Thread 1/5 Also, ICYMI, last week's #podcast was something different. @FinanceGhost and I both picked 2 newsworthy stocks and talked about our views on them.... check it out here:

moe-knows.com/2021/08/12/mag…

moe-knows.com/2021/08/12/mag…

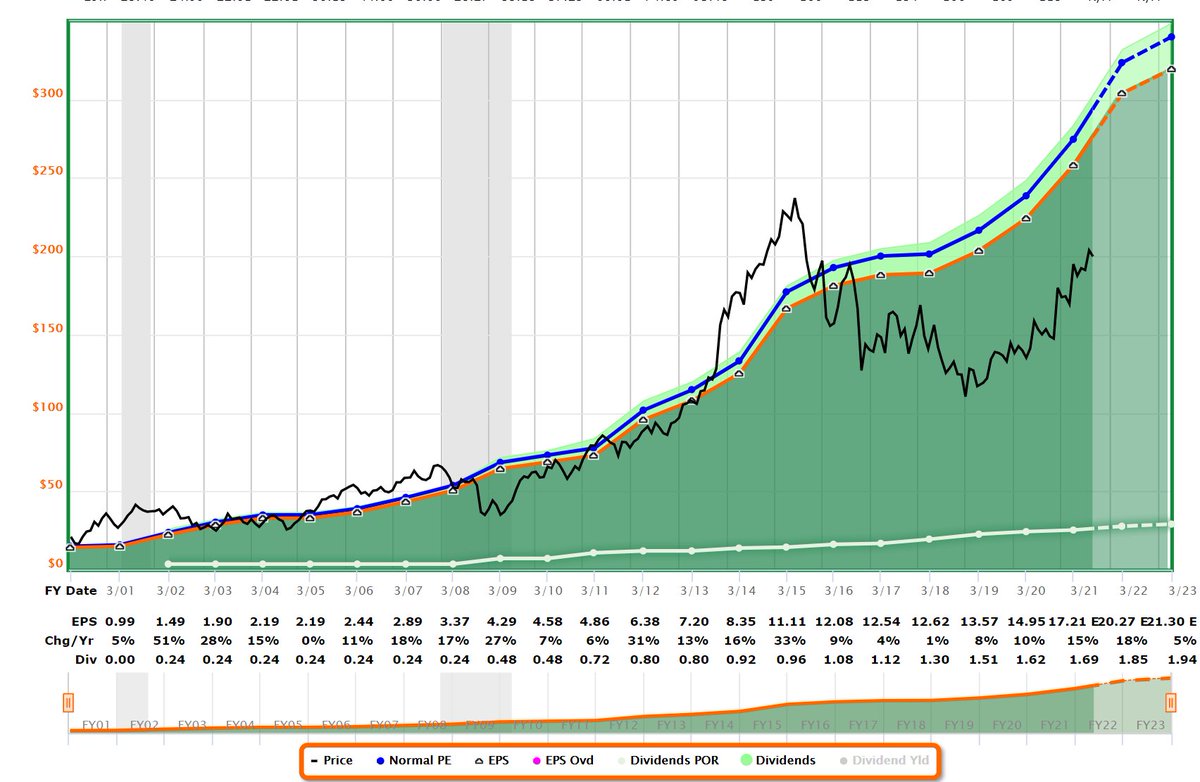

Thread 2/5 I look at a number of indicators both technical and fundamental. In the podcast, at one stage, I referred to looking at my @FASTGraphs , so here's some screenshots on the stocks we spoke about in the thread below:

Thread 3/5 We discussed $MCK as one of the 'value' plays I have liked in the #healthcare sector... @FASTGraphs

Thread 4/5 And this was the one I referred to on $ELY @FASTGraphs saying that the numbers were like my golf game.... all over the show:

Thread 5/5 It's a great show where we look at stocks from very different industries, what makes sense to us and what doesn't as we share some of our views and how we look at investing in our own portfolios....

remember, you can subscribe to my blog here:

moe-knows.com

remember, you can subscribe to my blog here:

moe-knows.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh