1/

My thoughts on the $CRYPTO market over the coming weeks!

Hope you enjoy!

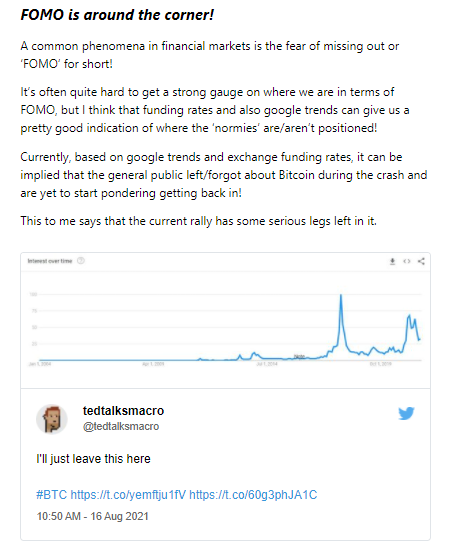

'Funding rates are yet to spike'

My thoughts on the $CRYPTO market over the coming weeks!

Hope you enjoy!

'Funding rates are yet to spike'

7/

Thanks for reading, if you'd like to have these newsletters delivered for free (2x per week), please subscribe via the link below 👇

getrevue.co/profile/MacroU…

Thanks for reading, if you'd like to have these newsletters delivered for free (2x per week), please subscribe via the link below 👇

getrevue.co/profile/MacroU…

• • •

Missing some Tweet in this thread? You can try to

force a refresh