New findings on spending during unemployment and macro conditions by my colleagues at #JPMCInstitute

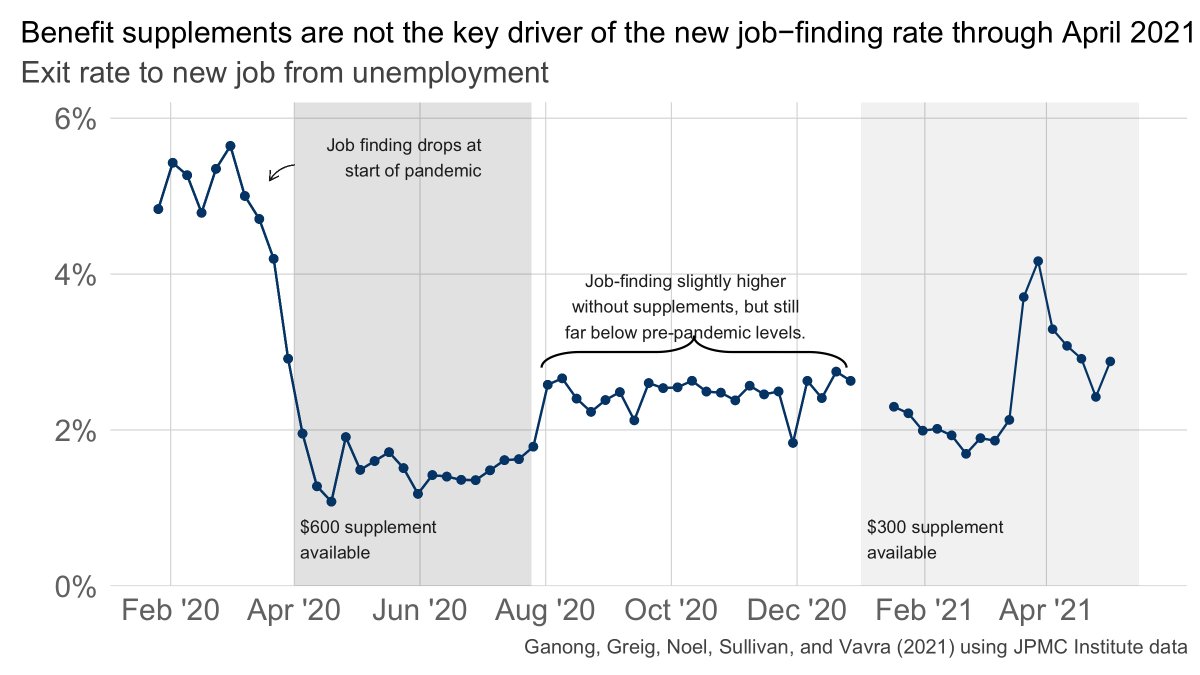

TLDR: UI policy and liquidity are the key drivers of spending for unemployed households.

Macro conditions, in contrast, appear not to matter.

Thread

TLDR: UI policy and liquidity are the key drivers of spending for unemployed households.

Macro conditions, in contrast, appear not to matter.

Thread

^ Spending very similar for

* Green line: Great Recession

* Blue line (almost identical): 2010's boom

These are two periods where macro conditions are very different, but income in the first few months of unemployment are very similar

* Green line: Great Recession

* Blue line (almost identical): 2010's boom

These are two periods where macro conditions are very different, but income in the first few months of unemployment are very similar

^ The orange line for 2020 when PUC available, is radically different -- much more income paid out and much higher spending too

One clear way to see the neutrality result regarding how macro conditions don't change the spending drop at unemployment is to compare the drop in 2009 when the economy was tanking and in 2019 in the white hot labor market

The spending drop from unemployment is the same in both!

The spending drop from unemployment is the same in both!

(Important piece of context: *everyone's* consumption fell in the Great Recession, but that gap between employed and unemployed was constant.)

They also find that households with lower pre-job loss income and lower pre-job loss liquidity have higher MPCs during unemployed

Finally, they show a striking neutrality result regarding racial inequality: after taking into account income and liquidity, there are essentially no *residual* MPC differences by race/ethnicity.

What this means is *not* that race doesn't matter for the MPC. Rather, it means that those differences are mediated by income and liquidity. This echoes the neutrality result in prior work with the same data by @nomadj1s @pascaljnoel nber.org/papers/w27552

Thread by author @chrisowheat on their new research is here

https://twitter.com/chrisowheat/status/1427633614892711943?s=20

Full report is here jpmorganchase.com/institute/rese…

Congrats to @chrisowheat @FionaGreigDC @g3ontheweb @melissaobrien_1 @shantanuatx on a great new paper, which I encourage everyone to read!

Congrats to @chrisowheat @FionaGreigDC @g3ontheweb @melissaobrien_1 @shantanuatx on a great new paper, which I encourage everyone to read!

• • •

Missing some Tweet in this thread? You can try to

force a refresh