1/ Rate of change in technology

“It isn’t that I don’t understand software products, but I don’t know how that industry is going to develop over 10 or 20 years… so anything that’s rapidly developing that has lots of change embodied in it, by my definition, I won’t understand.”

“It isn’t that I don’t understand software products, but I don’t know how that industry is going to develop over 10 or 20 years… so anything that’s rapidly developing that has lots of change embodied in it, by my definition, I won’t understand.”

2/ Two companies that I recently studied ( $CRWD and $ROKU) reminded me of that Buffett quote.

Both are run by founders, have executed incredibly well over last few years and enjoyed secular tailwinds on their back. They were nimble, aggressive, and eating incumbents’ share.

Both are run by founders, have executed incredibly well over last few years and enjoyed secular tailwinds on their back. They were nimble, aggressive, and eating incumbents’ share.

3/ Both companies are valued in a way that assumes they will coast through the next 5-10 years.

But when you look at the rate of change in their respective industries, it makes you think whether such assumptions will indeed hold.

But when you look at the rate of change in their respective industries, it makes you think whether such assumptions will indeed hold.

4/ Take $CRWD for example.

It didn’t even make it to Gartner’s magic quadrant in 2016, but by 2019, it was one of the best companies in cybersecurity. By 2021, CRWD and MSFT are way ahead from the rest.

It didn’t even make it to Gartner’s magic quadrant in 2016, but by 2019, it was one of the best companies in cybersecurity. By 2021, CRWD and MSFT are way ahead from the rest.

5/ The pessimists will argue what CRWD did to the incumbents in the last 5 years, a startup may do the same to CRWD in the next 5-10 years.

Optimists will point out CRWD is comfortably ahead, and it can do tuck-in acquisitions to win the red queen’s race.

Optimists will point out CRWD is comfortably ahead, and it can do tuck-in acquisitions to win the red queen’s race.

6/ The question is how do you assign some sort of probability to these pov?

If in 10 years CRWD’s topline is 11x of last year’s revenue, we still need to assign ~40x FCF multiple to generate ~8% IRR.

If in 10 years CRWD’s topline is 11x of last year’s revenue, we still need to assign ~40x FCF multiple to generate ~8% IRR.

7/ So to invest in companies such as CRWD, you not only need to be optimistic but also assign a pretty high probability (>75%) of the optimistic case playing out.

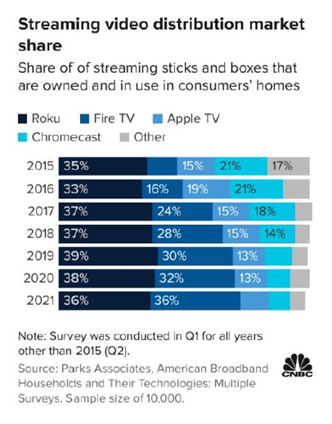

8/ $ROKU is also somewhat similar. It also operates in a very dynamic, rapidly changing industry.

See, how $AMZN came out of nowhere to match ROKU’s market share in the streaming sticks/box market.

See, how $AMZN came out of nowhere to match ROKU’s market share in the streaming sticks/box market.

9/ The math is similar for Roku as well. If they 10x their last year’s revenue in 10 years, despite the recent correction, you still need 40x FCF multiple in 2030 to get ~8% IRR.

10/ To 10x its revenue, Roku will need to increase its active accounts in *international* market from ~15 mn now to ~130 mn in 10 years. Of course, AMZN and GOOG are already dominant in some international markets and it remains an open question whether ROKU can displace them.

11/ The slugging ratio math (upside if you're right) is looking less appealing for many of the high growth companies.

I should acknowledge that worrying about valuation has been (and may remain) a losing concern for quite some time.

I should acknowledge that worrying about valuation has been (and may remain) a losing concern for quite some time.

12/ If you asked even the most bullish person to forecast ROKU or CRWD’s 2020 revenue three years ago, they would probably project a number noticeably lower than what they ended up posting.

13/ So who knows maybe they can escape from regression to the mean and from competitive threats for far longer than many think.

End/ The risk of double whammy (decelerating growth and multiple extraction) is probably not negligible.

Long-term investing in the tech sector is perhaps one of the most difficult areas of investing although we may not think or feel that based on recent returns.

Long-term investing in the tech sector is perhaps one of the most difficult areas of investing although we may not think or feel that based on recent returns.

• • •

Missing some Tweet in this thread? You can try to

force a refresh