1/

With the upcoming release of the AMM Trident and NFT marketplace Shoyu, @SushiSwap is poised to capture increased DEX market share as well as build out its moat, all while becoming the most complete DeFi ecosystem.

$SUSHI #SUSHI

With the upcoming release of the AMM Trident and NFT marketplace Shoyu, @SushiSwap is poised to capture increased DEX market share as well as build out its moat, all while becoming the most complete DeFi ecosystem.

$SUSHI #SUSHI

2/

Trident is a one-of-a-kind AMM model that increases LP flexibility as there are 3 new pools:

- Weighted Pools (Think Balancer)

- Hybrid Pools (Think Curve)

- Concentrated Liquidity Pools (Think Uniswap)

Increased optionality = decreased capital elasticity

Trident is a one-of-a-kind AMM model that increases LP flexibility as there are 3 new pools:

- Weighted Pools (Think Balancer)

- Hybrid Pools (Think Curve)

- Concentrated Liquidity Pools (Think Uniswap)

Increased optionality = decreased capital elasticity

3/

Sushiswap's native NFT marketplace is also releasing soon, and this should bring plenty of new and incumbent users. $SUSHI is also trying to make NFTs more interactive by building a metaverse display, and allowing for creators to experiment with 'social tokens'.

Sushiswap's native NFT marketplace is also releasing soon, and this should bring plenty of new and incumbent users. $SUSHI is also trying to make NFTs more interactive by building a metaverse display, and allowing for creators to experiment with 'social tokens'.

4/

Cool Shoyu social token features:

- Burn-and-participate: holders can burn tokens to redeem real-life items, such as merchandise (think of @0x_b1's initiative with Spunks, but anyone can do it)

- Revenue sharing: token creators can decide to re-distribute on-chain earnings

Cool Shoyu social token features:

- Burn-and-participate: holders can burn tokens to redeem real-life items, such as merchandise (think of @0x_b1's initiative with Spunks, but anyone can do it)

- Revenue sharing: token creators can decide to re-distribute on-chain earnings

5/

2.5% of every transaction on Sushi's NFT marketplace will go towards $xSUSHI holders, which means that the token's value accrual isn't solely dependent on token swap activity anymore.

Diversified revenue streams = stronger 'business' model

2.5% of every transaction on Sushi's NFT marketplace will go towards $xSUSHI holders, which means that the token's value accrual isn't solely dependent on token swap activity anymore.

Diversified revenue streams = stronger 'business' model

6/

$SUSHI's P/E ratio sits at 60.70x and its P/S ratio sits at 10.12x, which is fundamentally sound for a protocol that is operating in numerous exponentially growing industries (DEXes, NFTs).

We also expect Sushi's market share to increase after Trident's release.

$SUSHI's P/E ratio sits at 60.70x and its P/S ratio sits at 10.12x, which is fundamentally sound for a protocol that is operating in numerous exponentially growing industries (DEXes, NFTs).

We also expect Sushi's market share to increase after Trident's release.

7/

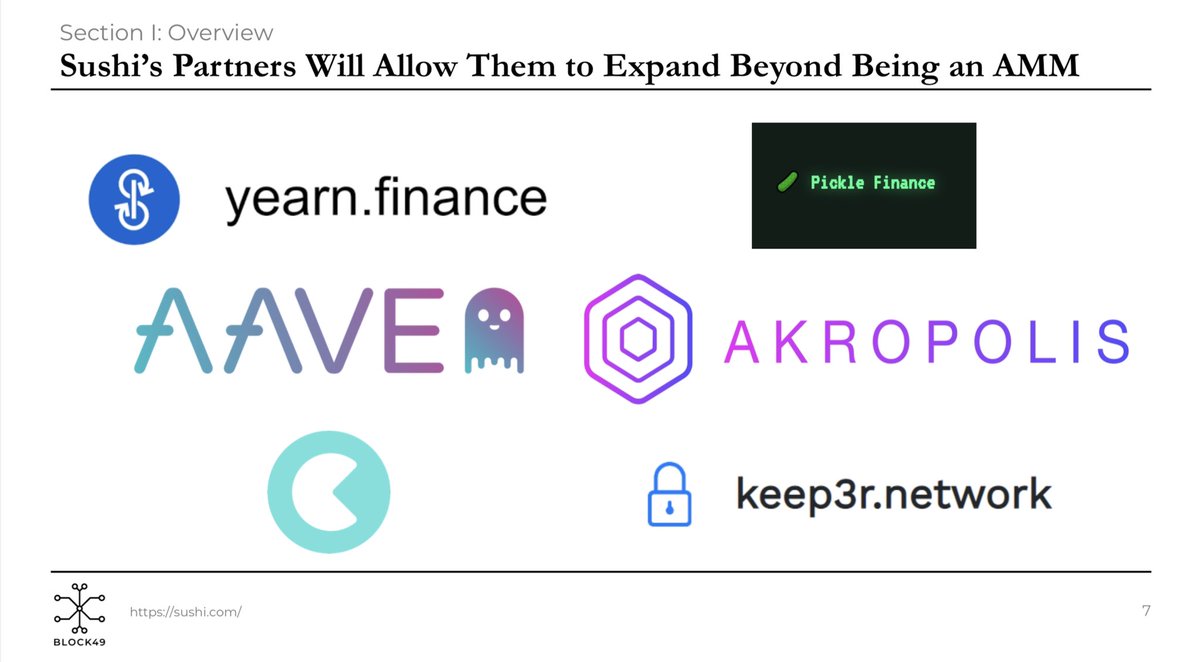

Sushiswap's horizontal expansion approach is proving to be an excellent protocol model.

Lastly, we believe that team strength is the most important factor in an open-sourced world, and it is evident that Sushiswap is in great hands.

DYOR, NFA.

Sushiswap's horizontal expansion approach is proving to be an excellent protocol model.

Lastly, we believe that team strength is the most important factor in an open-sourced world, and it is evident that Sushiswap is in great hands.

DYOR, NFA.

• • •

Missing some Tweet in this thread? You can try to

force a refresh