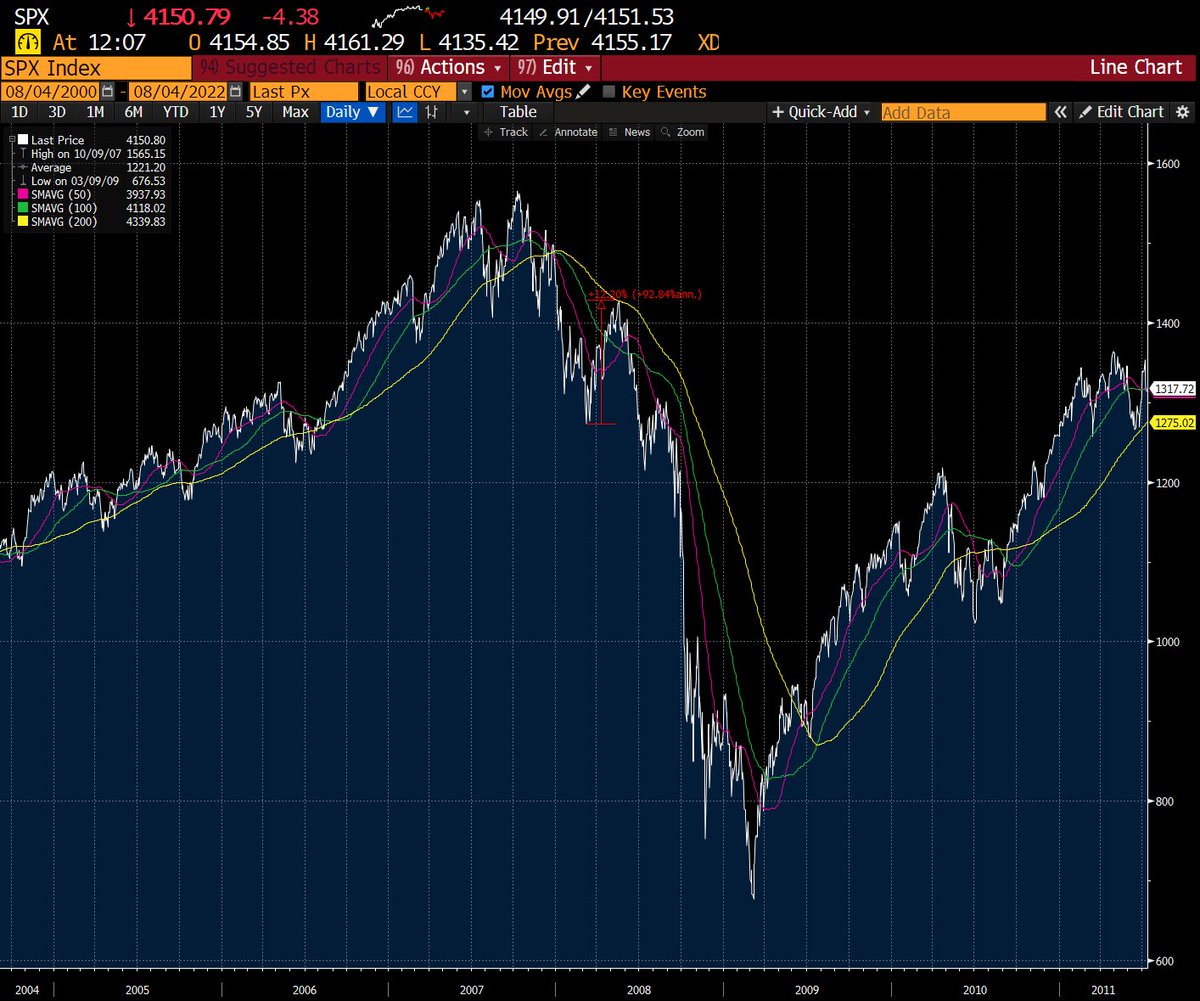

In a word....#China

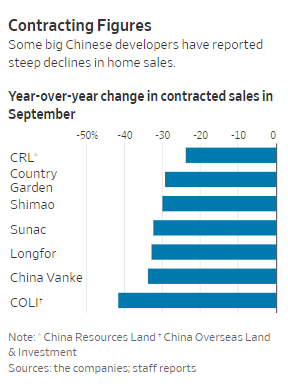

This platform looks like a pure play on Chinese luxury growth at this point...and right now that ain't good

