1/ Thread: $LULU 2Q'22 Update

"I am pleased to share that we will surpass our 2023 revenue target by the end of this year, 2 years ahead of schedule." 👀

2Q'22 topline $1.5 Bn (guidance $1.3-1.33 Bn) which is 28% 2-yr CAGR. No wonder the stock was +14% AH.

Here are my notes.

"I am pleased to share that we will surpass our 2023 revenue target by the end of this year, 2 years ahead of schedule." 👀

2Q'22 topline $1.5 Bn (guidance $1.3-1.33 Bn) which is 28% 2-yr CAGR. No wonder the stock was +14% AH.

Here are my notes.

2/ Company operated stores

+142% YoY, but misleading due to store closure last yr. 2-yr CAGR +9% vs flat expectation

Store productivity now at par with 2019 level.

~95% stores open now (most store closure in Australia and NZ)

28 net new store open in LTM

+142% YoY, but misleading due to store closure last yr. 2-yr CAGR +9% vs flat expectation

Store productivity now at par with 2019 level.

~95% stores open now (most store closure in Australia and NZ)

28 net new store open in LTM

3/ DTC/E-com

+4% YoY which is pretty impressive given last yr's +157% YoY growth

2-yr CAGR +66% vs expectation +55%

+4% YoY which is pretty impressive given last yr's +157% YoY growth

2-yr CAGR +66% vs expectation +55%

4/ Overall revenue 2-yr CAGR in North America and international markets +26%, and +43% respectively.

2-yr CAGR on women and segment +26% and 31% respectively

2-yr CAGR on women and segment +26% and 31% respectively

5/ Hard to imagine things could have been even better looking at those numbers, but this is what the CEO said:

"I think it's fair to say that our business would have been even stronger without these challenges facing the industry."

Challenges = supply chain issues

"I think it's fair to say that our business would have been even stronger without these challenges facing the industry."

Challenges = supply chain issues

6/ Mirror is now in 150 stores and plan is to make it available in 200 stores by holiday season.

Interesting update on LULU membership program: they are suspending it following the pilot in the last couple of years in some region.

But it's not cancelled forever...

Interesting update on LULU membership program: they are suspending it following the pilot in the last couple of years in some region.

But it's not cancelled forever...

7/ It appears LULU will launch another membership program that will incorporate Mirror into the program.

I was initially skeptical about the loyalty program. Not much details provided about this potential Mirror+Lulu, so obviously no opinion.

I was initially skeptical about the loyalty program. Not much details provided about this potential Mirror+Lulu, so obviously no opinion.

8/ LULU is increasing minimum pay from $15/hr to $17/hr.

Also called out rising CPM in digital marketing. $FB

Also called out rising CPM in digital marketing. $FB

9/ Despite the headwinds, Gross margin: 2Q'22 +58.1% vs 2Q'20 +54.2% vs 2Q'19 55.0%

~180 bps of SG&A leverage as well this quarter

Inventory grew +17% vs expectation +25-30%

~180 bps of SG&A leverage as well this quarter

Inventory grew +17% vs expectation +25-30%

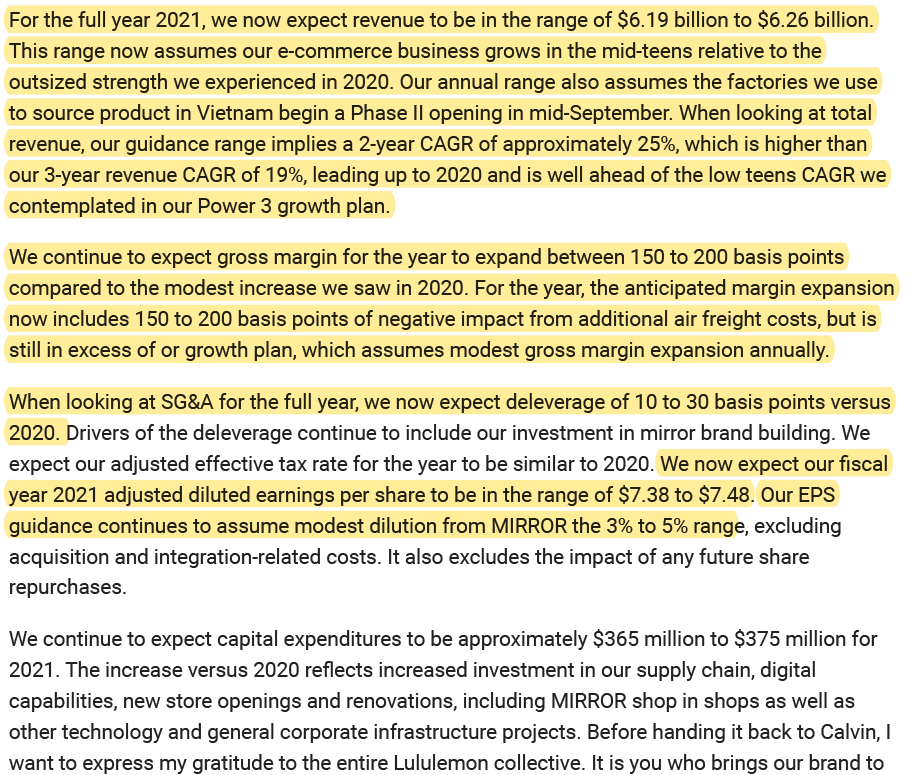

10/ Outlook

$LULU raised full yr FY'22 guidance to $6.19-6.26 Bn from $5.8-5.9 Bn

I was looking at my model that I provided in my deep dive published in Nov'20. I modeled $6.0 Bn next year (FY'23) 🤡

$LULU raised full yr FY'22 guidance to $6.19-6.26 Bn from $5.8-5.9 Bn

I was looking at my model that I provided in my deep dive published in Nov'20. I modeled $6.0 Bn next year (FY'23) 🤡

11/ Thankfully, I changed my mind soon enough once I observed the underlying momentum after Q1. This quarter was just firing on all cylinders and as per guidance, that will continue.

I explained after Q1 why I changed my mind and bought LULU:

mbi-deepdives.com/lulu2/

I explained after Q1 why I changed my mind and bought LULU:

mbi-deepdives.com/lulu2/

12/ One of the underappreciated factors is how the $LULU brand wasn't managed well for 10 yrs and yet it did okay due to the brand's cult status, but may be the true potential of the LULU brand was never quite realized.

The era of Calvin McDonald is making me think on that q.

The era of Calvin McDonald is making me think on that q.

End/ All my twitter threads are here: mbi-deepdives.com/twitter-thread…

Subscribe for one deep dive every month (will publish $SQ on 15th this month): mbi-deepdives.com/plans/subscrib…

Subscribe for one deep dive every month (will publish $SQ on 15th this month): mbi-deepdives.com/plans/subscrib…

• • •

Missing some Tweet in this thread? You can try to

force a refresh