Why @AaveAave will be an essential piece to the Web 3.0 Puzzle. [Thread]

A couple weeks ago @StaniKulechov hinted at building a decentralized social network. That got us thinking about how that might work. Here's what we think.

$AAVE

A couple weeks ago @StaniKulechov hinted at building a decentralized social network. That got us thinking about how that might work. Here's what we think.

$AAVE

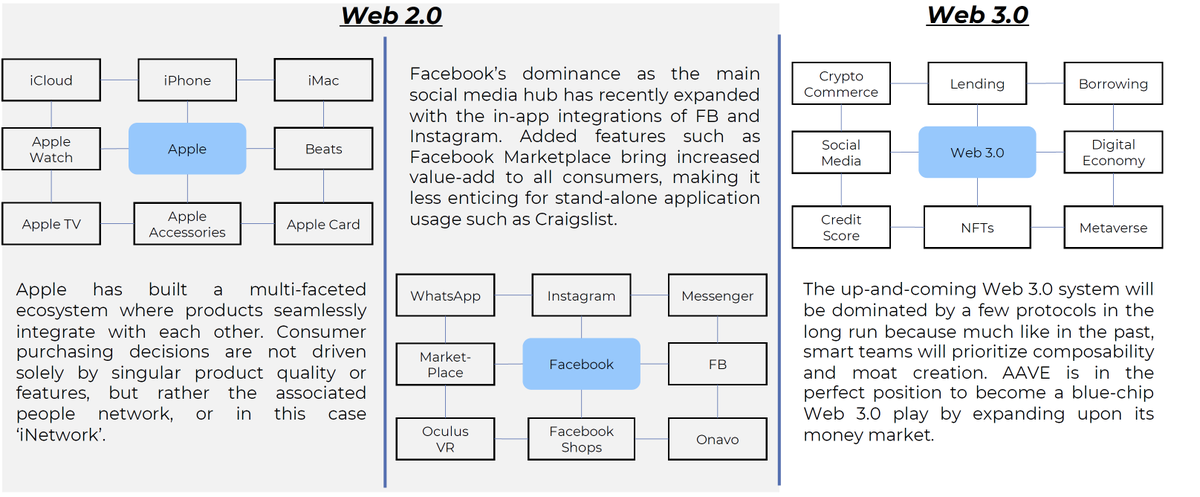

The current problem with the current social media landscape is that the centralized entities hold too much power. The goal of these entities is not to maximize user value but rather shareholder value, creating unaligned incentives.

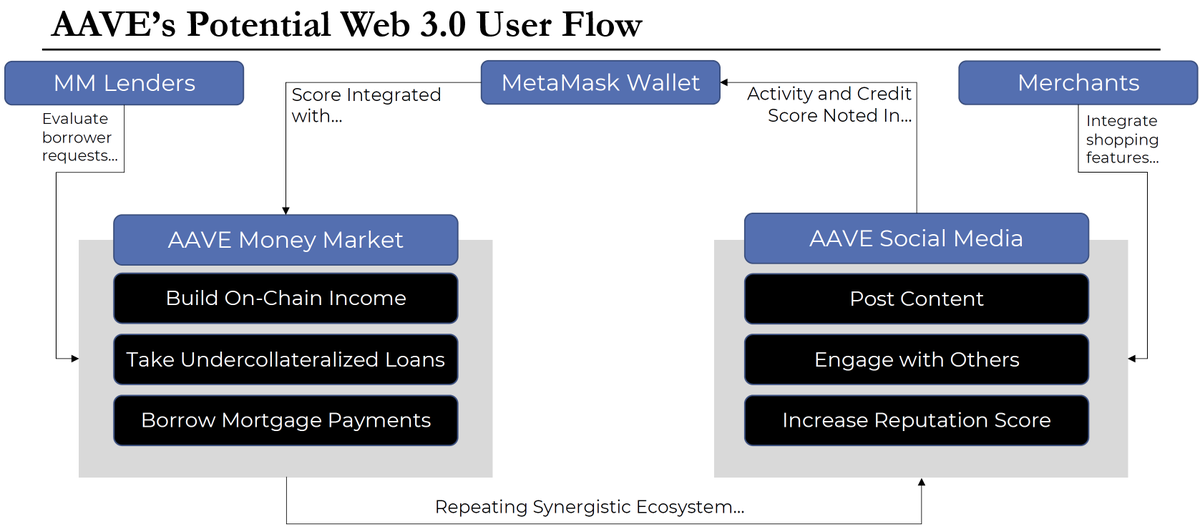

What would a decentralized social media look like? We imagine it will be wallet-based. Given users a non-KYC identity that they can build through their on-chain activity. Whether it be metaverse, DeFi or gaming, your wallet will be your sign-in.

Similar to how Web 2.0 entities try and control the entire stack. Web 3.0 will try and do the same except allowing for infinitely more possibilities as users will be able to interact with the metaverse, DeFi and so many other aspects of the crypto ecosystem.

The user's activity on the social media platform will help them build a reputation score. This can be combined with other on-chain activities which can then be used to evaluate the user for loans on the @AaveAave money market and other services across the ecosystem.

This has some pretty interesting possibilities in DeFi. It can open up the possibility for undercollateralized lending pools. Users with a high enough social score will be able to leverage their reputation rather than their capital and get access to undercollateralized loans.

As more users move from Web 2.0 to Web 3.0, the instantaneous nature of decentralized finance will

bring up new use-cases never seen before in the traditional world. The combination of

digital money and the social economy will be intertwined tightly.

bring up new use-cases never seen before in the traditional world. The combination of

digital money and the social economy will be intertwined tightly.

• • •

Missing some Tweet in this thread? You can try to

force a refresh