wsj.com/articles/selli…

This platform looks like a pure play on Chinese luxury growth at this point...and right now that ain't good

wsj.com/articles/selli…

No China risk right? I would also note that they are not disclosing geographical segment data since y/e 2020

$FTCH could be a near *pure play* on China luxury, live by the sword, die by the sword

$FTCH could be a near *pure play* on China luxury, live by the sword, die by the sword

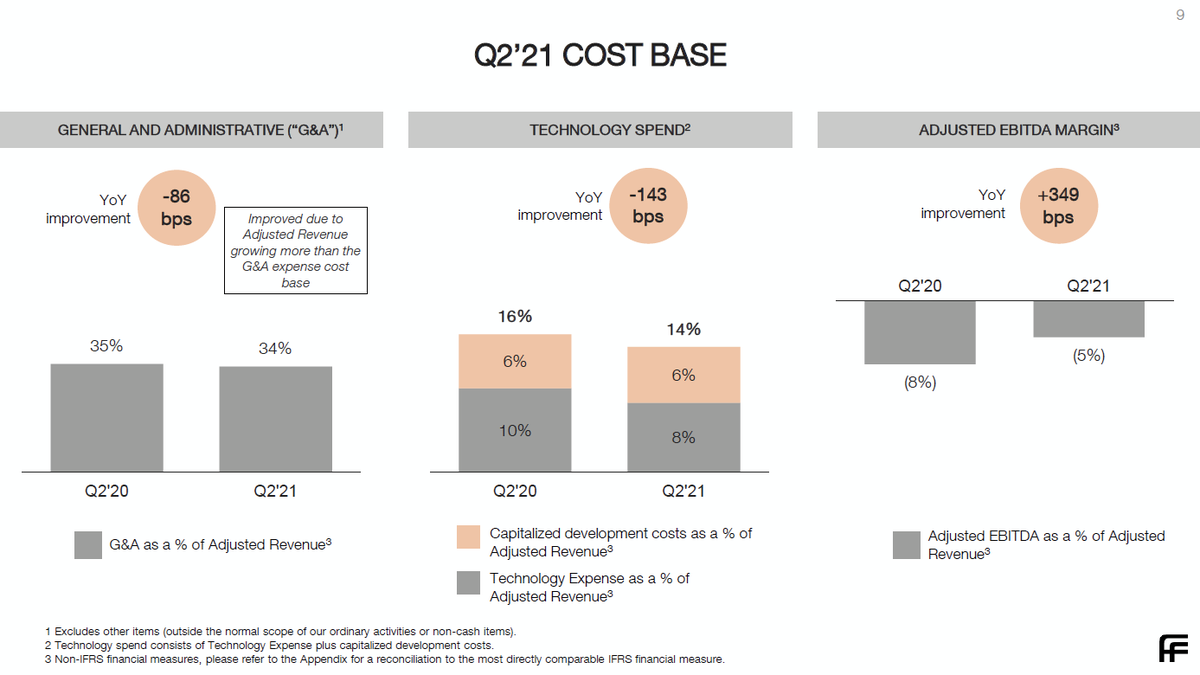

The market focused on the fact that they were able to narrow (#Adjust) this massive loss profile

