC and 📈 CLV

• • •

Missing some Tweet in this thread? You can try to

force a refresh