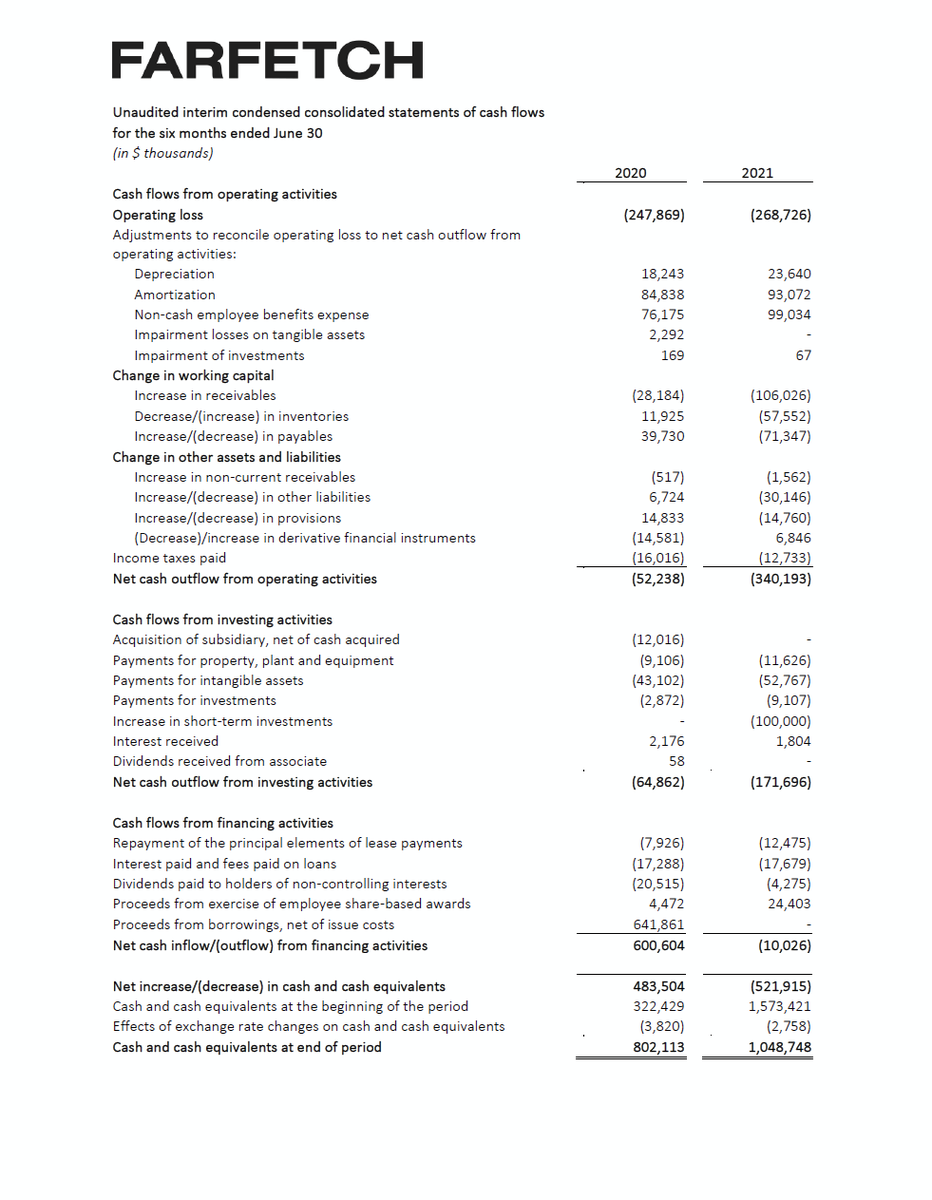

SG&A still grew substantially, but the real juice is in the cash flow statement

The cash flow statement shows this thing incinerating cash where every old retailer used to - inventory and payables (though not real estate)

The cash flow statement shows this thing incinerating cash where every old retailer used to - inventory and payables (though not real estate)

So let them tout reducing the cost base...Neves will be out of cash by 2022 in our view and be back to the market with a financing....better hope Papa Xi lets him sell happiness that long

Also why is $FTCH extending receivables ahead of revenue in 2021? Big red 🇨🇳

Private label brands seem to be on the bulls list because it ties up less working capital - for this sleeve $FTCH paid 10x sales in 2019

• • •

Missing some Tweet in this thread? You can try to

force a refresh